[ad_1]

*Tweets relating to the image: The nothing of Tesla, Worth it.

I’ve been tracking Tesla (NASDAQ:TSLA) for a while now. Not because I was ever interested in investing in the company (financials were always so bad and volatile), but because I’d read about it everywhere and all the time. The coverage this company has enjoyed is unprecedented. And because of it, Tesla should have thrived, right?

Well, I’m not so sure. When I look at the cannabis industry (“Green Rush”), many newcomers to this ever-expanding market are over-leveraged and not (yet) profitable. So, I guess any new venture is always a risky bet. Let’s give Tesla a break, shall we? – I’m already hearing “booh” in the background.

I finally decided to write about Elon Musk and his, yes magnificent, business. I was never really a fan. I don’t like it when certain corporations are allowed to do more mistakes than others. It’s just unfair. Any other stock would have already collapsed by now, but not Tesla. I must admit though, I enjoyed the moment when Q3/2018 results came out and were positive.

Yes, I know, the company has major working capital issues, rising debt, unstable margins (cannot be predicted), and growing competition. It will dilute its shareholders soon, that’s a certainty. But still… Tesla is a business with great potential.

I’m a bit sad myself. I would like to put some money into Tesla just to make things more interesting for me. I wouldn’t hope to make money, and I’d be prepared to lose it all as well. But at current price levels (anything above ~$170), the odds are most likely against me.

There are many great articles on Seeking Alpha, which really spice up the debate. To receive a proper “round-up” of views and perspectives on the matter, I’d suggest reading the latest articles of the following contributors: Bill Maurer (a major critic of Tesla, focuses on the negative aspects of the company), Victor Dergunov (pro-Tesla, predicted a profit for the company, but mostly based on ZEV credits), Jonathan Cooper (balanced realistic approach, called the Model 3 production output for Q3), Andreas Hopf (great comprehensive reports, stands negative on Tesla) and finally, Trent Eady (over-optimist, j’adore Tesla).

If you have read the latest articles of the contributors just mentioned, you are probably ready to take part in the debate (please do so). To be honest, I would also like to see more contributions from one of my favorites, Michael Boyd, who always seems to be “down to earth” (would really be practical with the Mars talk and all).

Hunted Like A Wild Animal

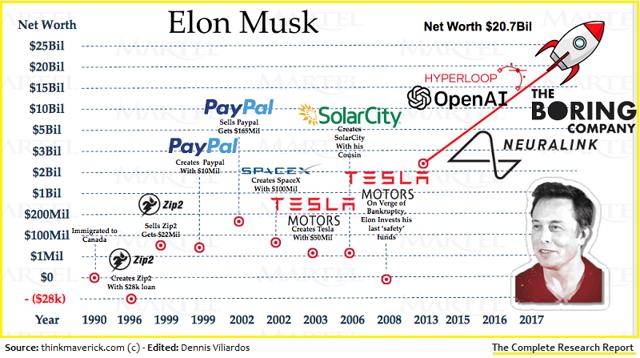

When discussing Tesla Inc., it would be wise to also address the case of Elon Musk. In particular, what his business background was prior to his current venture, what his “culture” really is, and how strong his grip over Tesla is.

When Elon Musk migrated from South Africa, he and his brother started Zip.com and later PayPal (NASDAQ:PYPL). Both companies were a success. But their industry is quite different from Tesla’s. The latter is a capital-intensive business, which maintains an inventory (sales need to be forecasted to properly manage cash flows) and operates under relatively low margins. The electronic/online technology industry on the other hand (Zip.com, PayPal) has the exact opposite characteristics: Its corporate components do not require much capital per unit of revenue, do not maintain an inventory (for the most part), operate under high margins and can therefore survive with a highly leveraged balance sheet.

The fact that Elon Musk acquired Tesla Motors (now Tesla Inc.) instead of creating the company himself means that, for a long time, he was experimenting and learning how the business works. Tesla’s current financial position proves that Elon and the culture he brought with him are not compatible with the industry characteristics of the company. At least that has been the reality for quite some time.

Now that Tesla is in a distressing situation (Q3 sales could stall after Q4), Elon Musk feels the pressure, and it is slowly eating him up. There are many signs of his psychological fatigue (tweets, actions) and the possible lack of a work-life balance is making things worse (read more about Elon Musk’s relationship history) – (read more about the consequences of Work-Life imbalances).

All of the above should worry the average investor, because “if Elon goes down, Tesla might go down with him”. Shareholders have thought about this, and so has the SEC. So, they came up with the idea of promoting James Murdoch (at least that was the rumor). Although his background lies mostly with media, he has in the past been successful in turning businesses around. He also has strong “promotional power” (due to his connections with the media world), something Elon has been providing Tesla with. But corporate sweetheart James will not become Musk’s nightmare after all. It will instead be Robyn Denholm, who by no accident happens to be Telstra’s (TLSYY) CFO (until now). Another financial expert on board.

Tesla’s current CEO has in the past be ousted before, namely from PayPal. Back then, many thought he was about to destroy the company he built. Sound familiar? Right now, there are many reasons though that could hinder Robyn from getting rid of Elon:

(a) Musk owns about 19% of Tesla’s stock. That gives him great power over Tesla.

(b) Being the primary image maker of the company and partly the brand himself, it would be risky to send him packing. It’s like firing your best salesperson (selling both to consumers and shareholders) at a time when sales are everything. Below is a video verifying that Elon Musk would “feed” anyone willing to promote Tesla in a meaningful way (even YouTube influencers):

(c) Musk is also the man who “formulated” the company’s culture. If he was to leave, no one knows if the next person could properly communicate his/her own culture to Tesla employees. After all, they were picked by Musk himself (meaning executives and through them all employees).

(d) Finally, Q3/2018 results proved to shareholders that he can deliver. And that maybe (just maybe) he has a different, broader strategy in mind. Allow me to explain:

When I was younger, I used to love real-time strategy games. One of my favorites was C&C Zero Hour. In multiplayer mode, one could play against many online players, up to 7 at a time. Such a match was very competitive and a classic attack strategy granted a player a 50-50% chance of winning the game. So I decided to change my plan. I’d keep a low profile and would chat with other players without them knowing (private chat was available), co-coordinating attacks by making myself “likable” (I got reported many times for that).

In the meantime I looked weak. I wasn’t building any armies, because I was expanding my tech capabilities (costly) and gathered funds. The other players were busy fighting each other, since I was not much of a threat. When I was done with all the tech upgrades and had enough funds, I constructed a major army and ravaged my competitors one by one. They had no chance.

Elon Musk seems to be targeting supremacy. And one cannot achieve that with slow riskless steps. But rather with bold ones that will, of course, attract a lot of criticism. But this way, in reality, he is increasing Tesla’s chances of surviving the game (and the fact that it is an all-electric car company also increases its chances). A 50-50% chance of winning was simply not worth the risk.

And while I stated earlier that Elon is experiencing psychological fatigue, the truth is most likely something else: He is stirring up things, provoking anyone that will get him to the headlines. A politician will tell you that “there is no bad publicity”. Meaning that as long as something makes you relevant, people will continue to know you exist, and the same goes for your products (assuming that publicity has a positive effect on sales).

Tesla has no money to promote itself. Everything has to be directed towards R&D and expansion. So, Elon Musk had to deal with that “shortage” himself. And he did. And it worked. It still does.

Anyway. Let’s focus on the business. By now, we are all pretty much aware that Tesla’s financial risk is extremely high. And that ZEV credits won’t be the solution to that problem, even if it the company tries to sell these credits (Tesla is not the only seller, so it will have to sell at a discount).

Shareholders should not worry so much about bankruptcy risk. They should instead worry about dilution: Instant dilution (selling new shares) or “postponed dilution” (issuing convertible bonds). It’s pretty clear that Tesla is running out of financing options. It would be a bad idea to borrow more money, since interest expenses are already huge. At its current Debt/Asset ratio, borrowing more would cost more, since lenders would ask for a higher risk premium. And with Tesla’s credit rating being low, the only option it might have is diluting its shareholders (again).

One should also remain wary of Tesla’s practices. Why did the company suddenly change the release date for Q3/2018 results from Nov. 7th to the 24th of October? Could it have something to do with the chairman selection process? Or was it because of the FBI probe and the fact that a possible market correction was looming (a risky mix)?

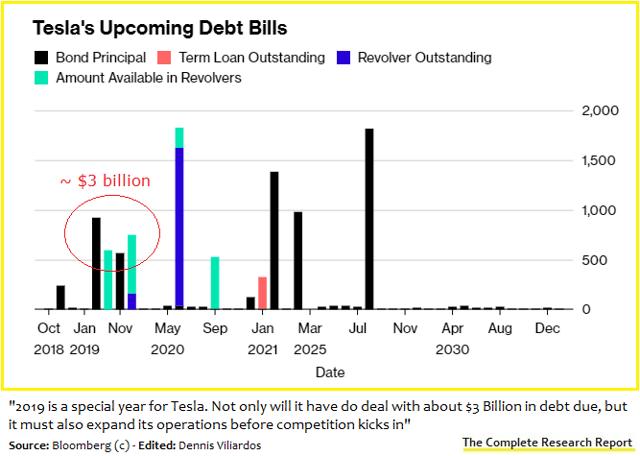

In my opinion, Tesla will most likely choose the following route: It will first try to prop up the company’s stock price, by remaining profitable in the 4th quarter as well (maybe by utilizing ZEV credits, although Model 3 sales should continue higher for another quarter at least). After that, it will need to raise more money. So, it will dilute shares with another financing round (at higher stock price levels, more money will flow in per share). It will then use the funds raised to finance the Shanghai facility, pay down some debt (see graph below), and move Model Y forward.

And this possible “route” is why I’m not willing to invest in Tesla. I’ll get diluted, and I don’t know by how much. Investors who bought in much earlier (a couple of years back) are at the very least not running the risk of losing money. I would not be so fortunate.

Tesla’s Business Segments

To make it easier for us to analyze Tesla’s business, I am creating two separate categories: The primary and the secondary business, named after the importance of each to the company. The primary business includes the Electric Vehicle segment (or product category). The secondary business then includes everything else: Powerpack, Powerwall, Solar Panels/Tiles and Services.

Under “Services”, I’ll also be including the leasing part of the EV business. The reason for that are its unique characteristics. Leasing out a car both constitutes a sale (partly) and a service. Let me be more clear:

- More cash is required: When Tesla produces a $50K Model 3 in order to lease it, it won’t get that money back anytime soon (as opposed to a sale). The leased car is still property (inventory) of the company in a sense. Which means that the “net” cash it cost to produce it will stay on hold. That’s about 80% of $50K minus the initial down payment, with a gross margin of 20% for Model 3 (as you can see margins are not only important for profits).

- More sources of revenue: When Tesla is leasing a car, it makes money via (a) the initial down payment, (b) interest it charges, (c) insurance it sells and (d) selling the car as a used one. Tesla used to refurbish ex-leased out cars prior to selling them, but that’s no longer the case. This means that the company is no longer fixing cosmetic damage done to the car (only mechanical issues are being repaired).

- There are special expenses: Aside from inflation costs concerning the money “put on hold”, Tesla also offers (a) free service for a leased out car and (b) free supercharging (at supercharge stations).

Now, as you can see fellow investors, the leasing part of the EV business is not only a complex one but can also be a very profitable unit for Tesla. Hopefully, the head of the relevant department is doing a good job.

Finally, before we start discussing the two sets of businesses (primary, secondary), we should first acknowledge the importance of each based on the weighted revenue they contribute to the company. And by weighted, I mean taking the gross profit margin under consideration (a higher GM brings in more value).

The primary business brings in about 80% in revenue value, when weighted according to the Q3/2018 average margin levels (~25%). The secondary business (including leasing) brings in a lot less, especially when margins are taken into account (power with a 10-25% range and services at a negative GM). But 20% is almost still the equivalent of a new lux model.

In essence, the above values tell us that we should mainly target our attention towards the EV business, since it’s hard to keep everything simultaneously in mind. And when electric car sales start maturing and competition becomes ripe, the secondary business will play a more important role – it will diversify Tesla’s operations and grant it the extra mile. Remember that Tesla’s growth rate can decline when the market becomes saturated, i.e. supply meets current demand (high competition), even if the industry is projected to keep growing years.

Primary Business: Electric Vehicles

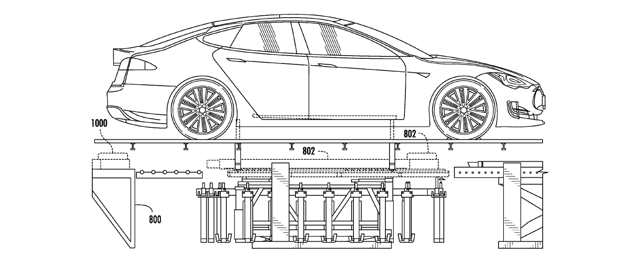

What differentiates the electric vehicle from the conventional car? Well, for the most part, nothing (hull, gadgets, purpose). The EV however incorporates two “new” technologies: The electric motor and the lithium battery.

Being an all-electric car producer is a smart move. By devoting all of its resources to a single market, not already saturated, Tesla is gradually establishing a long term advantage. It would make little sense for a new conventional car producer to pop-up, even if half its business was targeting the EV market. Already existing companies are facing a dilemma when deciding how to properly allocate R&D funds: Should they put more money into EV tech? But what about gasoline cars? Won’t clients expect an updated version of those models every 1-2 years? After all, competition demands it.

Of course, Tesla’s all-electric strategy comes with its own risks. The EV market needs to be “cultivated”. There is no guarantee that consumers will shift away from internal combustion engine cars anytime soon. But even if the relating growth forecasts do materialize, companies would need to be “healthy” enough (financially) to cope with the demand.

There are ways for Tesla to manage the risks (aside from moderating expectations a bit). And they share a common name: Collaboration. Elon Musk’s decision to work together with Panasonic (PCRFY) for the purpose of producing lithium batteries was a wise one. No money was wasted in researching and developing those power units. Tesla should expand such joint ventures beyond batteries as well.

In particular, it should collaborate with another company in relation to its Autopilot software. Competition is already severe, and companies with more resources available than Tesla could conquer this niche market sooner. Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is among these companies and could prove to be an ideal ally to Tesla. But that’s just speculation.

The point made here is that the EV automaker should look for possible partners in order to reduce overall risk, without though sharing (forgoing) too much revenue/profits. The autopilot software is not the component with the highest value for each model. It is rather a gadget, an upgrade. But it could be enough to spark more sales. And if it does, the bigger part of the revenues per car still stays in Tesla’s pocket. Entering an agreement with a popular ride hailing company is yet another such example. It would boost sales, increase “coverage” (more people would see Teslas on the road), both without sharing too much revenue with the collaborating company.

As a final observation before digging deeper into Tesla’s actual potential, we should point out that its current EV price range ($45,000-120,000) means that it targets the upper income class. Reaching its $35,000 goal for Model 3 would partially bring it into the middle income class context, but if federal tax breaks and other subsidies come to an end (we’ll come to that later), it would make it harder for Tesla to become an EV producer “for the masses”. Luckily, the used car segment could ease things up a bit.

Industry Potential and Tesla’s Alignment

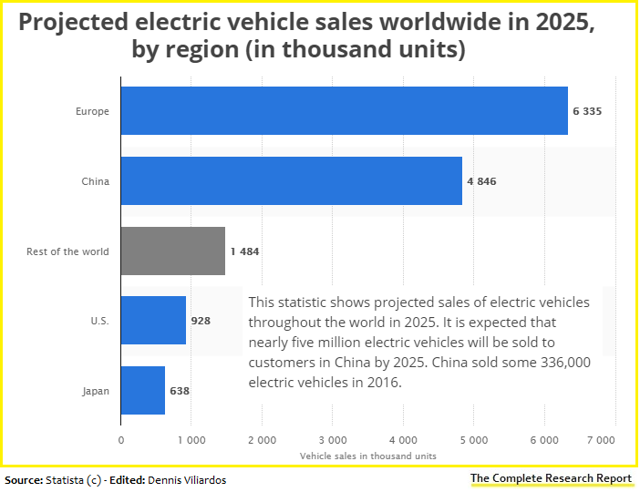

In the medium term, Europe and China seem to be the two regions/nations projected to pose the highest demand for electric vehicles. The graph below shows that sales might climb quite a bit by 2025 (4-6 years from now).

(a) Europe is a region that depends on oil imports. It is barely a producer of this raw material itself, if we were to exclude the Scandinavian sub-region. It has also been pushing for renewable energy production, in an effort to move away from nuclear and coal based power.

Renewable power, however, won’t be enough to cover further demand for electricity (EVs will contribute to that demand). For that reason, Europe is also investing in natural gas power, which can satisfactorily “collaborate” with renewables. Gazprom (OGZPY), Rosneft (RNFTF), Equinor (EQNR) and other international companies, are among those who supply Europe with natural gas. In short, it seems to be clear why Europe is to become the leader in demand for EVs. The culture just fits.

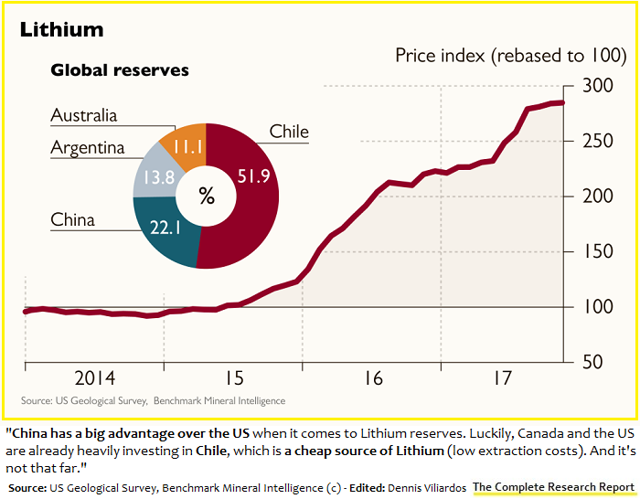

(b) China’s demand for electric vehicles is also going to surge. Aside from its goal to reduce CO2 levels in major towns (most of its power still comes from coal), it also wants to become a global player in the EV industry. Luckily, the nation sits on one of the largest lithium reserves of the planet (see graph below).

This grants its automakers a major advantage, since the government can put a cap on how high lithium prices can “fly” domestically. As a result, companies like BYD (BYDDF), Nio (NIO) and Geely (GELYY), can remain competitive (high gross profit margins) in the global market, even when lithium prices surge. Such a cap exists on crude oil (domestically), and it targets to keep prices above $40. This means that Tesla will have to fight much harder to acquire and retain a piece of the Chinese market.

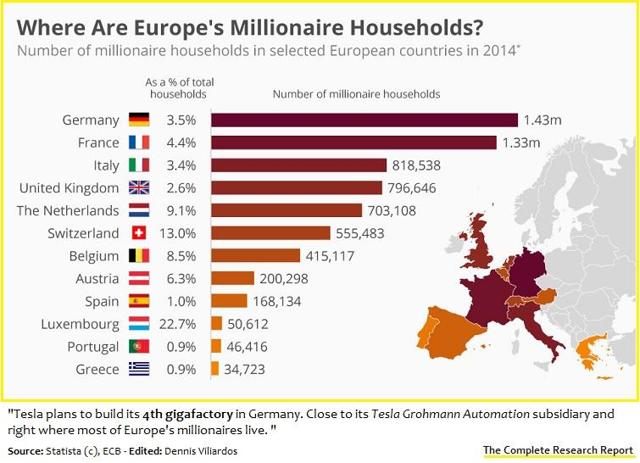

Has Tesla positioned itself properly to take advantage of the medium-term demand for EVs? Well plans for a Gigafactory no.3 (Shanghai) and a Gigafactory no.4 (Germany) seem to indicate that the company believes in the forecasted demand figures for Europe and China.

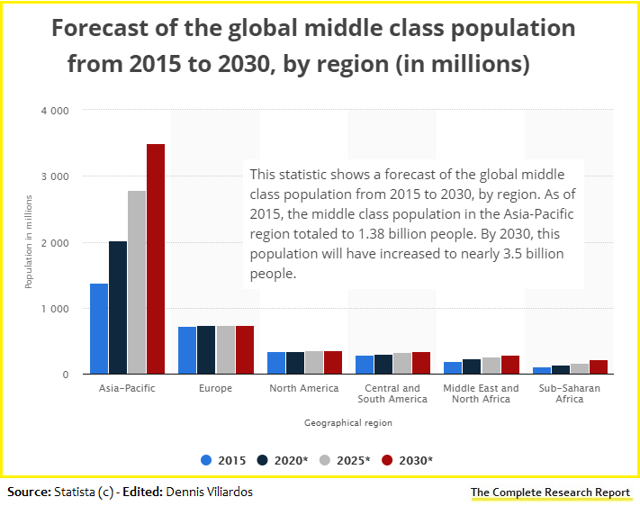

(i) Why the Shanghai plant matters: Aside from China’s pledge to both reduce CO2 levels and become a global EV player (producer), its potential also lies on the fact that the nation’s middle class is expected to grow substantially over time – as opposed to the west, where the “super-rich 1%” problem only becomes bigger.

(ii) Why the German plant matters: Germany, on the other hand, has a different advantage. It is the nation with the highest number of household millionaires in Europe. Right next to it, France, comes in second for that matter.

(iii) Both China and Germany have a well developed recharging network in place (compared to other nations of course). But there are also some negative aspects. Corporate spying will become an increasing problem for Tesla, a company that is betting its recognition on high quality vehicles (expertise). In China, strict government corporate supervision will allow officials to get their hands on Tesla tech fairly easy. In Germany, a nation where domestic car companies have created a vast network of influence (from banks to unions), preventing corporate spying can be hard if not impossible.

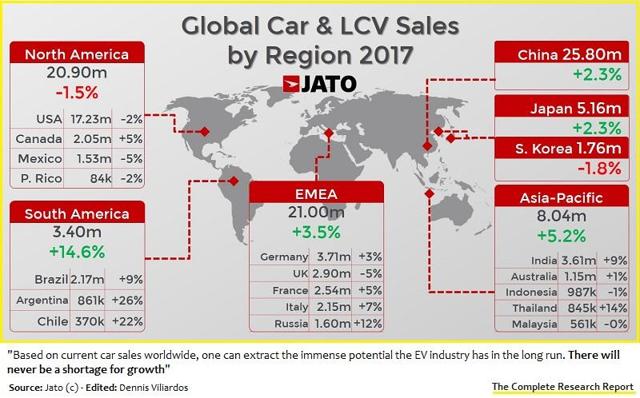

Moving on. Forecasting the long-term demand for EVs can be challenging. German carmakers are already lobbying for the revival of diesel cars (quietly), which do have many positive characteristics (long engine life, lower gas consumption). In the US, energy billionaires are lobbying against EV subsidies. But even so, a simplified approach (which needs to be verified every year) is to just take current global conventional car sales into account and assume that they will eventually be covered by EVs (or hydrogen-gas based vehicles).

China, Europe, and North America are the markets with the highest number of car sales. Now, it will all come down to capacity and the sales network. And here is how Tesla will try to manage the challenges posed:

- At the moment, the EV maker is continuously expanding the capacity of its existing factories.

- As we’ve already mentioned, it is also planning on constructing a Gigafactory in Shanghai and Germany.

- Its Grohmann Automation subsidiary in Germany focuses on increasing productivity by developing more advanced automation equipment used in assembling a car.

Bloomberg has created a useful tracking tool for those who wish to keep an eye on capacity: Click here.

“Net Competition”

Remember that, in this article, we only discuss Tesla’s Primary Business. So, by competition, I mean strictly in relation to the EV segment of the company.

When analyzing Tesla’s growth potential, we are usually quick to assume that the more the EV industry expands the better it will be for the all-electric car maker. Well, that’s only half the truth. It all comes down to demand yes (industry expansion), but also supply (competition). Hence, “net competition” is what we should base our investment decisions on.

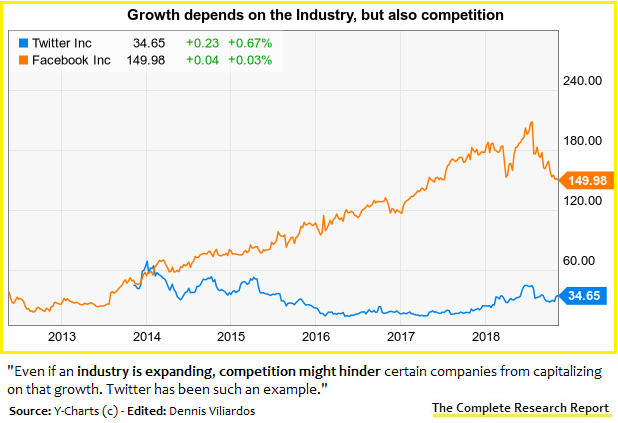

And it matters. A lot. See for yourself (graph).

I’ve recently completed a series on Twitter (NYSE:TWTR) a company that is just now managing to stabilize its business. When the social medium decided to initiate an IPO, its industry was expanding. Facebook (FB), its main competitor at the time, managed to take advantage of the expansion and grow for many years. Although there was a lot of money in the industry that changed the reality for traditional media such as the New York Times (which now depends mostly on subscriptions to survive), Twitter could not compete until today (and that’s still an ongoing process). Tesla could have the same fate. Or not.

Currently talking about numbers, how many cars Tesla sold versus how many cars General Motors (GM) or Toyota (TM) sold, brings in little value to our discussion. Here is a link in case you want to know more about these numbers within the US (Monthly plug-in sales scorecard), but it won’t really matter much in the medium and longer term. And that’s because many of the world’s largest car corporations are planning on releasing their complete EV model lines during 2019-2021. Before that happens, talking about current sales will only be an incomplete assessment of competition. We should instead talk about organizational structure and the advantages that Tesla’s (future) competitors have:

- Worldwide brand recognition: We are all well acquainted with companies like Toyota, VW (VWAGY), Daimler (DMLRY) and General Motors. Thanks to Elon Musk, Tesla has been receiving more than its fair share of fame and coverage. But conventional car producers have already proven that their products are of high quality and with no hidden surprises. Tesla has not yet gotten the chance.

- Promotional networks: They (competitors) also have complete PR channels in place and data from past campaigns. So, they know how to best promote an SUV, a compact model or a family vehicle.

- Market statistics: All of them have a department devoted to gathering and analyzing market data. And have deep roots when it comes to collaborating with advisory (consulting) companies (McKinsey, PWC, etc.).

- Global sales & service network: Consumers can find a sales or a service representative anywhere in the world.

- Financial firepower: They also have easy access to capital markets and can finance operations or an expansion. Because they are “old” companies, with a proven business model and a good credit history, issuing corporate bonds will be much cheaper compared to Tesla (lower premiums, higher demand).

- Political influence and spy networks: Finally, Tesla’s competitors are also heavily influential. They have been lobbying the political context for decades. They also have “trusted friends” all over the banking system, among unions and in other industry layers.

Along with all of the above, American and European conventional car companies are also looking for prosperous joint ventures. Either with each other or with ride hailing and even software companies (hacking vehicles will be a major issue in the near future, especially if many operations are controlled by a tablet).

And that’s not all. Competition will also come from newly formed all-electric vehicle producers. So, the question then is:

“Can Tesla formulate a corporate strategy capable of coping with all of the mentioned competing forces and still thrive? Is Elon and his team up to the task”?

At the very least, here is what the EV maker must focus on:

(a) Brand recognition,

(b) Broad sales and service network,

(c) Quality EV models and pricing,

(d) Financial health and

(e) Production capacity that meets demand.

For the latter, Tesla will only get one shot. If it fails to meet demand the moment competitors roll-out their model lines, the finite trust that the company now enjoys as an innovator will most likely evaporate. Tesla will either be a “market opener”, a company that created the market initially but then others took over. Or it will become “semi-monopoly”, monopolizing certain niches of the EV market. Being already highly leveraged (a lot of debt) and a newcomer, it will find it hard to survive anywhere below the state of a semi-monopoly.

Elon Made A Mistake: A CUV Instead Of An SUV

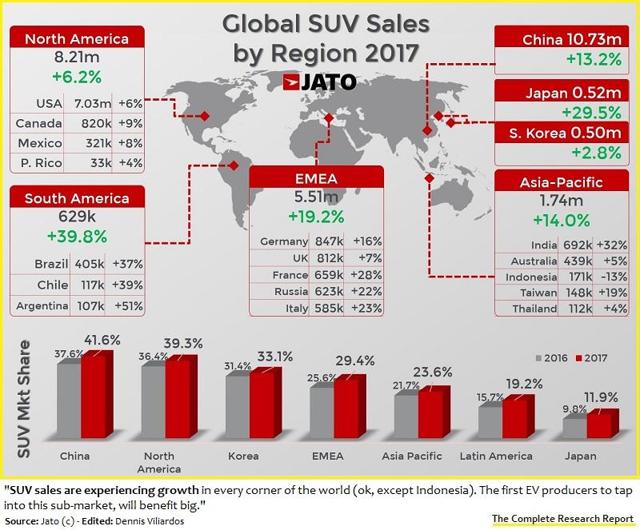

When Model S was introduced, Elon was under pressure. He had to prove that his dream of “an EV for the masses” was a realistic goal. At the same time his team was well aware that SUVs have great demand in the US, Europe and China (graph below).

So, he probably just wanted to combine both needs at the time: An SUV (which is relatively expensive) and a compact family car (less expensive) that is one step closer to the vehicle for the masses (now Model 3). And he came up with Model X, a CUV.

In my humble opinion, this was a mistake. Competitors like Volkswagen and NIO already have an SUV on their product lines. And you know what they say… well, what famous industrialist Andrew Carnegie said anyway:

“The first one gets the oyster. The second gets the shell”.

Either way, hopefully, Model Y will be an SUV. Simultaneously though, it is of vital importance that Tesla unveils the cheaper version of Model 3 soon (no later than mid 2019). With the EV-maker losing certain benefits after the 200,000 cars milestone, it will need that lower priced car to maintain a healthy sales quota.

Model U (or P), a pick-up and Model C, a Smart-alike tiny town-center car (see images to the right) should probably come next. I know that many believe (including Elon Musk) that the semi-truck should come next. But, in my opinion, this would be a risky move. You see corporate clients are not really driven by trends and social movements. They only care about utility, life expectancy, and cost. They won’t invest in an electric truck just because Elon promotes it. The “pocket” comes first. Consumers in that respect think and act differently.

Why I Stand Against Subsidies

Tesla is actually a very important company for the West. It was the one to promote the idea of a low cost electric vehicle for the masses. If the company was to falter, demand for EVs could witness a decline in the short term because consumers would lose faith in “the revolution” (most don’t buy an EV because they need it). And other producers would struggle to persuade their shareholders that the industry (sub-industry) is worth their money.

Nevertheless, I stand against subsidies. They are in a sense a form of government intervention, giving money to certain companies only (money that comes out of citizens’ pockets). This “corporate racism” distorts how markets and industries are supposed to work, allowing for companies with a non-viable business model to survive (temporarily). This moves against honest competition, the cornerstone of any healthy economy. And that is primarily why Tesla is hated so much: No fair play.

Now, Donald Trump’s efforts to annul both the gas-mileage standards and the ZEV program will damage the EV industry. This is a bad idea. What I would propose instead is to maintain the gas-mileage standards, halt the tax break benefits, and modify the ZEV program by only keeping the “penalty” part of it (i.e. ZEV credits will no longer exist, but penalties for those who miss the minimum yearly quotas should remain in effect).

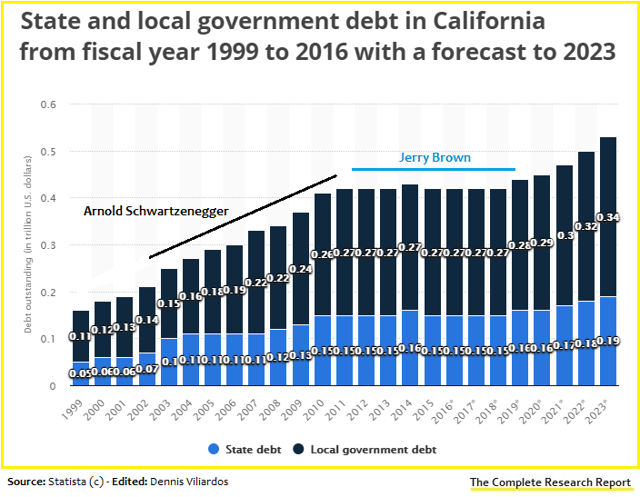

The ZEV program has a 200,000 EV sales limit anyway. But then… here comes General Motors, with its “great idea” to make the ZEV program an international one. Looking for a free meal is it? Either way, the Republicans will find it hard to challenge California and the subsidies it offers. Jerry Brown, the state’s current governor (a democrat), has done a relatively good job containing debt levels (graph below). No reduction has been achieved yet, but at least, he took things out of the hands of Arnold Schwarzenegger. “Cali’s Terminator”.

Being the biggest car market, California has yet to prove that EVs are here to stay. And this, of course, can never happen if companies like Tesla thrive only on subsidies. But I have to admit: They seem to be working so far (have sparked demand).

Coming up next (Part II of this series): Tesla’s “Secondary Business”, which includes Powerpack, Powerwall, Solarcity and Services (plus the leasing segment of the EV business). It covers about 20% of the company’s “net revenue contribution” and will play a very important role when the EV market matures (when projected demand meets supply).

Author’s postscript note

Don’t forget to “Like” the article if you found it informative and enjoyed reading it. Press the “Follow” button on this article or on my Profile Page, if you want to stay informed about my latest research articles and become part of the community.

My Goal is simple: Objectively research businesses, exchange my information with the community and generate profits while assisting the global society (by only investing in businesses that productively assist the global economy, shunning the rest). This is my mission.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link