[ad_1]

The absence of news led to a lasting consolidation of Nvidia's action

After a good performance last year, Nvidia (NVDA) took a few days off during the past months, as the stock continues to fluctuate around the $ 250 level with no progress.

I believe that the reason is simple: a lot of positivity had already been incorporated before 2018. Moreover, there was no particular catalyst for the stock grows during the last period. months, probably with the exception of profits that turned out better than expected.

However, it seems that the current consolidation may soon be over, as new graphics products may come out sooner than expected. The future of the company remains promising in light of the increased adoption of AI and other technologies that require significant computing power. In light of this, the current valuation seems more than reasonable, which is why Nvidia is attractive for investment right now. Let me explain that in more detail.

The new generation of GeForce graphics cards could be unveiled in the coming months

One of the reasons Nvidia has recently escaped the attention of investors is the lack of new products. The current generation of GeForce game cards based on Pascal architecture appeared about two years ago and many expect the company to offer a more powerful solution for gaming. At last Computex, Nvidia CEO Jensen Huang said the next generation of graphics cards is "a long time from now." This statement served as an additional catalyst to Nvidia's competitors such as AMD (AMD), which revealed the first Computex-based 7nm GPU

. However, it seems that Nvidia's new family of GPUs could be revealed sooner than expected. The Nvidia Verge reports sends invitations for the Gamescom, which will take place at the end of August, for "a mysterious event related to a PC". Although this news does not reveal anything significant, the invitation follows a set of other events that are more indicative.

For example, in an E3 video, Lenovo product manager mentioned Nvidia's GeForce GTX 11 products (the current GPU series). is number 10), referring to a Lenovo Gaming computer.

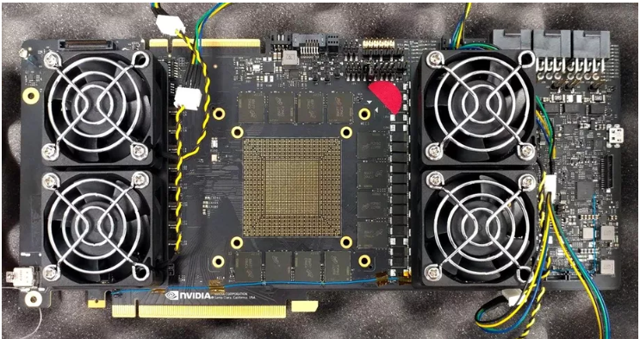

Referring to a Lenovo gaming PC, Lenovo's representative says "but it's time to market with NVIDIA 11 Series up to 1180 on the road", suggesting that Nvidia's GeForce GTX 1180 is on the way soon. images of what looks like an engineering sample for the GeForce GTX 1180 were leaked last week. An interesting point here is the fact that the board has a "dozen installed Micron GDDR6 (MU) memory modules," while this type of memory is clearly supported by no existing graphics card yet, Micron has only started mass production of GDDR6 at the end of June. The next generation of memory aims to "improve the bandwidth capabilities of new generation GPUs " on PCs and consoles.

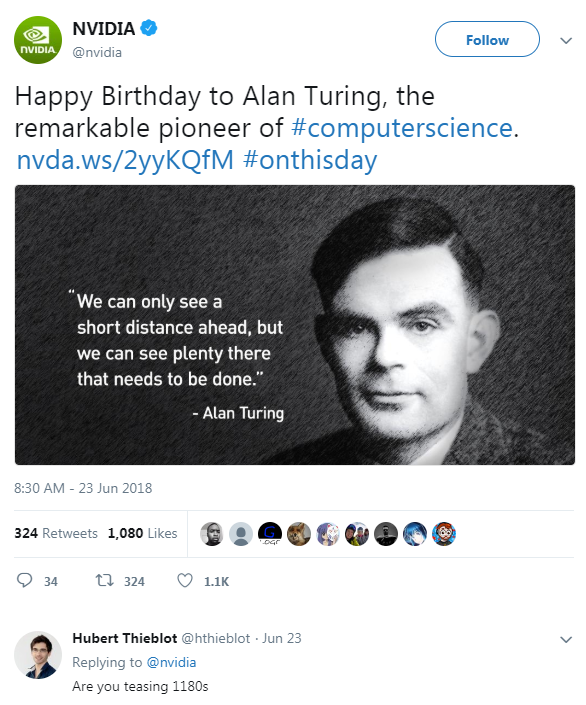

Another small indication is Nvidia's commemoration of Alan Turing's birthday on Twitter, which supports the belief that the company is teasing the next generation graphics cards, likely to be based on the Nvidia Turing platform. Although this thing does not seem to be an affair in itself, all the above mentioned events together create certain expectations.

(Source: Twitter )Unveiling a next generation graphics card can become an important catalyst for the company, with Nvidia realizing over 80% of its business figure GPU activity. In addition, the company's growth during the 2018 fiscal year was largely boosted by the gaming activity, highlighted in the annual report.

The GPU business figure reached $ 8.14 billion, up 40% over the previous year. , data center and professional visualization. The strong growth of our Pascal-based GeForce GPUs has been spurred by growth associated with GPU updates / updates, new players, new games, eSports and cryptocurrency extraction.

The game industry itself continues to be rising, which is explained by strong sales data, driven by hardware. Titles like Fortnite from Epic Games show how video games can become important, with esports being the future of entertainment. This game alone has allowed Amazon (AMZN) to boost its leading audience by 70% in just 5 months after launch. Therefore, I believe that Nvidia's PC event can cause big movements in the stock. With a new, more powerful GPU, Nvidia will be able to compete with AMD and continue to take advantage of the gaming market.

The current evaluation of Nvidia seems reasonable and offers a decent risk-reward opportunity

At the same time, it is clear that the launch in August of Turing-based game cards can only be simple rumors, but even in this case, Nvidia will remain well positioned in the market.

For example, data center revenues increased 133% from Nvidia's 2018 fiscal year, reaching the level of $ 1.93 billion. Applications such as AI and machine learning require significant computing power, which is why companies often buy GPU card packs for their datacenters.

In addition, the automobile market will inevitably become a major source of revenue. consider Nvidia solutions for digital cockpits and autonomous driving systems. During fiscal year 2018, Nvidia had Aurora, Autoliv (ALV), Baidu (BIDU), Bosch (OTC: BSWQY), Continental (OTCPK: CTTAY), Mercedes-Benz (OTCPK: DDAIF), Uber, Volkswagen (OTCPK: VLKAY), Volvo (OTCPK: VLVLY), Toyota (OTCPK: TOYOF) and other companies as partners. As a result, "Tegra Processor's sales figure has increased 47% over fiscal year 2017 compared to fiscal 2016", thanks to an increase of more than 50% in sales Tegra products and services for automotive systems. Total automotive revenues increased by 15% during fiscal year 2018, reaching $ 558 million.

Another encouraging point is valuation. While the stock jumped in 2017, the price has been consolidating in recent months, which can be used as a time to invest in the stock or to continue building a position in the company. It is likely that the market does not take into account the possible presentation by Nvidia of a new generation of GPUs. Therefore, even if the August event turns out to be something else, the decline will be limited.

Thus, in the first quarter, Nvidia posted earnings per share of $ 2.05, up 140% over expectations. If the trend continues throughout the 2019 fiscal year, earnings per share for the entire year can reach the level of $ 11 to $ 12. This would lead to a forecast price / earnings ratio of 20-22, which is too conservative considering a 65% increase in first quarter earnings. The 70% increase in annual EPS, which is more cautious, gives a price / earnings ratio of 29 and a PEG ratio of less than 1. All of this shows that the stock has a certain margin of safety, while the upside potential is important. The current equity price consolidation offers a strong risk-reward opportunity. This is also supported by the technical picture, which shows that several levels of support are located near the current price.

My detailed analyzes of Nvidia, AMD, Micron and other technological companies can be found on my page in profile. If you like my article and want to stay updated on the next one, please click the "Follow" button next to my profile.

Disclosure: I am / we have been AMD for a long time.

I write this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link