[ad_1]

As investors, we tend to focus on the future. After all, our portfolios reflect how we envision the future in various sectors of the economy.

Given this future direction, a comparison between You're here (NASDAQ: TSLA) and Ford Motor Company (NYSE: F) could seem strange. After all, Tesla is the future and Ford, the past – is not it?

The truth is that it is not so simple. As the shares of both companies have dropped significantly over the last year, the time is right to take a closer look at: what is the best buy for new money right now?

Tesla fans love Model 3. But a too ambitious production plan for the Model 3 has been expensive for Tesla over the last year. Image Source: Tesla Inc.

How Tesla and Ford compare in terms of valuation and stock market performance

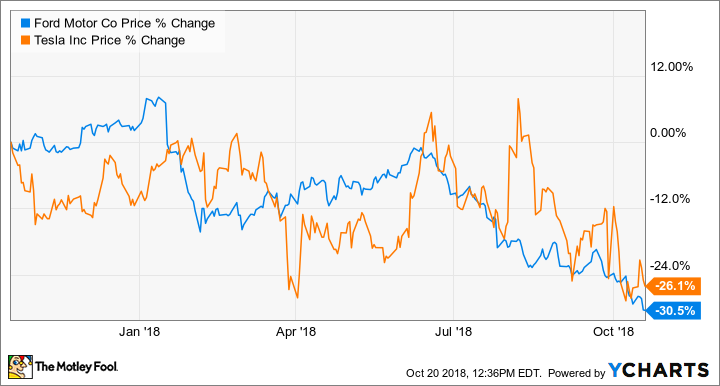

Neither Ford nor Tesla had a good year on the stock market. Last Friday, they had both lost more than 25% over the past year, while Ford was down slightly.

F data by YCharts. The graph shows the performance of Ford and Tesla shares for the year ended October 19, 2018.

Usual valuation measures based on profits do not give us much work here. Ford is trading at about five times its net profit for the past 12 months, while Tesla is trading at about 21 times its share price. loss during the same period.

The truth is that Ford and Tesla are different types of stocks. Ford is solidly profitable: its net profit was $ 7.6 billion in 2017, $ 4.6 billion in 2016 and $ 7.4 billion in 2015. Tesla does not do it: if it managed to generate a quarterly profit here and there over the course of its history has not yet announced earnings for the year.

In reality, it is largely useless to compare these two companies to fundamentals, because Tesla's evaluation is not about fundamentals, but about history.

Does the history of Tesla still confirm its value?

Tesla has had one of the most beautiful stories of all time. As fans have seen, CEO Elon Musk is inventing the future – not just cars, but energy – before our eyes. In the minds of these fans, the growth potential of Tesla seems unlimited.

This is not an exaggeration. About a year and a half ago, Morgan Stanley Analyst Adam Jonas published a note that Tesla's total potential market was estimated at $ 15 trillion – about one-fifth of the total whole world gross domestic product.

So it's no surprise that Tesla's market capitalization reached $ 60 billion in June 2017, about one and a half times that of Ford at the same time.

But the history of Tesla has experienced some slowdowns in the last year. Tesla has struggled to move its Model 3 sedan, its long-promised "mass market" model, to full production, installation and then partial extinguishment of a highly automated production line. Persistent concerns over the quality of construction, a long list of executive departures and the decline in Tesla's cash reserves have not contributed to investor confidence.

In August, when Musk, frustrated, tweeted that he had "obtained funding" to privatize the company, but that the contract (if any) evaporated in the days that followed, it seemed that the company wheels could fly away.

It is possible that Tesla managed to generate another small profit in the third quarter by delivering heavily loaded versions of the high-margin Model 3. It is also possible that the product has a fairly healthy cash balance at the end of the period. appeared to be the payment schedule to maximize cash on the last day of the quarter. And it is possible that these things give a boost during Tesla's action, at least for a moment.

But the story has come to an end. Specifically, Tesla 's margin of error now seems thinner than it has been for years. There is good reason to believe that, despite a 26% fall in share price over the last year, Tesla is still overvalued.

The story of Ford starts of course with the super-efficient F Series pickup. But Ford is also investing heavily in electric vehicles and autonomous driving technology. Source of the picture: Ford Motor Company.

Does not Ford fight?

Ford struggles a bit, at least according to its own recent standards, but it does not present any serious danger. In simple terms, Ford's sales and margins have declined over the last few quarters, due to the aging of its product line.

This is a problem that can be solved by launching new products. Many new models are forthcoming, including the all-new versions of its big SUV crossovers Escape and Explorer and the return of the mid-size Ranger pickup to the American lineup.

President and Chief Executive Officer Jim Hackett also makes a number of changes to maximize the profitability of Ford's traditional business sectors, while aggressively investing in new technologies and exploring new business models related to Ford. to mobility.

Yes, these changes include the highly criticized decision to remove the low-end sedan and sedan models from Ford's North American lineup. They also include the launch of new crossover vehicles with higher profitability in these same market segments, as well as additional models in segments that Ford has not challenged in recent years. (Example: Ford will launch a powerful off-road SUV called Bronco in 2020, which aims squarely at Fiat Chrysler Automobiles"Jeep brand.)

There is another thing to note. Ford may not have the growth of Tesla, but it has something more concrete: a dividend, which yields about 6.8% at current prices. High dividend yields are often a sign of caution, as troubled companies tend to reduce dividends early, there is reason to believe that Ford will be both ready and able to maintain its quarterly dividend at the same level. Even in times of recession, profits (and stock prices) could well be reduced.

Tesla or Ford is it better to buy now?

Now, you probably know how much I'm inclined to answer that question. I think for a patient investor, Ford is a good bet for substantial growth in the stock price from this location over the next five to seven years. I own Ford shares and I do not intend to sell.

As for Tesla, it really depends on what you think of the story. I never believed in the more far-fetched predictions of Tesla, but I thought for a long time that society had the chance to become rough BMWmedium-sized, selling between 2 and 3 million high-end vehicles per year at good margins.

There is still a chance that this will happen, in which case the stock of Tesla could be worth (in fundamental terms) something like what it is selling. But it is also possible that society suffers a sharp fall if it is forced to restructure or recapitalize – opportunities that seem much more likely today than they were there are a few years.

It is true that the stock of Tesla could easily reach $ 350 again, or even more. This could make a fun business if you are inclined to do it. But as a long term investment, I think that there is a lot Tesla may not be easily visible a year or two ago, and that's why I think Ford is the best buy today.

[ad_2]

Source link