[ad_1]

Spotify, the streaming music company that was made public earlier this year, released its quarterly results today. While it continues to grow at a moderate pace, it simply seems to meet analysts' expectations regarding its financial data. fight on public markets.

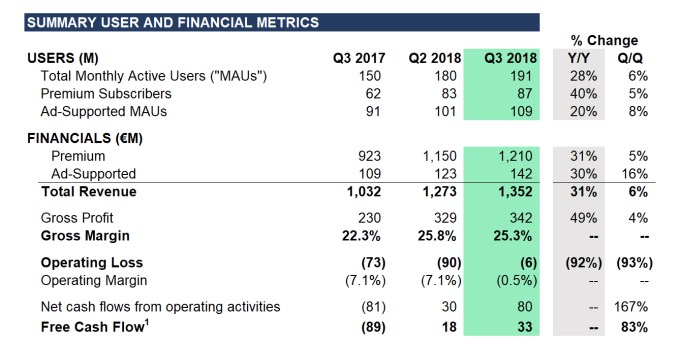

The company has announced a turnover of 1.352 billion euros for the quarter ended in September. That was right in front of the average analysts estimate of $ 1.51 billion, or 1.33 billion euros.

Spotify revenues are up 31% over last year; its operating loss is now 6 million euros, an improvement of 92% compared to a year ago; and his margins are now at 25%, "exceeding" his expectations. The monthly active users of Spotify now representing 191 million users, up 28% over last year, it will be interesting to know if investors will remain patient in the months to come, Spotify trying to tip the balance in his favour.

The company's shares have been hammered lately, with persistent market skepticism that Spotify will be able to maintain its growth and switch to the black in the long run.

It does not seem that today's news has done much to change that. At the beginning of the week, his share price fell to $ 139 / share. Currently, it stands at $ 134 / share, down 10%. and it went down to $ 134.54 / share today – a sign that, despite the gains reported today, investors are not very impressed. (Its market capitalization at yesterday's close was $ 26.9 billion.)

One of the reasons for skepticism, while meeting expectations, could be that Spotify has already warned that there will indeed be some falls in this margin over the coming quarters. This week, the company announced a partnership with Google, where it will offer Google Home Mini to address people taking its Family Plan as a holiday promotion.

"We expect this partnership to have a negative impact of approximately 50 basis points on our gross margin profile in the fourth quarter," the company said.

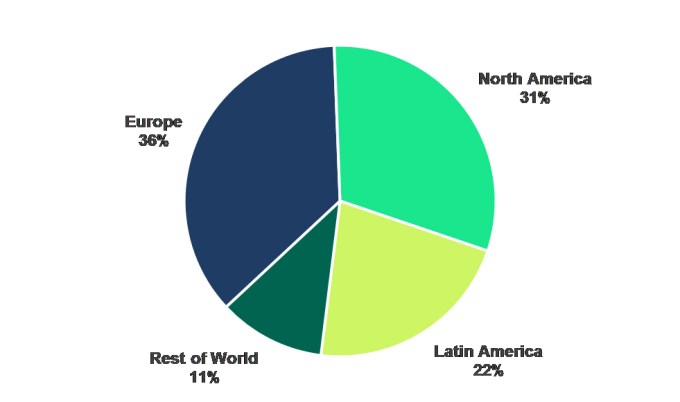

The United States continues to be the largest part of Spotify's user base, although the company has said that Latin America and the rest of the world are the fastest growing (which is often the case with the new consumer business markets).

In its user base, the total number of paid subscribers is 87 million, which is well ahead of the 50 million Apple Music (announced last summer) . This figure is up 40% and Spotify said the company's family and student plans had fueled it. The company is now collaborating with other streaming providers, such as Hulu and Showtime, to offer entertainment offerings. The Student level introduced in the fourth quarter priced at $ 4.99 has allowed the company to capture more users less likely to turn.

However, the company continues to rely heavily on the "free" part of its freemium growth model: it now has 109 million MAUs funded by advertising, up 20%. The company is expanding the type of advertising it broadcasts to these users. Therefore, even if she does not monetize them with subscriptions, she will get her flesh weight in another way. Its programmatic advertising platform, Ad Studio, is currently only active in the United States, the United Kingdom, Canada and Australia. So there is still a lot of room for growth, both in these markets and in others.

It will also mean that he has to put his affairs in order. Spotify has been confronted – like many others who allow quick and easy recordings to access services – a long-term problem of eliminating bots and other bogus users of the platform in order to get an audience number more precise. Spotify does not indicate the number of users identified during this process, but indicates that it is continuing this work.

In any case, the free users and the advertising model that supports them remain a relatively untapped sector in Spotify's business: premium revenue amounted to € 1,210 million in the third quarter, 31% increase compared to the previous year. This means that ads are only reporting 140 million euros at the moment.

Source link