[ad_1]

With less than two months to go to the mid-term elections in the United States, there is a lot of important news about the possible outcomes for the House and Senate. This article will discuss possible scenarios and what this means for investors, combined with a historical study of the price action of different asset classes before and after the mid-term elections.

Three possible scenarios for mid-term US elections

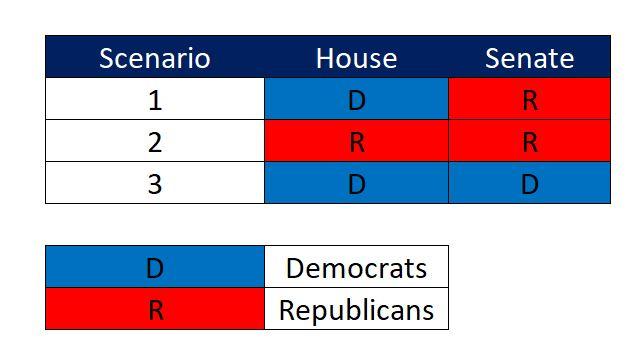

The mid-term elections take place in the middle of Republican President Trump's first term. The 435 seats in the House of Representatives and 35 of the 100 seats in the US Senate will be contested. The three possible scenarios will include Democratic control of the House while the Republican controls the Senate, a red repetition with Republican controlling both House and Senate and finally a blue sweep where Democrats control the House and Senate as indicated in Table 1 below.

Table 1: Possible Scenario for the House and Senate

Scenario 1 (House: Democrat, Senate: Republican)

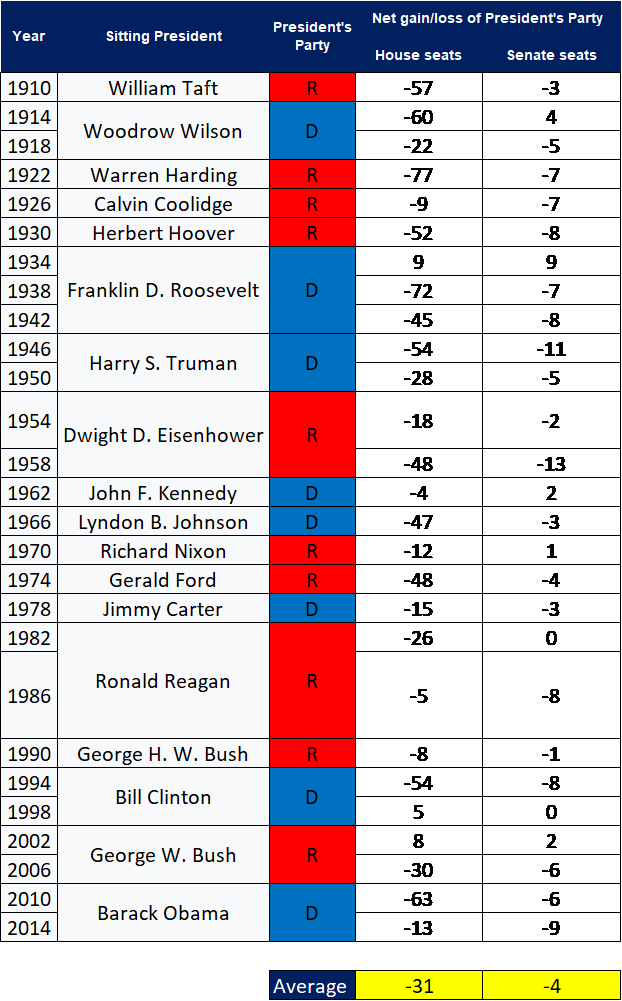

Democrats are likely to take control of the House, since the party has to win 23 seats to overthrow the House. In the case of a democratic house, this will likely result in a temporary sale of the US dollar. That said, markets may not be able to see it deeply as incumbent parties tend to lose a large number of mid-term seats. This is supported by the historic mid-term elections, as shown in Table 2, where the president's party lost on average 31 seats in the House and an average of 4 seats in the Senate.

Table 2: Mid-Term Historic Seating of the House of Elections and Senate Gains / Net Losses

Scenario 2 (House: Republican, Senate: Republican)

In this case, the Republicans have managed to keep the House and Senate, this would probably keep the political agenda of the current president at stake. This may include the extension of individual tax cuts and the realization other technical changes of taxes. The impact would provide support for the US dollar and equities. It would be bearish for US Treasury rates given the focus of the administration on stimulus measures and the lack of emphasis on budget deficits.

Scenario 3 (House: Democrat, Senate: Democrat)

Although Democrats have grown in recent times, a blue sweep is facing a difficult battle. A blue scan will likely result in a change of policy not immediate but progressive. We can expect a softening of positions on trade protectionism and a reduction in fiscal stimulus. This could lead to a gradual decline in equities while benefiting from US treasury rates in general. If scenario 3 unfolds, it will suggest a potential Republican loss in 2020 and this will probably have the most dramatic impact.

Historical study of price actions on the mid-term elections on different classes of assets

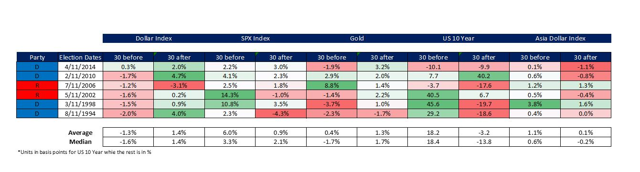

In addition to examining the possible scenarios that could occur and what it means for investors, a historical mid-term price survey was conducted to determine the prices of different asset classes. . There are two columns for each asset class, as shown in Table 3. The left column 30 essentially means the price change between 1 month before the mid-term and mid-term elections. The column to the right after 30 means the price change 1 month after the mid-term elections.

Elections before mid-term (1 month before the price change)

As can be seen in Table 3 below, we can observe that the Asia Dollar Index has appreciated and that SPX Index has risen by one month in the mid-term elections. However, the US dollar index depreciated five out of six times as gold declined.

Table 3: Historical study of the price of the mid-term elections. Calculation of the author.

Elections after mid-term (1 month after the price change)

Interestingly, the US Dollar loser index and gold in the mid-term elections turned into winners 1 month after the mid-term elections where the US dollar strengthened and gold five times higher. Thus, the price action study shows that, regardless of the party, the dollar and gold display similar price behavior before and after the mid-term elections and the natural question would be whether will it repeat itself in 2018?

Conclusion

In conclusion, regardless of the outcome of the 2018 mid-term elections, investors should not let politics dominate their views on what matters most to the US dollar or the stock markets. We should spend our time looking at the macroeconomic data as well as the position taken by the Federal Reserve instead of analyzing the results of the polls based on the example of the 2016 presidential elections.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link