[ad_1]

This has pushed up oil prices and left some analysts arguing that they can not rule out a rebound at $ 100 a barrel. Too many questions arise as to the thoroughness with which the Trump administration will enforce the sanctions, the number of oil importers who will ignore the sanctions and the speed with which a group of producers led by the government. Saudi Arabia and Russia will be able to open the faucets.

"There is currently some market fever in the market with respect to supply and demand," said John Kilduff, founding partner of the energy hedge fund, Again Capital.

This fever will persist until the market determines the number of Iranian barrels that will be withdrawn from the market and whether Saudi Arabia will be able to step up its efforts to fill the void, Kilduff said. He thinks the uncertainty could drive up the price of a barrel of US oil to $ 10 a barrel, up to $ 85, until the new supply potentially lowers costs early next year.

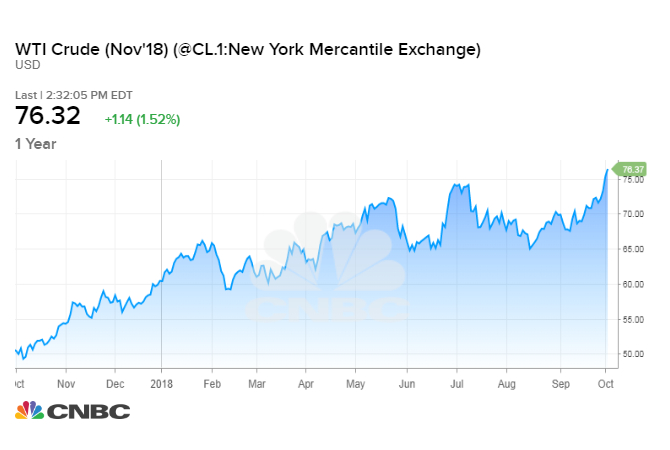

US crude closed the trading session on Wednesday at $ 76.41, climbing to more than a dollar a barrel since its highest level since November 2014.

Oil prices rebounded despite a sharp increase of 8 million barrels of US crude inventories and confirmation of Saudi Arabia's production increase. Saudi Energy Minister Khalid al-Falih announced Wednesday that the kingdom has pumped 10.7 million barrels a day this month, which is close to the national record. It will increase again in November.

"I think the Saudis are finally going to take the lead, but they're going to be stingy at first," Kilduff told CNBC's "Squawk Box" on Wednesday. "The winter will be tough for consumers at the gas pump, the oil tank, the airlines, everyone."

Saudi Arabia and OPEC have long been waiting for supply shortages to develop before increasing production, fearing that an early rise in production could tip the market into oversupply. But it's a cold comfort considering the rapid decline of Iranian exports so far.

The decline has exceeded expectations, with Iranian exports down about 650,000 barrels a day since April, according to Goldman Sachs.

Jeff Currie, Global Head of Commodity Research at Goldman, said prices were rising because many investors and oil consumers were buying oil contracts to protect themselves from the risk of oil break – ups. major supply. At the same time, there are not enough sellers on the market to ease the upward pressure on prices.