[ad_1]

Bitcoin last week sank to its lowest level in 2018, amid a combination of another cryptocurrency exchange hack from South Korea and an action potentially hostile by Japanese financial regulators, long-term cryptos.

A closer look however, the recent news is actually the noise in terms of long-term cryptos drivers, but still had the effect of sending the asset down 10-15% in some days.

What is happening in Japan and South Korea for Cryptos?

Japan and South Korea, where much of the global cryptocurrency activity has taken place, have also been the target of huge hacks in recent months. From the $ 500 million piracy of the Japanese Coincheck exchange in January to South Korea having faced this month's hacking of $ 40 million from Coinrail and $ 30 million from Bithumb, it seems that the security of trade remains tenuous.

At the cost of this, Bitcoin (BTC-USD) sank at a price of $ 6,199 per piece and a market capitalization of only $ 104.7 billion, down 5.98% this week and 18.57% on a month. At its lowest level in 2018, BitCoin has not seen this price level since a brief correction in November 2017.

(Source: CoinMarketCap)

BitCoin Cash has fallen 11.13% this week and 27.03% this month, Ethereum 5.84% this week and 19.68% this month, LiteCoin down 14.98% this week and 32.33% this month.

The EOS, which shows a drop of 22.35% over a week, is perhaps the worst known cryptocurrency, followed by Cardano (-16.60%), IOTA (-16.58%) and Stellar ( -14.01%).

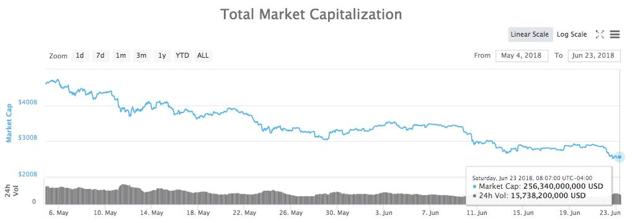

As we have seen, it is less of a particular sale of BitCoin, but of a widespread correction across cryptocurrecies in general. Cryptocurrency market capitalization dropped to about $ 256 billion, down about 22.4% from $ 330 billion earlier this month.

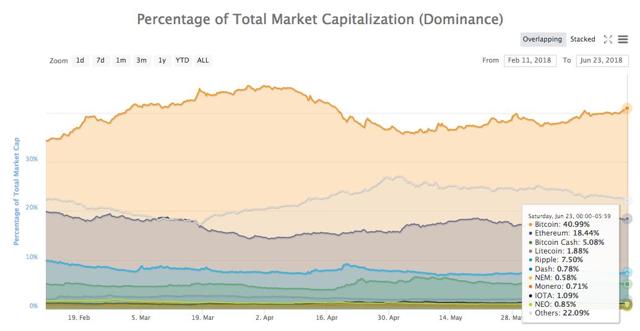

Meanwhile, BitCoin's market share has increased slightly, with some other alt-cryptos having retreated (some more than others).

(Source: CoinMarketCap)

(Source: CoinMarketCap)

Recent public speculation has shown that recent events in South Korea and Japan have been the drivers behind this recent downturn, due to the apparent resurgence of cryptocurrencies in April, when we saw cryptos climb by $ 252 billion at beginning of April at 469 billion dollars. May, for an increase of nearly 86% and driven mainly by altcoins.

The theory is essentially that consistent hacks will push South Korea to slow down its recent regulatory easing towards cryptocurrencies, as potentially lifting a ban on OIC, in contrast to its severe approach if not months ago.

Japan has long been known as one of the most favorable regulatory regimes for cryptos, and it has been the source of much of the cryptocurrency inflows over the past year . Japan has recently issued business improvement orders for six cryptocurrency exchanges, as part of a move several weeks ago aimed at banning some privacy cryptocurrencies.

Although Japan has stated that all these actions are intended to combat money laundering, some worry that this may be a sign of Japan's changing regulatory stance. in respect of cryptos.

What is really happening?

Personally, I think the developments in South Korea and Japan are very loud in themselves, since South Korea's regulatory attitudes are complex and hacks may not suddenly sweep the regulation. In the case of Japan, the regulatory "tightening" has not been as important as the ban on privacy, as business improvement orders may even be beneficial to cryptos because the public has more confidence in foreign exchange security.

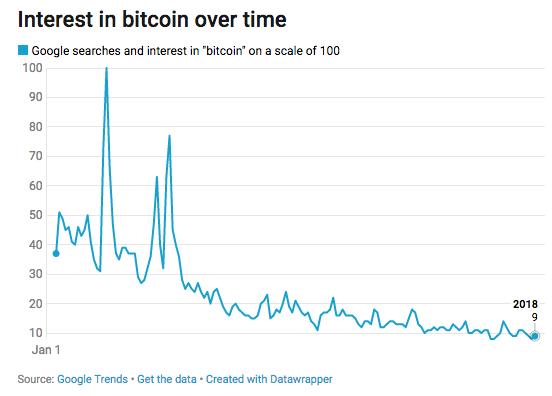

On the contrary, I believe that the decline in the market is due in part to news that is very reminiscent of the decreasing level of interest in cryptocurrencies, and thus the decreasing market demand for a highly elastic demand-driven asset. Indeed, as of January this year, Google 's searches for Bitcoin have dropped dramatically, about 75% since the beginning of the year and more than 90% since their peak. Other different growth parameters, such as portfolio interest, showed similar sluggishness or similar declines.

(Source: CNBC)

I believe that some cryptocurrencies have an inherently somewhat reasonable valuation in themselves based on the current and potential market share of the product. Nevertheless, their price at this time remains largely overwhelmed by market demand because of the size of the public whims that take precedence over the valuation factors and the changing nature of the cryptos themselves, changing the markets to which they belong. Crypto.

In my opinion, until crypto-currencies have been stabilized, both in terms of regulation and underlying technology fundamentals, crypto's like BitCoin will continue to experience high volatility and will focus primarily on market demand. The market demand for cryptos, as for ordinary fiduciary currencies, is mainly motivated by the general interest rather than a consistent valuation of assets.

Conclusion

The news in South Korea and Japan is the noise, a correlation with the recent cryptos price movement rather than a cause.

With the general interest for momentarily declining cryptos, and institutional crypto-currency outbreaks still in development, unstable, or even negative for current cryptos as institutions create their own cryptos, the current correction of BitCoin and Other crypto price is not too surprising.

Cryptos will likely be floored long enough because there is still a significant level of public and institutional demand, but once the sector stabilizes and becomes truly dominant then asset-based cryptographic valuations will likely become a factor too. market prices based on the currency.

AT Overview of Technology Investment I discuss specific companies and investment products that I believe are particularly likely to win in the market, as well as those to avoid, including how to accurately evaluate a cryptocurrency as an asset and some cryptocurrencies among the 1,600+ there I believe can be particularly ready for success.

With a focus on technology in particular, I present updated risk-reward scores for dozens of companies, potentially attractive price targets for investment, portfolio strategies and attractive risks to investors. to avoid. I hope you will take a look at it.

Disclosure: I / we have no positions in the stocks mentioned, and we do not plan to take a position in the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link