[ad_1]

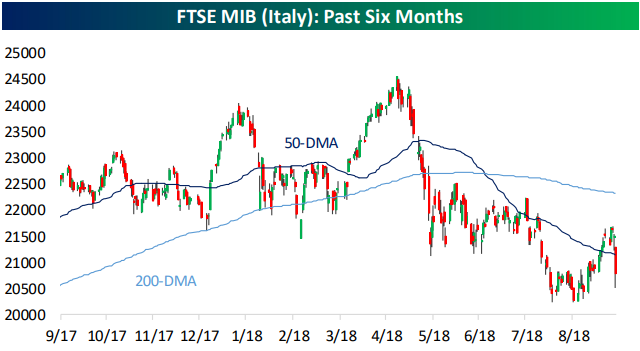

European equities ended last week by losing two weeks of solid gains. Friday, the STOXX 600 was down 0.83% on very high volumes, but the real chaos was observed in Italy, where the FTSE MIB was down 3.7%. Within the STOXX 600, banks suffered the most, down 2.8%, while insurance was not far behind at 1.7%. Italian banks represented four of the five worst-performing STOXX 600 countries: Banco BPM (OTC: BNNCY), Unione Banche Italiane (OTC: BPPUY), UniCredit (OTCPK: UNCFY) and Intesa Sanpaolo (OTCPK: ISNPY). all at least 7.8%. The FTSE MIB saw the continuation of these problems today, down 0.49% on the session.

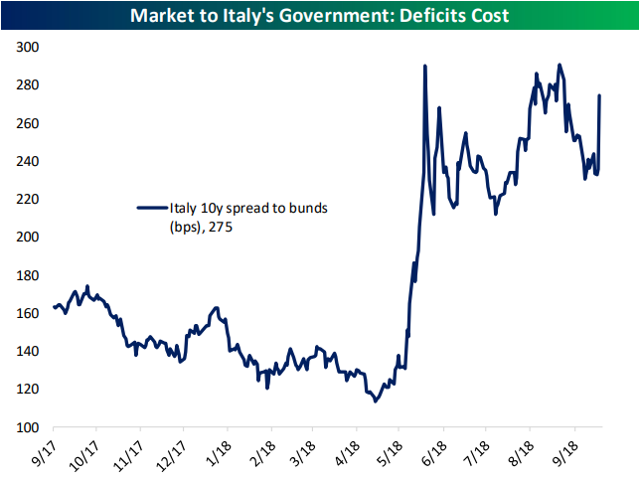

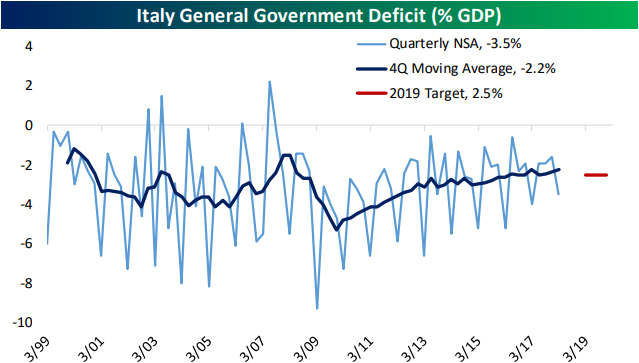

The reason for all this chaos was that the Italian government had wiped out hopes of budget cuts in the market. On Thursday evening, they announced a target of 2.4% of GDP for the 2019 budget for the 2019 budget. Italian public debt to GDP is 132% and its economic indicators are systematically lagging behind. it is simply impossible that they sustainably spend more than 2% of GDP if the markets do not want to let them do it. Eurozone officials echoed these concerns at a meeting earlier in the day and sought to mitigate the escalation of these concerns.

Although there has been much talk of Italy-EU divides, this market-imposed discipline is currently much more restrictive and saves much of the work that EU bodies might otherwise have to do to limit Italian spending.

[ad_2]

Source link