[ad_1]

Friday was another cat and mouse game for markets, especially financials. All big names were up in the morning with Wells Fargo (WFC) and Citi (C) topping the standings

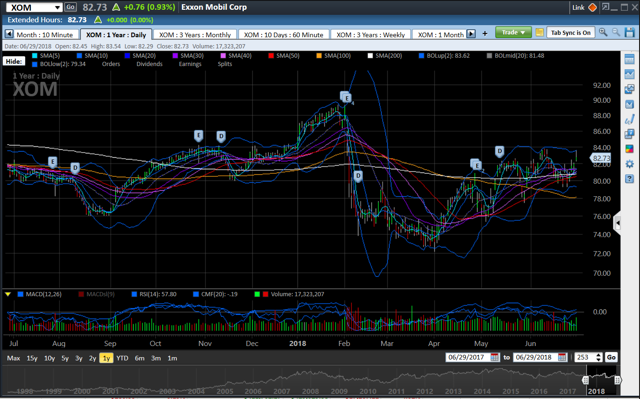

The Daily Chart (XLF) Shows History

Short Trap or Short Bull

This table below could be spun as a negative; a new low is possible but daily trading also represents a gap that has been painful.

Important note: the stock held the lowest of $ 28.01 on Tuesday.

This graph could be a bearish or a bullish one. So, in reality, this could be a trap for those who are short or long term. The market is a fascinating place, it always allows you to guess in the short term.

Here is a 30-minute intraday chart to show the pain that I felt was not selling from my entire position.

I will not take the action of Friday. It was terrible, the financiers were reversed on a day catalyst catalyst that could have been considered positive. The rally did not hold, the rebound did not take place.

The financiers gave up most of their earnings with only a few names ending in the positive. Wells Fargo (WFC) up 3.37% and Citi (C) up 0.04%.

Look, this one could exchange one way or the other Monday. It is possible that over the weekend positive commercial news will develop, but I would not rely on it

Bears come out of hibernation

Look for the street to start setting goals bearish in the next few days. This is not because a title is cheap and its value does not mean it can not be cheaper.

About the time a title hits a target price, you find it excellent. An analyst comes out with 3 reasons why it goes lower. The feeling changes in a minute in this business and sometimes it's hard to know what to do.

Short-term movements should not be as important to an investor, but for a trader this can mean the difference between being paid or losing one's job. We are all connected in this global world and whether it changes or not

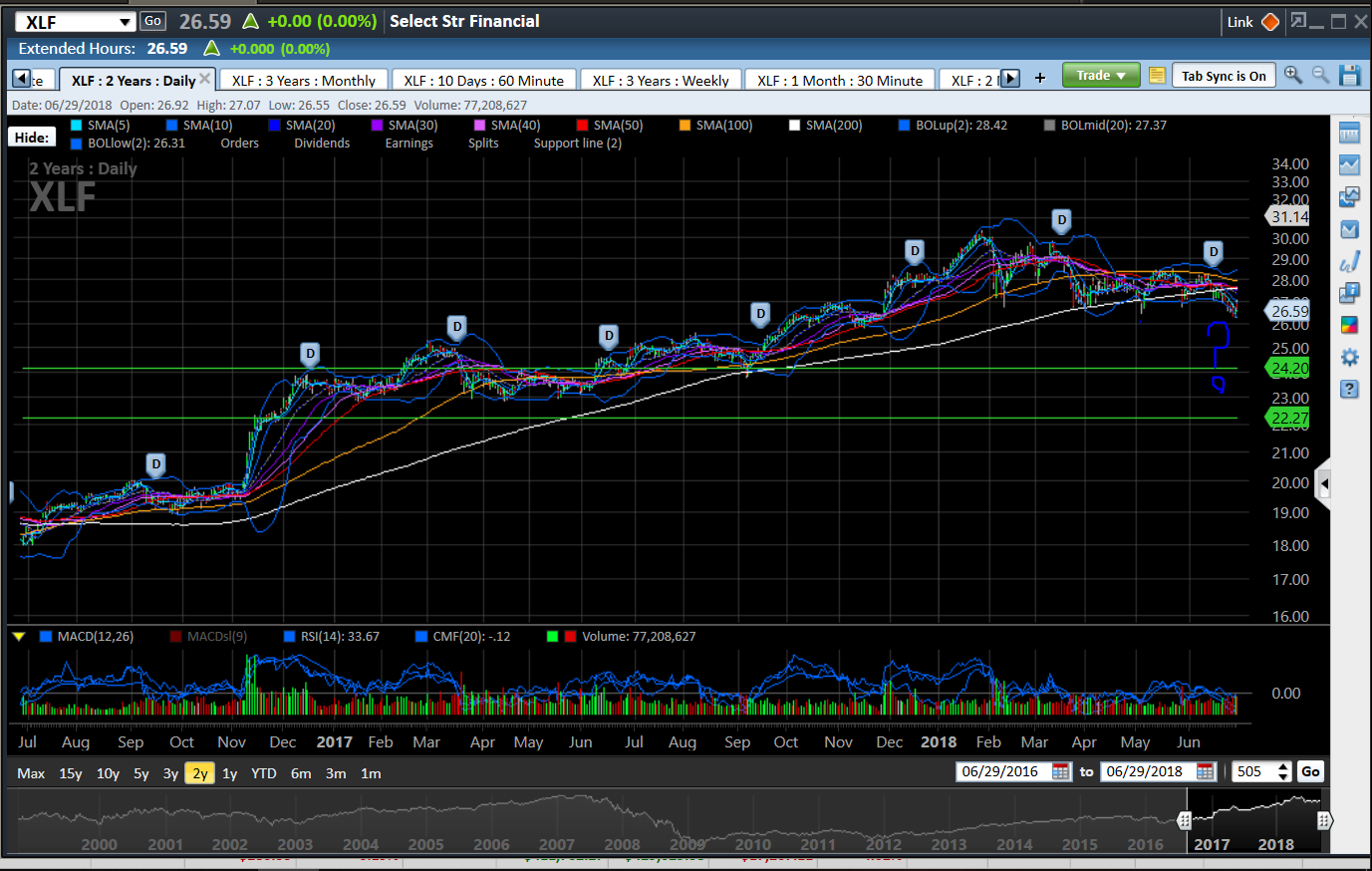

Banks remind me of oil a few months ago.

Improving fundamentals, rising oil prices and yet all oil stocks were hollowing 52 weeks. Exxon Mobile (NYSE: XOM) was trading at $ 72, I remember buying in April. All oil stocks were in a bear market territory and short targets

Here is a chart of reference price cumulation

Here's what I mean: everyone has their turn in the barrel, right now, it's the finances.

Banks buy on weakness, the key point is weakness. I do not know, that's why I trade. I do not want to be a bag holder at $ 28.50 at Bank of America if it's up to $ 25. I would rather sell and buy everything there.

The bank thesis is still intact

Good economic growth, good business policy, rising property values and low unemployment are all positive factors for banks. Once the financial straighten and recover, the sentiment will change again.

Do not let fear dominate your mind. Do not let tenuity obscure your thought.

As traders, all we need to do is probabilities, we can use options to hedge our positions against risk. As CEO Jamie Dimon says, "everything revolves around risk management." Murphys law reigns on the stock market, remember that when you place your bets.

Was this weakness made at the end of the quarter?

This trader was taking advantage today of certain positions for the end of the quarter. As a trader, I also took some losses. It is possible that the market reacts differently to the good news of the FED and is recovering from the peaks of Friday morning. It is also possible that we will make a gap and that we will make a new low for the year.

Possible short squeeze?

I heard a lot of bearish analysis on the financial Friday afternoon. I have seen and heard this before on many titles doing the same thing as the financial ones, only to see a rally in your face two days later.

Actually, I'll give you an example now.

Nike (NKE), I remember when that stock was trading close to $ 50 and nobody wanted to touch it. The feeling was ugly, one after the other, the analyst was giving all the reasons why they thought Nike was dead money. Fast forward 8 months later and Nike hits $ 81 on a positive earnings report.

Positive Catalyst

The reports on profits and GDP growth are likely to be the drivers of bank stocks during the hot summer days. A positive commercial resolution with China could have short films under cover.

Friday's Takeaway

The financials started the week in the negative and they ended the week in the same way. The FEDS has agreed to redistribute capital to almost all banks and the market has rewarded them with another day of decline. The last 14 days of 15 were for the finances

The feeling is negative but there is no surrender. Financials are now short targets for some and this could actually take the stocks higher because shorts may be forced to hedge a strong recovery.

Bulls and bears are about to make a little fight. It's going to be an interesting fight.

The shorts are under control as of Friday, but that could change by Monday morning.

Investors need to keep their eyes open and compete with their purchases. There is enough time to take a position.

As always, do your own research and set up an exit strategy when a trade goes against you.

Disclosure: I am / we are long BAC C.

I have written this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link