[ad_1]

<div _ngcontent-c16 = "" innerhtml = "

Getty

The US Bureau of Labor Statistics reported today that the Consumer Price Index (CPI) rose 0.2% in August, as it did in July. The CPI measures the cost of goods and services – in other words, your cost of living. When the CPI does not change much, this tends to indicate that interest rates will remain in place. This information is important for taxpayers because the Tax Code provides for mandatory annual adjustments for certain tax elements based on inflation.

That said, there is a change in the way the Internal Revenue Service (IRS) will calculate cost-of-living adjustments for 2019. As part of the law on tax cuts and jobs, it is the only way to do this. "Normal" CPI has been replaced by "CPI. The IPC chained measures the consumer the answers at higher prices rather than simply measuring higher prices. What this means for taxpayers is that the adjustments for inflation will seem less important.

(You can find examples of how the IPC chained here.)

Inflation and cost-of-living adjustments are regularly included in tax legislation. That's why you'll see year-to-year changes ranging from amounts deducted to the standard deduction to federal gift tax exemptions. To help you with your tax planning, Bloomberg Tax has published a first glimpse of the rates projected for 2019.

"Although the IRS will not be announcing inflation adjustments for next year, our forecasts will help taxpayers and tax planners start the tax planning season in 2019 in their own way. to more accurately estimate their tax liabilities for the coming year, "said George Farrah, Bloomberg's editorial director. "This process is particularly important for 2019, as most of the changes made under the 2017 Tax Act will be in effect. Taxpayers and their advisors should pay particular attention to the impact of inflation adjustments determined using the chained CPI index on income tax bracket and other amounts of tax. "

Here are some projected numbers for the 2019 taxation year, as of January 1, 2019. These are do not tax rates and other figures for 2018 (you will find the official 2018 tax rates here).

Tax support

Since a higher CPI pushes up the ranges and increases the amounts of the standard deduction and exemption, the taxes owed on the same earnings will decrease, albeit slightly. Here's what the rates should look like:

KPE

KPE

KPE

KPE

KPE

Capital gains

The capital gains rates will not change for 2019. However, the rate break points will change. Bloomberg Tax provides that the maximum zero rate amounts and maximum rate amounts of 15% will be allocated as follows:

KPE

Amounts of personal exemption

Under the TCJA, there is no personal exemption amount for 2019. Personal exemptions used to further reduce your taxable income before determining your tax. You were generally granted an exemption for you (unless you can be claimed as a dependent of another taxpayer), an exemption for your spouse if you filed a joint declaration and a personal exemption for each of them. your dependents. .

(To learn more about what has changed under the TCJA, click here.)

Also note that, for the purposes of defining an eligible parent, the amount of the exemption is deemed to be $ 4,200 ($ 4,150). The first amount, $ 4,200, is the amount that Bloomberg Tax considers to be the literal application of the applicable IRC provision, but the amount in parentheses is the amount that it expects the IRS publishes.

(To learn more about the recent IRS Guidelines on Qualified Parents for Expanded Child Tax Credit click here.)

Standard deduction

As part of the TCJA, the amount of the standard deduction doubled in 2018 for most taxpayers. This increase means that more taxpayers should opt for the standard deduction rather than claiming detailed deductions. With inflation, these amounts will increase slightly. The standard deduction amounts for 2019 are:

KPE

In addition, for 2019, it is expected that the standard deduction for a person who can be claimed as a dependent by another taxpayer will not exceed the greater of:

- $ 1,100, or

- the sum of $ 350 plus the earned income of the individual.

The additional standard deduction amount for the elderly or blind will be $ 1,300. The amount of the additional standard deduction will be increased to $ 1,650 if the person is also single and not a surviving spouse.

For high-income taxpayers who detail their deductions, the limitations of Pease, named after the former Rep. Don Pease (D-OH) used to cap or eliminate certain deductions. However, because of the TCJA, there are no Pease limitations in 2019.

Deduction under section 199A (also known as the deduction for the transfer)

As part of the TCJA, sole proprietors and business owners of pass-through are eligible for a deduction of up to 20% to reduce the tax rate of business income. qualified company. The deduction is subject to certain thresholds and amounts in installments. For 2019, these amounts will look like this:

KPE

(To learn more about passing deduction, click here.)

Alternative Minimum Tax (AMT)

The exemption rate of the AMT is also subject to inflation. Bloomberg Tax anticipates that the exemption amounts will look like this in 2019:

KPE

Retirement savings account

For 2019, Bloomberg Tax expects the maximum contribution limit for traditional IRAs and Roth will reach $ 6,000 for people under 50, with a total contribution of up to $ 7,000 for those 50 and older .

(For comparison, you can see here the 2018 figures of Ashlea Ebeling of Forbes.)

Exclusion of federal inheritance tax

The federal estate tax exclusion for those who died in 2018 was $ 11.2 million per married couple. BNA expects this amount to increase slightly to $ 11.4 million for a married couple.

Exclusion of gift tax

The annual exclusion for purposes of the federal gift tax will remain at $ 15,000 in 2019. This means that you can offer $ 15,000 per person to as many people as you want without federal tax consequences. donations in 2019; If you divide the gifts with your spouse, this total is $ 30,000 per person.

(You can see the 2018 numbers of Ashlea Ebeling of Forbes for inheritance tax and donations.)

This should be enough for your tax planning to start in 2019. You may need to do an audit to make sure you're on the right track. For more information on verifying your withholding, click here. To learn how to make adjustments on your W-4 form, click here.

Remember, however, that these are just projections. The Internal Revenue Service (IRS) will release official tax brackets and other tax figures for 2019 later this year, likely in October.

The 2019 tax projections are just one of the features of Bloomberg Tax. The full report is available for free here (downloads in pdf format).

Bloomberg Tax provides legal, tax and compliance professionals with critical information, practical advice and workflow solutions.

">

Getty

The US Bureau of Labor Statistics reported today that the Consumer Price Index (CPI) rose 0.2% in August, as it did in July. The CPI measures the cost of goods and services – in other words, your cost of living. When the CPI does not change much, this tends to indicate that interest rates will remain in place. This information is important for taxpayers because the Tax Code provides for mandatory annual adjustments for certain tax elements based on inflation.

That said, there is a change in the way the Internal Revenue Service (IRS) will calculate cost-of-living adjustments for 2019. As part of the law on tax cuts and jobs, it is the only way to do this. "Normal" CPI has been replaced by "CPI. The IPC chained measures the consumer the answers at higher prices rather than simply measuring higher prices. What this means for taxpayers is that the adjustments for inflation will seem less important.

(You can find examples of how the IPC chained here.)

Inflation and cost-of-living adjustments are regularly included in tax legislation. That's why you'll see year-to-year changes ranging from amounts deducted to the standard deduction to federal gift tax exemptions. To help you with your tax planning, Bloomberg Tax has published a first glimpse of the rates projected for 2019.

"Although the IRS will not be announcing inflation adjustments for next year, our forecasts will help taxpayers and tax planners start the tax planning season in 2019 in their own way. to more accurately estimate their tax liabilities for the coming year, "said George Farrah, Bloomberg's editorial director. "This process is particularly important for 2019, as most of the changes made under the 2017 Tax Act will be in effect. Taxpayers and their advisors should pay particular attention to the impact of inflation adjustments determined using the chained CPI index on income tax bracket and other amounts of tax. "

Here are some projected numbers for the 2019 taxation year, as of January 1, 2019. These are do not tax rates and other figures for 2018 (you will find the official 2018 tax rates here).

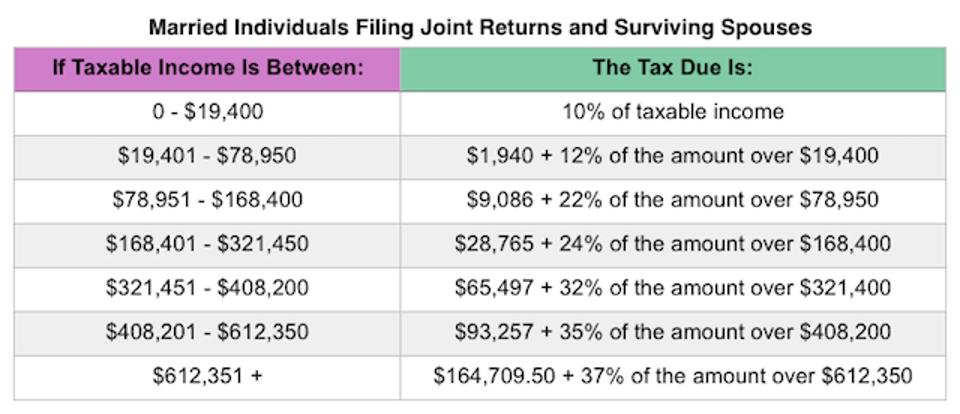

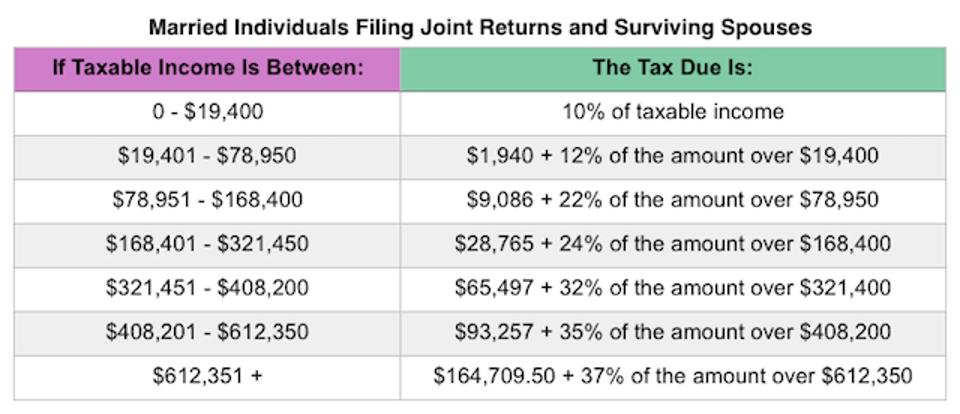

Tax support

Since a higher CPI pushes up the ranges and increases the amounts of the standard deduction and exemption, the taxes owed on the same earnings will decrease, albeit slightly. Here's what the rates should look like:

KPE

KPE

KPE

KPE

KPE

Capital gains

The capital gains rates will not change for 2019. However, the rate break points will change. Bloomberg Tax provides that the maximum zero rate amounts and maximum rate amounts of 15% will be allocated as follows:

KPE

Amounts of personal exemption

Under the TCJA, there is no personal exemption amount for 2019. Personal exemptions used to further reduce your taxable income before determining your tax. You were generally granted an exemption for you (unless you can be claimed as a dependent of another taxpayer), an exemption for your spouse if you filed a joint declaration and a personal exemption for each of them. your dependents. .

(To learn more about what has changed under the TCJA, click here.)

Also note that, for the purposes of defining an eligible parent, the amount of the exemption is deemed to be $ 4,200 ($ 4,150). The first amount, $ 4,200, is the amount that Bloomberg Tax considers to be the literal application of the applicable IRC provision, but the amount in parentheses is the amount that it expects the IRS publishes.

(To learn more about the recent IRS Guidelines on Qualified Parents for Expanded Child Tax Credit click here.)

Standard deduction

As part of the TCJA, the amount of the standard deduction doubled in 2018 for most taxpayers. This increase means that more taxpayers should opt for the standard deduction rather than claiming detailed deductions. With inflation, these amounts will increase slightly. The standard deduction amounts for 2019 are:

KPE

In addition, for 2019, it is expected that the standard deduction for a person who can be claimed as a dependent by another taxpayer will not exceed the greater of:

- $ 1,100, or

- the sum of $ 350 plus the earned income of the individual.

The additional standard deduction amount for the elderly or blind will be $ 1,300. The amount of the additional standard deduction will be increased to $ 1,650 if the person is also single and not a surviving spouse.

For high-income taxpayers who detail their deductions, the limitations of Pease, named after the former Rep. Don Pease (D-OH) used to cap or eliminate certain deductions. However, because of the TCJA, there are no Pease limitations in 2019.

Deduction under section 199A (also known as the deduction for the transfer)

As part of the TCJA, sole proprietors and business owners of pass-through are eligible for a deduction of up to 20% to reduce the tax rate of business income. qualified company. The deduction is subject to certain thresholds and amounts in installments. For 2019, these amounts will look like this:

KPE

(To learn more about passing deduction, click here.)

Alternative Minimum Tax (AMT)

The exemption rate of the AMT is also subject to inflation. Bloomberg Tax anticipates that the exemption amounts will look like this in 2019:

KPE

Retirement savings account

For 2019, Bloomberg Tax expects the maximum contribution limit for traditional IRAs and Roth will reach $ 6,000 for people under 50, with a total contribution of up to $ 7,000 for those 50 and older .

(For comparison, you can see here the 2018 figures of Ashlea Ebeling of Forbes.)

Exclusion of federal inheritance tax

The federal estate tax exclusion for those who died in 2018 was $ 11.2 million per married couple. BNA expects this amount to increase slightly to $ 11.4 million for a married couple.

Exclusion of gift tax

The annual exclusion for purposes of the federal gift tax will remain at $ 15,000 in 2019. This means that you can offer $ 15,000 per person to as many people as you want without federal tax consequences. donations in 2019; If you divide the gifts with your spouse, this total is $ 30,000 per person.

(You can see the 2018 numbers of Ashlea Ebeling of Forbes for inheritance tax and donations.)

This should be enough for your tax planning to start in 2019. You may need to do an audit to make sure you're on the right track. For more information on verifying your withholding, click here. To learn how to make adjustments on your W-4 form, click here.

Remember, however, that these are just projections. The Internal Revenue Service (IRS) will release official tax brackets and other tax figures for 2019 later this year, likely in October.

The 2019 tax projections are just one of the features of Bloomberg Tax. The full report is available for free here (downloads in pdf format).

Bloomberg Tax provides legal, tax and compliance professionals with critical information, practical advice and workflow solutions.