[ad_1]

In May, I wrote on Seeking Alpha that Tesla (TSLA) could reach a turnover of $ 6.5 billion this quarter and that Model 3 could rank among the top 20 cars sold to the States. -United.

This updated analysis comes at an estimate of $ 6.78 billion, almost the same. With revenue up $ 2 billion this quarter, if Tesla has $ 1 billion of expenses compared to the second quarter, Tesla is expected to post a small net profit for the third quarter of 2018.

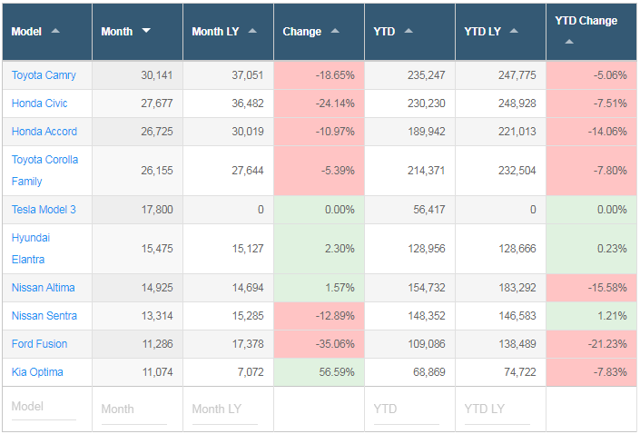

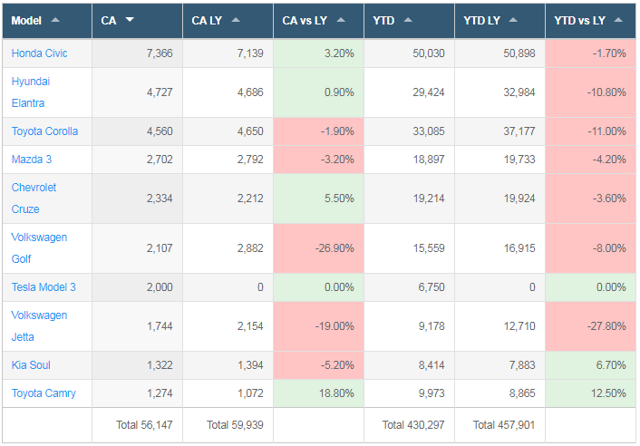

Model 3 has already reached position # 18 for all vehicles sold in the United States in August 2018 (see the bullet with the link below to retrieve this result); # 5 position for passenger vehicles sold in the United States (see table and link below); Item No. 7 for passenger cars sold in Canada (see table and link below); and No. 1 in revenue generated by US car sales (see the discussion section below, where I calculate this result)

(References: for # 18 above, follow this linkand then double-click on the heading "Month" to sort the table by the best-selling cars from August 2018. Count to the position of Model 3 in 18th place on this list.

The table below shows sales of passenger cars in the United States for the month of August with the model 3 ranked fifth among the best-selling passenger cars:

(Source: GoodCarBadCar. To organize the list as shown above, go to the link and then click on the "Month" header 2 times)

The table below shows that sales of passenger cars in Canada for the month of August with model 3 ranked the best-selling car in Canada at the 7th rank of the month:

(Source: GoodCarBadCar right hereTo organize the list as indicated above, go to the link then click on "Ca" at the top left for sales in Canada in August – 2 times)

Tesla Model 3 tested by Consumer Reports:

(Source: Consumer reports)

This article presents the existing data in an innovative way to reveal interesting facts, including the fact that the Model 3 has now been replaced by Toyota (NYSE: TM) Camry as the first revenue-generating passenger car in the United States.

If Tesla can keep its expenses while its revenues increase by $ 2 billion compared to the second quarter, the loss of $ 700 million in the second quarter could result in a modest net income for the third quarter.

The Model 3 business figure now accounts for 2% of the entire automotive industry

According to Automobile Magazine, in 2017, 17.25 million vehicles were sold in the United States.

Trucks and SUVs now account for about 67 percent of the US market, says Jack Hollis, vice president and general manager of the Toyota division.

And yet, the Hollis Toyota Camry still managed to outperform all Mercedes-Benz USA, including vans and smart cars, last year.

As I show below, the Tesla 3 model was sold more expensive than the Toyota Camry to become the most profitable passenger car in the United States in terms of revenue in August, a measure missed by the analysts.

In a June Forbes article, US auto sales forecast for 2018 were 16.8 million units:

Atlanta-based Autotrader owner, Kelley Blue Book, Manheim's used car platform and Dealertrack retail management systems have increased their sales forecast for 2018 to 16.8 million units, compared with 16.7 million previously.

According to Kelley Blue Book, the average price of a car in the United States is approximately:

IRVINE, Calif., April 3, 2018 / PRNewswire / – Analysts at Kelley Blue Book today announced that the estimated average transaction price for light vehicles in the United States was $ 35,285 in March 2018.

For the purpose of this estimate, I will use 17.5 million vehicles (overestimation) for 2018 sales in the US and $ 35,000 as the average selling price.

Multiplying these values yields about $ 612 billion a year, or about $ 51 billion a month.

In August, model 3 gross sales were just over $ 1 billion (see discussion and details below), about 2% of $ 51 billion.

What is important about this result is that, as the less expensive variants of Model 3 become available, sales volume is expected to increase. The current ASP for Model 3 represents roughly double the ASP auto market. This will also pave the way for the upcoming BEV Y model to make further breakthroughs in the ICE-dominated automotive market.

Model 3 is number 1 in sales in the United States and around the world

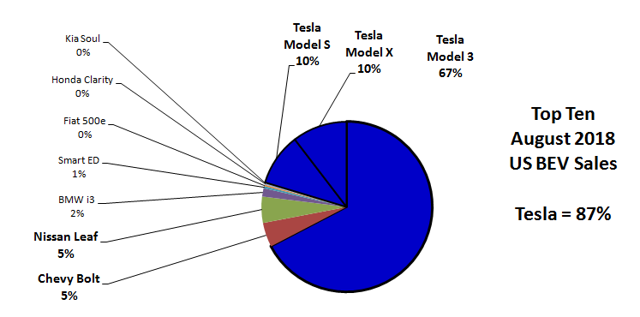

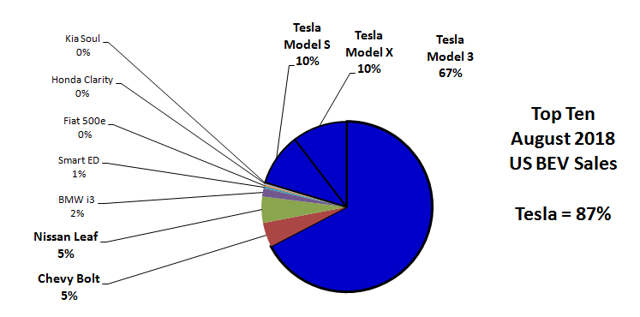

The chart below was created using InsideEVs data for the top 10 electric vehicles sold in the United States in August. Tesla Model 3 has ~ 67% of the electric vehicle market in the United States and Tesla overall ~ 87%. Last month, Tesla's share of the top 10 EVs was 84%, so August was up 3%. As Model 3 sales in September are expected to increase, Tesla's market share is expected to continue to grow.

(Source InsideEVs data, Author Chart, Top 10 BEVs in the US, # Sold Units)

China has many EV companies, but the best-selling model is a BYD model according to CleanTechnica. With around 4,174 units sold by BYD in July, up from 14,250 in July, the Tesla Model 3 is currently the most sold in the world. China has a lot of EV sales if we add up all the companies.

Model 3 is the best-selling passenger car in the United States

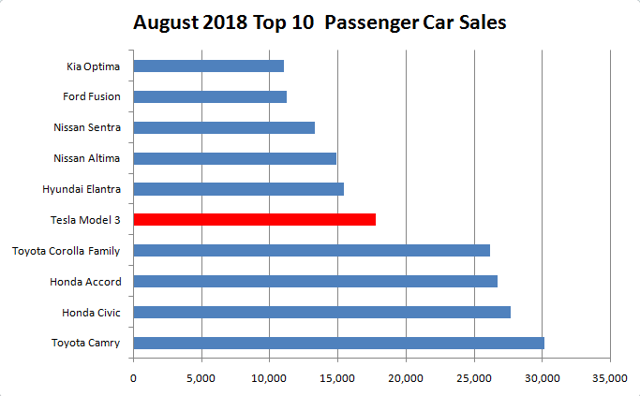

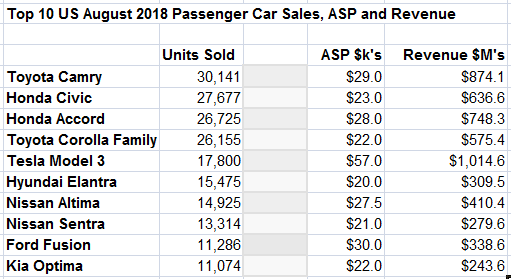

GoodCarBadCar has compiled a list of 121 cars sold in the United States with the number sold for each model. Almost all of these vehicles are the usual ICE vehicles that fill the roads today. Below are the top 10 car models on this list:

(Source GoodCarBadCar data here, Parcel of units sold by the author

Here we notice a few things. First, model 3 (an electric vehicle) landed on the top ten passenger cars sold in the United States in August 2018. This is the only electric vehicle in the top 10. The other nine have engines internal combustion.

The next EVs listed are the Tesla Model S in position 39, then the Nissan (OTCPK: NSANY) in position 57. The sales of the model 3 are therefore clearly superior to those of other electric vehicles.

What model 3 did, is to demonstrate that an electric vehicle can beat the competition of ICE vehicles head-on. But what is even more interesting is that the Tesla models beat ICE cars despite a significantly higher ASP.

What happens if we consider the price with the number of cars sold?

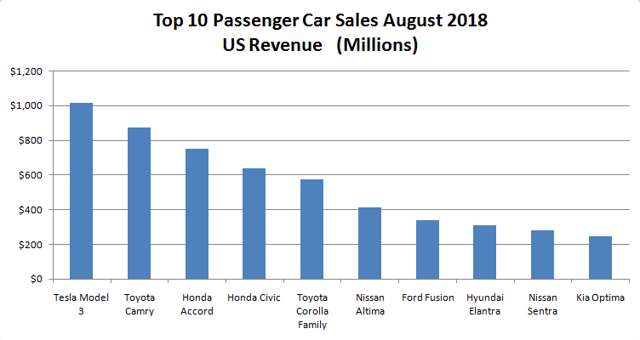

Model 3 gets the # 1 Toyota Camry in August 2018

If instead of plotting the number of cars sold, I trace income figures in dollars, the story is different. Here, the Tesla 3 model takes first place away from Toyota Camry. The graph is below and the way I derive the ASP for vehicles is detailed below.

To estimate the ASP for each vehicle, I had to deduct a value using the MSRP up and down.

First, I found the range of MSRP prices for each model on the Kelley Blue Book website. For example, here is the link to the data of the Toyota Camry. This link shows the MSRP of $ 24,565 to $ 36,020. I took the lowest price at $ 24,000 and the highest price at $ 36,000 to get a difference of $ 12,000. I divided it by 3 to get $ 4k.

Next, I estimated that the average ASP selling price was between $ 24 and $ 36,000 and probably about a third of the base MSRP at most. So, I added a third of the difference between the high and low MSRP at the MSRP base price.

I've usually used $ 24k + $ 4k = $ 28k = $ ASP

For Camry, different websites had different numbers and I added a thousand to the ASP estimate.

Most models have been subject to discounts and manufacturer rebates of several thousand dollars on the actual price. I did not reduce the ASP by these cuts to keep the comparison conservative.

For model 3, I found different items.

CleanTechnica wrote an article entitled: Average selling price (ASP) Tesla Model 3 = $ 59,300, survey results

I've read other numbers, but for these calculations, I wanted to be careful, so I used $ 57,000 as ASP for the model 3. All this work put in a table, here are the results I found:

(Source: GoodCarBadCar Sold units, ASP Author and recipes and chart)

The arrangement of data (above) on a bar chart (below) in descending order shows that the Tesla 3 model is now the revenue generator of No. 1 passenger cars. Sure, SUVs and trucks sell larger quantities at higher prices. But this is quite telling for an electric vehicle as it beats all other ICE vehicles of the passenger cars on the market according to the revenue generated.

(Source: GoodCarBadCar Data with ASP ASP and revenue estimates)

Tesla revenue estimate in the third quarter

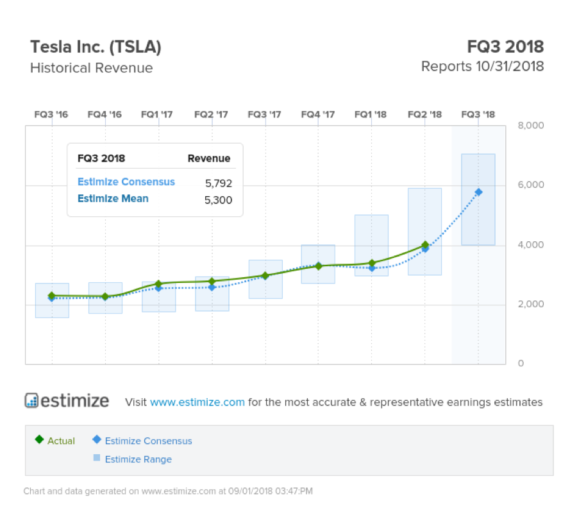

CleanTechnica estimates that third-quarter revenue will be close to $ 6 billion, compared to $ 4 billion in the previous quarter.

(Source: CleanTechnica)

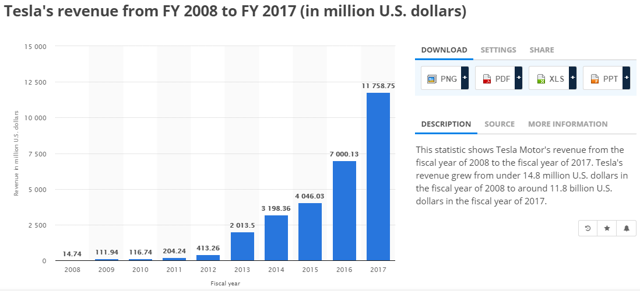

Below is a graph of Tesla's annual business figure. Current revenues (in the future), using quarterly revenues in excess of $ 6 billion, are $ 24 billion, double the 2017 straight bar. The question is whether Tesla will become profitable.

(Source: Statista)

As a proxy for the revenue of the S and X models and energy in 2018, I will use the total business figure of 2017 for Tesla. This should be close to 2018 for these products as sales of these products are estimated to be about stable. Per quarter, last year's sales averaged $ 3.7 billion.

For the third quarter, I estimate the turnover of M3 below:

| Model 3 units sold | NEWT | Turnover (estimates in millions of dollars) | |

| July | 14,250 | $ 57k | 812 |

| August | 17,800 | $ 57k | 1,015 |

| September | 22,000 (estimate) | $ 57k | 1,254 |

| Total | 54.050 | 3,081 |

If I add $ 3.08 billion (new sales estimate for the third quarter of Model 3) to $ 3.7 billion (average quarterly sales in 2017), I get my updated estimate of 6 , $ 78 billion in the third quarter of 2018. That's only $ 250 million more than my estimate in May. That's about $ 800 million more than the estimate above from CleanTechnica by Estimize.

The fact that Tesla generates a net profit depends on the ability of the company to spend. Tesla will have a gross turnover of about $ 2 billion this quarter compared to last year. If he manages to keep spending at around $ 1 billion, he should be able to make a profit this quarter.

Conclusion:

Tesla Model 3 is now:

- 2% of the total income of the automotive industry

- No. 1 in EV sales in the United States

- # 18 selling a vehicle of any type (August 2018, US)

- Passenger car # 5 (August 2018, United States)

- # 7 selling a passenger vehicle in Canada (August 2018)

- # 1 gross revenue car (August 2018, United States)

I expect the stock price to rise when these financial parameters are understood. Most people will learn these numbers as a result of Q3 2018 (early November).

In the last few days, Kimbal Musk said Tesla was significantly increasing deliveries in the last two weeks of September. If so, my estimates may be too low.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Additional disclosure: I am Pro EV and Pro Tesla, but I do not have stocks or links with Tesla or any other company. I am an engineer who says it as I see it.

Editor's Note: This article discusses one or more securities that are not traded on a major US market. Please be aware of the risks associated with these stocks.

[ad_2]

Source link