[ad_1]

Bear Market is a scary term for Wall Street and investors. What does it mean? And how does it affect Wall Street and Main Street? Adam Shell explains.

October is at the height of its Wall Street reputation as a month known for its wild swings.

The broad US stock market tumbled for the 12th time in the last 14 days on Tuesday, marking the worst month of October since the 2008 financial crisis. The market as measured by the Standard Market Index & Poor's 500, has become unstable since it reached a record on September 20, taking a defensive turn.

The psychology of investors has become more cautious about the growing list of risks that weigh on the 9-year bull market. These risks now include worries about corporate earnings after two industry giants, Caterpillar and 3M, released troubling prospects for investors, tumbling their shares early Tuesday.

This news has added to investor concerns over the slowdown in the Chinese economy, global trade disputes and rising interest rates in the United States, which makes borrowing more expensive for businesses and buyers.

"The markets remain covered by a thick hedge of risk," said Stephen Innes, head of trading operations at Oanda, a foreign exchange trading company.

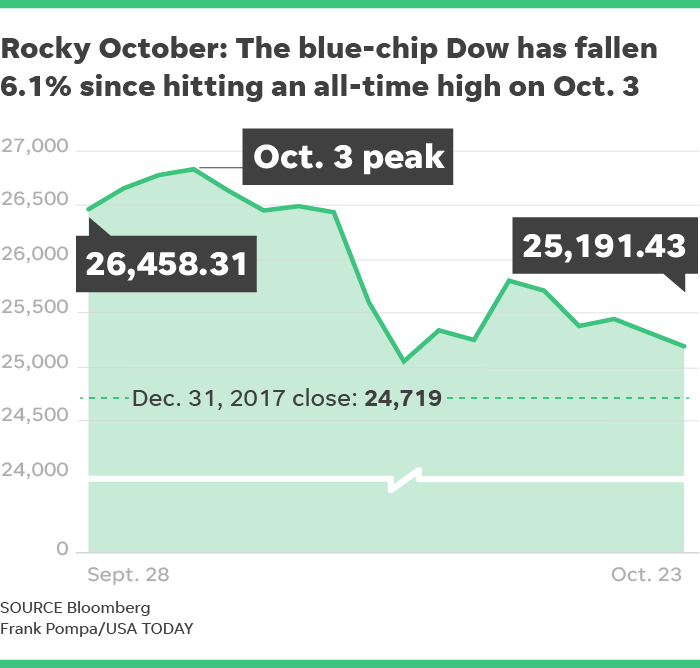

whipsawed

Investors were trapped on Tuesday, as the Dow Jones industrial average dropped nearly 550 points, or more than 2%, at some point before reducing some of its losses to close to 126 points, or 0 , 5%, down to 25,191. The Nasdaq composite, rich in technology, once again suffered losses, passing briefly in territory "corrector", 10% less than its record level of August, before closing 0.4% to 7438, or 8 , 3% of its recent peak. .

October has a history of scary returns and high volatility. The stock market collisions of 1929 and 1987 took place on the 10th month of the year, as did nearly 17% in 2008, when the US banking system was on the verge of collapse, according to S's data. & P Dow Jones Indices. And no month has had more daily price movements of 1% or more in both directions since 1950, data from LPL Research show.

The S & P 500 is down 5.9% so far in October.

But all history is not bad. Over the past 20 years, October was the best month for the Dow, posting average gains of 2.5% and a 75% faster increase, according to Bespoke Investment Group.

Wall Street professionals are still trying to determine whether the recent decline in stock prices indicates a change in the market trend, going from top to bottom, or whether the price declines are simply a regular adjustment that will lead to a further rise actions.

Signs of hope

A sign of hope, the S & P 500 closed at 2741, above the key level of 2700 which had reached its lowest level this month and which served as a kind of floor to the market. Some Wall Street professionals say the sale has been excessive and buyers will reappear and rally the stock.

"The (market) is oversold," said Mark Arbeter, chairman of Arbeter Investments, adding that the stock could prepare for a potential bullish rally.

Another positive sign is that the market has become much cheaper than at the end of January, when investor optimism was much brighter. The S & P 500 is now trading at 17.7 times expected earnings over the next four quarters, down 4 points from its P / E ratio of 21.7, after peaking in 2018 January 26, according to Refinitiv earnings tracking.

Nevertheless, market success this month could be a sign of the future and "set the tone for much of the next few quarters," warns Oliver Jones, market economist at UK-based Capital Economics. United.

It's time to heal & # 39;

What worries Jones is that many parts of the market related to the health of the economy, such as technology companies and companies that sell discretionary goods to consumers, have been less successful than so-called "defensive" stocks. Such as utilities and manufacturers. consumer goods. This "reflects investors' concerns about growth prospects in the United States and China," Jones told his clients in a report.

Citing what he calls "post-traumatic volatility," Jonathan Golub, chief US equity strategist for Credit Suisse in New York, said the markets "need time to recover" after suffering strong fluctuations. "It's not uncommon for markets to remain nervous for some time" after soaring investor fears, he said in a report.

After the sharp swings and modest losses on Tuesday, the S & P 500 stock index closed 6.5% below its September record, and the Dow was 6.1% of its record of 3 October.

Wall Street hoped that quarterly earnings would support the market, but that was not the case, even though analysts expect the S & P 500 companies to collectively post their third consecutive quarter of earnings growth above 20%, according to Refinitiv.

As a sign of investor concern, even though 79% of the S & P 500's 111 companies outperformed the third-quarter earnings forecast, equities are not being pushed up by investors, according to a Bank study of America Merrill Lynch. This suggests "that the good news is announced," the firm said.

More money: Of course, you remember Sears with affection, but why do not you shop?

More money: Harley-Davidson results: Motorcycle sales in the United States continue to fall, but profits are increasing

More money: Women lose $ 513 billion a year in wages because of the pay gap between men and women, and math is worse for some

Small stocks suffer

The Russell 2000, a small-business equity index that fell 0.8% on Tuesday, sinks deeper into the corrected territory and is down 12.3% from its August record.

Despite continued weakness in stock prices and a growing list of concerns, the broadly defined S & P 500 "still does not meet the 10% correction threshold," said Hank Smith, Co-Head of Investments at Haverford Trust, to USA TODAY by email.

Tensions on the markets are worse, he added, because investors have become accustomed to the stocks rising with virtually no wild fluctuation.

"With such low volatility in recent years, investors react emotionally to every decline," said Smith.

Read or share this story: https://www.usatoday.com/story/money/2018/10/23/stocks-drop-after-caterpillar-3-m-issue-disappointing-forecasts/1737169002/

Source link