[ad_1]

By Robert Hughes

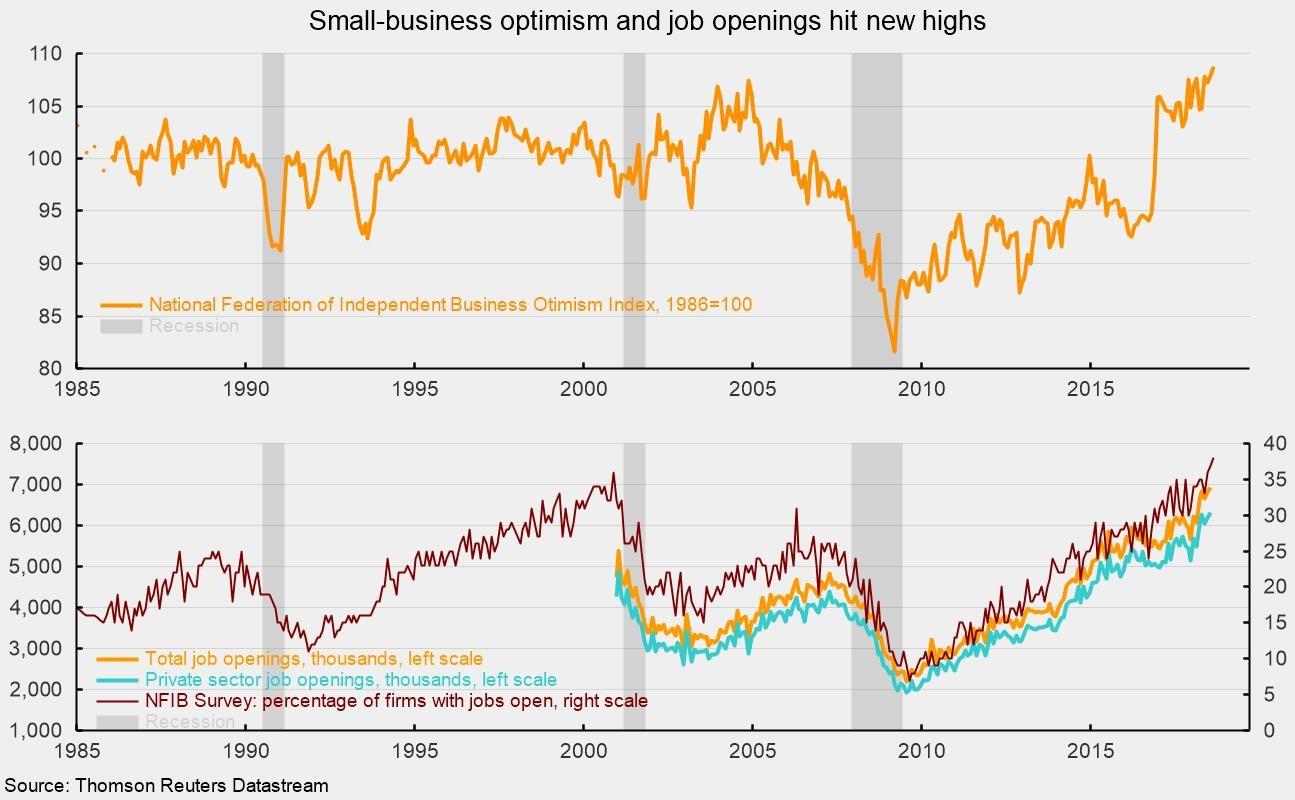

The index of small business optimism of the National Federation of Independent Business reached 108.8 in August, a new record. This represents an increase of 0.9 points from 107.9 in July and exceeds the previous record of 108.0 in July 1983. The last result extends a series of 21 consecutive months above 100, a very high figure. by historical comparison. Of the 10 individual indicators that make up the index of overall optimism, 6 have improved over the last month and many are at very high levels. The most important problem among small businesses remains the decline in the quality of the available workforce, particularly in the context of an already tight labor market and the record percentage of companies with open jobs (see lower graph).

According to Bill Dunkelberg, chief economist of the National Federation of Independent Businesses: "At the beginning of this historic period, expectations dominated the gains: good moment to develop, expected real sales, stock satisfaction, expected credit conditions and conditions. expected sales. The index is now dominated by business activities conducive to GDP growth: job creation plans, job vacancies, strong capital investment plans, investment plans in record stocks and profits. . "

The overall outlook remained positive, with the percentage of respondents believing that the time is right to grow rose from 32 in July to 34, up from 34 in May. The net percentage of respondents predicting better economic conditions ("better", "less" worse) was 34, down slightly from 35 in July, but still relatively high compared to 2016. The last 10 months a rise in sales for the last three months compared to the previous three months.

The percentage of companies planning to increase employment reached a record 26%, compared with 23% in July. A record 38% of companies say they have openings that they are not able to fill at the moment (see the table below again). At the same time, the percentage of companies reporting little or no qualified candidates for job offers was 55%, which corresponds to the record 55% recorded in June. This combination in the labor market, characterized by healthy demand and low supply, represents 32% of companies that claim to have already increased their remuneration in the last three months, while 21% plan to increase their remuneration during the last three months. next few months.

The dynamics of the labor market have made quality of work the most important problem for small businesses. Of the 10 problems listed in the survey, the quality of the workforce ranks first with 25%. Taxes ranked second at 15%, although they fell sharply from the record high of 32%, and government regulations and red tape ranked third at 13%. At the bottom of the list were inflation, financing rates and interest rates, with only 2% stating that both were important. Inflation has been at the bottom of the list for several years, reflecting sluggish price increases over the current cycle.

Small business capital spending also remains strong, with 56% of these firms making capital expenditures in the last six months compared to 58% last month. This is below the typical percentage in the '60s to the late' 90s, but well above the quarantine percentages during the last recession. Thirty-three per cent of companies expect capital expenditures over the next three to six months, up from 30 per cent last month and the highest since 2006.

Latest Job Openings and Turnover Survey by Bureau of Labor Statistics Shows Number of Job Vacancies in Economy and Private Sector Reaches New Record in July, Confirming Good Findings from the survey of the National Federation of Independent Businesses. Total job openings reached 6.939 million, while private job offers in the United States reached 6.316 million in July, compared to 6.183 million in June. The industries with the largest number of openings were health care (1.136 million), professional and commercial services (1.203 million), recreation and hospitality (1.003 million) and retail trade ( 757,000).

The job creation rate, boosted by the sum of jobs and openings, remained unchanged at 4.7% for the private sector, which corresponds to the peak reached last month. The highest open rates were recorded in health care (5.4%), accommodation and food services (6.1%) and professional and commercial services (5%). 4%).

The dismissal rate, which stood at 1.2% for private employers, shows other signs of strength in the labor market. Although slightly above the unprecedented 1.11% recorded in March 2018, it is well below the peak of 2.2% recorded in 2009. The low layoff rate corresponds to the low level of initial jobless claims. several decades. Together, the high number of openings, the high opening rate and the low rate of layoffs suggest that the labor market remains very tight.

On the whole, labor market data continue to show strength. Payroll increases appear to be on a solid track and layoffs remain low. The large number of open positions in the economy suggests that wage gains may continue to be under pressure. However, attracting and retaining a skilled workforce will likely remain a critical issue for businesses in the immediate future.

[ad_2]

Source link