[ad_1]

When a company asks suppliers to retroactively make money, it's a sign that something went wrong

That's what analysts do. Concerned with Tesla Inc., which asked suppliers to repay part of the payments. In the note to suppliers last week, Tesla asked for a significant sum of money to help it become profitable. The electric car maker has applied to less than 10 suppliers, related to capital expenditures for long-term projects that date back to 2016 and which are not completed, said a spokesman in a statement from . move is worrying because general manager Elon Musk said that the success of the new model 3 sedan is expected to draw perennial loser money in the dark in the second half of this year and show positive cash flow . What can happen is that Tesla has spent so much money to run its 5,000 Model 3 plant in a week – without delivering them all to buyers – as the second quarter numbers go sounding tough and Musk needs a David Whiston, an analyst at Morningstar Inc. in Chicago, said in an interview Monday that Tesla's stock and bonds had gone down. "Usually, automakers play hard with suppliers going forward not step back.The second quarter might seem ugly because they spent a ton of money to reach production goals.

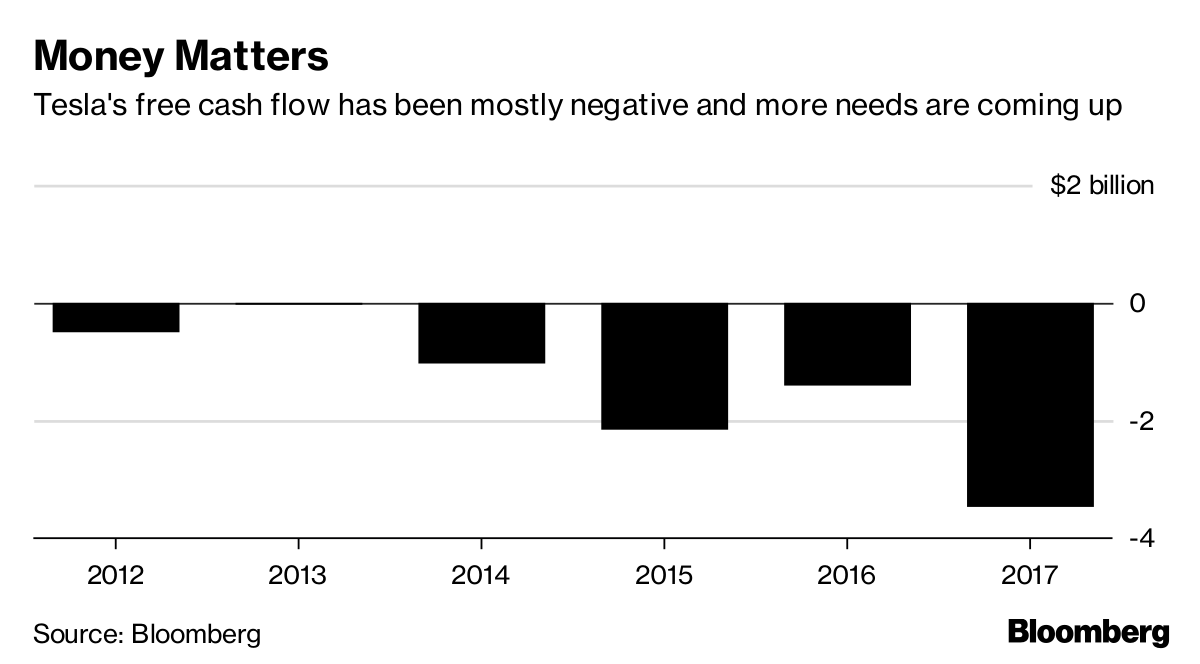

Money Matters

Tesla's free cash flow was essentially negative and more needs to be expected

Changes with suppliers will not affect third-quarter profitability, but they will improve future cash flow, said the spokesman.The rest of the vendor discussions is focused on the price of upcoming parts or other changes that will help reduce costs, he said.

Tesla has been a prodigious cash burner, torch $ 8 billion over the last four years.In the first quarter, as the company was pushing towards the production line of the mod

Race to 5000

As the pressure mounted to ramp up Model 3 production, Musk set up a tent outside the Tesla factory in Fremont, California. The company was having problems with its highly automated assembly line inside and needed to set up the outside line to increase production.

The race to run Model 3 could have added unexpected costs in the second quarter. Even if Tesla manufactures more sedans, the company will not deliver delivery and will not collect revenue for many of them until the third quarter, Whiston said. So, even though Tesla may be able to show a pleasant surprise to his investors in the second half, Musk may want suppliers to help him consolidate his cash and profits now.

In the memo, which was obtained by the Wall Street Journal, Tesla called the move a routine practice of working with suppliers. While it is true that builders will be asking for lower prices in the coming years, both parties are trying to cut manufacturing costs, but it is very unusual to ask for money from manufactured parts two years ago. 19659002] "I have never heard of that," said Harbor. "The providers have been asking for discounts, but coming back late for them backward in despair."

Not everyone agrees. Ben Kallo, an analyst at Robert W. Baird & Co. with the equivalent of a purchase note on Tesla shares, said he thought the renegotiation of suppliers involves boost profits "rather than a necessity for the balance sheet." "

Debt Bond

Musk said that he would not need to get any money this year, but some analysts have doubts. This could be a sign that Musk needs to change, Whiston said. In addition to boosting Model 3 production, Tesla is planning to build new plants in China and Europe and market the Model Y model utility vehicle, a semi-trailer truck, a pickup truck and a roadster.

to suppliers sent shares and Tesla bonds down. Tesla bonds at 5.3% maturing in 2025 fell to 1.75 cents on Monday, the largest decline since May, according to Trace bond price data. They were listed for the last time at 89.375 cents on the dollar from 11:01 in New York. Shares lost 3% to $ 304.19 at 2:31 pm In New York, previous losses were 6.6%.

While this is not a good sign, attacking suppliers is the last thing Tesla does to get money and get model 3 to enthusiastic Tesla shoppers. The company has also taken $ 1,000 deposits for Model 3 in order to fund development and manufacturing, which automakers do not have to do.

"I am not sure that it is worse than receiving money from your clients." Levington

( Updates with Tesla's statement in the second and fifth paragraphs. )

Source link