[ad_1]

Last Friday, OPEC oil ministers, the international oil cartel, met in Vienna, Austria, to agree on production policy for the rest of the country. year 2018. The market was expecting an increase in production. last year. When the price of a barrel of NYMEX WTI crude reached $ 72.90 per barrel on May 22 and Brent futures reached $ 80.50, the Saudis and Russians' statements resulted in a correction of the most expensive prices. since 2014.

WTI fell to a low of $ 63.40 a barrel on the nearby August futures contract on May 18, and Brent went down to $ 72.44 a barrel the same day. The downward correction came as the market forecast an increase in production given the statements of the two largest oil producers in the world. The United States recently joined the elite club of more than ten million barrels of oil each day and, in the run-up to the meeting, President Trump had claimed that OPEC should increase its production to bring down the price of energy. .

It is likely that the administration put pressure on the Saudis behind the scenes, but a series of tweets about OPEC and oil was enough for the oil ministers in Vienna to know that the United States United were on these issues. On June 22, before the publication of the OPEC statement, President Trump tweeted: "I hope that OPEC will significantly increase production.

Uncertainty at the meeting

There was a lot of uncertainty in the OPEC meeting of June 22nd. While the Saudis and Russians were of the opinion that production would increase by a million barrels a day, Iran opposed it. At the same time, the cartel's primary mission is to keep prices as high as possible for the member countries, which goes against the statements that drove down prices compared to the May 22 summits.

The market entered the meeting with a bearish tone. Meanwhile, many market analysts were unsure of the outcome given to the dichotomy between the statements on production increases and the OPEC mission. In addition, the Saudis continue to offer a public offering for Aramco shares and a higher price for oil is expected to produce a better result for the eventual sale of shares of the world's largest oil company.

A compromise that the market interprets as bullish

In a microcosm of issues dividing the Middle East, the United States favored a substantial increase in the daily oil production of the OPEC countries, while Iran argued that the cartel was honoring its commitment to production quotas until the end of 2018 Saudi Arabia and Russia, who planned to increase their short-term revenues by increasing their oil production, were the first to suggest a rise in oil prices. 39; one million barrels a day in the production of OPEC. However, the cartel has compromised and decided to increase daily supplies of about 600,000 barrels. Given the decline in production from Venezuela and Libya, the increase is minimal, but all parties could claim victory with the final decision of the oil ministers last Friday. The oil market was expecting a more substantial increase and the price of energy increased as a result of the statement of the agreement.

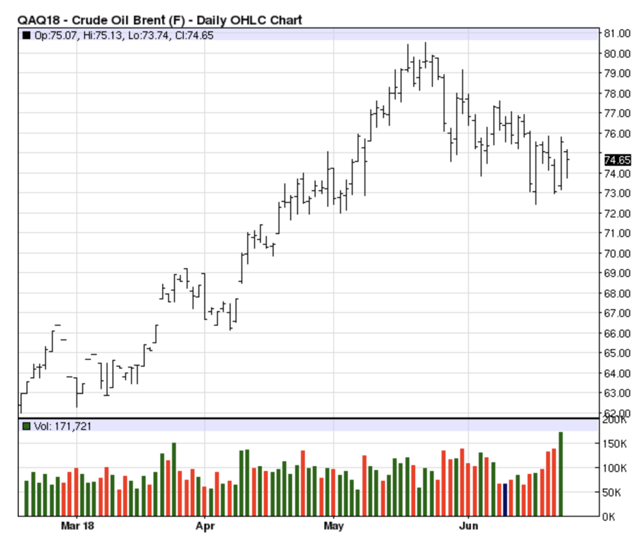

Source: CQG

As indicated on the daily chart, the NYMEX WTI crude oil futures price for August rose $ 3.04 a barrel between settlement and settlement on Friday, and the official price at the end of the market was 68.58 dollars a barrel. However, in the aftermarket, the price has traded at a high of $ 69.38 and the last price of the day was near the top. On Monday, fears of a commercial lane dominate the market, pushing the price of the August futures to just over $ 68 a barrel.

Source: ICE

Last Friday, Brent crude futures rose $ 2.50 a barrel, but dropped to $ 74.65 on Monday. The Brent-WTI gap in August was $ 6.65 per barrel on Monday, June 25, which is significantly lower than the peak in late May which brought it up to $ 11.65 a barrel.

Economic conditions support oil

The global economy continues to improve and GDP growth in the world means that the demand for energy has increased year by year. Perhaps the best representation of the demand comes from refining gaps that highlight the economics of processing a barrel of crude oil in gasoline and distillery products from one year to the next. . Last year, during the third week of June, the cracking spread of gasoline closed at the level of $ 16.69 per barrel. This year, the gap was $ 17.10, slightly higher than in 2017.

On Monday, the price of gasoline was 17.25 dollars a barrel. The price differential of heating oil, which is an indicator for other distillate products like jet fuels and diesel fuels, closed at $ 14.93 a barrel in 2017 and last week it was trading at $ 20.19 a barrel. On Monday, the distillate price was $ 20.40 per barrel. The strength of cracked spreads continues to be a sign of oil-based energy demand that sustains the price of crude crude oil.

A model similar to last year right now

Last year, the price of oil went into the June meeting of OPEC at the lowest. On June 21, 2017, the NYMEX oil price was exchanged at a minimum of $ 42.05 on the nearby futures contract.

Source: CQG

As shown in the weekly chart, the lowest price of the August contract was $ 63.59 per barrel during the same week. At the close of trading last Friday, crude oil showed an upward trend in reversing the uptrend on the weekly chart. The price action in crude oil has followed a similar trajectory this year compared to last, it has entered the meeting on the downs and rallied in the wake. If the model continues, the price of energy could rise in the weeks and months to come. However, this year, the global economy is facing a challenge that could either keep prices closed or raise them in the months to come.

Can we make $ 80 for NYMEX crude?

The ongoing saga of trade between the United States and trading partners around the world continues to reach new heights. Canada, Mexico and the European Union have all accused the United States of violating the laws of the World Trade Organization with the protectionist measures that the Trump Administration imposed on the United States. their exports to the United States. President Trump seeks new bilateral trade agreements with countries around the world and uses tariffs as a bargaining tool to achieve "reciprocity and equity" and "level playing field" international trade. While other nations continue to be reluctant to face new agreements, the president has taken his responsibilities, which has heightened rhetoric and the potential for a trade war with many US allies.

The president has taken a particularly tough stance against China for its restrictive business practices. Customs duties of $ 50 billion on Chinese goods will come into force on July 6 and, after Chinese retaliation, the president has threatened to raise tariffs by $ 200 billion. It is possible that the current stalemate will intensify in the coming weeks and months, which could lead to recessionary pressures on the global economy. If this happens, it is likely that the price of crude oil will stagnate and prices will be between $ 67 and $ 73 per barrel on the nearby NYMEX futures contract. Meanwhile, the bottleneck of US production of Permian Basin shale will continue to impede market supply for logistical reasons until new pipelines are operational in 2019.

However, any new trade agreement is likely to spur economic growth and could trigger a recovery that will bring the price of energy to $ 80 or more. At the same time, the Middle East remains a hotbed of political unrest with Iran and Saudi Arabia in a long-standing proxy war in Yemen and in other parts of the region. The blockade of Qatar by the Saudis and their allies in the Gulf States is a reminder of the current tensions in the region. Any increase in hostilities that threatens production, refining or logistics routes in the region could push up the price of nearby oil futures in the short term, as supply fears will affect the market. term.

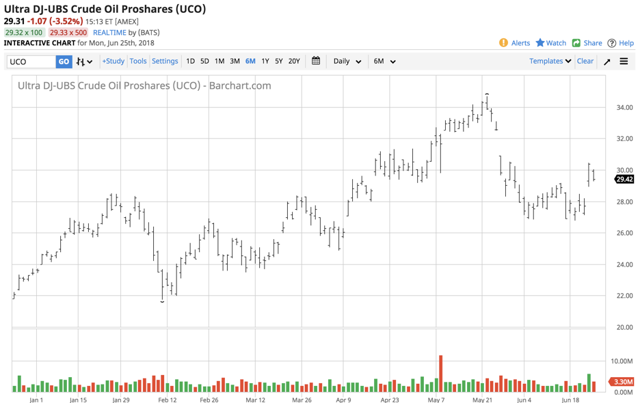

In the aftermath of the OPEC meeting, the cartel took a firm stance that supports its mission of keeping prices high for its members. As a result, the crude oil market is likely to provide long-term opportunities for any price weakness in the weeks and months to come. I will continue to use the ProShares Ultra Bloomberg Crude Oil (NYSEARCA: UCO) ETF product for short-term trading opportunities on the long side of the market due to the low prices in the coming weeks.

Source: Barchart

As the chart shows, UCO was trading at $ 29.31 on June 25th. With $ 414.03 million in net assets and an average daily volume of more than three million shares, the liquidity of this product presents an alternative to the futures markets.

With the June OPEC meeting now in the past, markets will focus on the end of the second quarter and the first half of 2018 for the remainder of this week. It seems that trade issues will continue to dominate the market psyche. Crude oil is taking the same departure as last year after the OPEC meeting and prospects for stability, and perhaps higher oil prices seem to be a good bet for the moment.

Hecht's Commodity Report is one of the most comprehensive commodity reports available today to the world's second-largest commodity author, and one of the world's leading commodities reports. precious metals. My weekly report covers the market movements of 20 different products and provides bullish, bearish and neutral calls; directional negotiation recommendations, and action ideas for traders. More than 120 subscribers derive real value from Hecht's Commodities Report.

Disclosure: I / we have no positions in the stocks mentioned, and we do not plan to take a position in the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose stock is mentioned in this article.

Additional disclosure: The author still has positions in commodities markets in futures, options, ETF / ETN products and commodities stocks. These long and short positions tend to change on an intraday basis.

[ad_2]

Source link