[ad_1]

L & # 39; opportunity

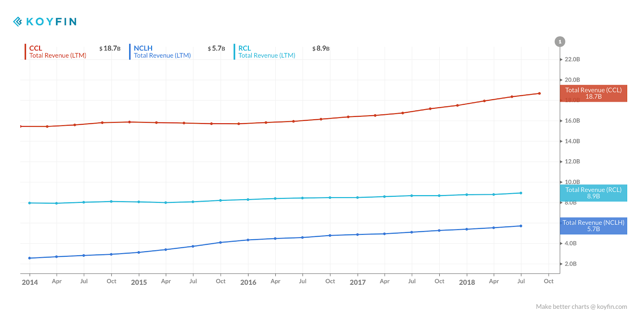

Royal Caribbean Cruises Ltd. (RCL) is a cruise company based in Norway headquartered in Miami, Florida. After Carnival Corporation & plc. (CCL / CUK) Royal Caribbean is the second largest cruise operator in the world.

The company's business model is to convince consumers that cruises are a better vacation option than traditional destinations. The company exploits this added value and makes cruises a popular vacation choice among families, couples and single travelers.

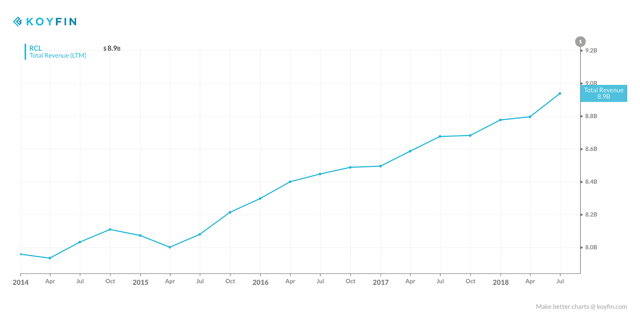

According to the company's forecast for the second half of 2018, the stock price could still evolve until 2019. Royal Caribbean is the best buy of the cruise industry. I am taking a fair value of $ 139 based on a multiple of 14 times the earnings of 2019. I expect a high rate of growth in teen earnings and a growth rate of sales to a high figure by 2019, while the company captures strong trends in consumer spending.

Business Overview

Royal Caribbean has three subsidiaries: Royal Caribbean International, Celebrity Cruises and Azamara Club Cruises. The company also owns 50% of TUI Cruises, 49% of Pullmantur and 36% of SkySea. Royal operates 49 vessels with a total of 124,070 berths. The destinations are about 540 ports on 7 continents.

Royal Caribbean International, Celebrity Cruises and Azamara Club are part of the company's Global Brands segment. The three brands are part of the company's strategy to improve its flexibility in the offering of vacation packages.

- Royal Caribbean International: It has a fleet of 24 ships serving popular destinations around the world such as Alaska, Asia, Australia, the Bahamas, Bermuda, Canada, the United States. Caribbean, Europe and New Zealand. Currently, they have 6 ships under construction that will add a capacity of 30,500 seats to the fleet. The first vessel of the new fleet is expected to enter service in the second quarter of 2019.

- Celebrity Cruises: This is the premium cruise fleet of Royal Caribbean Cruises Ltd. This segment of the company is responsible for providing luxury cruises and exotic destinations for customers with greater economic capacity. It has a fleet of 12 vessels with a capacity of 23,170 seats. The brand is waiting for the finalization of 5 additional ships that will add a capacity of 11,700 cabins. The first will be operational in the last quarter of 2018.

- Azamara Club Cruises: Azamara is responsible for offering smaller but more luxurious cruises in North America, the United Kingdom and Australia. This segment offers a much more personalized service and only has 2 boats with a capacity of 1,400 seats.

Royal in the industry

The year 2018 was a record year for the cruise industry, registering annual growth of around 7 to 10%. Royal Caribbean has captured this growth and is attracting new customers. These new customers are also known as "cruisers for the first time" and are essential to the success of the industry. The new cruisers are mainly concentrated in North America. For 2017, it accounted for 50% of cruise customers worldwide.

For Royal Caribbean, North America accounts for 59% of the total number of passengers and is of strategic importance to their operations. The company has also developed an effective customer engagement strategy around the world. International customers accounted for 42% of the company's revenue in 2017.

The company has been at the forefront of technology in the cruise market by investing in the WiFi of ships. While consumers need constant connectivity, the company has expanded its broadband WiFi offerings and updated its digital content by making it accessible to any platform. It has also improved the installed internet capacity on ships by increasing bandwidth for cruisers. The company monetizes WiFi by offering daily Internet packages ranging from $ 16 to $ 30 per day. Internet is expensive because the ship must use satellites to acquire the signal and a slight latency slows Internet browsing. This service is essential for the way the consumer assesses the overall experience of the cruise and is at the forefront of the company's capital investment plans.

The company's revenue model is largely based on ticket sales and 72% of last year's revenue came from notes. Most cruise packages are available for sale until one year before the departure of the cruise. The rest of the company's revenues are concentrated in the activities on board with 28% of the total.

Activities include the sale of beverages and alcohol, communication and internet services, gift shop, photography, spa and additional pension services.

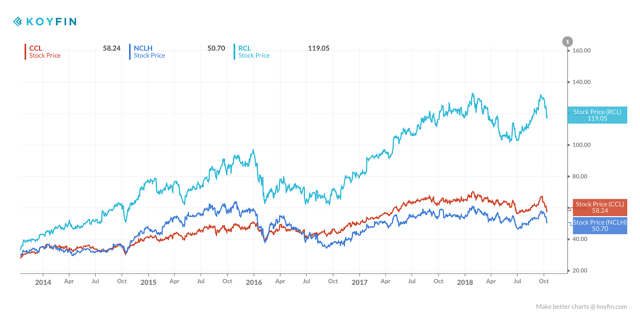

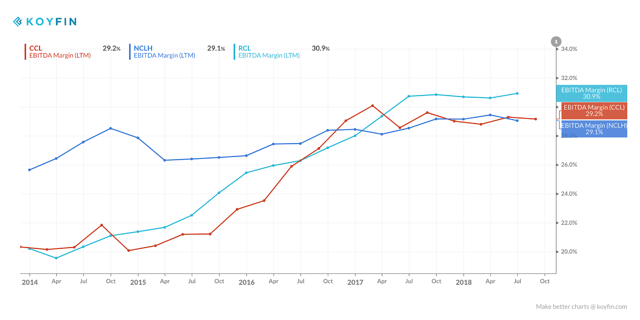

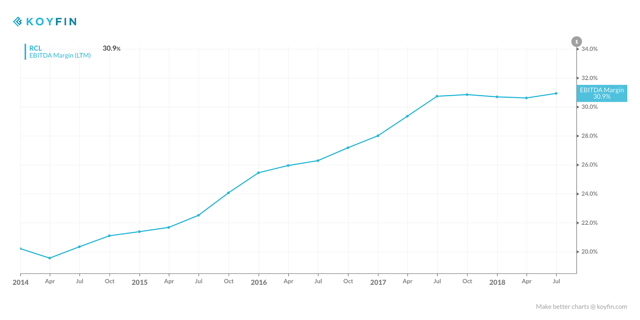

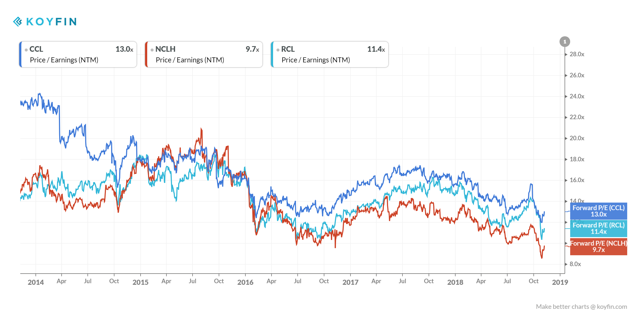

In the cruise business, Royal has the best stock market performance. When comparing Royal Caribbean (RCL) to Carnival (CCL) and Norwegian Cruise (NCLH), the company has better profit margins although it is not the most important of the three. The company is characterized by aggressive growth and sustained operational success.

Is it the best buy?

Royal's main competitor is Carnival Corp. (CCL) and I think Royal Caribbean Cruises is a better buy. The reasons are:

-

It has the highest net income margin of peers at 19.5%. Neither Carnival nor Norwegian are able to reach Royal's annual levels with net profit margins of 17.2% and 14.5% respectively.

-

Brand recognition is recognized around the world. It is a brand that enjoys great recognition for the cost-benefit ratio of its packages and the quality of service.

-

The eco-friendly approach increases brand awareness and the company improves its safety on board passengers and employees.

-

The expansion of the fleet is of crucial importance and the new vessels will add a capacity of about 43,000 berths by the end of 2024.

-

The company uses a state-of-the-art strategy to establish itself in the first segment of the cruiser market. This strategy allows for a high retention of customers who, usually after a first trip with Royal, do it again on subsequent trips.

-

Financial efficiency and effective investment strategies to reward shareholders with buybacks and dividends. The company's annual return is approximately 2.44%, which shows that management is aware of the need to return capital to shareholders.

-

Royal maintains the best business relationships with travel agencies around the world and they leverage this relationship to generate annual sales growth rates of more than 10%.

Evaluation

(Source: SEC EDGAR Filings, 10-K)

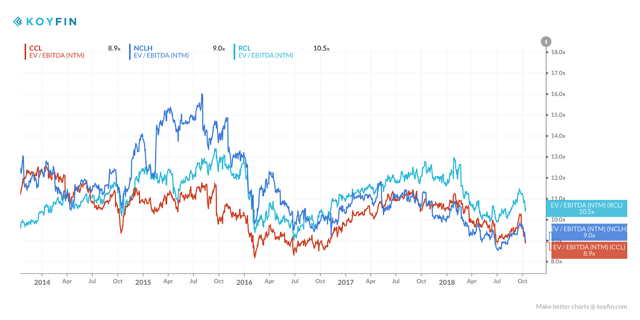

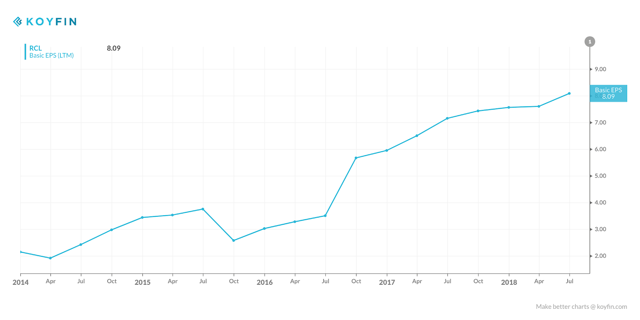

I derive a fair value for the stock of $ 139, which is based on a multiple of 14 times the earnings of 2019. When you look at the historical valuation multiples of the sector, the current valuation levels are the lowest in the last 5 years . The risk industry and the increase in earnings per share, which lowers overall price / earnings ratios, are two of the reasons the industry is trading at a discount.

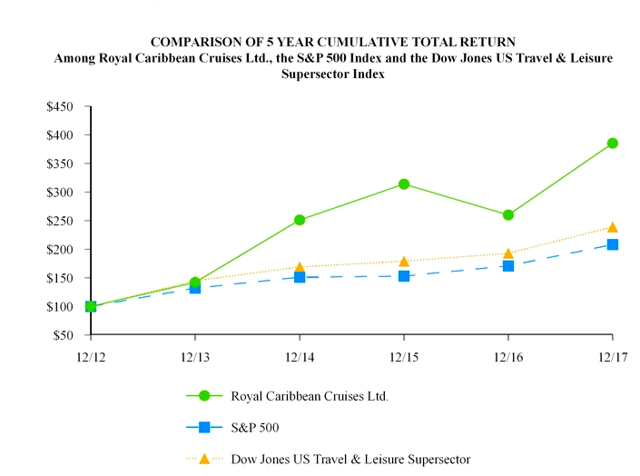

It is a company that has always managed to maintain high growth and effectively utilize shareholder capital. ROI increased by 18% over the last year and Adjusted EPS by 24%. The high level of return associated with increasing profitability is a sign of operational excellence to add value to its shareholders. The company is also increasing total shareholder return through a $ 500 million share repurchase program and annual dividend distribution of $ 2.80.

Fuel prices and exchange rate fluctuations are a significant operational risk. Royal Caribbean has put in place a currency and fuel hedging policy to reduce this risk. The company has been effective in reducing fuel costs over the last 3 years from 10% in 2015 to 6.5% in 2018 due to effective hedging strategies. It has been effective in reducing the impact of interest rates and volatility on the price of oil. The total derivative instruments used by the Company in the last year were $ 320 million. The most used instrument by the company is the foreign currency futures contract, which amounted to nearly $ 160 million.

Society is sometimes affected by uncontrollable natural events, such as hurricanes or typhoons. In 2017, the negative impact of these disasters was $ 0.26 per share. However, he was able to reduce expenses by $ 119 million and increase revenues by $ 281.4 million in order to mitigate the effects of unforeseen natural events.

During the last quarter, the cost of the company's property accounted for $ 1.4 billion on a total business turnover of $ 2.04 billion. Most of Royal's expenses are concentrated in transportation and commissions, accounting for 15.5% of total passenger ticket revenue, but marketing and advertising also account for a significant portion of spending, at 13.5%.

The company is expected to close this year with adjusted EPS of between $ 8.90 and $ 9.00, which represents a significant increase over 2017 levels. Royal Caribbean has very good expectations due to the expansion of its fleet with new vessels and a strong management team that allows them to implement a successful business strategy.

Management strives to save fuel and the environment

During the last quarter's teleconference, the President and CEO spoke about management's efforts to reduce the adverse effects of cruise on the environment, including its "AEP" emissions purification systems, which are installed on 19 of their ships. This is a high investment that pays with lower fuel costs and less impact on the environment.

Richard D. Fain, Royal's CEO and the entire board of directors have been very proactive in running the company. The council has been a pioneer of new environmental trends, environmental preservation and the reduction of fossil fuel consumption. It has also managed to overcome the headwinds that society faced due to the recent impact of the hurricane season. The image of the company abroad has improved thanks to the good performance of the board of directors and investors are increasingly positive for their brand.

During the last quarter's teleconference, the CEO highlighted the importance of aligning the company's conservation efforts and demonstrated its commitment to reducing the impact of its fleet on the environment.

Richard D. Fain, CEO

I should not leave the subject of fuels without mentioning our energy conservation efforts, because we are extremely proud of the work our teams have done and continue to do to find ways to reduce our consumption of energy. 39; energy. We already have the lowest levels in our industry and have partnered with the World Wide Fund for Nature to further improve it. While EWS and other such measures are effective, the best way to reduce our environmental footprint is to use less energy initially.

We will continue to work to reduce the use of energy and emissions to generate our remaining energy needs.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link