[ad_1]

Do not accuse Mark Carney of being a currency manipulator (more).

True, the governor of the Bank of England has something to answer. He announced a drop in interest rates in August 2016, just as the vote on the Brexit rocked the pound. This worsened the devaluation, and proved that he was not a friend of the currency. It was complicated.

Now they are talking again. The BoE will almost certainly raise its key rate by 25 basis points to 0.75% during Thursday's political decision. This should give money the support it desperately needs, not just because of the recent political turmoil induced by Brexit. Carney 's return on forecasts for a May hike after soaring first – quarter economic statistics gave traders the idea that the bank' s November increase could turn into a phase of (very) gradual tightening.

But for the pound, a friend is not enough, and it does not seem likely to find another anytime soon. Its range of the last two months, between 1.30 and 1.34 dollar, should last a little longer.

Do not be too excited

The pound is at a level comparable to the dollar, as when the BOE raised its rates for the last time, but the similarities stop there, its current range seems to last

Source: Bloomberg [19659011] Finally, it was finally decided to raise rates above 0.5% – as it did in May – Deputy Governor Ben Broadbent's speech on July 23 was his last chance to send a signal. And he did not send any.

Market expectations for a rate hike this week are now at 90 percent. At this point, if the officials voted for no change, the credibility of the Monetary Policy Committee to investors would be pretty well broken. This can not be completely ruled out, as about 20% of economists surveyed in a Bloomberg News survey predict that rates will remain at the current level.

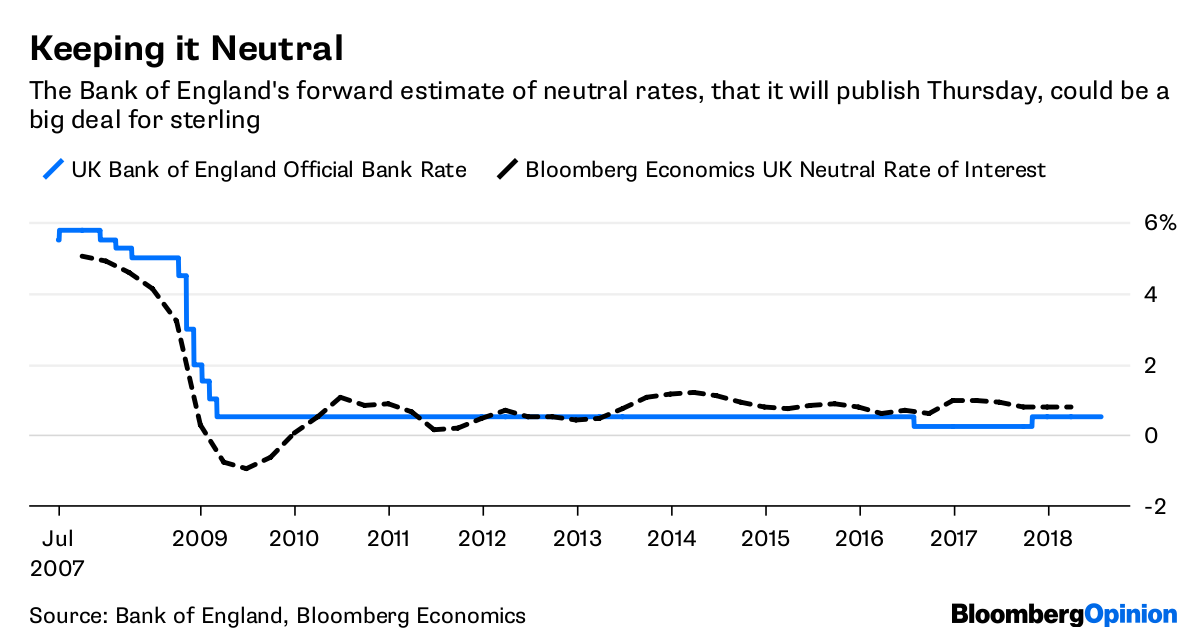

But as soon as a rate hike comes up, traders seek to flee when the next is due. Fortunately, the bank is about to give them help. The BOE will unveil a brilliant new measure that will encompass all elements of its forward guidance in one measure: the neutral interest rate, or in the central banking language, r-star (r *).

R * shows where the MPC estimates that rates should stabilize over its three-year forecast period so that the economy is balanced – neither too hot nor too cold. This level of Goldilocks defines what the "limited but gradual" political orientations of the bank really mean.

The BOE has already started expectations for 1.5%, as this is the level that officials must reach before they can start shopping – otherwise, they would act too early and the economy does not would not be able to cope.

Maintaining Neutrality

The prospective estimate of the Bank of England's neutral rates, which it will publish on Thursday, could be a big problem for the pound sterling

Source : Bank of England, Bloomberg Economics

Analysts give a range of forecasts for r *. Dan Hanson of Bloomberg Economics expects the initial estimate of the neutral rate to be around 1.5 to 1.75%. If the bank's estimate lands in this situation, this would imply that policymakers expect to raise rates three or four times before the summer of 2021. This corresponds to current expectations of market rates, therefore it is unlikely that the pound sterling will be shaken

See the initial estimate of the bank coming over the Hanson range. If it reaches 2% or more, it means that the bank expects rates to rise faster than current forecasts of one or two rate hikes per year. It would be safe to light a fire under sterling.

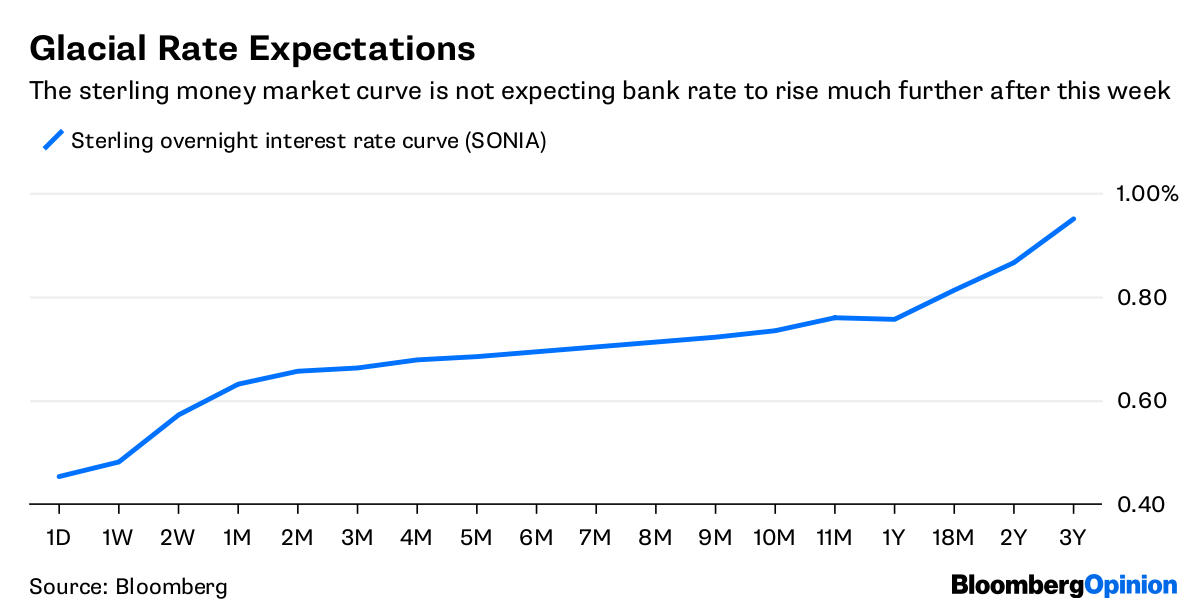

But the fire would not be a strong one. For starters, the BOE has not won the argument on the longer term path for rates. The Sterling Overnight Index Average curve (Sonia) shows that investors do not see a second rate hike within three years.

Freezing Rates Forecast

The Sterling Money Market Curve Does Not Expect the Bank Rate to Increase Much Further After This Week

Source: Bloomberg

Anyway, it is difficult to see day at the end of March. The political uncertainty is acute, besides the recent economic data has been disappointing.

Another problem is the dollar. Although the recent chaos in Prime Minister Theresa May's cabinet certainly sliced the pound, I argued that the recent weakness of the currency was essentially a history of dollars. Leaving aside any other source of confusion from Washington, there is good reason to expect the greenback to continue. The US Federal Reserve has limited investor expectations at a gradual rate of rate hike, including one or two other moves this year, a position that was confirmed Friday with a gross domestic product growth ratio higher than 4%.

With a second rise in UK interest rates on Thursday, the BOE will return on a cycle of rising rates, and the pound sterling will have at least a floor. It's the Brexit and the dollar that will prevent the pound from escaping.

( Updates the rate expectation measure in the sixth paragraph. )

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and of its owners.

To contact the editor-in-chief responsible for this story:

Jennifer Ryan at jryan13 @ bloomberg. net

[ad_2]

Source link

Tags book Carney finally friend mark