[ad_1]

Editor's note: This article was published on TechNode, a TechCrunch editorial partner based in China.

From Alibaba to JD, China is not running out of e-commerce giants. Although the country's e-commerce market is strongly consolidated, it's not impossible for start-up teams to break into this market as long as they solve the problems for the right group of customers.

The Chinese electronic business platform Pinduoduo. The Shanghai-based company has just secured a $ 1.6 billion fundraising through an IPO in the US this week, which is one of the most important transactions of the year. The excitement is rapidly escalating around the company, which claims 195 million monthly users and has managed to succeed in the highly competitive e-commerce market in China in just three years.

What is Pinduoduo and what did he do well?

Alibaba's Taobao and its rival JD.com, Pinduoduo is an e-commerce platform that offers a wide range of products from daily groceries to home appliances. The twist of Pinduoduo lies in its integration of social components in the traditional online shopping process, which the company describes as the "team purchase" model.

By sharing product information from Pinduoduo on social networks such as WeChat and QQ invite their contacts to form a shopping team to get a lower price for their purchase. The mechanism keeps users motivated and better hooked for a more interactive and dynamic shopping experience. Coupled with other incentives such as cash, coupon, lottery and free products, Pinduoduo manages to acquire users at a very low cost. Combined with the added satisfaction of scoring a bargain with your friends as a team, Pinduoduo quickly became a viral sensation in China.

Extremely low prices are another irresistible attraction of Pinduoduo. The discount is usually 90 percent, including everything from 10 RMB ($ 1.50) bed sheets to 1000 RMB ($ 150) PC. But bestsellers are everyday items at unbelievable prices. More than 6.4 million units of tissue paper were sold at 12.9 RMB ($ 1.90) for 10 boxes and 4.8 million umbrellas were purchased at 10.3 RMB (1, $ 51) each.

The wholesale model of the business easily creates huge orders. gives them more room to cut prices. At the same time, the application of Pinduoduo is designed to facilitate this, says an expert to local media: "Alibaba Taobao's interface is research-based and focused on several product presentations, while Pinduoduo looks more like a thread of news, a single product and easy to create "爆 款" [ baokuan, meaning viral elements]. Taobao has more products listed, but Pinduoduo has put focus on fewer bestsellers that attract more buyers. "

Pinduoduo (l) and Taobao (r) interfaces

The C2B model of Pinduoduo allows it to ship directly manufacturers. distributors, not only reduces the price of buyers, but also increases the profits of manufacturers. This approach is particularly effective for sales of agricultural products and perishable costs, where the speed of adaptation of supply and demand is critical.

Less well-known brands were chosen on famous brands to erase any premium related to the brand. In addition, advertising and marketing costs are also reduced by sharing users on social media. The approach is both cost effective and efficient. Through social sharing, users send product information specifically to friends and groups who may have similar income and consumption preferences. Viral marketing is a smarter way to build the identity of all the lesser known brands on its platform. Financially, the platform could balance some of the discounts with less marketing budgets.

Price and social features are not only the only way to the meteoric rise of Pinduoduo, and spotting the right user profile is the last piece of the puzzle. Chinese Chuchujie Electronic Commerce Platform operations director Yang Lin has drawn the heart of the problem in an interview with local media: "Taobao has more than 500 million users while WeChat has more than 1 billion, the gigantic missing group between two Chinese giants The applications are distributed in third or second level cities, mainly seniors, this group, which has appeared only recently and which depends on the omnipresence of WeChat as the main source of information, is the target of Pinduoduo. "

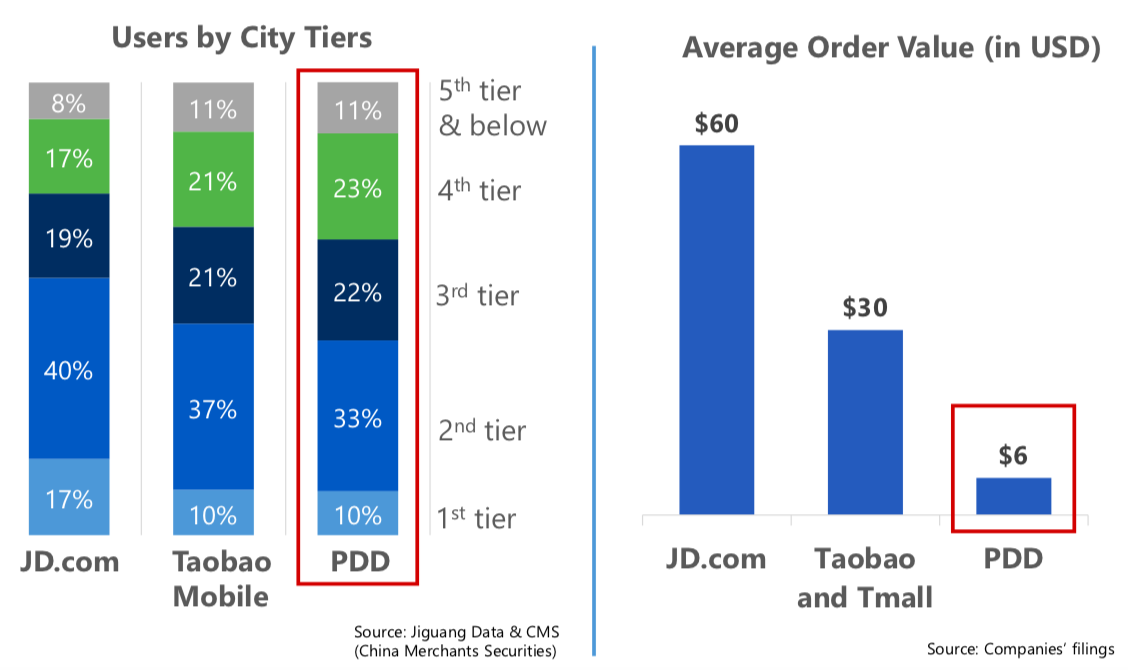

Jiguang research institute data show that third-city users and about 65% of the total base of Pinduoduo users, while JD users in first-tier and second-tier cities and in the rest of China were half-and-half. In addition, women represent 70% of the Pinduoduo user base. They are responsible for family shopping and more price sensitive. This ensures more active sharing and purchases.

Demographics of users and average order value of JD, Taobao and PDD (Image credit: GGV)

Improving consumption, a trend in which wealthy Chinese customers are increasingly willing to pay, has dominated E-commerce industry in China in recent years. The globalization initiatives of Taobao and JD to bring quality products abroad, the boom of cross-border e-commerce sites like Red and NetEase Yanxuan and Kaola are all based on the backdrop of consumption.

But the growth of Pinduoduo focusing on whether the platform represents the downgrade of consumption. Perhaps the valuation or degradation of consumption is not the key problem. This is just one more proof of the size and segmentation of the Chinese market. Rising incomes may give some Chinese city dwellers the freedom to vote for quality, but the price difference of RMB 1 can be a sufficient incentive for their rural counterparts who have been more neglected so far by the e-commerce. performance remains the most important factor to consider for consumers. A higher price does not necessarily represent the best quality or vice versa. The huge potential in this often overlooked market attracts more competitors. Taobao has launched Taobao Tejia, an application dedicated to low-end users of China.

Pinduoduo did not invent the social e-commerce model. Groupon pioneered the concept of group buying years ago. But it succeeds thanks to a new ecosystem consisting of a super WeChat application, a mobile payment infrastructure and mobile users.

History and main milestones of Pinduoduo

Founded in September 2015, Pinduoduo is the fourth startup of Colin Huang, a former Googler who has already worked on the first search algorithms for electronic commerce . His previous startups include the electronic ecommerce site Ouku.com, Leqi, an e-commerce platform marketing agent service and a role-playing company based on WeChat.

With experiences in e-commerce and games, Huang founded Pinduoduo. With a vision to combine the secret recipe of success of Alibaba and Tencent, the two Chinese Internet giants known for their e-commerce and domination of games / social respectively. "They do not really understand how else made money," Huang told Bloomberg

Huang seems to be right about how the two industries can work together. Pinduoduo's annual GMV (gross merchandise volume) exceeded RMB 100 billion ($ 14.7 billion) in 2017, about two years since its inception. To achieve the same goal, Taobao took five years, VIP.com took eight years and JD ten years. Pinduoduo now boasts more than 343.6 million active buyers with an annual GMV of RMB 262.1 billion, or $ 38.5 billion.

A huge turning point occurred in the third quarter of 2017 when the weekly active rate, the penetration rate and the opening rate The Pinduoduo application surpassed all of JD's. Compared to the previous year, it reaches an annual growth of 1,000% according to Jiguang data

Image credit: GGV Capital

An abrupt growth trajectory has attracted financial support. In 2015, Huang launched Pinhaohuo, a social commerce platform for fruits, with the team of its second startup, Leqi. Four months after Pinduoduo received an undisclosed tour of IDG and Lightspeed China in March 2016, the company obtained more than $ 110 million in Series B financing four months later from Baoyan Partners, New Horizon Capital, Tencent and others. In April 2018, Pinduoduo completed a new round of financing raising $ 3 billion to a valuation of nearly $ 15 billion. Given the history of Pencuoduo and Pinhaohuo, then two of the largest players in the social e-commerce sector, the two companies merged to form a single domineering.

Another counterfeit paradise in China?

"If you close your eyes and visualize the next step for Pinduoduo, it would be a combination of" Costco "and" Disneyland ", guided by a networked distribution of intelligence agents," wrote Huang in the IPO prospectus. Huang's comparison was thus interpreted as a combination of "value for money" and entertainment, but many questioned whether Pinduoduo could live up to the expectations of the founder

the increase in product quality and counterfeit complaints still raise concerns about the possibility of a low cost and low quality combination. The percentage of complaints against Pinduoduo is 17.87%, and the user satisfaction rate is only one star, according to the National Survey of User Satisfaction of Key Trading Platforms electronic newsletter published by the China Electronic Commerce Research Center. The complaints mainly concern problems of poor quality, slow delivery, misleading ads, etc.

In addition to mounting domestic complaints, the Chinese commercial application has been hit by a prosecution for trademark infringement in the United States. . Along with Alibaba and JD's efforts to remove counterfeit products on their platforms, fake products are flooding emerging e-commerce platforms like Pinduoduo and Weishang, according to Alibaba.

Pinduoduo becomes a public enterprise. e-commerce giants in the cleaning of the platform. According to the annual report of the company on the protection of consumer rights for 2017, it has removed 10.7 million problematic registrations, blocked 40 million suspicious external links, accounting for 95% of fake sellers of the platform. The company has set up a 150 million RMB ($ 22 million) fund to manage after-sales disputes.

But tighter regulations cause more friction between Pinduoduo and its traders on the platform. In June, fourteen shop owners selling products on Pinduoduo protested under the company's offices claiming that Pinduoduo had carried out quality checks on inappropriate products that violated the owners' rights. The company's founder Huang insisted that Pinduoduo's decision and the owners' punishment are fair and equitable.

Many also questioned the validity of the entertaining characteristics of Pinduoduo's value proposition. "We have observed that some users find the shopping on Pinduoduo very entertaining, which is attributable to its extremely low price and to the interaction between users of Weixin," according to the research institute 86 Research [19659004] IPO and Beyond

Pinduoduo went public on the NASDAQ market on July 26 and raised more than $ 1.6 billion with a valuation of $ 60 billion. However, shareholders should always be concerned about the fundamentals of the company

Financially, the company is still in the red. Pinduoduo suffered a net loss of 292 million yuan (43 million US dollars) and 525.1 million yuan (77 million US dollars) in 2016 and 2017, respectively. Net losses reached 201 million RMB ($ 30 million) in the first quarter of this year. The net loss is expected to be broadened mainly due to branding and advertising investments. Over 88.4% of the 1.2 billion yuan (180 million US dollars) worth of Pinduoduo RMB was spent on marketing. This could be translated as a sign of difficult traffic acquisition.

The most typical users of Pinduoduo are price-sensitive women residing in low-level cities. Merchants sell at low prices to appeal to this group. But how to maintain these users and its growth momentum is a big challenge for Pinduoduo now given increasing product quality complaints.

"The retention rate is a big challenge of Pinduoduo, implying potential GMV to slow down.Pinduoduo will have a hard time switching to a high-end product market because of the demographics of its users and its brand image," according to 86 Research

Source link