[ad_1]

Background of the analysis and disclosure

Twice a year, I go through my universe of companies that I want to own and update my intrinsic value for society. It is now time for Southwest Airlines to be updated.

In the case of Southwest Airlines, I have been a shareholder for about 18 months. Participation currently represents a partial position in my portfolio and I would like to add it to the right price.

Let's see if that's the right moment.

Description of the company

Southwest Airlines Co (NYSE: LUV) is an airline that provides scheduled air transportation services to the United States and close to international markets.

The company is distinguished by the fact that it uses only one type of aircraft – the Boeing 737 (there are several variants of this type of aircraft). As of December 2017, the company had 706 aircraft serving 100 destinations in 40 US states, the District of Columbia, the Commonwealth of Puerto Rico, and 10 near-international countries, including Mexico, Jamaica, Bahamas, Aruba, etc. the Dominican Republic, Costa Rica, Belize, Cuba, the Cayman Islands and the Turks and Caicos Islands.

The company was founded in 1967 as Air Southwest. The name was changed to Southwest Airlines in 1971 when the company went public with an initial public offering. The company's last fundraising was in 1992. The company has been profitable for 45 years. This is extremely unusual in this sector.

By the end of 2017, Southwest Airlines, according to the US Department of Transportation, was the largest US carrier in the United States, based on the number of domestic passengers boarded.

At the present time, the company has only one operating segment to report, but it divides the revenue into 3 sources (the proportion of total revenue in FY 2017 is shown in parentheses) :

- Passenger revenue (90%).

- Freight revenue (1%)

- Other (9%).

Business Overview

Southwest Airlines has experienced organic growth primarily by increasing the number of cities it serves. Throughout its history, there have been 3 relatively small acquisitions, the last of which was in 2010.

The cornerstone of Southwest Airline's overall strategy is the focus on costs. The company is very efficient and management has always been very focused on "processes", which has resulted in the lowest comparable operating costs.

This is still the case today, where the company has the lowest operating cost per available seat / kilometer of the 4 major US domestic airlines.

The low-cost operating model is embodied by:

- Have a single type of aircraft that leads to:

- Greater volume purchasing power with the aircraft supplier.

- Lower levels of spare parts for maintenance.

- Reduction of crew training costs.

- Exploitation of a point-to-point service and not of the "star" model operated by its competitors.

- Improved planning with emphasis on high utilization of aircraft and crew.

- Emphasis on fuel economy through modernization of the fleet and establishment of operating routes

Southwest Airlines initially offered high-frequency services to a small number of cities in the state of Texas. Over time, this concept has been extended and now offers direct flights to 675 city pairs. International flights were added in 2014 and in 2019, the airline will begin serving Hawaii. The average flight time of the company is currently 754 km and its average duration is 2 hours.

The company's strategy has not changed much over the years. According to management, the main current strategic imperatives are:

Increase revenue through:

- The addition of new routes.

- Improved customer service.

- Optimized Pricing (a new revenue management system has been put in place at a cost of $ 500 million).

- Expand the customer loyalty program (Rapid Rewards). Control costs by:

- Improve operational reliability.

- Modernization of the fleet to improve energy efficiency and reduce maintenance costs.

Recent events

Southwest Airlines had an impeccable airline safety record until April 2018, when an engine exploded into service and projected a burst of shells into the cabin of a plane killing a passenger. The plane landed unhindered after the incident. The National Transportation Safety Board hearings on this incident began this week.

After several years of rising fuel prices, the airline industry has seen relatively low fuel prices since 2014. In 2018, fuel prices increased by about 13% (year-over-year). With fuel accounting for approximately 20% of total operating costs (based on prevailing price), this has resulted in a recent decline in operating margins. This has resulted in lower share prices of companies such as Southwest Airlines in the last month.

RECENT SHARE PRICE ACTION

Source: Yahoo Finance

The chart indicates that Southwest Airline's stock price has fallen by just over 5% over the past year and that the S & P500 index has been delayed by nearly 23% .

HISTORICAL RETURNS OF SHAREHOLDERS

Source: Morningstar

Morningstar data shows that Southwest Airlines and the airline industry have underperformed the S & P500 index for the last 3 years. However, over a period of five to ten years, history is changing and Southwest Airlines has greatly outperformed the index and its sector.

Overview of the domestic air transport market

The US Department of Transportation (DOT) is a rich source of data for the US airline industry. The data is hosted on a website maintained by the Bureau of Transportation Statistics.

The Massachusetts Institute of Technology (MIT) is also a very useful source of data on the airline industry. MIT operates a Global Airlines Program compiles industry data and makes them public.

I used data from these two sources to develop the following graphs:

Total volume of the market

The air sector measures the available capacity in terms of the number of seats available to passengers. It then multiplies this number by the number of miles flown by the aircraft when it is available to carry passengers. This metric is called Available Seat Miles ((ASM)).

When a paying passenger uses an available seat, the number of miles traveled by the passenger becomes a volume measure called Revenue Passenger Miles (RPM).

The airline industry has relatively high fixed costs, so an important measurement factor for air operators is the load factor or the degree of filling of the aircraft.

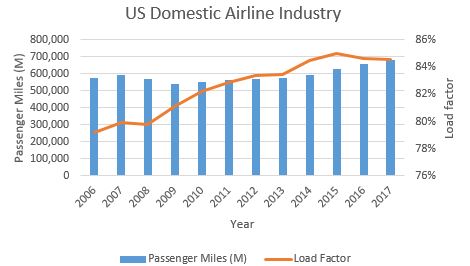

The graph below shows the total volume of passengers transported in the US domestic market and the aircraft load factors since 2006:

Source: Bureau of Transportation Statistics

From the data, we can calculate the compound annual growth rate (CAGR) in passenger kilometers. Over the past 10 years, it was 1.4%, but more recently over the last 5 years it was 3.8%.

Over the past 10 years, the load factor has increased from 80% to 85%.

The data is quite consistent with my understanding of the airline industry. The sector is mature and the total growth of the sector will be close to the overall growth of the economy. The sector is also cyclical. When the economy will be strong, demand will be strong and conversely, when the economy will be weak, the demand will be lower. Demand bottomed right after global finance Crisis (GFC)) and has increased in recent years as the US economy has strengthened.

Market share

The airline industry has never been excessively profitable. The GFC has put more financial pressure on already weak companies and, as a result, the US domestic airline market has been in a consolidation phase following a series of mergers and acquisitions. The number of major US domestic airlines has been reduced to four – Southwest Airlines, Delta (NYSE: DAL), American Airlines (NASDAQ: AAL) and United Airlines (NASDAQ: UAL).

The graph below shows the market share of these 4 airlines since 2006:

Source: Bureau of Transportation Statistics

Although the US national airline market has grown at an average annual rate of 3.8%, its data shows that the top four airlines recorded combined growth of 5.5%.

The data also reveals that Southwest Airlines holds the largest market share of US domestic airlines (based on seat passengers).

Impact of jet fuel prices on airline revenues and costs

In 2017, Southwest Airlines spent 18.6 cents on jet fuel and oils for every dollar of revenue generated. Over the last 10 years, this ratio has reached 36 cents when the price of oil peaked in 2011. Apart from the cost of labor, fuelNorth Dakota main cost element for an airline.

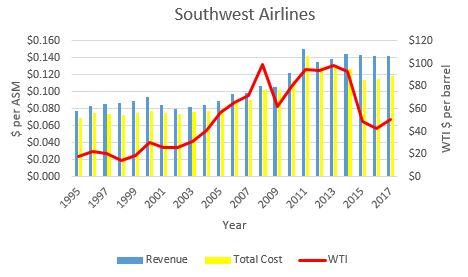

The graph below shows the relationship between passenger revenues, operating costs (measured in dollars per available seat) for Southwest Airlines and the average price of WTI oil since 1995:

Source: Southwest Airlines 10K Deposits

The relationship between Southwest Airlines passenger revenue per available seat kilometer, operating costs per available seat kilometer and the average price of oil is relatively common in the sector.

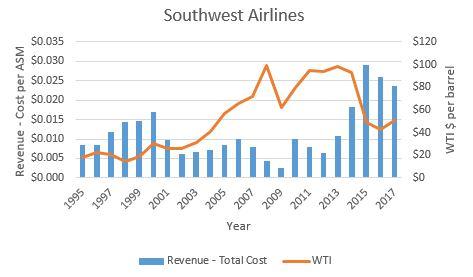

The key information in the graph is easier to understand if we graphically represent the difference between income and cost per ASM and superimpose the average price of oil:

The data indicate that, generally, when the price of oil is relatively low, operating margins are high. Similarly, if the price of oil increases, operating margins are reduced.

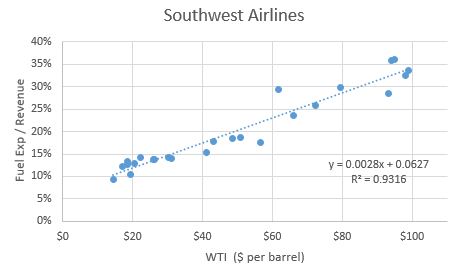

To further highlight the relationship between the price of oil and the proportion of fuel costs captured by the airline's sales revenue, I produced the following graph: using data from 1994 to 2018:

Source: Southwest Airlines 10K Deposits from 1994 to 2018

The chart and corresponding regression statistics show that 93% of the change in Southwest Airlines' fuel cost / revenue ratio is driven by the price of WTI crude oil.

For the purpose of evaluation, it is a very important relationship. If we are confident about the airline's revenue, we can use WTI's oil futures market to predict the airline's fuel cost ratio. More on that later.

Key facts to remember about the sector's data

The key information to remember is:

- The demand for air travel is heavily influenced by the health of the economy.

- The sector is mature with a compound annual growth rate of 1.4% in volume over 10 years and 3.8% in volume over 5 years.

- The sector is consolidating. The share of the four largest airlines in the US domestic market has increased from almost 50% to almost 70% over the last 10 years. The four major airlines are growing faster than the sector as a whole – so the market share of the four major airlines will continue to grow.

- The price of jet fuel is a determining factor in the profitability of the sector. Margins are compressed (and even negative) when the price of fuel is high, but they can be expanded when the price of fuel decreases.

Key financial measures of Southwest Airlines

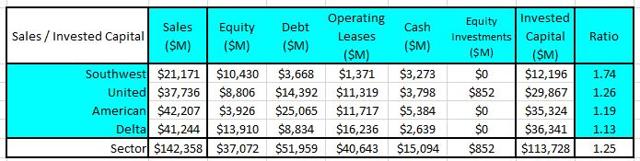

For the 4 largest listed airlines in the United States, I used their published financial reports to generate a comparison of their financial data.

Operating margins and revenue growth before tax reported

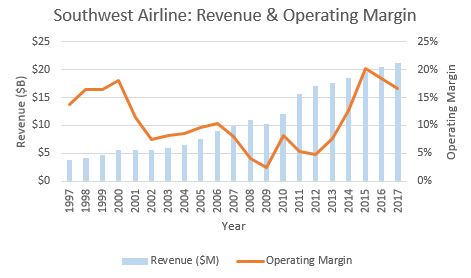

In the last five years, Southwest Airlines revenues have reached a CAGR of 4.4%.

Source: Summary of the author of the Southwest Airline 10K filings

The graph shows that while passenger revenues have been growing strongly for more than 20 years, operating margins are clearly cyclical. The variations in the operating margin observed throughout the cycle are quite dramatic.

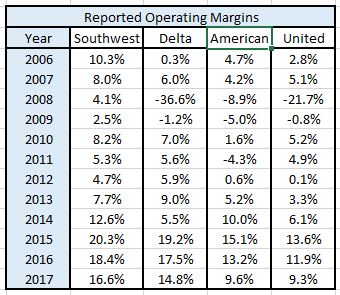

I have prepared a table showing the historical reported operating margins of Southwest Airlines' main competitors listed on the stock exchange over the last 12 years:

Source: Author's abstract on the company's 10-K repository data.

Note that these data are extracted directly from the financial statements of the company. No adjustment has been made for abnormal (or unique) costs or for the impact of operating leases. More on that later.

How does Southwest Airlines generate higher margins than its competitors?

The data indicate that Southwest Airlines' reported operating margins are generally higher than those of its competitors (with the exception of the period from 2011 to 2013 when Delta reported higher margins). The question may well be asked – why is this the case?

The answer must be in one or a combination of the following three areas:

- Its operational model generates higher revenue per available seat mile.

- Its operating model has a lower cost.

- It capitalizes more expenses than its competitors (thus paying lower expenses).

Let's look at each of these possible reasons to see if we can draw obvious conclusions:

Passenger revenue by Seat Mile available

The data suggests that the sector has experienced relatively low price inflation over the last five years, particularly in the south-west, with prices slightly lower than five years ago.

Source: Bureau of Transportation Statistics

The data provide an overview of outliers among the top 4 airlines. Passenger revenues per passenger seat are highest for Delta, while United Airlines has the lowest, with Southwest and Central America the lowest.

It is fair to assume that the higher margins of Southwest Airlines do not come from the application of higher average prices than those of its competitors.

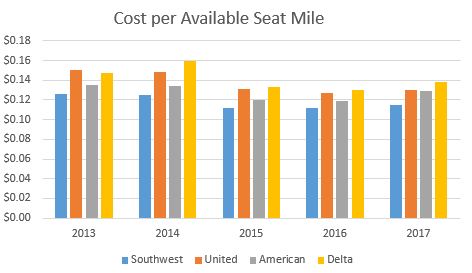

Cost per seat-mile available

The cost of air transportation per available seat has declined in recent years along with the price of jet fuel. Operating costs have decreased by almost 10% in the entire sector over the past five years.

Source: Bureau of Transportation Statistics

The data shows that Southwest Airlines appears to have a clear cost advantage over its competitors. Having the lowest cost base is a major competitive advantage in a commodity industry – this should lead to higher returns on capital.

How does Southwest Airlines reach its low cost?

Load factor

Since the airline industry uses a lot of assets, the average load factor per available seat-kilometer may be the answer. Could Southwest Airlines make its planes fly faster than their competitors?

Source: Bureau of Transportation Statistics

Interestingly, the data indicates that Southwest Airlines generally operates with load factors lower than those of the average US national carrier. The industry as a whole has increased load factors (I'm sure regular passengers can attest to that), but it's actually an opportunity for Southwest Airlines to improve further.

Although these data do not tell us how much of the available hours of an aircraft are spent flying (which can be an important source of capital use), this indicates that the lower cost of Southwest Airlines does not does not come from aircraft in operation with a higher proportion of occupied seats.

Use of assets

I have created the table below which shows the number of basic hours per airline. A blocking time is defined as the time elapsed between the time when the aircraft doors are closed on departure from a commercial flight and their opening at the arrival gate following his landing.

Source: MIT Global Airline Industry Program

The data indicates that after a few years of a downward trend in aircraft use in the sector, it appears that this trend has stabilized and an improvement trend has begun for some airlines.

Southwest Airlines now seems to be improving the average use of its aircraft, which has earned it a strong position thanks to its current position as market leader.

An airline has essentially two major costs: labor and fuel. These two categories of costs would generally represent between 50 and 60% of the total cost of operating the airline. Let's see how each of the major airlines is on these measures.

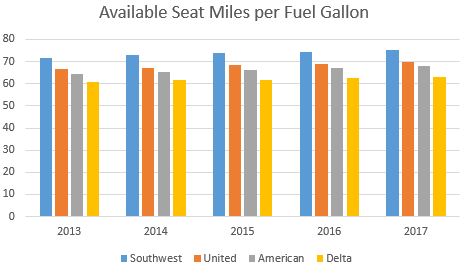

Fuel consumption

I've created a chart showing the average available seating seats per gallon of fuel. The table excludes the impact of regional flights on airlines operating non-jet services. The chart was created using the main line data by dividing the amount of fuel used in the available seat miles. In this particular case, a higher number represents the most efficient use of the fuel:

Source: The author's compilation from the 10 applications submitted by each company.

The data clearly shows that the Southwest Airlines fleet consumes on average less fuel than its competitors and that this would significantly contribute to their low cost position in the sector.

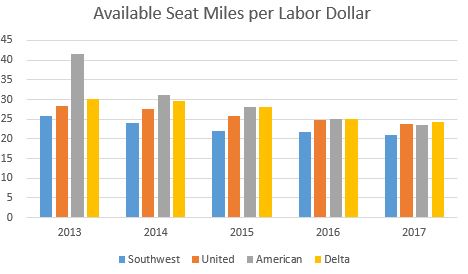

Work efficiency

Given the relatively limited data available to the public, I chose to use a very broad measure of work efficiency (nonetheless, it goes beyond productivity).

I calculated the number of available seat-seats per working dollar by dividing the total available seats-seats by the total labor costs reported in each company's income statement.

In this case, a higher number represents greater efficiency:

Source: The author's compilation from the 10 applications submitted by each company.

This is a very crude measure of labor productivity at the enterprise level. Nevertheless, the results are quite interesting.

It should be noted that American Airlines' result in 2013 appears to be an outlier, as financial results are affected by the recent acquisition of US Airways – the ratio is corrected over the next few years.

In summary, it would seem that all airlines suffer from a drop in productivity from one year to the next. I find this surprising and it would be interesting to speculate on what might be the cause, but the answer goes beyond the scope of this article.

What is most surprising is that the data indicates that Southwest Airlines has the lowest labor productivity of the four airlines. Given Southwest Airlines' historical focus on process efficiency, this is clearly an opportunity to get closer to the rest of the industry.

Efficiency of capital

A quick way to measure a company's capital efficiency is to calculate the ratio of sales revenue to net capital (net capital is accounting equity, book debts, operating leases, less cash, securities and equity investments).

I've created the following chart from the last 10K deposits of the 4 major US national airlines:

Source: Author's compilation from documents filed by 10-K in 2017.

The data indicates that Southwest Airlines is the most efficient capital allocator of the sector. It is able to generate the highest level of net capital income invested in its business. This would indicate that Southwest Airlines is not likely to invest in expenses significantly.

Low operating costs are driving Southwest Airlines' higher operating margins

The data indicates that Southwest Airlines is able to generate industry leading margins as its operating costs are the lowest. Its low-cost position is driven by its leading edge in fuel consumption, asset utilization and return on capital, but it sacrifices a margin due to its relatively lower labor productivity.

The key question is whether future management will have the discipline to retain this position.

Restatement of the operating result

Before we can do some of the evaluation work, we need to clean up some of the financial statements in order to make them more useful.

The airline industry is a major user of operating leases. Operating leases are a disguised form of off-balance sheet financing. My evaluation will use a Discounted Cash Flow ((DCF)) approach based on the free cash flow for the company.

Because we do not include interest earned in our cash flows, we must be consistent and also eliminate interest expense. The income statement presented contains a debit interest component in operating rents paid by Southwest Airlines. For this reason, we must reaffirm the operating result in order to ensure consistency.

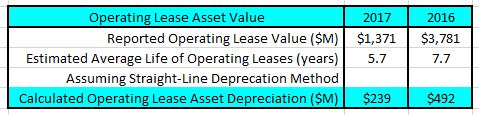

Restatement of the operating lease

This adjustment requires the creation of a lease finance asset, equivalent to the present value of the operating lease debt. The value of the asset is then amortized over the life of the operating lease and recognized as an expense in the adjusted statement of operations.

The value of the asset under the operating lease may be calculated:

Source: Author's calculations based on 2017 and 2016 Southwest Airlines 10-K statistics.

According to the 10-K 2017 published by Southwest Airlines, we can now calculate the restated operating profit:

Source: Author's calculations after 2017 10-K Southwest Airlines.

This means that the restated 2017 pre-tax operating income increased by $ 700 million and the restated pre-tax operating margin increased from 16.6% to 19.9%.

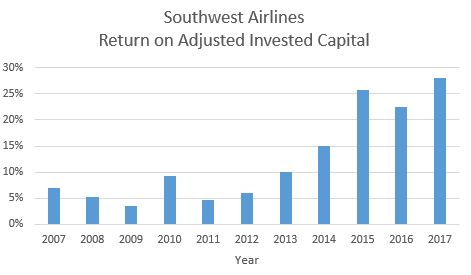

Return on invested capital (ROIC)

This measure attempts to estimate the return on the company's operating assets, which can then be used to determine whether the company is effectively allocating its capital.

Return on invested capital = Operating result after taxes / Invested capital

A number of adjustments must be made to the balance sheet to obtain a "real" picture of the profitability of Southwest Airlines' operating assets. Unfortunately, it becomes a little technical for those who do not understand accounting.

We have already adjusted operating income to reflect the impact of operating leases, and we must now charge operating income.

For 2017, the effective tax rate reported by Southwest Airlines was low due to the implementation of changes to the US tax codes. For this calculation, I used a theoretical effective tax rate of 22% (which should be close to Southwest Airlines' long-term tax rate).

We must now clean up the invested capital.

First, we assume that it is the invested capital presented at the end of the previous year that generates the profits of the current year. We do do not use the stated capital invested at the end of the current year (2017), but instead use the figures reported for 2016.

We need to establish the book value of the capital employed used to finance the operating assets. In this case, we take total equity in the financial statements of the corporation and add the total debt. In the last section, we determined that operating leases are really debts. We add the value of the operating lease debt to the reported total equity and debt.

We need to exclude non-operating investments from this total because the profits from these investments are not included in operating profit. This means that the value of cash, marketable securities and equity investments is entirely eliminated from the invested capital.

We must also examine the acquisitions that the company has recently made. Invariably, these acquisitions create a balance sheet item called Goodwill. There is an argument that goodwill represents the overpayment for productive assets, but there is also a counter-argument that goodwill items also represent future growth investments. I think that argument has advantages on both sides, so I will cover myself with risks on this issue.

If a company has goodwill in the balance sheet, I eliminate 50% and subtract this value from the total capital of the company. However, I will then gradually add the discounted purchase gap to the invested capital for the remaining forecast period of my model, as all the growth benefits should have been consumed at that time.

Finally, we need to check what asset depreciation has been done by the company over the past 10 years. Companies are trying to erase the past of their mistakes by writing the value of their operating assets. Unfortunately, shareholders have funded these investments and they must be accounted for. I estimate the total after tax of these amortizations and the addition to the invested capital.

In the case of Southwest Airlines, depreciation was only made in two years in the last decade, for a total of $ 35 million (which is very impressive compared to the amortization of its competitors).

You may be wondering why I had so much trouble making these adjustments? The answer is: in terms of valuation, one of the key questions to ask yourself is: what is the difference between the return on invested capital of the company compared to its cost of capital and whether there are returns how long will they last? This will be revealed later.

For Southwest Airlines, the capital invested to be used for the 2017 return on invested capital is calculated as follows:

Source: Author's calculations.

I used this approach to restate the operating income and capital invested of Southwest Airlines over the last 10 years. It is represented graphically on the following graph:

Source: Author's calculations.

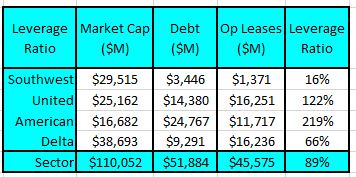

We are almost ready to do some evaluation work, but there is still an important metric to take into account. In order to develop a long-term capital cost for Southwest Airlines, it is often useful to understand what are the typical capital structures in the airline industry.

A useful measure, relatively easy to calculate, is the ratio Adjusted book value of debt to the market value of equity. This measure is calculated by adding the carrying amount of the debt to the carrying amount of operating leases and dividing it by the market capitalization of the company:

Adjusted total book value of debt / market value of equity

This measure is used to estimate the level of leverage that a company applies to its balance sheet.

Source: Company 2017 10-K and 3rd Quarterly filings 10-Q.

The data clearly demonstrates the financial strength of Southwest Airlines compared to its domestic competitors. Son bilan est très conservateur et pourrait probablement soutenir une augmentation de l'endettement.

Cela signifie que le coût du capital actuel de Southwest Airlines est plus élevé que nécessaire. Un coût du capital plus élevé conduit à une valorisation plus faible.

Problèmes auxquels Southwest Airlines est confrontée

Je pense que Southwest Airlines a un petit nombre de problèmes qui nécessitent l’attention de la direction. Ces questions doivent être soigneusement évaluées et mises en balance avec les stratégies qui ont permis à la société de réaliser des performances exceptionnelles à ce jour:

- La société peut-elle continuer à se développer sans sacrifier sa stratégie en matière d’aéronefs (la décision de ne faire fonctionner qu’un seul type d’aéronef a été un élément important de la réalisation de sa position à faible coût)?

- L’entreprise peut-elle encore améliorer ses coûts, notamment en ce qui concerne la productivité de la main-d’œuvre, qui affiche une tendance négative inquiétante?

- La société doit-elle augmenter son effet de levier et restituer plus de fonds à ses actionnaires?

La note la plus positive sur les deux premiers problèmes est que la direction en est bien consciente. Gary Kelly, président-directeur général de Southwest Airlines, en a pris acte lorsqu'il a fait les commentaires suivants au 3rd Conférence téléphonique du trimestre:

«Nous avons une compagnie aérienne plus forte, beaucoup plus prospère mais plus complexe. Dans certains cas, la génération de revenus plus élevés entraîne des coûts. Mais ce que je veux surtout dire, c’est que nos efforts stratégiques ont clairement visé à transformer la compagnie aérienne et à générer davantage de revenus, ainsi que la fiabilité opérationnelle et le service à la clientèle.

Mais finalement, je pense que nous tous, chez Southwest, savions que le moment viendrait où nos initiatives devraient être axées sur l'efficacité et la productivité, ainsi que sur le contrôle global des coûts. Et il est clair que le temps est venu et que les coûts seront notre priorité numéro un. "

La source: À la recherche d'alpha

Thèse d'investissement de Southwest Airlines

Southwest Airlines a des marges d’exploitation et des rendements du capital investis de premier plan. Cela démontre la force de ses avantages concurrentiels ou de son «fossé» (il est intéressant de noter que Morningstar n’attribue aucun fossé à la société – je pense qu’ils se trompent).

La société a un large fossé par rapport à ses concurrents, mais je soupçonne qu'avec le temps, ce fossé sera lentement éliminé. La force de la fosse repose uniquement sur son positionnement à faible coût qui peut être reproduit.

La société a bénéficié d'une excellente gestion (potentiellement la meilleure de sa catégorie) pendant de nombreuses années. Ils ont pris des décisions judicieuses concernant la stratégie de la société et son allocation de capital.

Même avec une excellente gestion, la société ne fait pas le poids face à la nature cyclique du secteur dans lequel elle opère. Le seul réconfort est que la performance financière de la société ne va pas plonger dans les profondeurs de ses concurrents au cours de ces périodes inévitablement difficiles pour l’économie américaine. Cela est démontré par le fait que la société a connu à ce jour 45 années de rentabilité continue dans un secteur dominé par les faillites et les fusions en raison de la mauvaise performance financière.

Je m'attends à ce que l'entreprise puisse continuer à croître plus vite que l'économie au cours des deux ou trois prochaines années avant de ralentir lentement au même rythme que l'économie d'ici la cinquième année. Je déclare essentiellement à ce stade que l'entreprise est arrivée à maturité.

Le secteur du transport aérien est sur le point de culminer dans cette partie du cycle économique. Nous avons vu récemment les marges diminuer, le coût du carburant ayant augmenté par rapport à son point bas cyclique. Le prix du carburant est une hypothèse clé pour toute évaluation de compagnie aérienne. Je n’ai aucune idée particulière du prix futur du pétrole. Je me suis appuyé sur les indications du marché des contrats à terme sur le pétrole pour prévoir l’évolution probable du prix du pétrole.

Sans surprise, on prévoit que le prix du pétrole reviendra à sa moyenne à long terme (voir les cours à terme du groupe CME) au cours des prochaines années (environ 59 $ le baril).

Je prévois que, dans les 5 prochaines années, les marges d’exploitation vont progressivement revenir à leurs niveaux de maturité et stables. La variable clé dans la ligne de dépense est le prix du pétrole. J'ai verrouillé ceci comme indiqué ci-dessus. Bien que la direction s’efforce d’améliorer la productivité de la main-d’œuvre, j’ai prévu que le ratio dépenses de main-d’œuvre / revenus resterait aux niveaux actuels. Il y aura peu de changement dans les autres éléments de coût.

La marge opérationnelle restera leader du secteur en raison de la discipline des coûts de la direction.

J'ai créé une équation de régression basée sur des données historiques qui relie la marge d'exploitation rapportée à ma marge d'exploitation ajustée calculée (la marge ajustée est utilisée dans le flux de trésorerie actualisé d'évaluation).

Bien que je n’aie pris en compte aucune acquisition dans mon modèle, il est possible que Southwest Airlines réalise un investissement en dehors des États-Unis. Ils ont certainement la capacité de bilan pour cela. L’objectif devrait être un opérateur relativement petit et concentré, capable de mettre en œuvre la stratégie d’exploitation de Southwest Airlines. Un opérateur de discount en Europe ou en Asie serait une solution potentielle, mais je note que le manque de rentabilité de ces marchés peut rendre cette option potentiellement académique. Donc, une acquisition est possible mais peu probable.

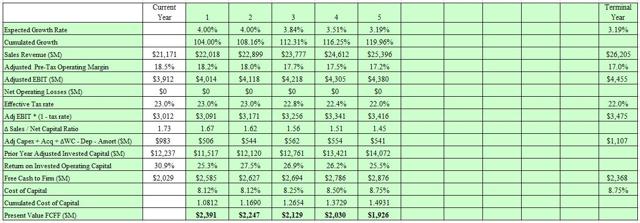

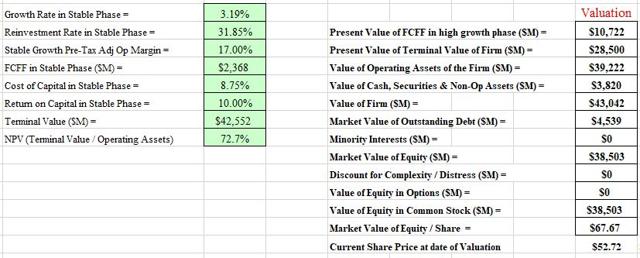

Méthodologie des flux de trésorerie actualisés

Le DCF est relativement simple. Une approche de flux de trésorerie disponibles à l’entreprise est utilisée avec un modèle en 3 étapes (croissance forte, croissance en baisse et maturité). Le modèle cherche uniquement à évaluer les flux de trésorerie des actifs d’exploitation. L'évaluation a été effectuée en dollars américains.

Hypothèses clés dans l’évaluation de Southwest Airlines

- Revenues will grow at 4 ± 2% for the next 2 years before growth begins to decline to GDP (3.19%) at the end of year 5.

- Operating Margins (which have been adjusted for the impact of operating lease expenses) will decline from the current level (18.5%) over 5 years to 17.0 ± 2% into perpetuity. The Adjusted Operating Margin equates to a reported Operating Margin of 14.8% (the 2017 reported Operating Margin was 16.6%).

- Capital productivity (as represented by Δ Sales / Net Capital) will decrease from the current level of 1.7 and settle at 1.45 ± 0.3 (between the current Sector average and Southwest Airlines’ historic performance).

- The current Return on Invested Operating Capital (around 31%) will decline over time before settling at 10 ± 1% in perpetuity. This will be above the cost of capital thus reflecting the strength of Southwest Airlines’ moat. The long term tax rate is expected to settle around 22% (Southwest Airlines is predominantly a US business).

- The assumptions relating to the Cost of Capital using the Capital Asset Pricing Model are:

- The unlevered beta was determined by running a screen for Airline companies on GuruFocus and adjusting for individual company leverage in order to determine a Sector average. The result was 0.92

- The current Cost of Equity is estimated to be 8.85% based on a US dollar risk-free rate of 3.186% and an Equity Risk Premium of 5.89% (I have used Damodaran’s November mature market ERP of 5.76% and adjusted for country risk in proportion to the estimated company revenues by region).

- The company’s pre-tax Cost of Debt is estimated to be 4.32% based on an S&P credit rating of A3/A- with a corresponding default spread of 1.13%

- Based on these inputs, the current Cost of Capital is estimated to be 8.12%.

- Due to the high uncertainty associated with the cyclical nature of the Airline Sector I have allowed the mature Cost of Capital to increase to 8.75 ± 0.5%. This means that the mature Cost of Capital will be higher than the median of all US listed companies.

- There are no Management Options to value.

- There are no Equity Investments to be valued.

Discounted Cash Flow Valuation

The output from my DCF model is:

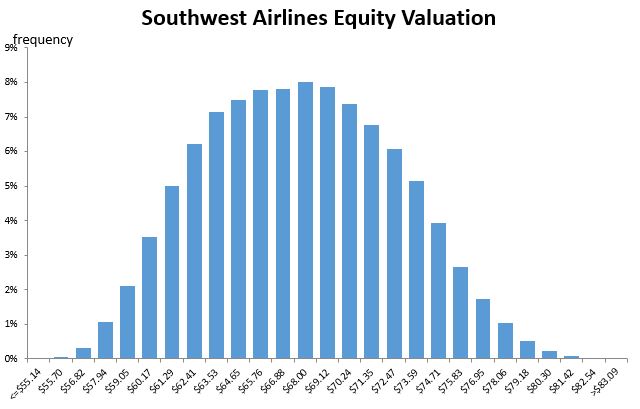

I also developed a Monte Carlo simulation for the valuation based on the range of inputs for the valuation. The output of the simulation was developed after 30,000 iterations.

The Monte Carlo simulation can be used to help us understand the major sources of sensitivity in the valuation:

- 74% comes from the Operating Margin.

- 17% comes from the Stable phase Cost of Capital.

- 5% comes from the Revenue.

The Monte Carlo simulation clearly demonstrates that the value driver in my valuation scenario is the Operating Margin. This variable most effects the valuation and is the greatest source of risk in the valuation.

The simulation indicates that at a discount rate of 8.75%, the valuation for Southwest Airlines’ equity per share is between $55 and $83 per share with an expected value around $68.

How Do I Use the Monte Carlo Simulation?

I in fact use it for help me to determine when to both buy and sell stock.

On the Buy side I use the simulation to generate my purchasing margin of safety. I am a very conservative investor. I only purchase stock in the bottom half of the valuation – typically I like to buy my first tranche around the 20th percentile. I then like to buy as the stock goes lower, typically adding another tranche every time the price dips around 2-5%. I generally buy a full stock allocation over 4 transactions – starting at the 20th percentile.

Conversely on the Sell side. I start to progressively sell down my holding starting around the 80th percentile. I typically sell 10% of my holding initially and continue to sell 10% of my holding every time the price rises 5%.

I know from bitter experience, pricing is often not very rational. This approach allows me to continue to capture the benefits of any momentum that may be built into the stock price whilst at the same time bank some of my profits.

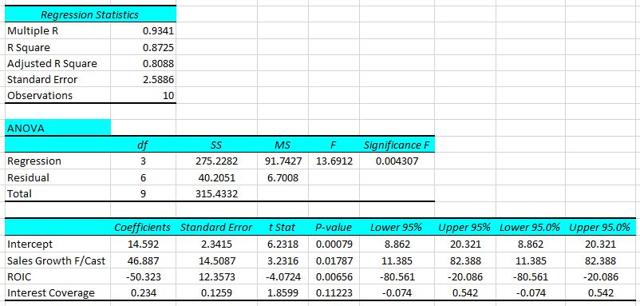

Relative Valuation

For completeness I also like to complete a relative valuation for my stock.

Methodology

GuruFocus was used to generate a list of comparable companies. The list contained the 10 largest airlines in the North American market by market capitalization.

A range of financial ratios were calculated for these companies and they were used in developing a series of linear regressions for various market multiples using their companion variables.

Multiples Investigated

The table below shows the regression coefficient of determination for each of the multiples tested:

Generally speaking the results were pretty good. The regression whose multiple had the highest coefficient of determination is the EV/EBIT multiple. This multiple was used to estimate the relative valuation for Southwest Airlines.

EV/EBIT Regression Statistics

An EV/EBIT regression was developed using the independent variables:

- Next year’s consensus sales growth forecast (consensus forecasts from Yahoo Finance),

- Return on invested capital

- The interest cover ratio.

The regression statistics were:

Regression Output

At the time of writing this article, the EV/EBIT multiple for Southwest Airlines was 8.83 (Source: GuruFocus).

Using the regression coefficients and the current metrics for Southwest Airlines (as supplied by GuruFocus) we can calculate the regression EV/EBIT multiple:

The calculated regression multiple is 8.38 which is lower than the actual multiple of 8.83.

This indicates that on a relative basis compared to other airlines, Southwest Airlines is expensive.

We can convert the regression multiple into a share price using the following calculation:

The predicted EV / EBIT multiple equates to a share price of $47.40 and therefore since Southwest Airlines' current price is higher than this the conclusion is that the stock is currently relatively expensive.

Conclusion

Southwest Airlines appears to be currently priced below my estimate of the company’s intrinsic value but on a relative valuation the company is currently priced slightly above my estimate.

I rely on the intrinsic valuation ((DCF)) because I believe it to be the more rigorous estimate.

Based on this assessment I believe that the stock is a BUY but with some caveats.

Airline stocks are very cyclical. Typically the time to buy these companies is in the trough of a recession and then to “lighten” up on them as their earnings peak in the later stages of the economic cycle. My valuation is the expected long term intrinsic value for the company based on my expected long term view of the Sector. It is inevitable that the market price for this company may be lower as the US economy “rolls over” at some time in the future. Investors with a long term horizon may choose to wait for a lower price.

Thanks for reading my article. All questions and comments will be responded to. Best wishes and good investing. Rob Barnett

Disclosure: I am/we are long LUV.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link