[ad_1]

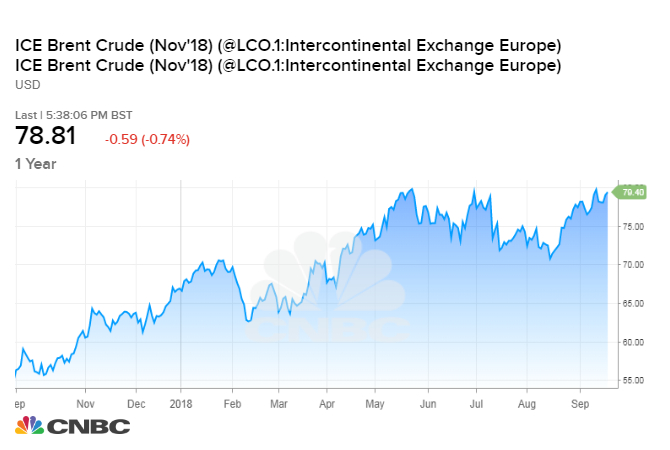

Trump initially accused OPEC of rising oil prices in April, renewing its demands in June and July, even after producers reinstated some of their production in June. Certainly, production problems in some countries have led the alliance to reduce its production more than expected, thus contributing to higher prices. But analysts say Trump's Iranian policy plays a major role in raising crude to its 2014 highs in the range of 70 to 80 dollars a barrel.

A report on Tuesday that the Saudis are now comfortable with Brent crude oil prices above $ 80 a barrel may have triggered Trump's latest tweet.

"I do not think the Saudis are quite comfortable with Brent over $ 80 because it brings President Trump on Twitter," McNally said.

The increase in production would also hurt many oil producers, as few alliance members have unused capacity. This means that many would see their oil revenues shrink while a handful of producers like Saudi Arabia, Russia and the UAE would increase their market share.

Analysts believe that the most likely course for OPEC this weekend is to reaffirm its current policy: slightly increase production to regain its goal of maintaining 1.8 million barrels a day in the market. The Saudis and Russians could then put downward pressure on oil prices by stating that they are ready to face any shortfall.

John Kilduff, founding partner of the venture capital firm "Energy", doubts that this will be enough to tame oil bulls. In his opinion, maintaining the status quo and not adding additional barrels will result in increased purchases and higher oil prices.

"At the moment, the market is decently supplied, and so [OPEC members] will play with fire as they always do, "he said. Whatever comment they are going to make, we will be bullish and we will go higher in the short term. "

The seasonal decline in fuel demand at the end of the summer will help limit oil and gasoline prices, possibly in the mid-term congressional elections in the first week of November. However, Trump's deadline for oil buyers to stop importing Iranian barrels arrives just two days before Americans go to the polls.

Kilduff expects that the impact of Trump's sanctions on Iran will become clearer in the weeks following the mid-term elections. Once the elections are over, the administration may be willing to tolerate a higher price at the pump.

"I believe that they want to get these [Iranian] lower volumes as much as they can,

and I think they'll be ready to suffer a higher price for a while in the name of the defeat of the Middle East. "

Helima Croft, Head of Global Commodity Strategy at RBC Capital Markets, also believes that some aspects of the market underestimate how serious the Trump administration is in sanctioning Iran. The question of how much Iranian oil the Trump administration can withdraw from the market is only part of the equation, she said. In his view, the market is not focused enough on how Iran will respond.

Source link