[ad_1]

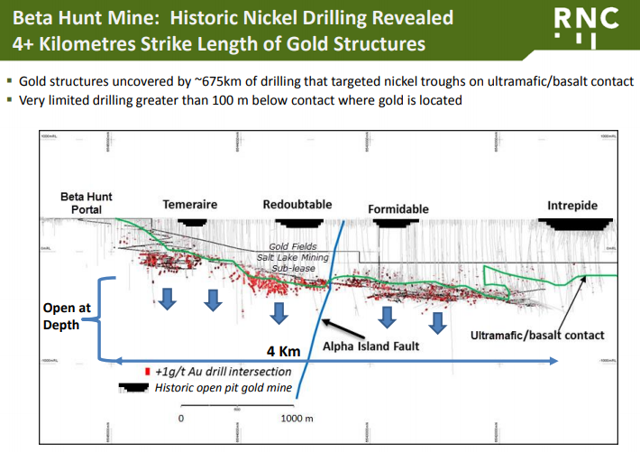

RNC Minerals (OTCQX: RNKLF) is a miner specialized in micro-capitalization. It owns the operating gold mine Beta Hunt, operating in Western Australia, but its main asset is one of the largest undeveloped nickel-cobalt mines in the world, located in the region. 39, Abitibi in Quebec, Canada.

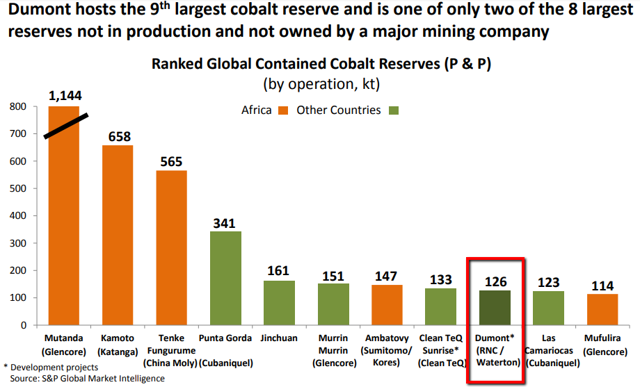

The DuMont deposit has long been the most attractive component of RNC. Nickel is a key element of steel production, which has experienced strong growth. This was unfortunately offset by a large stock that kept prices down. The rise of electric vehicles has also made the cobalt portion of this deposit more attractive for potential developers. The project has been authorized and is "ready to go", according to management. However, to date, RNC has not been able to find a partner or funding itself to move the project forward.

Source: Company Presentation, September 2018

The company was refinancing its balance sheet, which included the sale of its Beta Hunt mine, to focus solely on the DuMont property. All this changed on September 9, 2018 when the company revealed a massive high-grade discovery at Beta Hunt3 cut the company did during the last week. This discovery makes the Beta Hunt mine more than an abandoned activity that the company seeks to sell.

DuMont's focus

RNC is focused on the DuMont property for most of 2018, starting with the announcement of its strategic focus in January, the goal being to be in development in 2019. She said she had discussed with several strategic investors, but so far, is still nothing in place. Unfortunately, this is often the case for young miners who end up owning a project but lack capital.

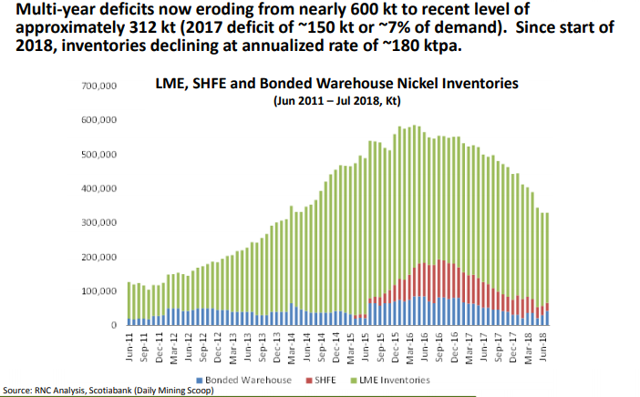

I do not think management is wrong to have this orientation; The overall supply has fallen sharply over the last 3 years, down almost 50% from the peak reached in 2015:

Source: Company Overview

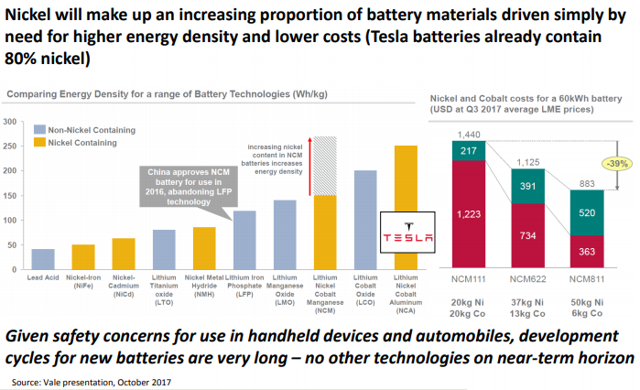

RNC estimates that nickel demand will increase significantly as electric vehicles become more important:

Source: Company Overview

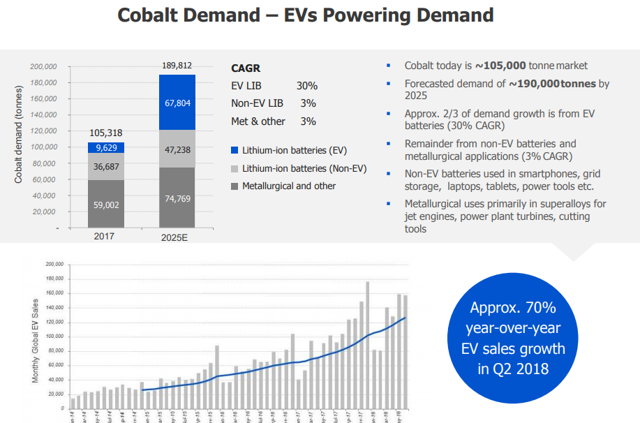

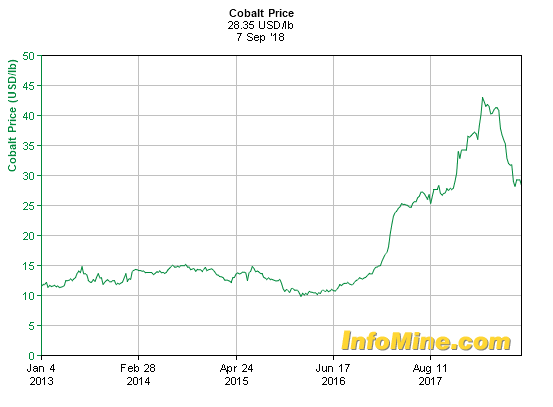

The increased importance of Cobalt has also increased, giving the RNC project additional potential as a valuable bi-product:

Source: Presentation of Cobalt27, September 2018

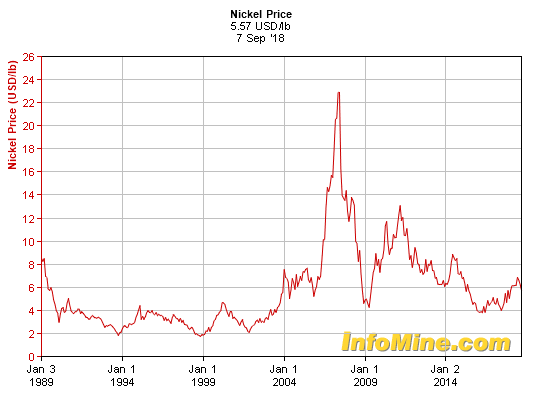

With these fundamentals, it would follow that suitors would have to bump down to buy a partner or buy RNC. This is not due in part to the price environment; the price of nickel was somewhat dull:

Source: Infomine.com

Cobalt prices were stronger but insufficient to offset nickel prices:

Source: Infomine.com

RNC's finances have also been a deterrent. RNC raised funds by different means during the year. These included:

RNC had to give portions of its project to refinance its books; which are now much cleaner. His goal was to liquidate Beta Hunt, even announcing in July 2018 that he was in negotiation with a preferred bidder, which would further clean up his balance sheet and give him liquidity to attract a partner. I believe that the announcement of September 9, 2018 will change the situation.

The nut

Beta Hunt is producing better grades at about 50,000 oz per year by improving grades and reducing costs to about $ 650 / oz in the second quarter of 2018. Although the company has put the mine on sale, it continues to grow. explore his property. In his September 2018 presentation, he shows the possibility that the company can dig deeper than its current infrastructure:

Source: Company Overview

The company discovered during its drilling more than 9,250 oz in a single earthen cube:

Source: Press release of the company, September 10, 2018

Source: Financial Post, September 10, 2018

The question is whether there is a single anomaly or the beginning of a large vein. Another Australian-based miner, Novo Resources (OTCQX: NSRPF), found a similar gold nugget and quickly saw its price rise from $ 0.63 to over $ 7 in just over 3 months. had found 1,500 oz in other sedimentary deposits and there are several other areas that the company is currently looking to study. Needless to say, they interrupted the process of eliminating Beta Hunt right now.

The takeaway dish

RNC's action reacted dramatically in response to this press release:

RNX data by YCharts

I admit that I am not a professional geologist, but I know that these types of deposits are very difficult to model because they are not easy to map. I will quote some notes taken by the geologist Brent Cook during a field visit in 2017, on the deposit of Novo.

What this gives to Royal Nickel is an important catalyst in the months to come, while others discover the discovery and the project plan. If other finds are located, this could easily drive the price of RNC gold. Its current market capitalization is only $ 48.7 million; this discovery alone represents approximately 25% of the market capitalization, leaving aside the optionality on the rest of the mine and the DuMont project.

The company can go in many ways from here; it could sell its stake in DuMont, it could sell the Beta Hunt mine or it could be bought by someone willing to bet on any of these projects. After years of no interest from investors and questionable management, RNC can finally give investors something to encourage; if the market reacts as it did to Novo, the multiples are positive; otherwise, the DuMont project still has a lot of potential. In any case, the discovery of Beta Hunt has added an important source of price discovery for its assets.

If you see something in this article that you agree with, or even better with, please take the time to comment below. This makes us all better investors. I focus mainly on my investment in small and medium businesses. but reserves the right to dismiss it from time to time, including short theses. If you like what I do, you can follow me by pressing the "Follow" button at the top of this article. In addition, you can follow me in real time by selecting this option.

Disclosure: I am / we are long RNKLF.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Additional disclosure: I am long through the more liquid RNX.TO teletypewriter on the Toronto Stock Exchange.

Editor's Note: This article covers one or more shares traded at less than $ 1 per share and / or with a market capitalization of less than $ 100 million. Please be aware of the risks associated with these stocks.

[ad_2]

Source link