[ad_1]

Qualcomm Inc. is expected to terminate its $ 44 billion bid for competitor NXP Semiconductors NV after China will not approve the largest takeover of the industry by the deadline .

Trade spat between China and the United States, while all other jurisdictions in the world liquidated the supply months ago. Qualcomm had until midnight in New York on July 25 to get approval from regulators, who delayed approval for months. Although the companies did not comment in the hours that followed the deadline, China said the agreement had nothing to do with trade tensions.

Unveiled in October 2016, the collapsed deal is a blow to both companies. Qualcomm will be forced to go it alone in its push towards automotive silicon by trying to reduce its reliance on the slowing smartphone market, where it faces more competition and legal battles with customers. Earlier Wednesday, Qualcomm announced its intention to pay NXP a $ 2 billion break-up fee and plans to buy back up to $ 30 billion in shares if the purchase is scrapped . NXP's management, after almost two years of waiting, will now have to find a way to convince customers and investors that it has a strong future as an independent company.

"We did not see anything in the short term that would make it worthwhile to change the timing – there were probably more forces involved here than just us," said Steve Qualcomm's general manager. Mollenkopf in an interview before the deadline. "We are still fans of the agreement and logic behind the agreement."

Learn more about the uncertainties facing Qualcomm and NXP

Shares of Eindhoven, Netherlands NXP tumbled 1.6 percent to $ 96.79 in prolonged negotiation following the declaration of Qualcomm. Qualcomm, based in San Diego, has jumped about 3.4%. Qualcomm had offered $ 127.50 per share for NXP and the transaction was approved by both groups of shareholders and government agencies in Europe, the United States and elsewhere.

Qualcomm initially assured investors that approval would arrive in late 2017. In April, the two companies extended the agreement until Wednesday's deadline while Qualcomm negotiated concessions with China. But US President Donald Trump has accused mainland China of creating an unjust imbalance in trade between the world's two largest economies

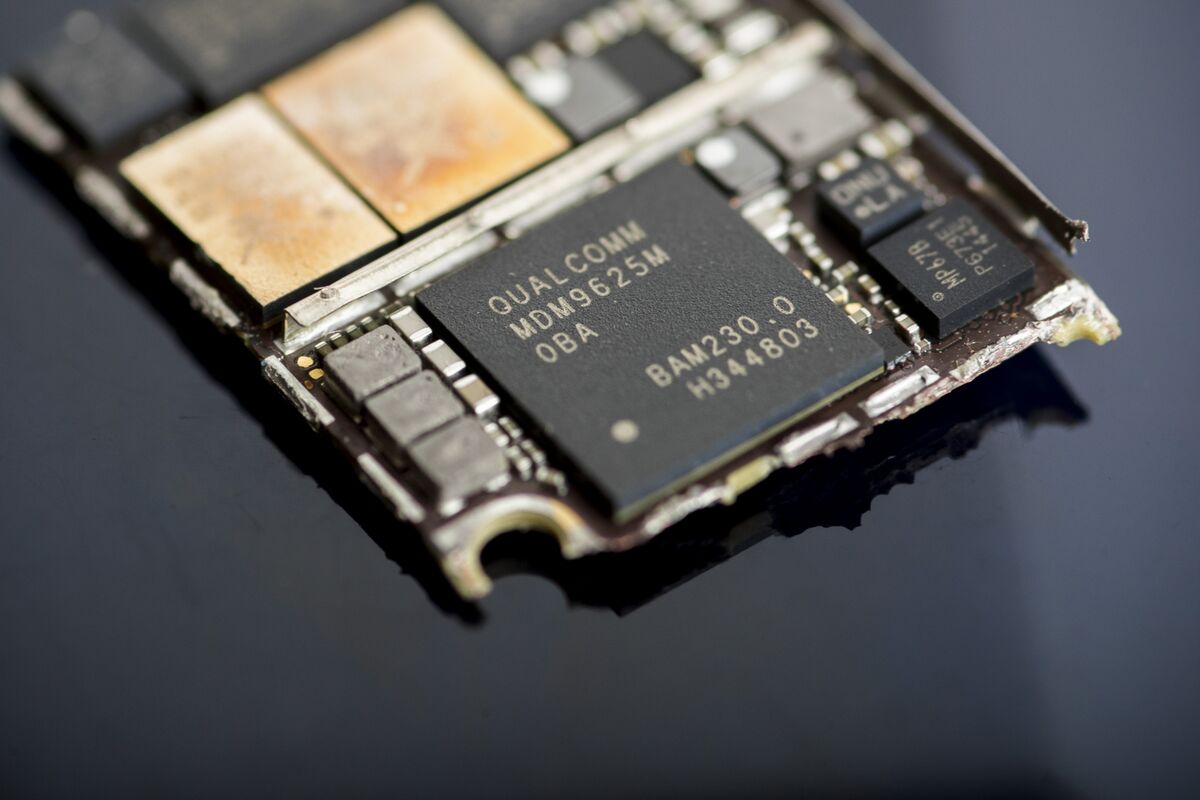

Qualcomm expects Apple to abandon its modems for the next iPhones

The deal is about market monopoly, said Gao Feng, spokesman for the Chinese Ministry of Commerce, during a press briefing in Beijing on Thursday. He referred the reporters to the State Regulatory Market Authority for more information.

The SAMR had been charged with approving the acquisition, said people familiar with the process in recent months. But, as the trade dispute continued, ZTE Corp., the Chinese telecom equipment manufacturer that was likely to fail due to a seven-year ban on buying components in the United States , was a stumbling block. After Trump's personal intervention, ZTE's ban was lifted – something that was considered a prerequisite to the Chinese approval of the Qualcomm agreement -NXP.

The ultimate failure of the agreement, which had been the fact that two companies agreed little or no overlap between the two products weakened the prospects of other transactions in the market. $ 400 billion semiconductor industry, which has been reshaped over the past three years. Qualcomm itself was the subject of a hostile takeover bid by Broadcom Inc., an effort that seemed to have to be successful until the US government blocked it, citing risks to the company. national security.

Qualcomm also announced sales in the third quarter The turnover is expected to be between $ 5.1 and $ 5.9 billion in the fourth quarter, which ends in September. company said in a statement Wednesday. Analysts estimate an average revenue of $ 5.46 billion, according to data compiled by Bloomberg. Earnings in the third quarter were $ 1.01 per share excluding certain items. Revenues climbed to $ 5.6 billion. Analysts had predicted a profit of 70 cents per share on a $ 5.19 billion business figure.

To counter Broadcom's takeover bid, Qualcomm promised investors that it would improve its costs and profits this year and promised cash. in a share buyback program if the approval of NXP could not be obtained. Qualcomm is also once again the target of an attempted takeover – the former CEO and Qualcomm's chairman, Paul Jacobs, is trying to raise cash to privatize it.

– With the help of Miao Han [19659002] ( Updates with comments from China beginning in the second paragraph. )

Source link