[ad_1]

Apple (AAPLThe stock was downgraded by only two Wall Street analysts in the last 12 months – both were issued today. The reason? Apple's forecast that first-quarter revenue is between $ 89 billion and $ 93 billion was lower than predicted by consensus analysts for $ 93.02 billion in revenue. In addition, the street seems disappointed that the iPhone maker stops sharing unit sales statistics in fiscal year 2019.

To the credit of the company, FQ4 EPS of $ 2.91 and sales of $ 62.9 billion far exceeded the consensus estimates of $ 2.78 and $ 61.6 billion, respectively.

Rosenblatt analyst Jun Zhang commented, "We believe that Apple's slightly flexible guidelines reflect our recent view that Apple will reduce iPhone production (our estimate of a 6 million dollar reduction in production). units). We have also recently reduced our iPhone shipping estimates due to weak iPhone XS and XR sales. The iPhone Max is well sold and will likely help to increase the ASP and gross margin, but we think it will be difficult for ASP to grow during the second half of C2019. "

"We believe that C2019 will be a difficult year for all smartphone gamers due to the transition from 4G to 5G. With the launch of the 5G service in 2020, we believe that consumers will delay upgrading their smartphone until 2020 and beyond, "added the analyst.

Zhang downgraded Buy's AAPL shares to Neutral, while maintaining its price target at $ 200, which implies a slight drawback from current levels. (To look at Zhang's background, click here)

In addition, Wamsi Mohan, an analyst at Merrill Lynch, downgraded Apple's shares from Buy to Neutral, noting: "We are seeing increased risk as a result of a weaker macroeconomic environment. After the results, we are more and more concerned that not all the weaknesses are captured in N / T and that we will probably see another negative estimate. "(See the results of Mohan, click here)

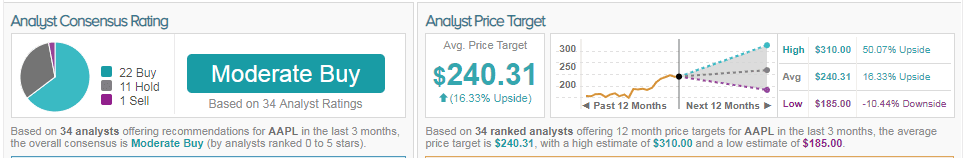

While Zhang and Mohan wait to wait for the stock to rebound, most Wall Street analysts show a bullish outlook on the technology giant, while TipRanks analytics presents AAPL as a buy. Based on 34 analysts surveyed in the last 3 months, 22 note a purchase on an Apple stock, 11 issue a block, while only one recommends a purchase. The 12-month average price target is set at $ 240.31, an increase of nearly 16% over the current market. (See AAPL price goals and analyst ratings on TipRanks)

[ad_2]

Source link