[ad_1]

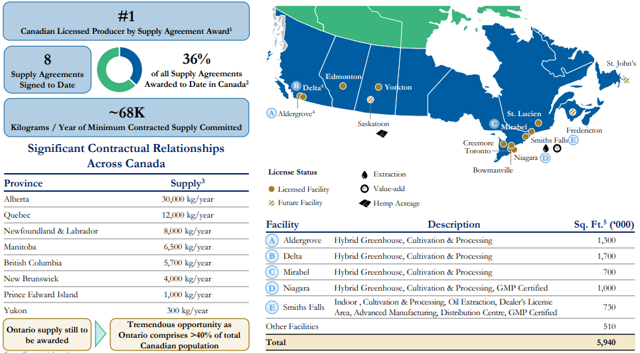

Many investors mistakenly think of Canopy Growth Corporation (CGC) as primarily Canadian marijuana farmers. In fact, if you look at their website, you will see they are indeed are one of the largest producers of cannabis in Canada as well as having distribution rights and sales presence in more Canadian provinces than any other company.

Source: Company Website

Thus, with Canada recently making recreational marijuana legal on and edibles due to come out in 2019, Canopy should get a nice portion of this business. However, Canopy Growth is much, much more than just a Canadian pot farmer.

Canopy, for instance, has one of the most, if not the most, recognized brand in the cannabis industry, Tweed. If you went to their merchandise website yesterday, October 17th when recreational marijuana first became legal, you would find every shirt, hat, bag, and mug with the brand Tweed on it was sold out by 10 am. It’s hard to deny there is enthusiasm for the Tweed brand. However, that is not the only brand they own. Others include: Spectrum, vert, Maitri, Powered by ebbu, Van der Pop, DOJA, Tokyo Smoke, and an exclusive partnership with Leafs by Snoop.

Spectrum, Canopy’s medical arm, currently competes in size and scope with companies whose entire focus is on the medical cannabis space such as GW Pharmaceuticals (GWPH) or CannTrust Holdings (TRST.TO, OTC:CNTTF). Indeed, Canopy likely has more money earmarked for growth in the medical space than both these companies combined.

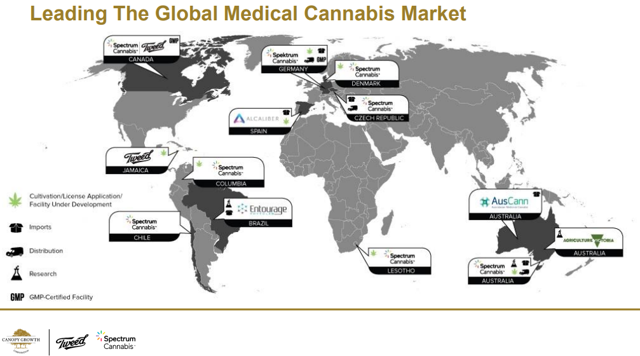

Additionally, Canopy Growth is an international company with more worldwide scope than any other cannabis company.

Source: CGC Website

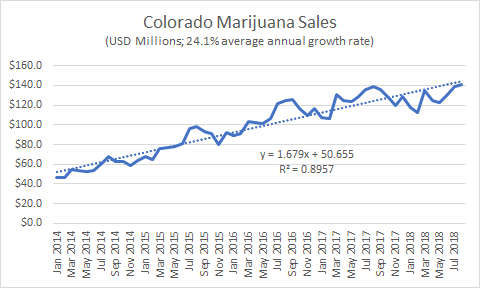

No, Canopy is not presently merely a Canadian pot farmer, and we haven’t even started looking forward yet. For example, we haven’t mentioned Colorado has experienced a 24.1% annual growth rate in legal marijuana sales since it started collecting data:

Source: Colorado Department of Revenue

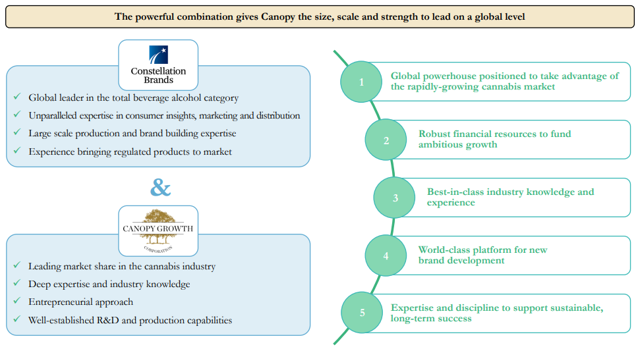

Nor that this may be the best indicator for the kind of growth rates we might see throughout the rest of the world post recreational marijuana legalization. Nor have we even begun to give Canopy credit for their relationship with international consumer brand powerhouse, Constellation Brands (STZ), nor what that is likely to add for their international marketing and distribution prowess. The size and scope of Canopy, coupled with the $4 billion-dollar investment Constellation made in Canopy, absolutely dominates the space. If there is a blue chip of cannabis or a future blue chip of cannabis, Canopy is it.

The Constellation Investment:

Constellation Brands – Corona, Modelo, Robert Mondavi, etc. – made a $190 million initial investment in Canopy Growth which it then added to with a whopping $4 billion follow-on. Realize this add-on was 10 months after the initial investment, by then, Constellation knew exactly what they were getting for the $4 billion and had a pretty darn good idea what the strategy was for putting it to work. Constellation now owns 38% of Canopy, placed 4 members on its board and has the necessary warrants to take that ownership above 50%. In effect, Constellation after getting a very good look under the hood went all in on Canopy.

To say this is a game changer doesn’t do justice to the effect it is having on the industry. To put it simply, Constellation threw down a gauntlet. If other major consumer brands – Coca-Cola (KO), Diageo (DEO), Molson Coors (TAP), Altria (MO), etc. – want to have a meaningful place in this promising high growth sector, its put-up or shut-up time. Competing cannabis companies are going to have to secure their own multi-billion-dollar investments quickly, join others that have, or be left behind as also-rans. Marijuana companies that don’t capture share, rights, and patents soon will become the Geocities and Pets.com of this decade. Meanwhile investors continue to place their bets, guessing who, if anyone, is the next company able to secure the capital necessary to compete with Canopy… (sound of crickets chirping).

You see Constellation didn’t just invest in Canopy to protect its beer market share as is sometimes reported, but rather it is ensuring Canopy has $4 billion to spend consolidating and growing the overall industry. For example, if they put just 1/4th of their cash hoard, $1 billion, into Spectrum that would give Spectrum more cash to spend on medical than 4x what GW Pharma and CannTrust have combined.

Source: Canopy Presentation

Most will think having $4 billion in cash to invest, develop, and grow a lot. However, subconsciously they are probably still underestimating its effect by comparing it to say the market cap of their favorite cannabis market stock or the $21B market cap estimated for the entire industry before this deal. In doing so, they drastically underestimate the effect thereby missing the point.

Canopy doesn’t have $4 billion in market cap, shares that one couldn’t really sell without tanking the stock. They have $4 billion in directly spendable cash PLUS highly valued shares which can be used to trade for ownership in promising startups. Many if not all cannabis companies are chronically short on cash for growth, particularly the private ones. Compare CGC’s $4 billion in cash to what Aurora (OTCQX:ACBFF), Aphria (OTCQB:APHQF), GW Pharma, MedReleaf (OTCPK:MEDFF), and Cronos (CRON) have on hand combined ($860 million) and you get a better idea of the relative impact. Canopy now has more than 4 times the money to spend on development, mergers, and acquisitions as its next five largest competitors combined. If you want to guess what relative market shares and profits are likely to look like for this high-growth industry five years down the road, this is as good an indicator as any.

Capturing a New High Growth Industry:

Operations for most marijuana companies still generate relatively little cash flow compared to more established industries. Additionally, whatever cash flow is produced is needed to further take advantage of the opportunity in the space. Cannabis companies would be crazy not to spend every dollar they make, plus whatever they can reasonably raise, to grow as fast as practical. The opportunity is just too large not to, but at least until the Gardner/Warren act passes (April 2019?) private US-based cannabis companies are continuously starving for growth capital.

The Cannabis industry is essentially a wild west land grab. Think Uber and Didi burning as much cash as possible, locking in critical mass in as many cities as possible before some else does. Because the cannabis plant has been illegal all this time, everything about it is an open field waiting to be staked, homesteaded, and developed. There are few patents, no establish worldwide dominant brands, new product types are still being introduced, delivery methods are not standardized, and logistical supply chains and processes aren’t even close to being efficient. This, however, is changing quickly, marijuana is going mainstream. The $4 billion in cash, plus its own highly valued shares, are huge because it allows Canopy to develop, buy, and dominate this high-growth industry now while others sit in the slow lane.

The biggest question for Canopy investors now is how good is management going to be on making capital allocation decisions? Judging by their first two purchases, Hiku, a licensed Manitoba cannabis retailer and branding company, and ebbu, a cannabis IP factory, I’d say pretty good. Obviously, Constellation thinks so too or they never would have made the $4 billion follow-on which anointed Canopy, “The Cisco of Pot”.

Canopy has the resources to buy other companies, establish logistics and efficiency of scale, and develop and research this burgeoning industry like no other. In the process, it can create synergies, establish brands, and own patents that will make the whole much greater than the sum of the parts. Canopy will lead the way; long-term dominance is now theirs to lose.

The ebbu Purchase Dissected:

Case in point, the announcement earlier this week that Canopy has purchased little-known cannabis R&D shop, ebbu.

Beyond the technological edge this transaction provides, we are pursuing this acquisition because Canopy shares ebbu’s core ethos of building consumer trust. We collectively believe consumer trust is achieved by driving the scientific agenda needed to build predictable, repeatable outcomes and layering on brand power.” – Mark Zekulin, Co-CEO & President, Canopy Growth.

This is the Canopy cannabis powerhouse using some of its highly valued stock and $4 billion dollars of cash on hand, to buy key technology (apparently ebbu investors wanted mainly CGC stock as this purchase appears about 80% stock / 20% cash). This is “The Cisco of Pot” (CGC) at work. If you spend the time to peruse ebbu’s website, you will see it as an excellent buy greatly enhancing Canopy’s ability to build a moat. That ebbu not only helps Canopy lower costs, but also helps it to maintain high margins on its edible products, accelerate development of cannabis medical products, and provides a large and growing stable of patented innovations.

The publicly available articles currently out in the mass media appear to have missed a few things. They indicate ebbu is mainly a hemp company which will help Canopy lower costs via genetics. Ebbu is certainly that but based on items revealed in its website, articles, and blog posts, it is so much more.

For example, ebbu’s indicates it has:

- Patented plant genetics which can maximize cannabinoid output by boosting in-plant cannabinoid production and creating rare-cannabinoid-specific plants. (e.g. Think plants which have 5x the number of trichomes, or 2x the THC, or which produce 99% rare cannabinoid CBG. This would greatly lower cost of purification, processing, and thereby edible and pharmaceutical production.)

- A water-soluble cannabinoid technology that is specially formulated to produce a fast-acting, consistent and precise consumption experience-every time. (e.g. In other words, an ideal process for making a cannabis-infused beer, wine, or soda. Other articles hint at it having the same taste, effect and time to effect as your typical alcohol-based beer only with ¼ the calories and no hangover.)

- They also mention “custom formulations for consistent cannabis products-from medical products treating anxiety, pain, and insomnia to recreational products that inspire specific sensations such as energy and calm.” (e.g. Potentially a better anti-anxiety drug than Valium, a better pain reliever than Oxycontin, and a better sleep aid than Ambien.)

- Two key patents on the very process of breaking the cannabis plant into its purified component parts (THC, CBD, CBG, etc.) then recombining those parts into specific formulations. (e.g. Any brand that distills the cannabis plant into its components then recombines them in a specific formulation to create its product, will likely owe ebbu/Canopy a licensing fee.)

- In fact, they indicate they have “a deep portfolio including over 40 patents filed covering 1,500 inventions”. In other words, what I listed above are only a few of the more promising patents pending. They have many more.

You see ebbu only gave up its license for producing cannabis products in April of this year. My guess is this was probably done in preparation for selling the company. Before that, it did a whole lot of research into cannabis, including THC. It even made what was rated as one of the highest quality THC based product families on the market, Genesis.

Genesis, however, despite selling over $100k per month just in Colorado, was described as merely “a proof of concept, a clean crisp high, not the typical feeling of being stoned, not the body high that many experiences when ingesting (whole) cannabis.” Furthermore, Genesis products weren’t made from the oil of a particular strain of cannabis but rather from breaking down the cannabis plant into its base components – THC, CBD, CBG, various terpenes, etc. – then recombining specifically chosen ones in the right proportion to create the desired “entourage effect”. Just the right combination for the desired effect was derived and tested via double-blind studies. In the case of Genesis, the desired effect was “a clean crisp high”; however, it is important to understand the desired effect could just as easily have been getting a better night’s sleep (e.g. Ambien), dealing with chronic pain (e.g. Oxycontin), or may be chronic pain plus the munchies (e.g. a future cancer treatment). Really any of dozens of other highly marketable desired effects can and probably have been tested via this method. Some of those other 1,500 inventions mentioned, probably refers to other combinations creating other desired effects (sleep, anti-anxiety, pain reduction, etc.).

Along the way, ebbu appears to have also created Genesis Aqua drops.

“Ebbu Genesis Aqua Drops are formulated to contain ten milligrams of THC per serving that is pre-activated and ready to be added into any baked good, drink, or food item.” (italic emphasis is mine, ten milligrams is considered a standard dosage of THC in the cannabis industry.)

In other words, Genesis Aqua Drops were the essential solution to make a good cannabis-infused beer, wine, or soda. A beer that has the same great taste, a similar effect as alcohol, purportedly including the same 10-15 minutes time to effect; yet with much less calories, and no hangover. Can you imagine a Guinness with the exact same taste, effect and time to effect as alcohol-based Guinness, but also with less calories than a Coors Light and no hangover?

Yep, Canopy Growth made a great buy in ebbu. So far since Constellations investment in Canopy, they have purchased:

That’s not a bad start at all. I wonder who will be next?

Hopefully, readers are starting to get the idea behind Canopy’s targets-Licensed locations which benefit from restricted competition, Brands, Patents and other R&D. They are buying things which they can put their resources behind to dominate the industry; classic moat stuff. It why I say Canopy is “The Cisco of Pot”.

Standardization of dosage, effect, and time to effect is key to establishing a brand:

Unless it’s the very first time you consumed a product when you buy any mass market branded item – a Big Mac, a Corona, a Marlboro – you already know what to expect. You know how that Big Mac and Corona are going to taste. You even have a pretty good idea the effect a Corona or a Marlboro are going to have on you. You also expect exactly that same experience no matter whether you buy it, this week or next, in San Francisco or New York. This standardization allows you to know what you are going to get and is absolutely critical for any vendor to build a brand. Without it, if the experience were different each time, the vendor would have nothing to advertise and the brand wouldn’t stand for anything. Imagine getting a Corona one week which gets you a little intoxicated and tastes like a Mexican pale lager, but the next week it’s twice as potent and tastes like a stout. That wouldn’t work, how would you know what you were buying; what a Corona even was?

Unfortunately, that continues to be too close to the current situation with most cannabis products. A Sativa (pale lager), has a very different profile and effect than an Indica (stout), and there are all sorts of hybrids in between. Even once you get down to a particular strain, “’98 Aloha White Widow” (got to love the names), the dispensary you go to might have it one week and not the next. Or even if it has the strain you liked so much last week, it might have been sourced from a different grower this week. Heck even with a same strain, same grower situation, the plant can be very different from one harvest to the next. This problem becomes even more acute when you are looking at edible products (including drinks). The maker of Goodship Chocolate Chip cookies might try to ensure it derives its cannabis oil from the exact same source every time (or not); however, when that source isn’t currently harvesting or is out of oil concentrate what is it going to do? Buy from another supplier that’s what. And even if it says, no, we’ll run out of stock of cookies before switching the cannabis oil source, as I’ve already indicated, cannabis oil from exactly the same strain and source still differs from one harvest to the next. Furthermore, maybe there are some things customers like in that particular strain (e.g. 5 parts THC: 1 part CBD: 1.5 parts CBG: 3 parts Terpene C), but others they can do without (e.g. the parts that also create couchlock, or give you the munchies).

It’s a situation that is impossible to brand especially over large distances. This is likely a big part of why first ebbu breaks down every plant into constituent parts – there are over 400 different cannabinoids and terpene’s – then recombines them into a specific formulation. Standardization, same dosage, same effect, each time, everywhere, every time. That’s what ebbu promises, and it is absolutely necessary to establish a brand.

So too, the time it takes for a product to affect you is key. Waiting 45 minutes for an edible to digest is a problem as it leads to overuse and bad experiences. People eat a cookie, wait 40 minutes and say this isn’t doing anything, have another one or two, end up partaking too much, and having a bad experience. No brand wants to spend tens of millions on advertising and distribution only for the end user to have a bad experience because they took too much. ebbu, Lexaria (OTCQX:LXRP), and Nanosphere (OTC:NSHSF) all purport to have tech solving this issue; to help reduce time to effect in a cannabis-infused drink to about the same as an alcohol-based beer. Which does it best I don’t know; however, it’s pretty clear this is just one thing ebbu offers, with the other two it appears to be the only thing. Regardless, if 10-15 minutes to effect is acceptable for an alcohol-based beer, it’s probably also acceptable for a cannabis-based beer; especially if the dosage and effect in the cannabis-based beer are designed to closely mimic the alcohol-based version. Only ebbu appears to also be able to deliver that.

Valuation:

One objection you hear frequently is that Canopy stock is over-priced. As the holder of a large position in Canopy you might be surprised to hear me say, your right, it is! By any normal measure, Price to Earnings, Price to Sales, Price to Cash Flow, etc. Canopy and every other publicly traded stock in the marijuana sector is over-priced. Not only are these companies over-priced, but they will also continue to be. You see the Motley Fool coined a term called “Rule Breakers” which applies well to Canopy. A “Rule Breaker” is a stock which defies normal fundamental valuation rules because it is both brand new, and in a very high growth sector, with almost no ability to predict how much growth there will be. A 100 P/Sales stock is outrageously overpriced, that is unless it experiences 100%+ annual growth per year for the next 5 years. Then it might very well be a bargain.

Back in the 90’s Cisco and Amazon were way overpriced by all fundamental measures. They were some of the first stocks the Motley Fool termed, Rule-Breakers, and commonly traded at 50-100x earnings (Amazon still does more than 20 years later). However, it is exactly the high-priced currency represented by the stock which allowed them to buy and build value beneath them. To dominate their high growth sector.

That is also what Canopy is (with Constellations help), a Rule Breaker. There are now 4 billion reasons why Canopy is going to continue dominating this very high growth new industry going forward (7.3 billion including warrants). No one comparing past performance to current price will ever be able to justify the purchase of a company in a strong secular uptrend such as this. Some might even say cannabis legalization is a paradigm shift in both the consumer brands and medical drug sector. Sorry, but trying to guess future sales and profits in such a situation is pretty much an exercise in futility. It’s a brand-new field, and the variables are so unknown, that a guess 3-5 years out is much more likely to be off by orders of magnitude than to be anything near correct.

In such a situation, all I can advise the conservative investor to do is either stay away completely or designate a portion of your portfolio as speculative and only invest with it. You are never going to be able to justify investing in the next great growth company by looking in the rear-view mirror, its simply wasted effort. If you want to spend your time researching what a good investment would be in this sector, do it by looking forward. Figure out which company is most likely to be a long-term winner, buy it, and let time and management do its job.

(Hint: I think a really good choice rhyme’s with panoply).

Looking Forward, How Big Will Cannabis Consumable Products Be?

At this point Constellation (STZ) has made a multi-billion-dollar investment in the cannabis space, Coors (TAP) has done a significant JV, and Diageo (DEO), Coca-Cola (KO), and Atria (MO) are heavily rumored to be actively seeking an investment partner. It is possible cannabis consumables will not be a big deal; however, the management of all these major companies appear to think differently. So, for those individuals still under-estimating the potential, I’ll just say you may want to consider there’s a number of mega-cap consumer brands that have or are looking to place significant bets that you are incorrect. These companies think cannabis is going mainstream and now is the time to take a position less they (and you) miss out. I agree.

Let’s take a look at the potential for the cannabis beer market, remembering that this is just one promising type of cannabis-derived product.

How Big Might Cannabis-Derived Beer Be?

I can go find out the size of the worldwide beer market ($593 billion in 2017). I can find that light beer makes up 44.5% of the US beer market but only 34.4% of the worldwide market and apply that latter number to get $204 billion in worldwide light beer sales. I can even write a nice reasoned article talking about this and basing my estimate of cannabis sales off the light beer segments sales. However, what I can’t actually say is whether cannabis-based beer is going to be as big as light beer or not. Nobody knows that any answer I or anyone else comes up with will just be a flat-out guess.

Those who think negatively about pot and/or pot stocks are likely to tell you there’s no way cannabis-based beer will ever be a big seller. They’ll give your reasons: pot is still illegal in most of the world, too many people have opposed it, even if approved, pot-based beer is too expensive, it doesn’t have the distribution, etc. Proponents of pot stocks will tell you those are all obstacles that are being overcome, point to light beer market share, and tell you cannabis is going to be just as big. But have you ever considered there’s a non-negligible possibility marijuana base beer could eventually be even bigger than light beer? I bet Constellation has. After all, it’s looking like cannabis may fundamentally make a better beer.

To understand why let’s assume your favorite beer is a Guinness (sorry Canopy, I prefer porters and stouts to Mexican pale lagers). What if I could offer you the exact same Guinness in every way, same taste, consistency, effect, and time to effect as a current Guinness, EXCEPT this Guinness has less calories than a Coors Light, and no hangover? Would you be interested in that? If you could get it at your local store would you pay say 40¢ more a bottle for it?

I know I would; in a second, I would. 40¢ extra for same great taste and effect but no worries or guilt over calories is a no-brainer for me. Heck, I’d probably even take advantage of the opportunity to treat myself to two. That’s looking to be what a Guinness “powered by ebbu”, a Guinness Genesis, maybe.

(Side note: ebbu is now owned by Canopy. So, Diageo, the maker of Guinness, may one day be paying Canopy a licensing fee on every “powered by ebbu” beer sold.)

Potential Economics of Cannabis-based Beer:

Currently, marijuana is not produced anywhere near what it needs to be in order to optimize economies of scale. Regulations are currently prohibitive for obtaining real scale (e.g. no transport across state lines, indoor only grow states, etc.), which in turn causes cannabis-infused beverages to be very expensive.

To get an idea of what I mean by optimized economies of scale let’s look at some basic statistics for the current beer industry in the US. For example, did you know there are currently over 58 thousand acres of hops planted in the US? Or that 75% of hops production comes from just one conducive region for growing hops in Washington state called the Yakima Valley? Did you know that the Coors brewery in Golden, Colorado alone has the capacity to produce 7 billion bottles of beer per year? That’s BILLION with a capital B, 7 of them, from one brewery, in one year. Beer is big business, and that’s a lot of hops being shipped from the Yakima Valley in Washington to Golden, Colorado. Unfortunately, you can’t do the same with marijuana even though cannabis is legal in both states. Unfortunately, it’s still illegal to transport cannabis across state lines, at least for now.

Comparing beer efficiency further to cannabis, in general, if you added up all the resources devoted to producing cannabis-infused beverages in the US currently, it’s not currently going to be even 1/100th the scale of beer. Probably not even 1/1,000th. Cannabis is nowhere near full economies of scale, and therefore it remains expensive for now. But when I refer to future economies of scale, economies of scale like beer is what I mean. Thousands of acres of outdoor marijuana row crops planted in an optimal location for them, and entire large plants with hundreds of employees, plus tens of millions of dollars spent on specialized equipment, devoted to producing cannabis-based beer. We are a long, long way from economies scale, but that’s where I’m looking. I want to imagine what a cannabis-based beer with full economies of scale might look like a decade or two down the road.

Currently, a bottle of Dixie Elixir in a Denver dispensary goes for about $18. Just one bottle. However, to be fair Dixie, while probably the largest producer of cannabis-infused beverages in the US, is nowhere near scale and one bottle of Dixie Root Beer is not meant to be one serving. A bottle of Dixie Root Beer currently contains 100mg of THC. That’s a lot of THC, way more than one serving for someone just looking to relax.

A normal dose of THC is considered 10mg. That’s why the cap on a Dixie bottle substitutes as a 15ml serving size (about 6mg THC). In theory, you are supposed to take one cap full and wait 45 minutes. Pretty ridiculous if you ask me. Dixie is just asking for abuse, and admittedly that’s part of the problem, but I don’t want to digress just yet.

For our purposes, let’s assume the cannabis-infused beer of the future contains just 10 mg THC per bottle. That’s considered a standard dose, with newbies recommended to sip it slowly or try half that the first time. Let’s further make what seems a reasonable assumption, that mass production and distribution leads to the rest of the beer-the bottle, hops, production, etc. – costing about the same as it does to produce a normal beer currently. How much might that 10 mg of THC add in extra cost?

Well if you go on the internet you will find firms claiming they can get down to 50¢ per gram production costs for greenhouse pot today, or possibly 25¢ per gram for twenty-acre+ outdoor grown, row crop cannabis. That means eventually, assuming mass outdoor growing and full efficiency of scale in processing, production, bottling, and distribution, the 10mg of THC itself might cost as little a 2.5-5¢ per bottle to grow. Taking the higher 5¢ figure, doubling it for processing, then again for distribution, and yet again to get to retail price. From this, you would then subtract whatever you save by not having the alcohol or recovering it for other uses (let’s assume that is 0¢). In this case, you end up with a THC infused beer retailing for about 40¢ more than a standard alcohol-based beer would. An extra 40¢ for a beer with the exact same profile-taste, consistency, effect, time to effect, etc.-except ¼ the calories and no hangover.

Granted it will take many years to get there, but that is where I think we are going. Put simply, cannabis-based beer may eventually be a BETTER beer than alcohol-based beer. It may have the same taste and effect but without some of the other unwanted side effect. If you could get a Guinness Genesis (my name for a cannabis-based beer) instead of an alcohol-based beer with the same taste and effect for 40¢ more, but also ¼ the calories and no hangover, would you? A beer that tastes like a Guinness but has less calories than a Michelob Ultra, oh yeah, I’d do that. There’s a non-negligible possibility that Cannabis-based beer may eventually replace alcohol-based beer. Not just a better light beer, a better beer PERIOD.

What About Other Cannabis-Derived Products?

Understand above I was just guessing. An educated guess based on a few things I think I understand and some vision may be, but still just a guess. Also understand however that I was talking about there being hundreds of billions in potential revenue for just one product, cannabis-based beer.

- Ebbu also openly talks about their plant genetics patents pending. That by itself could potentially make a division of Canopy, “The Monsanto of Pot”.

- Soda containing health enhancing CBD oil is purported to be something Coke is interested in; ebbu patents help foster that. If what they actually end up wanting is a bit more sophisticated than simply distilling CBD oil forma particular strain ebbu patents could be critical on more than one front.

- A better sleep aid than Ambien and a better chronic pain treatment than Oxycontin are just a couple drug products ebbu has hinted at filing patents on (only a few of the 40+ patents and 1,500 inventions have been even partially revealed to date, those I bullet pointed above).

Cannabis-based products are still mostly all potential, but one needs to understand the potential here is truly huge. We literally are only at the tip of the iceberg of what may occur. The cannabis plant is a wonder trove of discoveries, and Canopy “powered by ebbu” is my bet for who is going to get a big chunk of that.

Disclosure: I am/we are long CGC.

Business relationship disclosure: I wrote this article. I have an NDA with ebbu and therefore have limited myself to what has already been published on Canopy or ebbu’s website, blog, and articles from those websites. I am receiving no compensation from Canopy or ebbu for writing this article.

Additional disclosure: Darren McCammon was an initial seed round investor in ebbu and is therefore biased. He also has an NDA with ebbu that prevents him from discussing anything not already disclosed publicly (I limited myself to what was already in Canopy or ebbu’s website, blogs, and articles). This article discusses speculative investments that are not federally legal in the United States, at least not yet. I do not know your goals, risk tolerance, or particular situation; therefore, I cannot recommend any specific investment to you. Please do your own additional due diligence.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link