[ad_1]

This year, a number of technology companies majority or mainly owned by the Chinese giant went public in the United States. Baidu The iQiyi service, Huami and Viomi supported by Xiaomi are some examples, and now, Tencent Music – as you can guess, the musical division of Tencent – makes its way after many speculations.

TEN – Tencent Music Entertainment – has filed its initial documents for public opening in the United States (unspecified exchange) overnight. The initial target is an increase of $ 1 billion, although subject to change. We know that the value of Tencent Music is at least $ 12 billion, according to data from the IPO of Spotify earlier this year. It will be interesting to note the importance of this list.

Just a start-up, TME is a subsidiary of Spunout that hosts four music streaming services Tencent, Q Music, Kugou Music, Kuwo Music and WeSing. These include orthodox streaming services, karaoke applications and live streaming services. They are generally recognized as the top four music apps in China and together boast over 800 million monthly users.

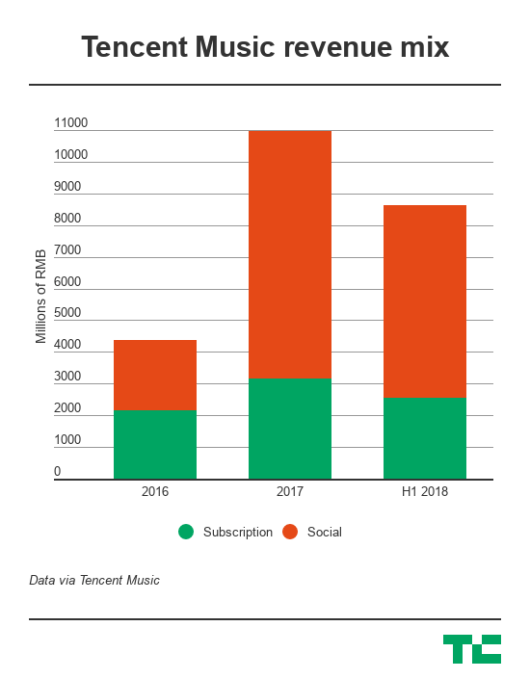

Unlike Apple Music, Spotify or Pandora, TME is a profitable company, but its gross income and its way of earning money are very different from those of its Western brothers. Spotify and its businesses rely on subscriptions and free levels funded by advertising, Tencent Music derives most of its revenue from social activities, advertising and sales of songs.

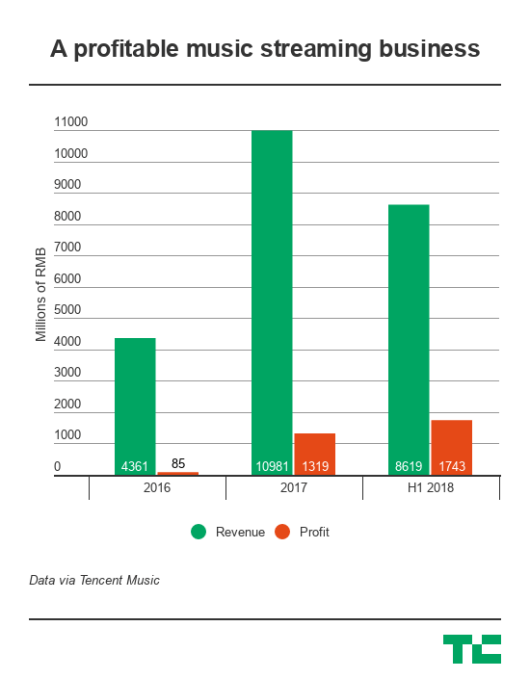

Tencent Music sales in 2017 amounted to 1.7 billion dollars (11 billion RMB), with a profit of 199 million dollars (1.3 billion RMB). The first half of 2018 has already registered a business turnover of 1.3 billion dollars (8.6 billion RMB) and a profit of 263 million dollars (1.7 billion RMB). Subscriptions account for only 30% of these sales, the rest being virtual gifts to live streamers and premium subscriptions.

This success is due in large part to its connection to Tencent services – in particular WeChat, which has a billion users, and QQ, but also Tencent Video – which offers Tencent Music services a way to reach users and customers. broadcast on friendly graphics and networks. This has reduced marketing expenses and made the company profitable. The cost of revenue for Tencent Music is 60%, compared to 75-85% for Spotify, which has to do a lot more work to attract users.

It is interesting to note that Tencent Music notes in its flyer that it expects revenue from subscriptions to increase over time.

"We had a pay ratio of 3.6% in the second quarter of 2018, which remains very low compared to pay ratios for online gaming and video services in China and other online music services cited by iResearch, which indicates significant growth potential. , "Wrote the company.

This is not obvious, however, when considering the invasion of privacy in China. Industry players claim that this is changing, it's in their own interest to say so, but it's unclear if alternative "social" monetization models that Tencent Music is taking advantage of cannibalize revenue. potential from subscriptions.

Either way, society might also be able to learn from the West. Spotify holds a 9.1% stake in the trade through a share swap last year – Tencent owns 7.5% of Spotify – which could however create synergies between the two parties, although Spotify is in competition with Joox (not part of TME) in markets such as South East Asia.

For now, the main thing to remember is that Tencent Music is the best chinese dog streaming and it relies on WeChat. dominant messaging platform of the country. This bodes well, but, as has been repeated many times in its prospectus, monetizing music is still a new concept in China, so that there are few parallels to follow.

However, it is a rare example of an IPO in the Chinese technology sector that is not a haemorrhage – for example, Nio – which, coupled with the Tencent connection, will probably make it a popular one.

Source link