[ad_1]

Oil fell back to its usual range of $ 65 to $ 70 per barrel last week after a brave attempt to exceed $ 70 on Tuesday. A report on mixed oil stocks in the US EIA has accentuated the slowdown in prices. Although the country's crude oil stocks have dropped 4.3 million barrels in the weekly bulletin, a surprising increase in gasoline and distillate inventories suggests that the summer peak period has ended and that the demand could weaken.

Monthly reports from IEA, EIA and OPEC

Next week, traders and analysts will receive up-to-date market intelligence from IEA, EIA and OPEC, with the three parties having to publish their respective market reports. In the first place, EIA's short-term energy outlook on Tuesday, where operators will be interested in the government's expectations regarding oil prices. In the August report, the EIA expects the average monthly Brent barrel to remain between $ 70 and $ 73 a barrel from August 2018 to late 2019. Brent closed on Friday. at $ 77.03.

The following report will be released Wednesday by OPEC. Traders and analysts will look for changes in OPEC's supply and demand forecasts. Last month, OPEC revised downward its global demand oil demand forecast for 2019 to 20 million barrels per day to 1.43 million barrels per day due to a demand lower in Latin America and the Middle East.

At the same time, OPEC has revised upward its forecast of global supply growth, stating that "the supply of oil outside OPEC in 2019 is expected to average 61.75 Mb / d, upward revision of 106,000 b / d. reassessment of Chinese supply forecasts next year. "A widening gap between lower demand and higher supply in OPEC's updated report will likely put downward pressure on prices.

Later in the week, the market will receive an update from IEA on Thursday. Last month, the IEA noted a significant slowdown in global oil demand growth in 2Q18 and 3Q18, with rebound forecasts in 4Q18. Traders will look closely at the changes made to this forecast to gauge short-term price direction. The IEA also said that by 2019, world demand for oil is expected to increase by 1.5 Mb / d. Changes to the 2019 forecast could influence medium-term price expectations.

[If you’re interested in trading oil and other commodities, consult Investopedia’s stock broker reviews and forex broker reviews to find a broker that meets your needs.]

Oil analysts remain bullish

Oil analysts remain optimistic about rising oil prices despite recent price resistance. They predict an increasingly tight oil market that could exceed $ 90 a barrel before the end of 2018. The central thesis is that the imminent sanctions against Iran will soon cripple global oil supplies.

OPEC crude oil production, however, rose in August to reach its highest level this year, and a trade war with the United States could affect future oil demand in China. The market is eagerly awaiting the final decision of US President Donald Trump, who warned Friday he was ready to apply tariffs on an additional $ 267 billion in Chinese products, in addition to the $ 200 billion in imports already reported. Economists estimate that it is all of the products imported from China by the United States and that tariffs could tilt the global economy into recession if the president implemented this policy fully. The uncertainty surrounding such a scenario does not give a bullish picture for the oil markets.

Mixed technical indicators again

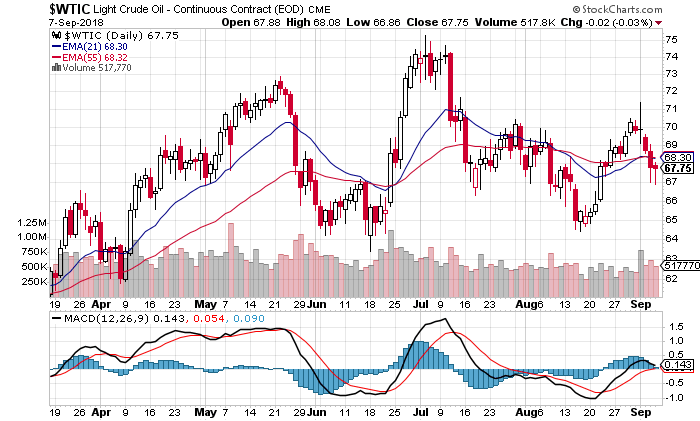

Oil lost momentum at the end of August and returned to its previous trading range after rising to $ 71.40 last week. Tuesday was particularly volatile, with a price of a barrel of oil just below $ 70 a day, which produced a classic doji model. Oil traded for the remainder of the week and closed at 67.75 dollars on Friday.

This last price action means that the technical indicators again produce neutral trade signals. For example, the 21-day exponential moving average is just below the 55-day moving average and the fast line of the moving average convergence (MACD) impulse indicator should fall below the zero level. Readings below zero tend to indicate low prices and a downward trend.

The technical signs on the daily price chart are negative with seven sell signals, two neutral and one purchase. Moving averages are also negative, with the exception of the 200-day moving average that signals a sale. The higher-priced technical charts on weekly price action currently show a neutral position with three sales, three neutral signals and four buy signals.

Bulls can be reassured by the price rises after earning $ 67 for two days last week, indicating that buyers are hitting these levels. Current side market trading, however, is difficult to manage and volatile fundamentals are not useful.

Disclaimer: Gary Ashton is an oil and gas financial consultant who writes for Investopedia. The observations that he makes are his and are not meant to be investment or negotiation tips. Price chart courtesy of StockCharts.com.

Source link