[ad_1]

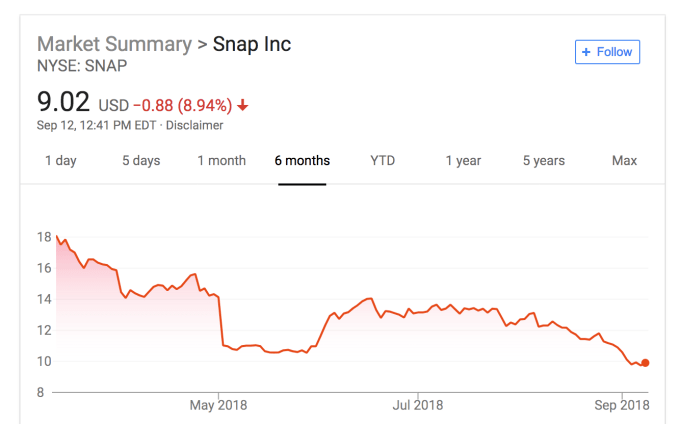

The falling share price of Snapchat makes it difficult to retain talent. Bobby Lo, The founder and CEO of the Vurb Mobile Search app, acquired by Snap Inc. for $ 114.5 million two years ago, is leaving the company's day-to-day operations. This means that Lo has ended its four-year vesting schedule, which was probably influenced by the fall of Snapchat to the lowest share price. Snap is trading today at around $ 9.15, up from $ 17 on the first day and $ 24 on the first day.

Rich Greenfield, a BTIG analyst, gave Snap a $ 5 sales note, saying, "We're tired of Snapchat's excuses for missing numbers and we're no longer willing to give management time to determine monetization. . "Greenfield is known as one of the best social media analysts, so people take it seriously when he says," We were disappointed with the evolution of SNAP products (just like users) and we see no reason to believe that it will change. "

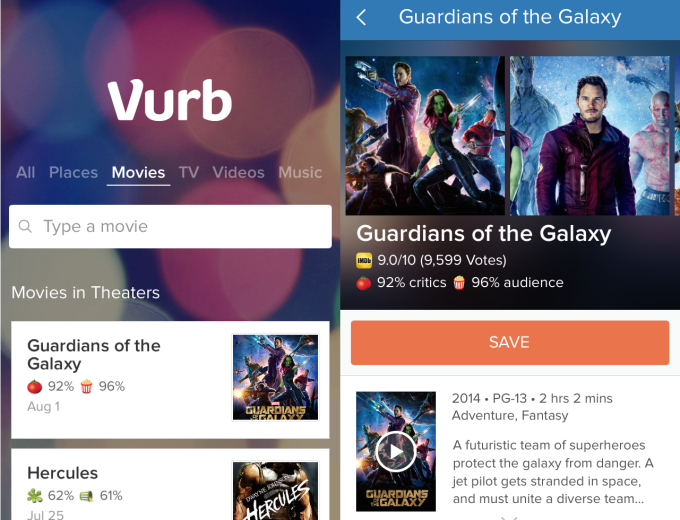

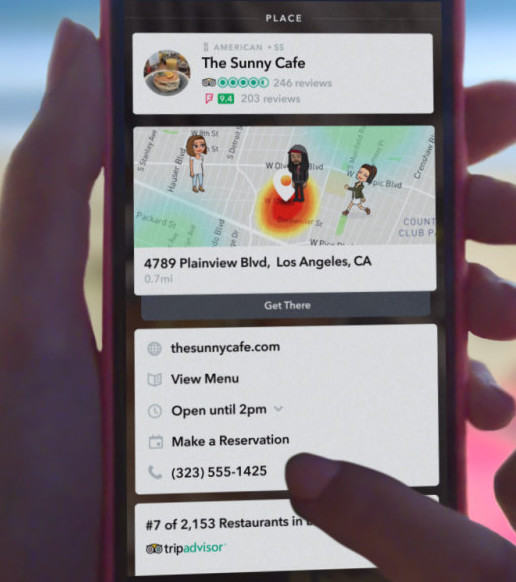

Vurb is a good example. The app allows users to make plans with friends to visit local places, allowing them to group restaurants, movie theaters and more into card games to share. It took more than a year after the October 2016 acquisition for the technology to be integrated with Snapchat in the form of context maps for research. But Snap never seemed to know how to make sure that his adolescent audience, eager for content, cares about the usefulness of Vurb. Snap could have developed powerful off-line meeting tools, but the adoption of Snap Map did not facilitate the growth of local businesses.

Now, Lo tells TechCrunch of his departure: "The creation of Snap experiences was a tremendous culmination of my seven-year journey with Vurb. My transition to a Snap advisor allows me to continue to support great people in the region while heading to startups, starting with investing and advising the founders.

Lo was very early to adopt the monolithic application style developed by WeChat in China, which has become increasingly influential in the states. Snap confirmed the departure by trying to minimize it. A spokesman told me, "Bobby has gone on an advisory role this summer and we appreciate his continued contributions to Snap."

Given that Snap is known to weight its stock purchase schedules, Lo could leave more than half of its holdings on the table. This decision should worry investors. As founder, Lo has already won a large portion of the purchase price, which includes $ 21 million in cash and $ 83 million in shares.

Snapchat context maps built from technology acquired by Vurb

Since last July, Snap has lost a ton of talent, including SV Sehn, vice president of engineering, Chloe Drimal, senior vice president of human and legal resources, Robyn Thomas and vice president of securities Martin Lev , Drew Vollero co-founder Jonathan Wegener, head of the Entertainment team, Mark Randall, advertising technology director Sriram Krishnan, sales chief Jeff Lucas and, last week, his chief of the show. operating Imran Khan.

Given the dwindling number of users, constant competition from Facebook and Instagram and the flight of talent, it's hard to see a bright future for Snap. Unless CEO Evan Spiegel, without the help of his departed lieutenants, can come up with a revolutionary new product that's not easy to copy, we could consider a downward spiral for ephemeral application. At what point should Snap consider selling to Google, Apple, Tencent, Disney or whoever is embarking on the distressed social network?

Source link