[ad_1]

TSLA data by YCharts

summary

The few months have been difficult for You're here (TSLA). Since the euphoria of the last earnings call, we have seen "$ 420 guaranteed" to be announced and canceled. We attended a lawsuit from the SEC (my breakdown here) and a settlement and even the Seeking Alpha press team that makes a "judgeville" joke while Elon Musk makes another unfortunate tweet . Despite this tweet, the SEC continued to support the settlement and it was approved.

Tesla has also introduced a new version of Model 3 – an intermediate option between its existing offering and a real $ 35,000 car. Finally, Tesla hastily announced the third quarter results of the year 18 and was approved by a celebrity short seller.

It has been a trip, it is the least we can say.

Rather than focusing on the theater, I will here take a close look at what Tesla has promised and targeted for the T3 / 18. The review of Tesla's objectives will provide insight into Tesla's results call. October 23, whether this news is positive or not.

The most important measures here will be profitability (profitable or not?) And cash flow (positive or not?) From Tesla. The gross margins of Tesla's Model 3 (targeting around 15%) will be critical in determining whether Tesla will make a profit. After these objectives, the next most important aspect could well be Tesla's objectives for the next quarter, including the production of Model 3, margin forecasts and any Chinese expansion plans.

Tomorrow we will have an interesting income call. Here's what I'm looking for for Tesla's revenue tomorrow.

Earnings Day: October 23

Tomorrow, Tesla announces its results after hours on October 23.

The process seems very rushed this time around. Tesla announced Monday after opening hours that the results would be released Wednesday:

Tesla Inc. announced Monday night that it plans to release its third-quarter results after the closing bell on Wednesday.Tesla shares lost 0.3% of their business after trading hours. will hold a teleconference at 3:30 pm Pacific Time to discuss the quarter and outlook. "Tesla stock is down 12% this year as the S & P 500 index has risen 1.9% . "

Marketwatch

This announcement has the market in full swing. As of 13:00 on 23/10, Tesla shares rose 9%, while the S & P 500 index lost 1.3% – possibly due to a positive comment from Andrew Left and rumors that a record quarter would be "almost profitable".

In anticipation of gains, it is helpful to separate the signal from the noise and review Tesla's third-quarter forecast from its second-quarter update letter and earnings call. This will allow us to have a baseline to measure Tesla's performance – have they achieved their stated goals?

All expectations in this document will be both recent (not multi-year statements) and measurable in the third quarter (not long-term goals). In addition, each expectation will have a quote from where it comes from. In my opinion, it is a useful exercise to be able to compare Tesla's performance with their promises later – as I did on my personal website in Q1 / 18.

Tesla's two main promises in Q2 / 18 were Model 3 production and deliveries, as well as profitability / cash flow. We have already obtained the results of the first promise and we will know the results of the last promise on Wednesday.

Profitability and cash flow

"[W]We still expect to achieve GAAP profitability in the third and fourth quarters. In the future, we believe that Tesla can achieve sustained quarterly profits, in the absence of force majeure or economic slowdown, while continuing to grow at a rapid pace. "

Tesla Q2 Update Letter

This is perhaps the most important promise of Tesla for the third quarter (and for the fourth quarter) – the profitability of GAAP. Tesla has only experienced two quarters of its history with GAAP – Q1 / 13 and T3 / 16 profits.

Electrek – often regarded as Tesla's unofficial spokesperson – is already preparing markets to miss such a wait, with Fred Lambert suggesting that Tesla will reach a record quarter "almost profitable":

"The first benefits come from the fact that Tesla is expected to record a record quarter and even get closer to its profitability, according to Elon Musk's comments.

…

In an email to employees at the end of the quarter, CEO Elon Musk said the company was very close to profitability.

It is not clear if Tesla will actually make a profit, which would be the first time since 2013 [sic – Q3/16]but some investors are quick to publish the results, which is a good sign. "

It is not clear whether Electrek has received information informing them of "near-profits" – as opposed to actual profits – or whether this is solely based on the Elon blog published in September.

"We expect to generate positive cash flows including operating cash flow and capital expenditures.as well as the normal influx of funds received from non-recourse financing activities on leased vehicles and solar products. "

Tesla Q2 Update Letter

"I feel comfortable with GAAP positive income and positive cash flow every quarter from now on. There may be occasional quarters in which we repay a large loan or amount, or simply because we have repaid a large loan. But without that, the cash flow would be positive. "

Elon Musk, Q2 / 18 CC

Tesla also projected positive free cash flow in the third quarter of year 18 and in the coming quarters.

Tesla has generated positive operating cash flow over the past seven quarters – the latest being T4 / 17. Tesla has posted positive free cash flow over the past four quarters – the last quarter of the year. 2006 being the third quarter.

Vehicle production, delivery and margins

"We expect to produce between 50,000 and 55,000 model 3 vehicles in the third quarter., Who go represent an increase of 75% to 92% compared to the previous quarter. Deliveries expected to exceed production in the third quarter as our delivery system stabilizes. "

Tesla Q2 Update Letter

Tesla expects 50 to 55,000 model 3 vehicles to be produced with deliveries above production. As I had planned in September ("Tesla is on the way to achieving the objectives of Model 3"), Tesla has achieved these goals – well did not exceed them.

On October 2, Tesla announced that it produced 53,239 Model 3 vehicles, slightly above the midpoint of its 50-55 km guided range. Tesla also delivered 55,840 model 3 vehicles, exceeding T3 / 18 production. Tesla achieved this goal – which was favorably received by the market until new suspicious Tweets on Elon Musk were sent out. free fall:

"After reaching our goal of 5,000 a week, we will continue to increase it further, with our goal being to produce 6,000 model 3 vehicles a week by the end of August. "

Tesla Q2 Update Letter

Personally, I do not think that Tesla's "burst rate" production metrics are very useful information. In the end, it's a car manufacturer that sells X cars in a quarter – the number of these cars produced during the busiest week is little more than an anecdote. I would rather simply count the total number of cars in a quarter and divide it by 13 weeks to find average weekly production rather than looking at maximum output.

Despite my doubts about the usefulness of this measure, Tesla continues to provide it and targets 6,000 model 3 vehicles a week by the end of August.

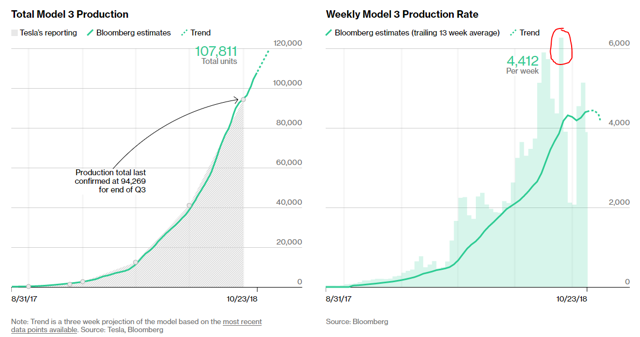

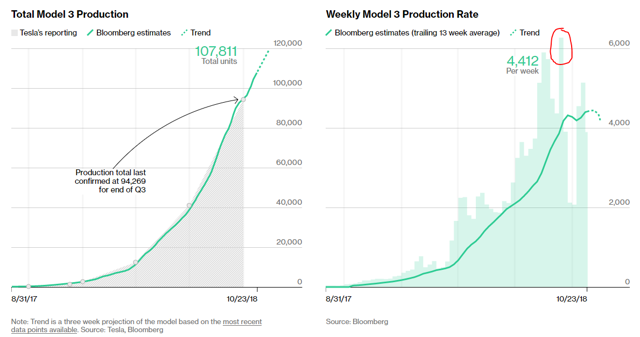

(Bloomberg)

We do not have yet the official word of Tesla on this metric, but everything indicates that Tesla missed this goal. The Bloomberg 3 tracking model indicates a single week above 6,000 people / week – but it tends to be unreliable, especially for weekday week numbers. Moreover, the encircled week was not at the end of August, but in mid-September.

"As revealed for the first time in the last episode of our podcast and based on the same reliable source familiar with Tesla production, the automaker has built about 6,400 vehicles over the last week (the last 7 days ) of the month of August (from 24 to 31 January), including approximately 4,300 model 3 vehicles. "

Electrek, September 2, 2018

Electrek announced that Tesla had already missed this production goal on September 2nd. They applied the news positively: "Tesla is missing the production target of Model 3 of 6,000 units a week, but on the right track for the overall goal Q3"- but a miss is a miss.

"Model 3 gross margin is expected to increase significantly to about 15% in the third quarter and about 20% in the fourth quarter, mainly due to continued reduction in manufacturing costs and, to some extent, an improvement in composition. "

Tesla Q2 Update Letter

We can not know if Tesla meets this goal or not. Tesla does not break down the gross margins of each vehicle in their financial statements. Instead, we hear about Tesla's margins on individual models only if Tesla tells them in its investor update. However, given the attention paid to model 3 margins, Tesla should provide us with this number – even if they can conceal it slightly (for example, saying "mid-teens" without giving an exact percentage).

The stated purpose of Tesla here is already a bit tasteless: they did not indicate a margin for margins of 15%, but rather margins of "approximately 15%" – which may mean ~ 14-16% or something similar?

Despite this, it will be one of Tesla's most important indicators this quarter. Shareholders and other stakeholders want to be assured that Tesla can increase the profitability of Model 3 and mass-produce a car at this scale in a cost-effective manner. If Tesla can not profitably produce a model of $ 55,000 to $ 60,000, why would the market give them enough confidence to lend money for an expansion of China?

"Deliveries of the S and X models are expected to accelerate in the second half of this year as we have now completed realigning our delivery process, and historically most deliveries were made towards the end of each quarter. but our delivery model is expected to normalize over the next two quarters. Our goal of delivering 100,000 Model S and Model X vehicles this year remains unchanged. "

Tesla Q2 Update Letter

Investors are apparently not interested in the S and X models, perhaps because they are mature products with limited growth prospects. However, Tesla also provided forecasts for these vehicles.

After the Q2 / 18, Tesla delivered about 44,100 S / X model vehicles in 2018. As a result, to reach a target of 100,000 people, Tesla is expected to have an average of 27,950 S / X model / quarter model vehicles. However, they did not even anticipate deliveries for the third and fourth quarters – so this is not a testable goal for the third quarter, although we can track their progress toward this goal in the third quarter. .

We already have deliveries in Q3 for the S and X models: Tesla delivered 14,470 S-model vehicles and 13,190 X-model vehicles in Q3 / 18. Together, this represents 27,660 vehicles. Tesla is slightly behind their target for S / X model deliveries. This is not yet a failure, but if Tesla's Q4 is Q3, it would miss about 580 out of 100,000 vehicles for a slight misfire.

Note that last year, Tesla delivered about 10% more model vehicles S and X in Q4 than in Q3. If Tesla's 4th quarter shipments again exceed Q3 shipments, Tesla would reach its target of 100,000 deliveries.

Other targets

The other goals of Tesla are likely to be of far less importance to the market than the objectives mentioned above. But here are other goals and expectations set by Tesla during the last quarter:

"For the remainder of the year, total non-GAAP operating expenses are expected to remain relatively stable in the second quarter, excluding restructuring costs, due to our general willingness to achieve efficiencies. "

Tesla Q2 Update Letter

In Q2 / 18, operating expenses under GAAP were $ 1.24 billion. Excluding restructuring costs, operating expenses were $ 1.14 billion. I've already forecast operating costs of about $ 1.18 billion. The question of whether the operating costs are "relatively stable" or not will probably be a matter of opinion. Maybe a reasonable measure for "relatively stable" would be +/- 5% – but others would have different ideas on relative stability.

"Our total 2018 capex is expected to be just under $ 2.5 billion, well below the total of $ 3.4 billion recorded in 2017".

"Interest expense in the third quarter is expected to rise to approximately $ 170 million (of which approximately half non-cash)."

"Losses attributable to minority interests should remain in line with the last quarter."

"We expect the negative margin of our service and other activities to decrease by the end of the year."

"[O]Solar deployments are expected to remain stable in the second half of this year. "

Tesla Q2 Update Letter

Tesla also set targets for capital expenditures (while allowing for cash flow flexibility), interest expense, losses on non-controlling interests, margins for services and other solar deployments.

Unless one of these parameters, especially capital expenditures, is very distorted, I do not expect these expectations to become a topic of discussion after the results call. from Tesla.

To take away

Tomorrow (October 23), Tesla will have big gains.

The most important indicators to be announced tomorrow are Tesla's profitability and cash flow. Tomorrow, a "home run" would involve announcing a profit, announcing a positive operating cash flow and announcing a positive free cash flow. Conversely, the worst case scenario would imply the absence of the three indicators – net losses, negative cash flow from operations and negative free cash flow.

Gross margins on Model 3 are another crucial parameter. This figure is closely related to profitability and cash flow: Model 3 accounted for more than two-thirds of Tesla's deliveries in Q3 / 18 and Tesla's margins from Model 3 could determine whether Tesla can be profitable and have a positive cash flow.

Future projections of Tesla will also be crucial: how many 3 Tesla models does it intend to produce from Q4 / 18 and beyond? Have there been any changes in Tesla's Gigafactory Chinese plans? What will Tesla say about repaying the debt? How will Tesla discuss the launch of the Model 3 Medium Range? Will Tesla update on the calendar of a 3 model of $ 35,000?

The answers to each of these questions will move Tesla's actions tomorrow afternoon and Thursday's negotiations.

Good luck to everyone – short and long.

Members of The growth operation, my community of newsletters on cannabis, receive:

- Daily articles on the news of cannabis – including information on US and Canadian cannabis growers.

- Exclusive access to my in-depth research articles on small cannabis businesses.

- Access my Cannabis template wallet.

- Access to my full, live wallet.

Membership is on sale this month only, and prices will go up next month, so sign up for a free trial today. (If prices rise later, the first members get exclusive prices, forever.)

Disclosure: I am / we are long TSLA.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link