[ad_1]

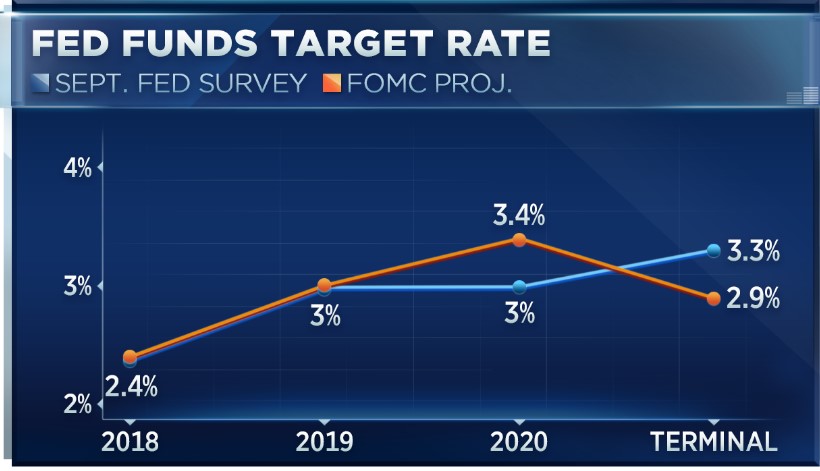

According to respondents in the latest CNBC Fed survey, two central banks are still expected to face two rate hikes this year and a central bank that would explicitly raise rates to slow growth.

"This means that the US bond market will reach a decision point next year, when market players will have to decide whether the Fed will go beyond current market prices," said Tony Crescenzi, executive vice president of PIMCO. . and when that's the case, the US Treasury bills will go up. "

A fifth of the group members said that a "policy error fueled" is one of the biggest threats facing expansion, right after trade protectionism.

"We are in danger of seeing trade and monetary policy plunge into a head-on collision, no one wearing seatbelt and airbags have been deactivated," wrote Art Hogan, head of market strategies, B. Riley FBR. "The biggest risk in the market is a political mistake, and we're working on a two-for-one special offer."

Respondents support the treatment of the economy by President Donald Trump by a margin of 61% to 30%, unchanged from the July survey. But 59% of respondents say that its trade policy will reduce growth and 52% say they will reduce their jobs in the United States.

A slight majority of 53% also say that the president's bargaining tactics will lead to better trade deals for the United States, while 20% say they will be worse and 22% expect them to change. not a lot.

Overall, the tariff effects on the economy are considered modest. Among those who find negative effects, the average is only a 0.2% drop in GDP in 2019 and a 0.2% rise in inflation.

But some see more substantial effects.

"We will remember the president for his cuts in the regulations that have so badly served the economy for years, but he will be remembered for his illogical and economically unjustifiable support for trade protection and tariffs. "How sad?" wrote Dennis Gartman, editor / publisher of The Gartman Letter.

Source link