[ad_1]

CEO Elon Musk’s vision has pushed Tesla (TSLA) to become one of the biggest and most innovative car companies on the planet. Yet, Musk’s recent tweets have cost Tesla shareholders more than $10 billion. Obviously, one may be wondering, “Is Tesla stock better off without Elon Musk?” This post explores this interesting notion.

Tesla without Elon Musk

Let’s say, in an alternate universe, there’s (“Tesla A”) that has identical financials as the actual Tesla (“Tesla”), except Tesla A does not have Elon Musk as the CEO. If the market prices Tesla A like other competitors, the valuation difference between Tesla A and Tesla must be due to Elon Musk’s contribution, whether that’s positive or negative.

To follow through this line of thinking, I need to first identify how the market prices the financials of a Musk-free automobile company. For such competitors, I selected Toyota (TM), General Motor (GM), and Volkswagen (OTCPK:VWAGY). GM is used in this analysis because it’s Tesla’s largest U.S. competitor, while Toyota and Volkswagen are the largest international competitors. Since stock prices are forward looking, I selected several typical forward financial metrics. These metrics include Street consensus estimates for quarterly revenue, earnings per share, free cash flow, and gross margin over the last five years with daily values. Then, I developed a market pricing structure by correlating stock prices with their corresponding forward financials at the time (multiple regressions). Thus, a significant correlation would imply the process of how the market has priced these firms’ fundamentals. Using this process, I was able to estimate each one of the three stocks’ fair value. At this point, I concede I have used the term “fair value” loosely since it’s merely derived from actual price reactions, which can be overreacting or under reacting to the forward financials. The proper way to derive a stock’s fair value is to estimate it from the underlying financials, rather than from the stock price itself. Maybe the estimates I calculated should be called “short-term target price” instead.

Elon Musk-Free Pricing Process

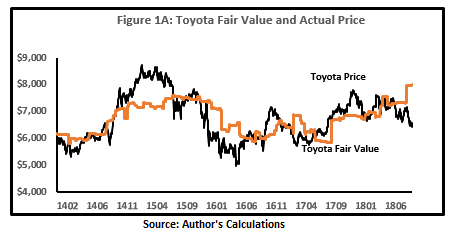

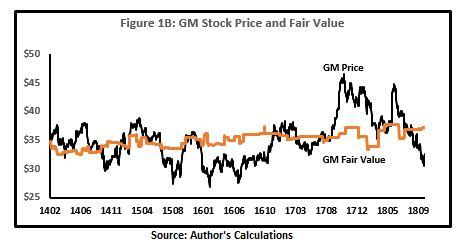

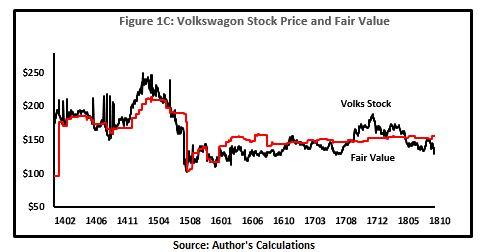

To show how “relevant” this process has been, I compared the model price to the actual stock price over time for each of the three stocks. It appears that the process has done a reasonably good job in predicting how the stock price should move toward (Figures 1A, 1B, and 1C). In all three cases, the actual stock price tends to stay very close to the fair value estimated only from the Street’s estimates of the future financials. Moreover, the stock price tends to cross over with the fair value a lot. This would suggest that there’s valid information of the company’s true value that the stock price will revert to. All these signs suggest the validity and the relevance of the pricing process that I used to estimate the fair fundamental value of the shares.

So, all the preparation comes to this last step. Using the same pricing process for these three competitors, I was able to estimate a Musk-free (Tesla without Musk) Tesla A’s short-term price target only from its forward financials, i.e., Street’s revenue, EPS, gross margin, and free cash flow estimates. Then, I compared Tesla A’s estimated fair value (Tesla without Elon Musk) with Tesla’s actual price (Tesla with Elon Musk). The difference is striking!

Other than the two prices exhibiting a totally different relationship, compared with that of the competitors, Tesla A’s stock would have been valued significantly lower than Tesla’s actual stock. In particular, at the most recent time point, 10/24/2016, the Tesla without Musk’s stock price would have traded around $180, which is significantly lower than the actual Tesla stock price of $315 (Figure 2). It’s more interesting, though, how there has been a consistent and persistent premium between Tesla’s actual stock price and its fair value since 2014. Following the logic of the current experiment, the conclusion seems clear that Elon Musk, the CEO himself, has brought a significant personal value over to the financial value to Tesla shareholders. A Barclays analyst also made a similar estimate that Tesla stock will drop to $130 if Elon Musk left the company.

Caveats

Admittedly, my approach may be oversimplified. For one, the pricing model may be incomplete for not including Tesla’s unique risk factors, comparing with other well established peers. Moreover, the historical Tesla forward financials I used, not truly Musk-free, are invariably affected by Elon Musk’s presence, so the resulting Tesla Musk-free price is not entirely Musk-free. While I fully acknowledge these criticisms, the resulting biases only make the Tesla A’s Musk-free value higher than that it should be (remember I used competitor pricing as a benchmark which does not consider Tesla’s high risk and Musk’s contribution). With a higher estimate of Musk-free value, the conclusion of the existence of a positive Elon Musk Premium factor only becomes more robust and conservative.

Elon Musk Premium and Tesla Shorts’ Predicament

The existence of an “Elon Musk Premium” makes perfect sense to Tesla longs who have been willing to pay almost 60% more in prices just to have Elon Musk as the CEO. However, the same price premium has put Tesla shorts in an interesting predicament. Since Tesla shorts’ investment theses have been mainly on criticizing Elon Musk’s management style, leadership quality, and most often his credibility, they must believe that Elon Musk has decreased the value of the company. Then, the end purpose of the shorts would have to be removing him from Tesla and the removal would have lifted Tesla’s stock value, a future outcome that shorts would not like to see.

On the other hand, if the market acknowledges the fact that Elon Musk’s presence has added positive value to Tesla, removing him would have brought down Tesla stock price – a future outcome shorts would love to see. In other words, Elon Musk has to add value currently to Tesla in order for shorts to make money. Then, how would shorts’ long-standing theses that Elon Musk is bad to Tesla be justified?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link