[ad_1]

Oil prices were put under pressure on Thursday after US President Donald Trump called on OPEC to "lower prices now!" before a meeting of the major oil exporters.

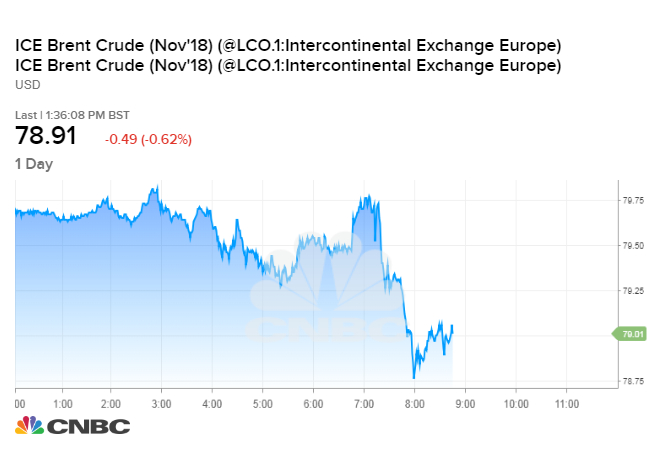

World benchmark crude Brent fell 59 cents to 78.81 dollars at 10:29 am (Paris time) (14:29 GMT), after gaining half a percent Wednesday.

US crude West Texas Intermediate rose 1 cent to 71.13 dollars a barrel, reducing gains in volatile trade following Trump's tweet. The contract grew by almost 2% in the previous session.

The North Sea benchmark is trading near $ 80 a barrel, near its highest level in almost four years, hoping that US sanctions against Iran, OPEC's third largest producer, will reduce supply on world markets.

US sanctions have been imposed by Trump in response to the Iranian nuclear program, which the White House claims is aimed at producing weapons, an allegation Tehran denies.

The Organization of Petroleum Exporting Countries and other producers, including Russia, are meeting Sunday in Algeria to discuss how to allocate supply increases to compensate for the loss of Iranian barrels.

The meeting is unlikely to agree on an official increase in crude production, although pressure is mounting on major producers to prevent price spikes.

US President Donald Trump took part in the debate via Twitter Thursday, urging OPEC to cut prices.

"The monopoly of OPEC must bring down prices now," said Trump.

"We are protecting the countries of the Middle East, they would not be safe for a very long time without us, and yet they continue to demand ever higher oil prices! We will remember that."

Despite the president's intervention, the sentiment of the market remained rather optimistic, with many traders and analysts predicting that Brent will soon exceed $ 80.

"Brent is definitely fighting against the $ 80 line, wanting to break above," said Bjarne Schieldrop, an analyst at SEB Markets. "But it will probably break very soon."

The market remained bullish after the announcement of a further drop in crude inventories in the United States.

[ad_2]

Source link