[ad_1]

introduction

This does not happen very often, but from time to time, sensitive investors overreact and send a well-tracked large-cap title to the trash. And even though there is something to be said for "investing in what you know," I have found that in cases where persistent negative narratives revolve around a changing pattern of growth. A large company pushes share prices down and the stock can help provide a degree of clarity detached to investors.

In these cases, this allows a potential investor to put himself in the shoes of recent shareholders as best as he can and to try to estimate the motives that he might have had to buy. the title. We can never be perfectly precise when we try to determine what other investors think and there is no measure we can examine who will tell us. But understanding investor sentiment can be a particularly useful exercise after we have seen a widely followed large-cap action like Starbucks (SBUX) fall by 20%, because, from time to time, group behavior can become irrational, especially if the media help to fan the flames.

I've never been to a Starbucks store and I do not have the title yet, but I see a lot of similarities in the change in investor sentiment that I saw with Apple (AAPL) in 2013. That's ended up being an excellent investment opportunity for me even though I was not a 'fan'. of Apple at the time. This article will examine some of the similarities I see between Starbucks and Apple's stock, as well as some of the differences, and how investors could use these comparisons to determine the best entry point for the stock.

Starbucks similarities to Apple around 2013

I have never owned a single Apple product, and I still do not own a smartphone. Until 2013, I have never owned or followed Apple stock. I was also seconded from Apple that no matter who could be it. And I think that from the point of view of investments, it ended up being a good thing.

AAPL Total Return Price by YCharts

From March 2009 to September 2012, Apple's share price rose nearly 750%. Much of this increase occurred in the first two-thirds of 2012 alone. One must ask: what kind of investors was engulfing the stock during this 2012 period? My point of view is that after Apple grew 125% a year for three consecutive years, and iPhones were continually stealing shelves, a large group of investors assumed that Apple sales would move online right, on the rise, exponentially. Another group has probably seen the good performance of recent years, loved Apple's products, and saw an opportunity to enrich it quickly.

Although I can not say for sure what motivated each investor, what I can say for sure, is that they were very meticulous. They expected the profits and the share price of Apple to increase significantly in a straight line. Thus, when the profits contracted a little, many of these investors sold off when their unrealistic expectations were not met immediately. At the time, the media and a variety of analysts were hearing, one after the other, predicting that Apple had peaked in the growth of the company. IPhone, etc. On top of that, stories were telling how Apple was using slaves in China to manufacture its products and its nets had been installed to prevent workers from jumping to their deaths through the windows of factory dormitories because working conditions were so bad.

These stories are important because Apple produces "reassuring" high-end products. I believe that there is a sense of pride and belonging for many Apple consumers that is derived from the use of Apple products. There are other companies that produce cheaper products that are quite similar to those of Apple, but in fact, these competing products do not produce the same feelings among their users as those of Apple. . These feelings, however, can be undermined when homeowners / users start to think of the Chinese slavery that went into the production of these products.

There are some stocks that benefit from a cult type consumer. In these cases, I think that consumers first fall in love with the products, then the company, and then the stock. And if stock prices continue to rise, it reinforces this cycle and these feelings. There is no better company than one where you can feel comfortable using their products, supporting their business and enriching their stock at the same time. But companies with these dynamics can crack in different ways than other actions, and if a perfect storm overcomes all these media at the same time, then this can be disastrous for the price of an action. And that's what happened to Apple in 2013.

In 2013, Apple had left without releasing a new iPhone or other successful product, Steve Jobs had been withdrawn for more than a year, profits had dropped slightly, competition was improving, the media had done so. Apple is both an exporter of US jobs and a forced labor user. In the summer of 2013, the stock price had dropped more than 40%. At that time, Apple was trading at a P / E of 9 and so oversold that even someone as disconnected from Apple as I could see it was a great value.

AAPL data by YCharts

The above chart dates from the 2013 calendar year and, in the middle of the summer, I was able to buy Apple on behalf of my daughter at a cost of $ 59.93. The stock has behaved very well since then:

AAPL Data Total Return Price by YCharts

At this point, you may be wondering what this has to do with Starbucks? And my answer to that is that I think Starbucks and Apple are attracting a similar profile from the investor. Starbucks offers a high-end product around the world, just like Apple. I think a lot of Starbucks shareholders appreciate the Starbucks products and the experience they have in the stores and it makes them feel good to be associated with the company. Starbucks has a strong association with its founder Howard Schultz, just as Apple does with its founder Steve Jobs. And frankly, these are some of the few companies that left-wing Americans seem to like to own the stock of. Schultz has been a PR master as much as he's been a great businessman when it comes to making Starbucks a "friendly" company.

Unfortunately for Starbucks shareholders, Schultz left the company this month, just after a public relations fiasco, and just as Starbucks' growth seems to decline. To make matters worse, Schultz may be considering entering the political sphere, which could politicize Starbucks unnecessarily even more than he already is. So just like Apple in 2013, Starbucks sees cracks in the virtuous circle with the shareholders it's built since the Great Recession. When Starbucks customers think of the Philadelphia incident, they may no longer feel as good in their shopping; when the company founder shares, the shareholders may no longer have confidence in his future; when growth slows, they no longer think of Starbucks as a long-term growth stock; and when the price drops by almost 20%, they may not think that Starbucks can make them rich anymore.

Similarities with McDonald's

Very often in the comments section of various articles, I will see commentators compare the action of Starbucks to McDonald's (MCD). And, I think that there is some validity to doing it. There are few international restaurants / restaurants that have the ability to evolve on a global scale like McDonald's, and Starbucks is one of those few. each. In addition, many investors are reminded of how McDonald's securities were left out in the early 2000s and also remember the fall of McDonald's shares from 2012 to 2015 where the price of the shares of McDonald's & # 39; s shares has not progressed for three years. The tone of these comments that compare Starbucks to McDonald's is generally an optimistic one for the future of Starbucks' share price. And I think part of this has to do with the fact that McDonald's stock has grown more than 25% a year since it broke out in October 2015:

MCD Total Return Price Data by YCharts

The general feeling is that Starbucks has the same potential and that, structurally, it faces the same kind of challenges that McDonald has encountered over the years.

That said, I think those who are optimistic about Starbucks' future stock price could overlook important differences between Starbucks and Apple, Starbucks and McDonald's. And these differences, combined with Starbucks 'historical price fluctuations, make Starbucks' stock look much less attractive at current prices than originally thought.

Key Differences

The main difference between Apple around 2013 and Starbucks around 2018 are the stock market multiples. Although I think the overall investment momentum behind Apple's price drop in 2013 and the price drop of Starbucks in 2018 are similar, in the summer of 2013, Apple was trading at a P / E less than 10. Depending on which P / E method you prefer, Starbucks trades between 16.8 TTM and 22.1 P / E mix at this time.

Whatever it is that we want to measure, Apple's stock is trading at a valuation of about 50% lower in 2013 than Starbucks. And I do not think those who think China will provide meaningful future growth to Starbucks can argue that Starbucks' potential growth in China is greater than what Apple's growth potential in China was in 2013. The fact is that Apple was worth a brainer in 2013, and this is just not the case with Starbucks here, even though we evaluate it using a multiple of 17 P / E. So even if Apple and Starbucks are selling high-end products and Starbucks is following the same sentiment as Apple in 2013, it does not seem clear to me that Starbucks shares at its current price offer the same value as Starbucks shares. Apple.

When it comes to comparisons with McDonald's, I think optimistic investors choose what they want to see about this comparison. They want to see a mature global catering company that was once left for dead, and once traded on the side, it's now trading at a relatively high valuation and assumes the same thing could happen to Starbucks. There are two key differences that these investors do not seem to take into account, however. The first, is again, the evaluation. The second is the type of customers that address each of these companies.

With regard to the assessment, it is important to point out that during McDonalds' lateral moves from 2012 to 2015, it was negotiated with a multiple between 15 and 20:

MCD P / E Ratio (TTM) given by YCharts

Since then, most of MCD's price movements have seen multiple expansion until the mid-20s. Starbucks optimists see this kind of multiple on a mature company as MCD with a similar global footprint and ask Why not Starbucks? But when Starbucks traded on the side, he made it to a much higher multiple than McDonald's did:

SBUX data by YCharts

From mid-2015 to January 2018, Starbucks was in the range of $ 50 to $ 60 per share, while the P / E ranged from 27 to 37, about double that of McDonald's. # 39; s business model a few years earlier.

So, again, like the comparison with Apple, we see that Starbucks' sideways movement is produced with a much higher rating than that of McDonald's.

McDonald's comparison that we should do

There has been a moment in the history of McDonald's where he has had the same type of ultra-premium assessment that Starbucks has recently, and I think this period is instructive for potential Starbucks investors to watch.

MCD P / E Ratio (TTM) given by YCharts

From mid-1998 to 2000, McDonald's shares enjoyed a multiple bonus similar to that of Starbucks (in their twenties to thirties), then from the peak of 1999 to 2002, the multiple fell back to historical standards between 15 and 20. This is how the MCD stock behaved during this contraction:

CDM Data by YCharts

Yes, it's a decline of more than 70% in McDonald's shares over the past four years. And if the stagnation of Starbucks continues into the next recession, then this kind of decline for the Starbucks title is a very real possibility.

The historical cyclicality of Starbucks

I have three main factors that I use when I try to determine the right entry points for equities: historical price cyclicity, historical P / E ratios, and where I think that we are in the economic cycle. There are many more factors that I consider before actually buying a stock, but when it comes to estimating the price, these three factors really help reduce my search to a handful of things. 39, potential purchases. Until now, I have mostly discussed historical P / E ratios and their relationship with similar companies. Now that Starbucks has been around for a few decades, I'm going to take a look at the price cycles that Starbucks has had in the past in order to use them as a potential guide for the future.

Readers familiar with my research will recognize the table below. It contains historical data on all the declines of more than 30% of Starbucks stock since its IPO. The table shows the approximate year of the beginning of the decline, the duration of the stock's fall, the duration of the total decline before the full recovery of the stock and the depth of the withdrawal from the peak to the trough. While it's important to keep in mind that businesses change over time, I've found that past price cyclicality, when placed in the right context, can be a good guide to know what to expect in the future. At the very least, it allows investors to know what kind of decline is possible for a stock.

| ~ Year | ~ Time to the bottom | ~ Duration | ~ Depth |

| 1998 | 3 months | 12 months | 47% |

| 1999 | 3 months | 12 months | 48% |

| 2000 | 2 months | 7 months | 37% |

| 2001 | 10 months | 18 months | 43% |

| 2007 | 2 years | 4 years | 78% |

Starbucks was primarily a high-growth stock, and in the late 1990s and early 2000s, it experienced moderate volatility at a time when the market was slowing and the economy was in recession. Although the volatility was high frequency in nature, it was not particularly deep given the macroeconomic environment and the high multiples Starbucks was experiencing at the time. What's more interesting is the drop in 2007. As we saw earlier with McDonald's, when Starbucks experienced a multiple contraction at the same time as the economy was experiencing a recession, the stock has seen a decline in value of more than 70%. If an economic downturn started tomorrow, I would expect this kind of decline again. So, the stock could have a lot more to fall than the 20% we've seen so far.

Intangible CEO

In general, I do not generally leave my opinion on management and media coverage to be central to my analysis. While I try to avoid incompetent or corrupt managers, I focus my attention on more quantitative than qualitative factors. That said, Starbucks is a situation where I think it's necessary to give unbiased analysis that cuts through the Starbucks media coverage during this recent decline, as well as Starbucks' convoluted response.

By the time this article is published, Howard Schultz, celebrity CEO, will have completely left Starbucks. It will not be the first time. He left in the year 2000, returning in 2008 after the Starbucks stock exceeded 75%. Last year, he appointed Kevin Johnson as CEO, but he remained in the chair this year. There has been some speculation that Schultz will enter the political arena, possibly running for president.

With this short context in mind, we turn to Starbucks' recently lowered growth projections and Kevin Johnson's disastrous interview with David Faber and Jim Cramer on CNBC last week. The interview lasts 15 minutes and can be viewed in its entirety here, but I will explain my interpretation of the interview because it was quite telling when we saw it properly.

David's first question to Kevin Johnson was "Is Starbucks a mature company? The background to this question was that same-store sales should only grow by 1% in the short term. Now, people, it's a simple question with a simple answer, and the answer is: Yes! Starbucks is a mature company with 28,000 stores around the world, but like many mature businesses, it can still find ways to innovate and grow for many years.

That's my answer. It's both honest and optimistic. Here is Kevin Johnson's answer:

What we talked about yesterday was really something we worked on last year, which fundamentally simplifies this business over the last year so we can focus on the most important priorities . And these priorities will allow us to move to a phase that I call large-scale growth.

Ok, let's stop here for a moment. First, Johnson evades a very simple question about whether Starbucks is a mature business. Then he claims that he has "basically rationalized" the company. What does it mean? Fewer products? Fewer employees? Fewer stores? Who knows? At one point, later, he talks about how they facilitated the work of the barista, but that was the only reference to a real "rationalization", and these results of efficiency should already have been transferred to Starbucks. net result and reflected in its results. So, this is primarily a meaningless statement. Then he follows him with a "phase" that he calls "growth on the scale". What does it mean? It should be obvious to anyone that with a company the size of Starbucks, all that it does has to be done "on a large scale". Duh. Putting the term "growth" in front of "scale" makes the term nonsense at worst, and quite obvious at best. Any kind of growth at Starbucks is going to have to be "scale-up" and any growth that has occurred at Starbucks over the last two decades of the company has been "on the scale." ". Mr. Johnson continues:

Starbucks was founded in 1971. Thus, over the past 47 years, we have built an iconic global brand, 77 countries 28.00 stores worldwide serving nearly 100 million customers a week. And now, at our scale, we need to be much more disciplined in setting our priorities. We need to be more data-centric in the way we allocate resources and adjust the model. And we must be more agile as innovators. And what we did yesterday paved the way for this transition to a company that really focuses on large-scale growth.

At this point, David is striving to get a definition of the nonsensical term "large-scale growth" and asks, "Does large-scale growth not mean growth as Starbucks and Starbucks investors?" were waiting before?

I will not quote Johnson's long and convoluted answer to this extremely simple question, but basically it implied the fact that they were still planning to open several hundred more stores, especially in China. I do not know why opening new stores in China requires an absurd term like "scale growth" and a whole "new phase" for Starbucks, other than hiding the fact that Starbucks is indeed a mature company. Which, honestly, anyone who can do basic math should be able to understand. As David pointed out in the interview, there are more Starbucks stores than McDonald's. Starbucks is a mature company with a big brand and should be evaluated as such by investors.

After some questions from David, Jim Cramer answered a few questions. Here is the first one:

Okay, good morning. Stock is down two dollars, have to take a little different story here. You arrived in April 2017. There were four terms that you chaired. In three of these four quarters, you have reduced your forecasts. You come from Juniper. You understand technology. You know that it is not correct. Kevin how could you be three out of four reduce your forecasts. Kevin, you'd be mad at yourself. I do not even hear you upset.

There is a reason why I rarely watch the news, except to get an idea of what the current stories are in the media. Jim Cramer's almost incomprehensible statement is not even a question, but if it was rephrased, it would be, "Why are not you sorry that you had to lower your growth forecasts?" The real answer to this question would be "Schultz set much higher expectations than we could actually achieve and challenged me to disappoint shareholders." But, come on, we can not expect Johnson to get on CNBC and Schultz, even if that would have been the truth, so he gives another meaningless answer. Then we get that from Cramer:

Ok, Kevin, one of the things I want to see more than anyone in the world, except maybe you and Howard, is a background in this stock. I do not ask a question. I make a statement and you can refute it. How can you reach a floor in this stock when you maintain a long-term growth rate of 3-5% that now seems unrealistic due to cannibalism and because of a slowdown in China. Why not just say that we are removing this long term? We can not get a background until you do it. You and I go back far. That's what we know about stocks!

Once again, Jim is asking us a ridiculous question, and I suspect that Jim's frustration comes from what he's buying into Schultz's high-growth storytelling and recommends buying Starbucks shares in his program. When Jim interviews Howard and tells people that Starbucks is a "buy, buy, buy"! he looks stupid when stock tanks. But the fact is that stock market performance is not Kevin Johnson's problem. His job is to lead the company. It's not his fault if investors overpaid Starbucks shares under Schultz's reign, because they bought into the high-growth story forever and bought Starbucks stock. at a multiple of 35. But, of course, Johnson does not say it because he's not able to downplay the stock price of the company.

To make this exchange even worse, after the Starbucks stock was even more abundant, Schultz took the time to email Jim Cramer the next day to talk about Starbucks' future prospects and defend his successor. It was almost as if the parents of a child entered the director's office to defend them against any transgression that their school had accused them of.

So, why is it important?

The main reason why this is important for potential investors is that we must realize that 1) Starbucks is a mature company, 2) The stock has been carrying a "Schultz" premium with respect to its recent valuation, and 3) No one at The company will openly admit this because it would lower the stock price and that it has strong personal reasons not to do so.

Put it all together

If we accept that Starbucks is a mature company with a strong brand then the easiest way to evaluate the company is to use the long term average historical valuation for these types of companies, which is a multiple of 15. Starbucks at 15 multiple should produce good long-term results that are at least in line with the broader market. If Starbucks offers a new product or accelerates the use of technology, it could outperform, and if it encounters more problems similar to those in Philadelphia, it could then underperform. But I think that a multiple of 15 is a solid point of reference for stock purchase.

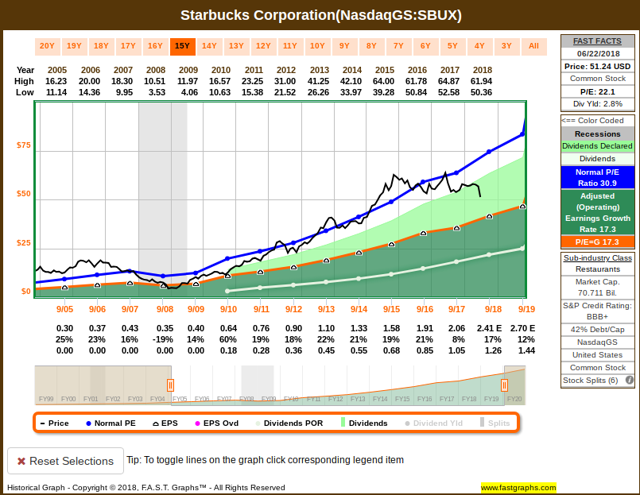

I've used Y-Charts and a TTM P / E previously in the article because their data goes back a bit further than my favorite P / E calculation, which is the mixed P / E used by F.A.S.T. Charts The weighted P / E ratio reflects the most recent actual results and combines them with the short-term expectations of analysts. This is therefore a mixture of strong historical numbers and forward looking numbers. I like it because it smooths the report a bit. Currently, there is a big difference between the TTM of 16.8 and the mixed P / E of 22.1:

This F.A.S.T.T. Chart can be very informative in the case of Starbucks because we can see the relatively high "normal" P / E of 30.9 Starbucks has averaged the last two decades represented by the blue line on the chart. This is the multiple of a high growth stock. The orange line follows where the stock would have been traded if it traded at a more indicative multiple of a mature company of 17.3 (slightly higher than my estimate of 15). As we can see, the black line representing the stock price has started to move from the trend of the blue line to the orange line, a move that we could expect from a maturing company where growth is slowing down. Also note, the price has a lot more to fall before it touches the orange line. At current earnings, it should be set at $ 41.62 to achieve this mixed P / E ratio of 17.3. Excluding the Great Recession, Starbucks has already experienced several price declines in the range of 37-48%. If he knew this kind of decline again, the price would range from $ 32 to $ 39 a share. If we use a more traditional mixed P / E ratio, we would have a price of about $ 36.

So, assuming we get a complete change in sentiment from investors who value Starbucks as a mature, yet solid business, I think a reasonable price range is expected at $ 32-42 per share. I would be inclined to make my first stock purchase in the high end of this range around $ 42 a share, provided the stock hits that price while the overall economy is still strong. Starbucks will continue to buy back shares and pay a good and growing dividend, which could increase the price. And I really like Kevin Johnson considering to focus on running an efficient and data-driven business. Despite his inability to announce that Starbucks is a mature business, at the operational level he is treating it as such, which is a good thing. He will never be as good a promoter of stocks as Schultz and we can not expect him to produce the kind of multiple bonuses that Schultz has been able to produce. But as long as we buy the stock at a good price, we do not need Johnson to do it. Nous avons juste besoin de lui pour faire du bon travail avec Starbucks, et pour garder son engagement à redonner de la valeur aux actionnaires via des rachats et des dividendes. Mais pour que ce soit une bonne valeur du point de vue d'un investisseur, je crois que le prix du stock doit baisser en premier.

Maintenant, les estimations ci-dessus supposent qu'il n'y a pas de ralentissement économique. Si c'est le cas, il est important de reconnaître une autre différence importante entre Starbucks et McDonald's. Dans l'interview de Kevin Johnson, il a mis l'accent sur le consommateur haut de gamme et essentiellement sur le fait qu'il n'était pas intéressé à poursuivre le bas de gamme. Cette approche est bonne, mais les investisseurs doivent se rendre compte que, avec cette approche, il y a beaucoup plus de volatilité en période de crise économique. Pendant la Grande Récession, l'action de Starbucks a perdu plus de 70% de sa valeur et ses bénéfices ont chuté, tandis que les actions et les bénéfices de McDonald ont fait exactement le contraire. McDonald's a le potentiel de le faire parce qu'ils vendent des produits à bas prix. Si nous avons une autre récession (et je pense que nous le ferons probablement dans les deux ou trois prochaines années), nous pouvons nous attendre à ce que le cours de l'action de Starbucks chute bien au-delà de 42 dollars par action. Je pense qu'il y a une très forte probabilité que pendant une récession moyenne, nous puissions avoir l'opportunité d'acheter les actions de Starbucks à 25 dollars par action.

Les lecteurs qui ont lu mon travail précédent savent que j'aime avoir deux points d'entrée potentiels pour les actions. Ces points d'entrée pour Starbucks sont de 42 $ et 25 $ par action.

Conclusion

Le titre Starbucks devrait perdre à la fois sa «prime Howard Schultz» et sa «prime de croissance». Le nouveau PDG Kevin Johnson semble le comprendre et prend des mesures raisonnables pour faire fonctionner Starbucks comme une entreprise mature même s'il ne peut admettre publiquement qu'il le fait. En utilisant les estimations historiques d'autres sociétés matures et en examinant les prélèvements antérieurs de Starbucks, je pense que 42 $ constitue un bon point d'entrée pour les investisseurs à moyen terme. Si nous connaissons une récession ou une grave stagnation économique, je pense qu'il y a de fortes chances pour que les actions de Starbucks affichent 25 $ par action et que j'achète des actions additionnelles à ce prix.

Essentiellement, ce que je m'attends à voir chez Starbucks, c'est un gros chiffre d'affaires dans le type d'investisseur qui détient les actions. Je m'attends à voir des investisseurs à court terme, des admirateurs de Howard Schultz, et des investisseurs axés sur la croissance quitter les actions au cours des deux prochaines années. Mais finalement, lorsque le prix sera suffisamment bas, nous verrons des investisseurs axés sur la valeur, des investisseurs axés sur le revenu et des investisseurs axés sur les affaires à long terme. C'est ce que nous avons vu avec Apple ces cinq dernières années. Le fait qu'une entreprise soit mature ne signifie pas que l'action ne peut pas être un bon investissement, et une fois que le prix est correct, l'action de Starbucks attirera de meilleurs actionnaires et permettra à Kevin Johnson de se concentrer sur son entreprise , plutôt que d'essayer de soutenir le cours des actions comme son prédécesseur l'a fait.

Disclosure: Je suis / nous sommes longtemps AAPL.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link