[ad_1]

In July 2018, I published an article on Red Hat (RHT), entitled "Red Hat: Who Will Wear It? The article spoke of RHT's strength as an open source leader, who had witnessed a slowdown in its middleware business. Despite the slowdown, RHT has a strong presence in the cloud and in the operating system space, making it a potentially attractive acquisition target. Yesterday, IBM announced plans to acquire RHT for $ 34 billion.

What did I understand?

Intrinsic value

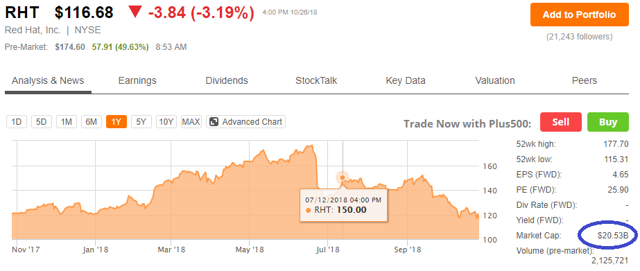

I had reached an underlying value of $ 20.4 billion for RHT, above which shareholders would benefit from synergies. At closing on Friday, RHT's equity rose to $ 20.53 billion (see image below).

Price

Assuming that the buyer could share between 20 and 40% of the synergies, this would imply an increase of 31 to 60% compared to the closing price of 12 July 18.

Source: Red Hat article

The implicit price range arrived was $ 196 to $ 240 (31% up to $ 150); IBM offered to buy RHT at $ 190 on the base floor of my range.

Source: Looking for alpha

Buyer

Based on the stacks of technology and the ability to finance a transaction of this size, I expected that the buyout was led by Microsoft (MSFT) or IBM – IBM seems to have taken the plunge. In doing so, the company will likely end up performing one of the largest merger and acquisition history of technology deals.

Why did I understand correctly?

The redemption of RHT was almost a writing on the wall, due to the state of maturity of the company:

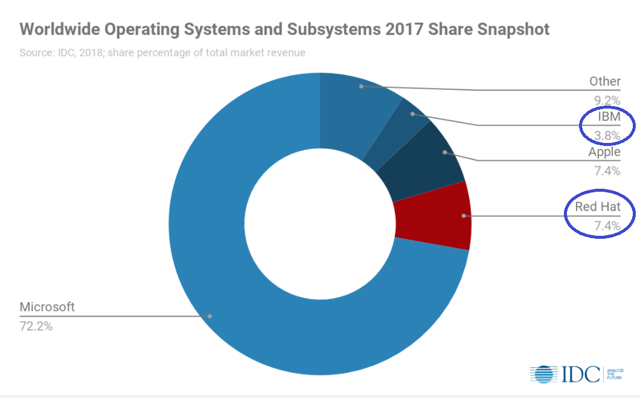

- Offers related to infrastructure: RHT was the only real competitor of MSFT's dominance in the operating systems market. However, MSFT had a tenfold greater share at 72% compared to 7.4% RHT.

- Virtualization: Due to high adoption rates, this market is expected to have peaked.

- IBM's growing influence on RHT: In May 2018, IBM announced a key partnership with RHT.

Another aspect was RHT's complementary product portfolio:

But what makes it so valuable is the fact that we do not have product overlap. And if we meet, we can offer global solutions. So, if you think – we both hear about products in the hybrid cloud, but we are at different levels. And therefore, we unite and can offer the most convincing solution. But that's because we have complementary products that solve an open hybrid multi-cloud problem. And that's where the real value lies. You are right. We have overlaps in this vast market, but not at the product level.

Source: IBM Conference Call

In addition, the consolidation of the market seems to be accelerated with the acquisition of MuleSoft by Salesforce (NYSE: CRM).

A great middleware player, whose offerings are less recommended than those of a smaller player and whose customer satisfaction and iPAAS experience are below the average middleware market) could be the precursor to an impending consolidation between these two companies.

Source: Red Hat article

Although the combination of strategic logic and business logic is almost perfect, the key question was the ability to finance such a transaction: while MSFT had a strong net cash position, IBM had a large debt.

MSFT recently closed its acquisition of GitHub and could have his hands full. In addition, MSFT also has LinkedIn in its portfolio. The combination of GitHub and LinkedIn can help MSFT easily realize its open-source ambitions. This may be why MSFT may not have wanted RHT. (Although the acquisition of RHT would have given MSFT more than 80% of the operating system market).

IBM appears to have taken up the dual challenge of making RHT FCF positive in the next 12 months and facing additional debt in an ever-increasing rate environment.

Market implications

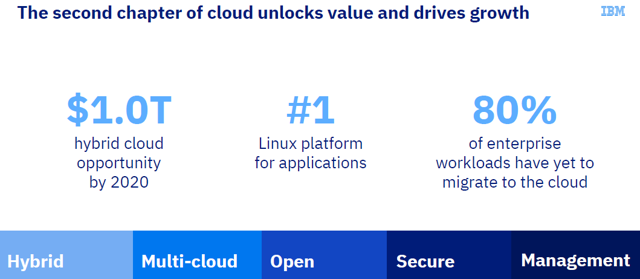

IBM believes it has sold the cloud market with this acquisition:

The combination of IBM and Red Hat changes the rules of the game. I want to say it all over again, it's about redefining the cloud landscape and we'll become the undisputed leader of the hybrid cloud.

Source: IBM Conference Call

Source: IBM Overview

However, I would also look at the evolution of the operating systems market.

Source: IDC

While still far behind MSFT's market share of more than 70 percent, the new IBM will hold about 12 percent of the operating system market, with an emphasis on open source.

Source: IDC

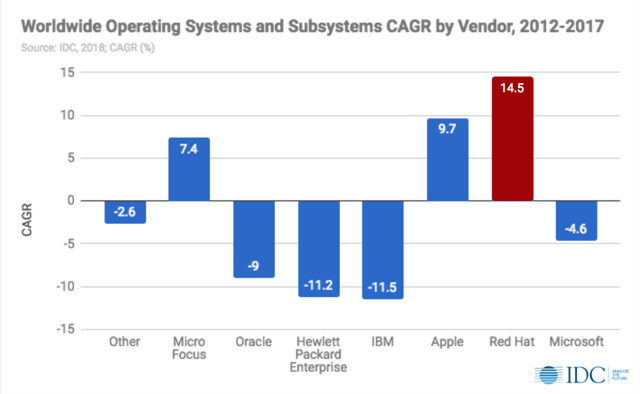

In addition to an increased presence, IBM will also inherit the fastest growing operating system market. Given that IBM was struggling in this market, renewing the lease could be a credible threat to MSFT.

Conclusion

In the words of Mark Twain, "The story is not repeated but rhymes oftenIBM will now become the main competitor of MSFT in the operating system market: in the 1980s, IBM licensed operating systems from MSFT.

At the time of the closing of this transaction, RHT repaid nearly 30% to the shareholders (at the close of July 12, 2018). Congratulations to everyone who made the drop from $ 150 to $ 116.

RHT data by YCharts

IBM will now have a bigger slice of markets where it was losing. IBM's ability to push its competitors back by boosting RHT technology on its platform will depend on several factors:

- The size of the IBM offer has led analysts to embark on further mergers and acquisitions in the cloud: the resulting technology and business clusters are likely to lead to the evolution of the cloud market in a way that might not have been anticipated by the best game theorists.

- Manage IBM's new partnerships with MSFT, Amazon (NASDAQ: AMZN) and Google (NASDAQ: GOOG) (NASDAQ: GOOGL): the love-hate relationship between these companies is likely to reach new heights given the master of IBM.

- Financing and interest rates: The Fed is on track to raise its rates and the balance of IBM 's debt seems to see a further increase thanks to the bridge loan that the company would take to finance the RHT transaction. The increase in debt service obligations will likely be offset by additional cash flows generated by RHT and potential synergies, but this is an area to watch closely.

As a side issue, even if it's difficult, it's possible that a more desperate suitor wants to pay more for RHT. Although IBM appears to be the best strategic solution for RHT, a higher bid could soften the deal for RHT's shareholders. However, because of the obvious synergies, RHT should still end up with IBM.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link