[ad_1]

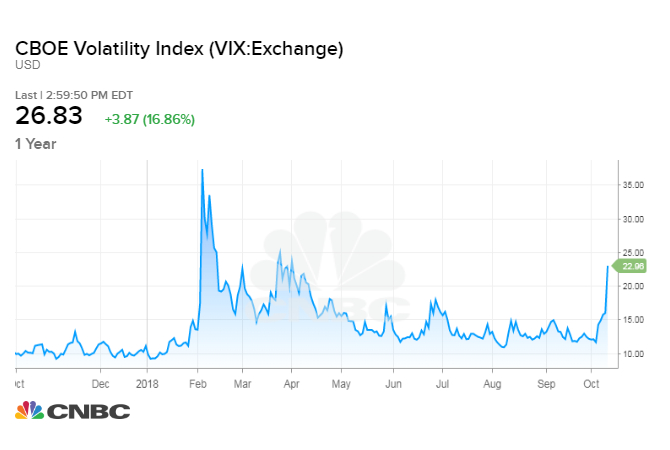

Wall Street's favorite fear indicator, the Cboe volatility index, hit its highest level since mid-February as traders accelerated the sale of their shares on Thursday afternoon.

The VIX measures the prices of put options on the S & P 500 versus the prices of the purchase options. A rising VIX theoretically means that investors are increasingly concerned about the market and are placing more bets to protect themselves.

Equities added to the week's strong losses on Thursday, a day after major indexes suffered significant losses from higher rates and a sell-off in tech stocks.

The Dow Jones Industrial Average lost 500 points on Thursday, dropping its losses in two days to more than 1,400 points. The S & P 500 fell 2.1% and was on the roll for six days. The broad index also fell below the 200-day moving average for the first time since May.

The Nasdaq Composite fell 1.5% and entered corrective territory.

Source link