[ad_1]

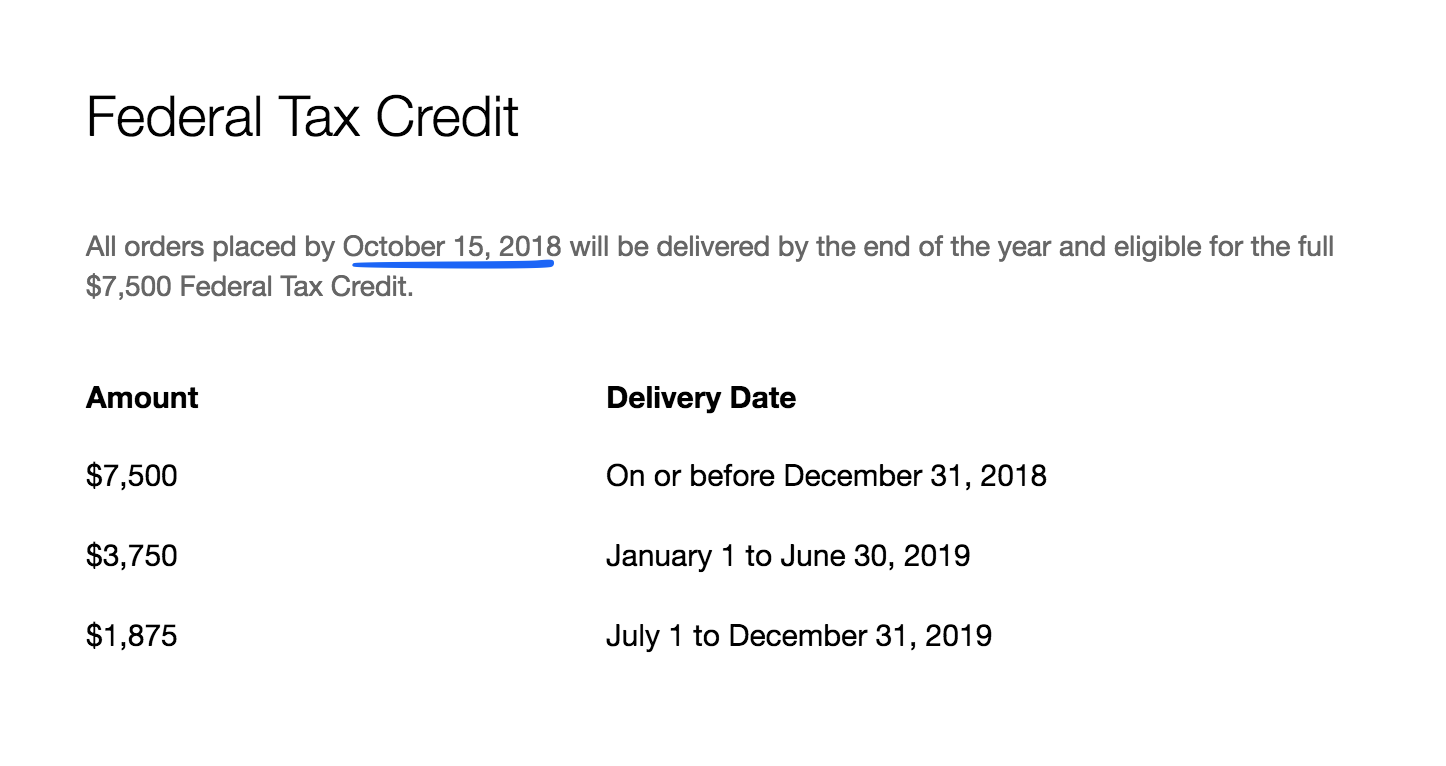

You're here Customers wishing to take advantage of the total federal tax credit of $ 7,500 have until October 15 to order a model S, model X or model 3 electric vehicle, a new deadline posted on the company's website. which could lead to a wave of sales.

The October 15th deadline has been added to the Tesla website on Thursday.

Earlier this year, Tesla took a bitter-sweet step in delivering its 200,000th electric vehicle. This success – a remarkable opportunity for a car manufacturer that did not exist 15 years ago – triggered a countdown to the $ 7,500 federal tax credit available to consumers buying new electric vehicles.

The tax credit begins to disappear once a manufacturer has sold 200,000 eligible vehicles to the United States. Under these rules, Tesla customers must take delivery of their new Model S, Model X or Model 3 by December 31st. Tesla explained how the tax credit phased out and the delivery deadline of December 31, two months ago.

Until Thursday, it was not clear whether or when Tesla would impose a deadline on customers to order their electric vehicle.

Tesla estimates that customers currently ordering an X model and an S model are expected to take delivery of their vehicles in November. Model 3, depending on the variant chosen by the client, could take up to eight weeks, according to the company's website.

The new deadline imposed could boost sales and give Tesla a boost for the 2018 closing. However, these delivery-sensitive sales carry additional responsibility – and the potential to thwart new customers if Tesla does not meet this deadline. .

Source link