[ad_1]

Nvidia's third quarter revenues (NVDA) were slightly lower than consensus at $ 3.18 billion and non-GAAP EPS exceeded the consensus at $ 1.84. The beat of EPS was due to a tax benefit. Nevertheless, the quarter, although lower than the consensus, seems respectable at first glance (picture below)

But, as we already know in the report on the results of the second quarter, appearances can be misleading.

The underlying numbers smell like paradise

Let's start with the tips. The company assumes no significant delivery of mid-range Pascal GPUs during the quarter due to the channel inventory. This is consistent with what Advanced Micro Devices (AMD) guided last month and is understandable given the crypto burst. Management has indicated that the mid-range Pascal is about 1/3rdgaming revenue – about $ 600 million. Faced with this unfavorable wind, the company guided its fourth-quarter sales to $ 2.70 billion, or $ 700 million less than the consensus of $ 3.4 billion analysts. Indeed, the T4, instead of being up about 10%, is down about 10%.

As disappointing as this guidance may seem, we do not find the results of the third quarter or the credible directions.

As in the second quarter, again, the company appears to have made very large investments to meet the expectations of the third quarter. Here are some strong clues from the report on the benefits that support such a move:

- Accounts receivable climbed to $ 2.22 billion from $ 1.66 billion in the second quarter and $ 1.22 billion in the first quarter (!). On effectively stable revenues ($ 3.2 billion in the first quarter, $ 3.1 billion in the second quarter and $ 3.1 billion in the third quarter), we almost doubled the number of AR. DSO has gone from 35 to 63 days in the meantime. The company cited the cause of Turing's shipments at the end of the quarter, but that is not credible. Did the company ship a billion Turing dollars last month? We are extremely skeptical about this statement. Investors who listen to Nvidia's management may be wrong here.

- Similarly, inventories jumped to $ 1.42 billion from $ 1.09 billion in the second quarter and $ 797 million in the first quarter (!!). Again, this occurred in the context of zero growth in sales since the first quarter. The ISD is now 102 days, compared with 65 days in the first quarter. Readers should note that this does not include channel inventory. Do not make mistakes: The problem of stocks is not a problem on a quarter, because the management of Nvidia wants investors to believe. It will take AT LEAST two quarters for the inventory correction to be complete.

We will put this more brutally. Compared to what would be normal operations, Nvidia borrowed approximately $ 1 billion in sales in the next quarter. This will be miserable for several quarters, because the company will gradually massage this number in the coming quarters.

You think it's bad? It will get worse.

What does it mean to transmit the EPS?

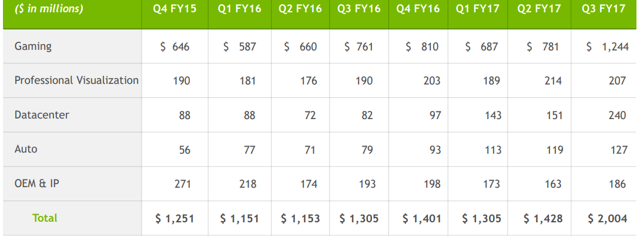

Let's look at the breakdown of the Nvidia segment for the last 4 years (image below).

You notice something about the income of the "game" in the last 4 years?

As it turns out, the explosion in the growth of the gaming sector is perfectly parallel to the cryptocurrency market. Although we do not doubt that the game is growing at a steady pace, the hyper-growth seen by Nvidia in the "gaming" sector, particularly in the last two years, seems to be almost entirely driven by the market of the game. cryptocurrency.

The question then becomes: what is a sustainable baseline for first quarter earnings in the year2020? We estimate that the number is about $ 2.6 billion.

You think it's bad? Not so fast! It will get worse.

We are not done yet with the bad news

The Nvidia share price has been influenced in recent quarters by the rapid growth of the Gaming and Datacenter segments.

If we exclude crypto from Gaming, it remains the PC GPU market. In this segment, AMD in full recovery begins to conquer market share. A quick look at holiday PC Specials shows that AMD is now in the best position it has been in for many years. AMD is also likely to capitalize on the success of its Ryzen processors to consolidate GPUs and generate even greater market share gains over Nvidia over the next fiscal year. In other words, we are seeing a significant slowdown in Nvidia's growth in the gaming sector. Despite Nvidia's new products, it is quite possible that growth will become negative in this segment.

The prognosis of the data center industry is hardly better. Unbeknownst to many investors, most of the data center growth of the past year is due to higher ASPs, not growth in units. And, this aspect seems to be fully enhanced as the data center underperformed the third quarter expectations. Even in this segment, AMD is starting to make progress. Add to that many new entrants into the data center scene: it is unlikely that any further increases in ASP will be realized. The loss of market share in this sector will dampen the company's growth in 2019. These combined factors point to a risk, not only of slower data center growth, but also of negative growth.

When we work that number in our model, we are considering the optimism of the CY2019 / FY2020 EPS for Nvidia around $ 5.00. That's about 40% less than the consensus of analysts, nearly 8 dollars for next year.

Prognosis

The magnitude of the absence and the reasons behind it make most of the story of management growth unconvincing. In our opinion, this report on results has significantly undermined the credibility of management.

With crypto burst, Nvidia's revenues have now been significantly reduced. Not only will the Company start from a lower base, but we now expect single-digit growth, if not negative growth, from NVDA. This reset of the growth trajectory is extremely different from the valuation of the company.

In our opinion, the estimate of $ 5 EPS with a flat growth profile does not deserve more than 10 times and we think that $ 50 is a fair valuation of Nvidia at the moment. However, we believe that it is likely that bullish analysts will not see this before the growth of the company deteriorates further. We find that it is likely that many analysts will model growth of about 20% and will give the company a valuation close to $ 100 to $ 50.

Although the stock has lost considerable value in recent weeks, we believe that the decline has only just begun. We therefore consider the stock as an excellent candidate for short selling.

Disclosure: I am / we have been for a long time.

I have written this article myself and it expresses my own opinions. I do not get compensation for that. I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: The author can initiate a short position in the next 72 hours

Beyond The Hype subscribers have access to all related articles that might otherwise be inaccessible. For timely information, advanced analysis and investment ideas on solar, batteries, autonomous vehicles and other emerging technologies, check out Beyond the Hype. This Marketplace service allows you to quickly access my best investment ideas, as well as arbitrage and event opportunities, when they are more advanced and actionable. If you want to get sound advice on how to get through the hype, separate the facts from the fiction, avoid investing anti-personnel mines in emerging technologies and participate in a forum. Dynamic and stimulating discussion in real time with other like minded investors, think about subscribing to Beyond the Hype today. Subscribers also have access to all past articles.

Disclosure: I am / we have been for a long time.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: The author can initiate a short position in the next 72 hours

[ad_2]

Source link