[ad_1]

It seems like an old story, but it was not until 2001, when GE (NYSE: GE) was the most valuable company in the world, with a market capitalization of over $ 500 billion. The conglomerate par excellence, present in almost all parts of the global economy, seemed to have been built to withstand economic shocks and was the choice of conservative investors, scared by the short life cycles and unstable fortunes of its competitors technology. Unlike other aging companies such as Sears, which have been progressively degraded in recent decades, GE's sharp drop has been precipitated, with the rate of decline accelerating over the past two years. With the arrival of a new CEO, who hopes to be a savior, now is the time to look back and look to the future of one of the most iconic companies in the world.

GE: A compressed story

GE's roots go back to Thomas Edison and his invention of the light bulb. The company Edison founded in 1878, Edison General Electric, was merged with two other electrical companies to create General Electric in 1892. The company created its first industrial laboratory in 1900 and it is not an exaggeration to say that it has revolutionized the American home, with its appliances, but changed the way Americans live. However, for much of the twentieth century, GE remained an appliance company, although it made incursions into other companies. It was in 1980, when Jack Welch became the CEO of the company, that it began its journey towards what it has become today.

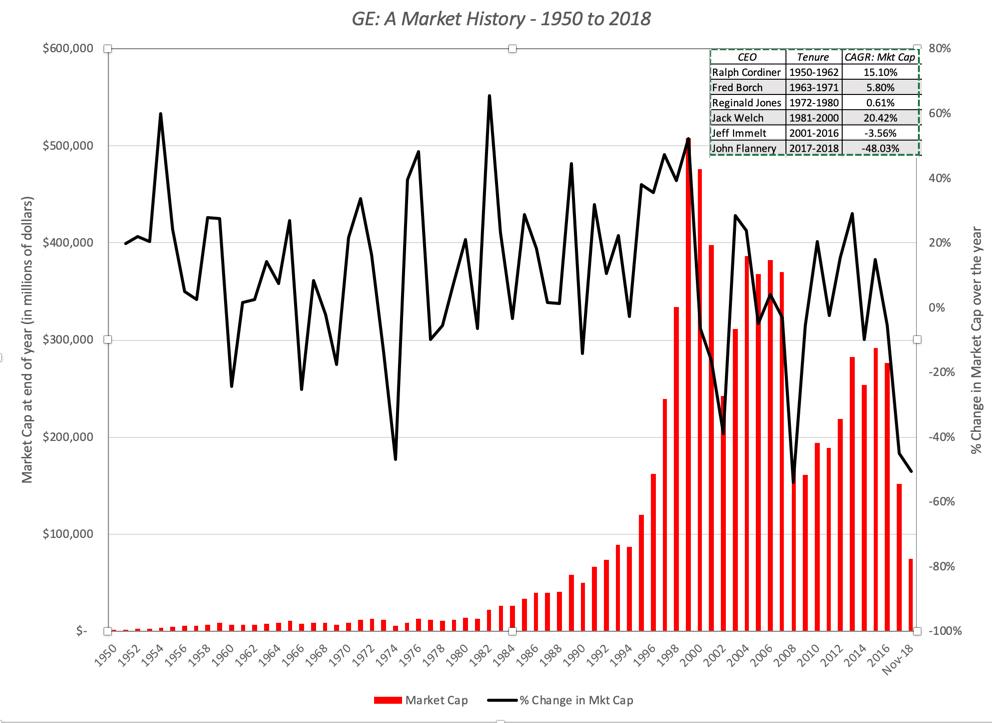

The history of the market

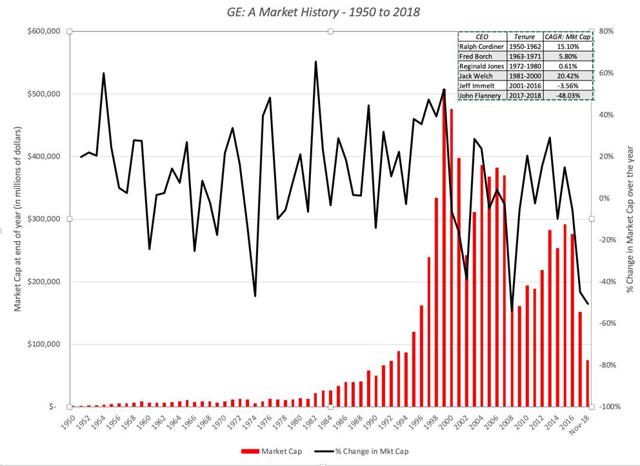

The first starting point, when you look at GE, is to see how the markets have perceived it, throughout one's life. By skipping the first half of GE's life, the graph below looks at the growth (and recent decline) in GE's market capitalization over time:

As you can see, GE was a solid but not spectacular investment from 1950 to 1980. Its value exploded in the 1980s and 1990s with Jack Welch at the helm. It reached its status as the most valuable company in the world in 2001. Under the direction of Jeff Immelt, his successor, the title continued to be well, but it fell with the rest of the market with the bursting of the bubble Internet, before recovering, giving way to the crisis of 2008. This crisis has been devastating for society and, although it has recovered somewhat in the years that followed, the fundamentally clearly collapsed in the last two years, with Jeff Immelt at the helm of the company.

The history of exploitation

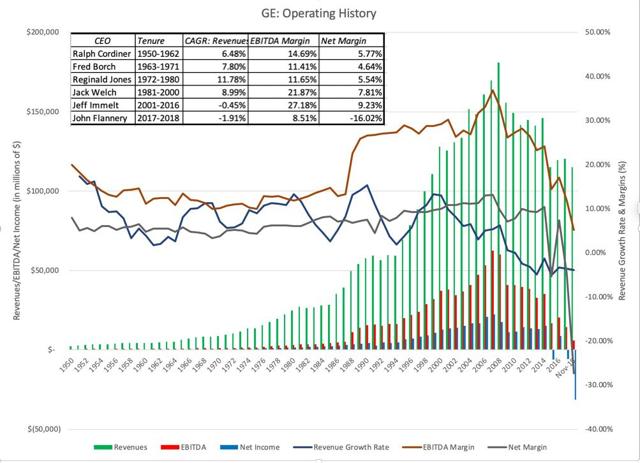

To have an operational perspective of the evolution of the company over time, we examined the evolution of GE's key operating parameters (revenues, EBITDA, net income) since 1950:

Consistent with our previous assessment of market capitalization, between 1950 and 1970, GE was a good but not exceptional company, generating solid revenue growth and decent margins. Under the leadership of Reginald Jones in the 1970s and Jack Welch in the next two decades, society is transforming itself. Jones helped the company weather the turbulent period of high inflation and oil prices, maintaining stable margins and double-digit revenue growth. Welch has made legendary by doubling his margins and pushing the company to the top of the market capitalization by the time he left the company. His successor, Jeff Immelt, faced the unenviable task of following Welch, but managed to keep his earnings up and cleared high margins until 2008, when the bottom collapsed. for the society.

The mix of companies

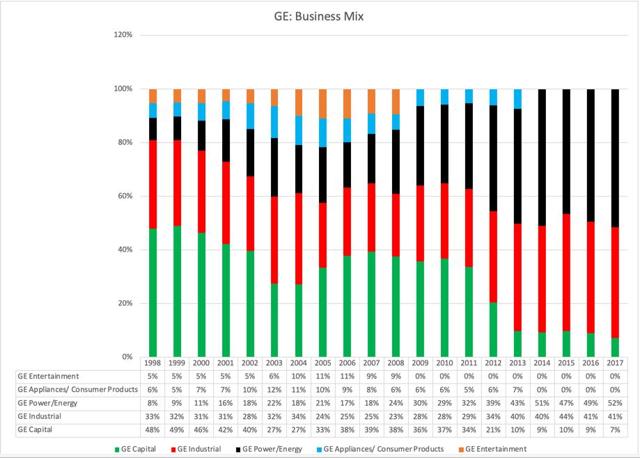

To understand GE's critical situation, we need to return to Welch's mandate as CEO, when he has reshaped society, turning it away from its national and industrial roots and giving it a global, multi-business vision. . GE's biggest leap forward during this period was in the financial services sector. One of the reasons for Welch's interest in this sector is its ability to generate high profits with a relatively low investment. At the end of the 1990s, GE Capital was the engine of GE's growth, accounting for nearly 48% of revenues in 1998. As you can see from the graph below, it continued to do so for much of of Immelt's first decade of management:

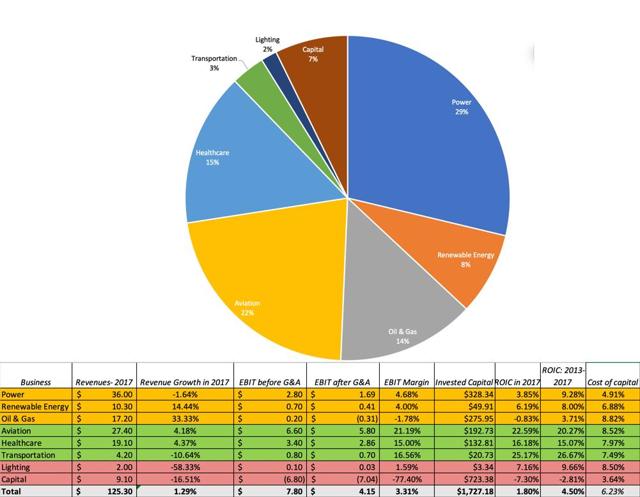

GE was exposed significantly in 2008, when the crisis hit financial services companies. Since then, GE has fallen not only from the financial services sector, but also from its entertainment bets (with the sale of NBC to Comcast) and the home appliance sector (now owned by Haier). The current composition of GE's activities, broken down in more detail, is illustrated in the pie chart below:

|

GE annual report for 2017 (capital invested, allocated by assets by activity) |

Today, GE has three low-growth, high-profit activities (aerospace, health and transportation) (margins and return on capital) in three energy-related businesses (energy, renewable energy and oil). high growth but low profitability (margins and returns of capital), one activity (lighting) that erases quickly and another (capital) in decline, but resulting in a loss of value. Also note that reported collective earnings for all businesses are before business expenses and eliminations of $ 3.83 billion (not including a one-time restructuring charge of $ 4.1 billion) that actually wipes out approximately half of the operating profits. When calculating the return on capital, I allocated these expenses to businesses, based on revenue, applying an effective tax rate of 25%. Although GE as a whole has not generated a return in line with its cost of capital needs in 2017, health care and transportation are eliminating their rate of return to nil. Replacing the 2017 revenues by each company with a standardized value (calculated using the average margins of each company between 2013 and 2017) improves the return on investment of the energy and renewable energy activities. but the general conclusion remains the same. GE, as a company, does not look attractive, but its activities create value.

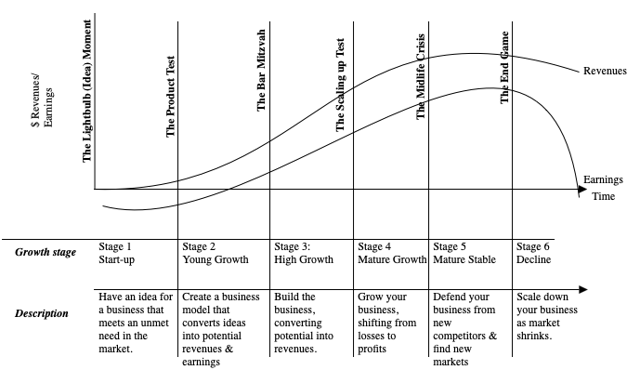

Life cycle of the company

Although there are different ways to define the current status of GE, I will use the business life cycle because it sums up the challenges that the company faces.

GE's light bulb could have been in Thomas Edison's lab in 1878, but at the official age of 126, GE is an old society and its problems reflect its age. In addition to renewable energies, all of GE's operations are mature or declining and, according to the laws of mathematics, GE itself is a mature, declining society. Any story you tell about the future of GE must reflect that reality, and there are three that can lead to different values.

1. Divide it: If GE, at its peak, represented the glory of conglomerates, its current situation is a sign of the loss of conglomerates in the world. Around the world, multi-enterprise companies are under pressure to separate and often their shareholders will be better off. To win a break, however, here are some of the things that must be true.

- Separable companies: The different companies must be separable, because leaks and synergies between companies can make it more difficult to split parts for sale or spin-offs. In this respect, GE is probably on the right track, as its activities (other than GE Capital) are, for the most part, self-sustaining, with little effect in terms of business relationships.

- Consenting buyers: There must be potential buyers willing to pay higher prices than they generate for the holding, which makes them more profitable, and these higher prices must come from potential synergies or a change of direction. None of GE's business appears attractive enough to attract multiple bidders, willing to pay higher prices, and given GE's precarious position in the negotiations, it is more likely that it would be unlikely rush to unload its activities will do more harm than good.

- Corporate waste (at headquarters): A large part of the company's overhead should be considered a waste, a sharp decline in business expenses accompanying the dissolution. How much of the $ 3.8 billion in business expenses reported by GE in 2017 is a waste of time and could be eliminated with targeted cost reductions? Looking at the distribution of these expenditures, about $ 2.2 billion to cover pension obligations and dismantling the company will not remove it from its contractual obligations. Part of the remaining $ 1.6 billion may be fat that can be reduced, but even reducing the entire amount (which would be a big challenge) will not return the company.

Since GE will try to sell these businesses to buyers today, it is a valuation exercise and not a valuation exercise. I estimate a price for GE's activities below, based on an EBITDA recalculated using the average operating margin of each activity over the last five years. years to calculate the operating profit and allocate the company's expenses to the divisions, depending on the products. To convert EBITDA to estimated value, I used the EV / EBITDA multiples of the peer group:

If GE succeeds in getting buyers to pay EBITDA multiples for each of these activities, it will be able to generate net income of approximately $ 103 billion for its equity investors, which is greater than the capitalization stock market of US $ 72 billion on 14 November. The problem, however, is that whole-company fire sales almost never yield the expected product, as buyers, aware of despair, are holding back their efforts. In fact, GE's attempts to withdraw from part of its investment in Baker-Hughes over the past few days show that these sales will be realized at a lower price.

2. Reprocessing and Restructuring: GE's second choice is to be entrenched and perhaps renew itself, not as a growing company, but as a high-margin, stable company in those sectors where it has the greatest potential for growth. a competitive advantage. Overall, GE's roadmap to succeed on this path is simple: shrink or sell parts of its low-margin businesses, exit the capital business and consolidate its presence in the aviation, healthcare sectors. health and transportation. To get a better idea of the value of the activities, by evaluating the ongoing activities, I evaluated each of GE's activities with the help of simplistic assumptions: I used the cost in sector capital for each company, and set the growth for the next five years in revenue growth in each GE business over the last five years and normalized operating income based on the average operating margin generated by each business. of GE in the last five years:

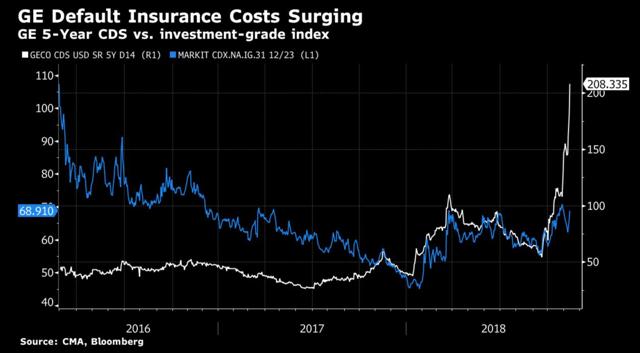

The value I get for equity is less than the $ 103 billion I estimated in the last section, but it does not require any short-term sales with discounts. GE will face two major challenges along the way. The first is that GE is struggling with a large debt, a legacy of GE Capital, that will not go away quickly, and claims represent a clear and present danger to the company. One of the reasons for the rapid drop in GE's share price over the past few weeks is the deterioration in the credit quality of the company, as evidenced by the increase in rate spreads of default for the company in the CDS market.

The reason why GE is trying to sell some of its stake in Baker Hughes (NYSE: BHGE) to reduce its debt, but the bond markets are skeptical, and for good reason. The second is that GE Capital is now more of a burden than a benefit for investors. In the valuation chart, note that the value I have estimated for GE Capital's business ($ 27 billion) is well below GE Capital's debt ($ 51 billion); in fact, I get very similar results in pricing. In other words, in my assessment, I expect that the cost of withdrawing GE's capital will be $ 24 billion today, but staggered over time. If GE manages to repay its debts to become a more focused company, with binding ambitions, it could survive and recover its place as a holding company for a conservative value investor.

3. Reincarnate (or the Bataan Death March): GE shareholders have a third option to hope and pray that GE does not take, as the company tries to regain its former glory, throwing caution and reinvesting money. large new businesses or, even worse, large acquisitions. Although nothing indicates that Larry Culp, the new CEO of GE, has grand plans for the company, it may be because the company is in crisis today. If the crisis passes, Culp is tempted to make the second coming of Jack Welch. The company will follow the path of other aging societies that refuse to act as they age and spend billions on cosmetic surgery (acquisitions) before finally surrendering. If there is a model that Mr. Culp should follow, it is less that of Steve the visionary and even more so that of Larry the liquidator.

General Lessons

Given its age, it is not surprising that GE has been the subject of more case studies than any other company in the world. In its infancy, it was used as an example of professional management and, during the years of Jack Welch, it was seen as an illustration of how aging manufacturing companies can rebuild, with enlightened management at the top. Now that he has problems, I think we look back over the last four decades and draw a different set of lessons:

- The conglomeration was, is and will always be a bad idea: I have never understood the attraction of conglomerates, even at their peak. Only a business strategist can say that grouping companies from different companies under one umbrella, paying high premiums throughout the acquisition process, creates value, ignoring the logic that you and I, as shareholders, can create our own diversified portfolios paying the same premium. If there is one lesson to be learned from the fall of GE, it is that even the best conglomerates are built on sand foundations. Note, however, that if this lesson can be learned for the moment, it will soon be forgotten, as most other business lessons are, and we will surely repeat the cycle in the future.

- The complexity comes at a cost: by looking through GE's annual report, I've been reminded again why I always described my vision of hell as having to value GE over and over again, for all eternity . Through its actions and design, this company has become one of the most complex companies in history, operating in dozens of companies around the world, and GE Capital acting as the icing on the cake of the complexity, a gigantic financial services firm in a large conglomerate. While this complexity has served GE well in its hour of glory, allowing it to hide errors from botched acquisition practices and poor results, it has ruined the company since 2008. Investors who are trying to find their way into The company's finances often give up and move on. prey easier. It may be too late for GE to do anything about this, but as Asian companies grow in market capitalization, new complex monsters are emerging around the world.

- Easy money has a disadvantage: I know that a 20/20 decline is both easy and unfair, but GE's experiences with GE Capital reveal a time-honored commercial truth: when a company seems to be able to to bring back easy money, there is always capture. Jack Welch's initial foray into GE Capital, and subsequent expansion, is based on the attraction that it was much easier to make money in financial services than in the manufacturing sector. It was true, but financial services companies have always gone through periods of plenty interspersed with episodes of heartbreaking and intense suffering, when borrowers begin to default and freeze the financial markets. By making GE Capital such a big part of GE, Welch bet the farm on its continued success, and this bet went wrong in 2008.

- The Savior's CEO is a myth: I do not intend to bury or congratulate Jack Welch, but despite being gone for almost two decades, GE remains the home Jack built. Since Welch had the glory of GE's rise in the last twenty years of the last century, he deserves some responsibility for what has happened since. Do not mistake yourself! Jack Welch was an inspiring senior executive, a man with vision and drive, but he was also an Imperial CEO, who had made his board an unparalleled stamp for his actions. When we look at a new generation of successful companies, this time in the technological space (the FANG actions and the Chinese giants), with at the top of the visionary founders, it should be remembered that the power is not controlled by anyone ( as smart as it is). and visionary) is dangerous.

The final result

As many of you know, I think every evaluation must have a story. With some companies, such as Amazon (NASDAQ: AMZN) and Google (NASDAQ: GOOG) (NASDAQ: GOOGL), the story is uplifting and optimistic, and the ratings follow, but they may not be no good investments because their prices can be even higher. My story for GE is not optimistic, but if she (and her management) acts as if she were getting older, if she admitted that slower or no growth was what was in the future and was not going well not too far, it was a good investment. I believe the market has been overcorrected for GE's numerous faults and that it is significantly undervalued at the current price of doing business. I will buy GE, but I will do it with my eyes open, without hope (or wish) that dividends be paid before the debt is repaid and that the company leaves the capital with so much grace (and d & # 39; as little cost) as necessary. can gather.

Youtube video

[ad_2]

Source link