[ad_1]

Cedar Fair LP (FUN), as it usually does shortly after the Labor Day weekend, has released preliminary results at the end of the summer season.

Although most of its parks cease their daily activities after Labor Day (with the exception of the Knotts Berry Farm in Southern California), the parks will be open on weekends in October for the famous Halloween party. . several weeks for Winterfest activities at the end of the year.

The press release made a good image and stocks have jumped more than 7% in the last two days. The press release called Cedar Fair Reports' Record Earnings in August and quickly found that its fiscal year had produced record results with:

"- Strong performance in August driven by increased attendance (+ 5%), client spending (+ 1%) and income outside the park (+ 7%).

– The company reiterates its commitment to 4% distribution growth.Cedar Fair … announced that preliminary results for the five weeks ended Monday, September 3, 2018 represented record revenues for the month of August.

For the five weeks, preliminary net revenues amounted to $ 288 million, up 6%, or $ 17 million, compared to the same period in 2017. This increase was the result of an increase in attendance of 5%, or 255,000 visits, an increase of 1%, or $ 0.52, of average per capita expenditures in parks and 7%, or $ 2. millions, increased revenue outside the park, including resort accommodation. "

Good news, no? Especially the part of the company's commitment to 4% growth of the distribution. And it was even a little better at the beginning of the following paragraph:

"Preliminary net revenues since the beginning of Labor Day on September 3, 2018 reached $ 1.04 billion, a slight increase over the similar Labor Day period of September 4, 2017. Compared 2018 results to 2017, or $ 0.38, on average per capita spending in the parks, at $ 47.46 and 5%, or $ 5 million, off-park revenues, including resorts, to $ 120 million of dollars. "

Unfortunately, this paragraph concluded:

"These increases were offset by a 1% visit, or 225,000 visits, and a decrease in attendance to 20.0 million guest visits."

For several years, the company said weather conditions tended to balance during the year, but despite this statement, the weather has had a major impact in recent years. One year, the bad weather in October had an impact on its Halloween weekends. Another event was the flood and a harsh winter in the Midwest, which prolonged the school year, reducing the use of its parks in the second quarter. Last year, a wave of attendance was attributed to the weather during key weekends, and it was too hot this year.

With Halloween weekends among the most profitable of the company and the continued expansion of operations (with Winterfest) after Labor Day, weather conditions are increasingly likely to increase. influence the results. And while this should not be ignored by investors, the biggest concern should be the company's inability to meet its adjusted EBITDA guidance. This is what was planned to drive the 4% increases in payment and business investment in the company. From the press release:

"[CEO Richard] Zimmerman also reiterated the company's commitment to providing a steady annual 4% increase in distribution to unitholders while continuing to invest in the business at a responsible level. "

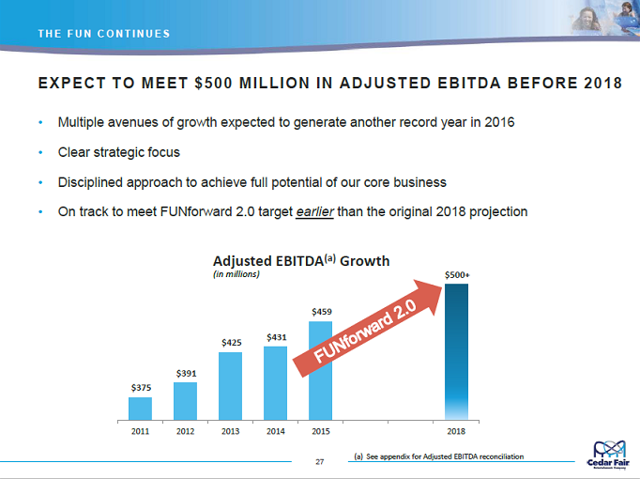

The company has been discussing a 4% growth for most of this decade. First, it was with FUNforward and then with FUNforward 2.0. Below, the slide used after a strong 2015:

It was expected that $ 500 million would be reached by 2017 and possibly 2016. When the weather started to show, 2016 ended with a disappointment of $ 481 million. At the end-of-year conference call of 2017 earlier this year, CFO Brian Witherow reported decline in adjusted EBITDA:

"Adjusted EBITDA which we believe is a significant measure of our fleet-level results of operations was $ 479 million for 2017, down $ 2 million or 1% from our record results last year. The decrease in Adjusted EBITDA for 2017 is due to higher expected operating costs and lower than expected growth in attendance. "

This week's press release tells us that:

"The company is now expecting net sales in fiscal 2018 to be in the range of $ 1.32 billion to $ 1.34 billion and EBITDA adjusted for the full year. between $ 460 and $ 470 million. "

This will be the return to declining EBITDA years. And, just as important, it means that the target of $ 500 million for 2018 will not be reached until at least 2019.

The distribution

To be clear, Cedar Fair is not a corporation but a publicly traded limited partnership. Instead of shares, one owns and trades units, and instead of receiving a dividend, the unitholder receives a quarterly distribution. There are significant differences at the time of taxation, and even when the asset is held in a tax-sheltered IRA account, there may be a tax liability.

Investors who bought the shares early in the decade were rewarded with a distribution that went from a one-time payment of $ 0.25 in 2010 to an annual total of $ 1, $ 1.60, $ 2,575, 2, $ 85, $ 3,075, $ 3.33 and $ 3,455. years. Current unitholders will receive their third distribution of $ 0.89 later this month and should the amount increase by 4% in the fourth quarter, they should total approximately $ 3.60 in 2018 and $ 3.75 in 2019 At the closing price of $ 55.52. the yield would be quite attractive ~ 6.8%.

The unit price

The unit price is also appreciated dramatically during this period, rising from a low teenage to a record high of $ 70 in the middle of last year. The price has recently dropped to a low of $ 50 following a low attendance report over the weekend of July 4th and has slightly recovered after this recent press release. Obviously, those who have bought at prices above the $ 50 range have little consolation from the mass market and it could take years before those who bought at prices above $ 65 reach break even.

So, what's next? Should we buy now, or be inspired by the official slogan of the state where Cedar Fair's Worlds of Fun / Oceans of Fun Park is located in Kansas City, in the state of Show-Me ?

Buy, sell or keep?

Negative EBITDA growth over the last two years could indicate that the 4% growth in the distribution may not be sustainable. And, if the growth rate of the distribution is under pressure, it is more of an income-oriented investment that yields about 7%. And that 7% could lose some of their luster as the Fed continues to raise interest rates.

I can see a very modest increase in unit price, but it might not even be as good as the market, and the risk-reward reward keeps me from marking this as a recommendation to buy. Because of this 7% yield, I would suggest to anyone to sell. For those looking for a little higher income and who are willing to add a little complexity, a simultaneous purchase of shares and the sale of a covered call can push the annual return into potential double-digit percentage.

Personally, I am long, but it currently represents less than 2% of the income portion of my portfolio. Ideally, I would like to have 20 to 25 investments in this portfolio, with each investment representing no more than 4% to 5% of the total. I may Add to my position of Cedar Fair by buying units and simultaneously selling a $ 50 or $ 55 guaranteed call as a pure income game. On the other hand, I can also decide to wait for the end-of-year results and let the company show me that it can at least reach the midpoint of its new target '460 million $ 470 million. "

Disclosure: I am / we are long FUN.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Additional disclosure: I could add to my position with a hedged buy buying strategy if the price goes down.

[ad_2]

Source link