[ad_1]

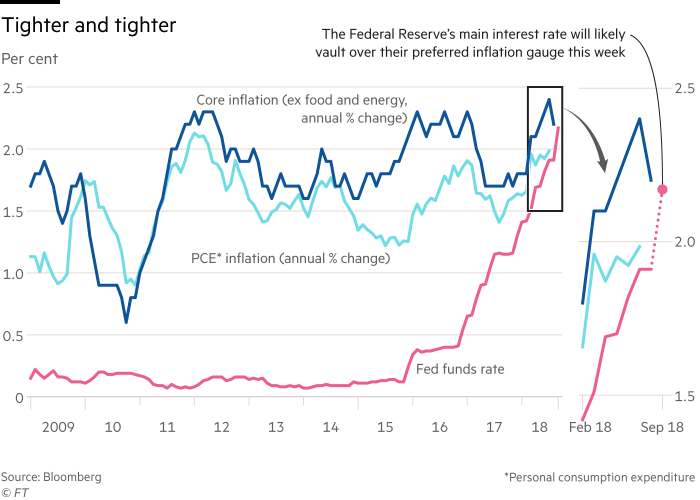

The main interest rate of the Federal Reserve will exceed the central bank's preferred inflation measure for the first time in a decade, when policymakers announce that the widely expected rate is interest rates.

Fed funds rate – the cost of borrowing overnight Fed excess reserves, unsecured by banks and other financial institutions – will exceed the central bank's preferred measure of the US economy's inflation rate , the first time since September 2008.

The Fed and central banks around the world have lowered their interest rates as a result of the crisis, some having even introduced negative interest rates for the first time in history. But with economic recovery on the rise, the Fed started raising interest rates in 2015, and other central banks are now watching a tightening of monetary policy.

"The question is what rate is high enough to slow down the economy," said Anne Mathias, Vanguard's strategist. "We hope to find out when we see it."

The US central bank has already raised its interest rate range twice this year, to 1.75-2%. This had the effect of increasing the rate of Fed funds – the main objective it tries to cross with its interest rate corridor – to 1.92%, its highest level in 10 years.

The Fed is expected to raise its lane by a quarter point more when it meets on Wednesday, and this will likely bring the Fed funds rate to about 2.17 percent.

This means that the "real" US interest rate, adjusted for inflation, will be positive again, and investors and analysts are now asking how much the Fed will raise interest rates.

Indeed, a further rate hike in December is widely expected, which will likely lead to a rise in the federal funds rate relative to the "core" inflation rate, which excludes the costs of food and energy. However, opinions differ considerably on the degree of tightening of the central bank's policy in 2019.

"This is the puzzle they will have to solve in 2019," said Jim Caron, bond fund manager at Morgan Stanley Investment Management. "There is little risk of an inflationary eruption, so why continue to hike?"

Markets are starting to assess the possibility of a two-percentage-point increase in the Fed's interest rate in 2019. The Fed said it would raise its rates three times, while economists Goldman Sachs predict that the central bank will have to raise its rates four. times to prevent the economy from overheating.

Source link