[ad_1]

Posted at 11:54 AM on 10 October 2018 |

According to a Homes.com survey, buying a home is the most stressful life event for some. Elizabeth Keatinge has more.

Buzz60

The purchase of a house has become a little more expensive.

The most common mortgage rates have surpassed 5% for the first time since February 2011, which made it even more difficult to obtain affordable housing for homebuyers.

The average 30-year fixed rate mortgage rate – the most popular mortgages for purchases – reached 5.05% last week, compared to 4.96% the previous week and 4.16% a year ago, according to the Mortgage Bankers Association. The rates for other types of home loans – jumbo, FHA, 15-year adjustable rate, and 5/1 – all reached several-year highs.

The steady rise in the rate to 30 years has also cooled the appetite of borrowers. The volume of requests for purchase fell by 1% last week compared to the previous one, while the number of applications for refinancing fell by 3%, according to the MBA.

"Two weeks ago, I was very busy," said Scott Sheldon, director of the New American Funding subsidiary in California. "But the pace has slowed, it's not normal."

The increase in rates adds to the barriers faced by buyers. The housing shortage on the market has led to an increase in housing values across the country, pushing them up by 6% in July, according to the latest S & P Case-Shiller housing price index.

More: Sears could go bankrupt as debt payment looms, reports say

More: Retirement savings: how to turn your nest egg into monthly income

More: The Millennial Generation says, "It's only a matter of time" before the next financial crisis

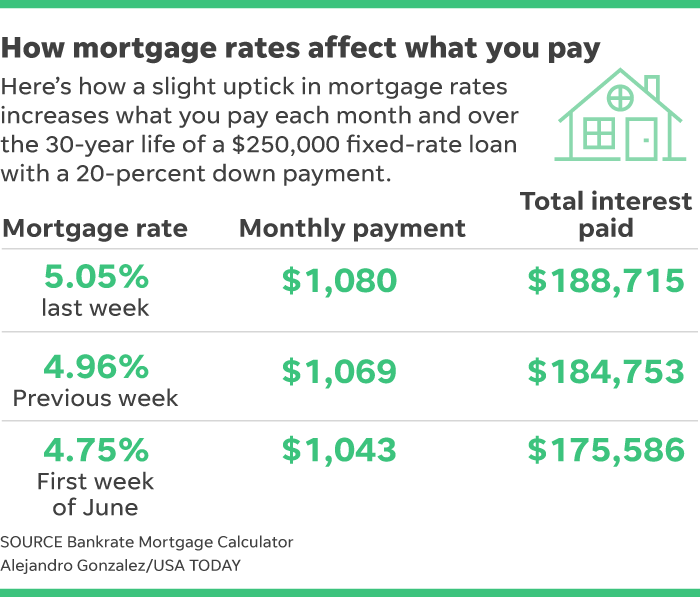

Even a quarter-point rate increase could make a significant difference over time for buyers, especially those who buy in higher-priced markets. For example, a home buyer with a 20% discount would pay $ 37 more each month if they bought a $ 250,000 house this week compared to June, while the rates were 4.75%. That's $ 444 more each year and $ 13,129 more interest over the life of the loan.

Rising costs, too

On the ground, however, rates for most people have been above 5% for some time, unless they are privileged borrowers. "You have to have a flawless credit score of 760 or more and have 15 percent to get 5 percent," said Sheldon.

Otherwise, borrowers have to pay more in fees – also known as mortgage points – to get a 5% home equity loan. One point equals 1% of the outstanding loan. The average points on a 30-year fixed rate loan went from 0.49 to 0.51 points, according to the MBA.

As a general rule, borrowers pay out points if they can not claim a higher mortgage rate, or prefer to receive a lower monthly payment. Homebuyers can get a credit from the seller to offset points – if the seller is a player – or they can incorporate the cost of points into their mortgage.

Goodbye refinancing

The bulk of refinancing opportunities is aimed at those who want to get rid of private mortgage insurance, withdraw money to improve their home or pay off a debt, such as a car loan, a card credit or other high interest rate debt, Sheldon said.

The days of refinancing your current mortgage at a lower rate are also over. Many homeowners have already made this move while rates ranged from 3.5% to 4.25% in recent years. The only exception is borrowers who can refinance for 10 or 15 years. "Otherwise, it's thin," said Sheldon.

Read or share this story: https://www.usatoday.com/story/money/2018/10/10/mortgage-rates-30-year-home-loan-hit-5-percent/1588544002/

Source link