[ad_1]

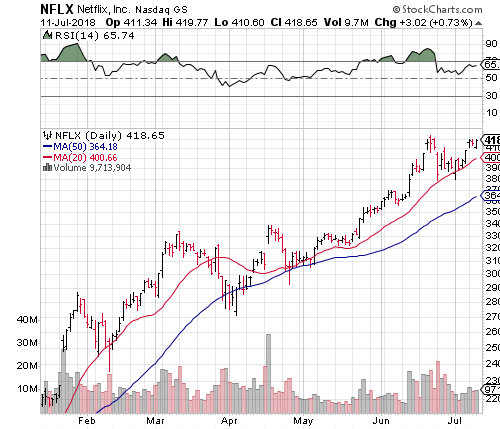

This is not an easy question to answer. NFLX stock is clearly a dynamic game for any right bull in next week's report. With a price / earnings ratio of more than 280, how could it be something else? High stock market values have even begun to weigh on some Netflix bulls.

This morning, UBS downgraded NFLX's shares to "neutral" buyouts. Eric Sheridan told customers that all the benefits of Netflix it is already rated in stocks. Sheridan has still raised his price target to $ 375 from $ 375, which adds a bit of panache to the downside.

InvestorPlace – Stock Market News, Stock Exchanges and Stock Tips

The rest of Wall Street remains optimistic about NFLX Stock. According to Thomson / First Call, 25 of the 41 analysts who follow the stock give them a "buy" or better. The 12-month consensus target, however, remains at $ 371.76 and could see further upward revisions, either before or after earnings.

<p class = "canvas-atom canvas- text Mb (1.0em) Mo (0) – sm Mt (0.8em) – sm" type = "text" content = "

Click to enlarge

As for Netflix's earnings report, Wall Street is expecting a profit of 79 cents a share, up significantly from 15 cents a share, same quarter last year.Incomes are expected to increase 41.4% to $ 3.94 billion. "data-reactid =" 28 ">

Click to enlarge

Regarding the report on Netflix's profits, Wall Street expects earnings of 79 cents per share, up significantly from 15 cents a year. Revenues are expected to increase 41.4% to $ 3.94 billion

. EarningsWhispers.com reports a second-quarter whisper number for Netflix at 81 cents per share. If Netflix catches on the rise and encounters this number of rumors, the next rally could send NFLX shares north of $ 500 in a hurry.

But subscriber growth will be, again, the big story of Netflix. Analysts fear that the US market is oversaturated and that geopolitical problems are slowing international growth. Netflix currently has about 56% of US broadband households and 46% of all US households. Internationally, the Netflix subscriber base is growing rapidly in India and elsewhere.

As for the mob of options, July's implied volatility predicts a move of nearly 10% of NFLX shares after next week's earnings. This places the upper limit at $ 458 and the lower limit at $ 378. In the end, NFLX still has a lot of momentum – even UBS admitted that's with its target price increase. Here's how to play a surge post-profit

2 Trades for Stock NFLX

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – -sm "type =" text "content =" Call Spread: For those looking to take advantage of the momentum of NFLX up here this year, a $ 440 / $ 450 spread in call off could double your investment, the spread is $ 3.11, or $ 311 per pair of contracts, the profit is $ 443.11, while the maximum profit is $ 6.89, or $ 689 per policy pair – a potential return of 120 % – is possible if the NFLX stock closes at more than $ 450 when the July options expire at the end of next week. "data-reactid =" 35 "> Call Spread: For those searching for information To take advantage of the NFLX momentum up here this year, a $ 440 / $ 450 call-up spread could double your investment. At the last control, this margin was offered at $ 3.11, or $ 311 per pair of contracts. The breakeven point is $ 443.11, while a maximum profit of $ 6.89, or $ 689 per pair of contracts – a potential return of 120% – is possible if the NFLX shares reach or exceed 450 $ when the July options expire at the end of next week. <p class = "web-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = " Sell: Alternately If volatility market or an inappropriate tweet from Donald Trump worries you, a sale of $ 350 in July is likely to end at the last minute, priced at $ 1.53, or $ 153 per contract data-reactid = " 36 "> Put Sell: Alternatively, if market volatility or an unexpected tweet from Donald Trump worries you, a sale of $ 350 in July has a high probability of ending up out of the money. At last check, this put was $ 1.53, or $ 153 per contract

As usual with a put sale, you keep the bonus as long as Netflix shares close over $ 350 when the July options expire.On the downside, if NFLX exchanges at less than $ 350 before the expiry, you could receive 100 shares for each sale sold at the price of $ 350 pa action

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = " At the time of Write these lines, Joseph Hargett did not hold any position in any of the aforementioned titles. "data-reactid =" 38 "> At the time of writing this report, Joseph Hargett held no position in the aforementioned securities.

Legendary Investor Louis Navellier # 1 Stock to Buy NOW

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "Louis Navellier – the investor on ] New York Times called an "icon" – just helped investors to make 487% in the burgeoning Chinese stock market … 408% in the medical device sector … 150% in Netflix .. in less than 2 years! Now, Louis urges investors to enter What can be the opportunity of a lifetime. By using a unique investment strategy called "The Master Key", you could achieve returns of hundreds of percent over the next few years. Click here to read more about Stock Recommendation # 1 from one of the best American investors. "Data-React =" 40 "> Louis Navellier – the investor on New York Times icon" – just helped investors to make 487% in the booming Chinese stock market … 408 % in the medical devices sector … 150% in Netflix … all in less than 2 years! Now, Louis urges investors to understand what can be By using a unique investment strategy called "The Key Mistress", you could make hundreds of percent back over the next few years. Click here to find out more about the # 1 stock recommendation from one of America's Top Investors

More from InvestorPlace

Compare Brokers

L & # Netflix share is directed towards $ 450 following the results posted first on InvestorPlace.

Source link