[ad_1]

Although there is no shortage of doom and pessimism coming from American companies about President Donald Trump's trade war with China, there is at least one American industry that encourages it: textiles

Thousands of jobs and plant closures while the United States opened its trade with China and d & # 39; In other countries, textiles have stabilized in recent years. And just as the sector was trying to spur growth, a presidential candidate has pledged to revive US manufacturing

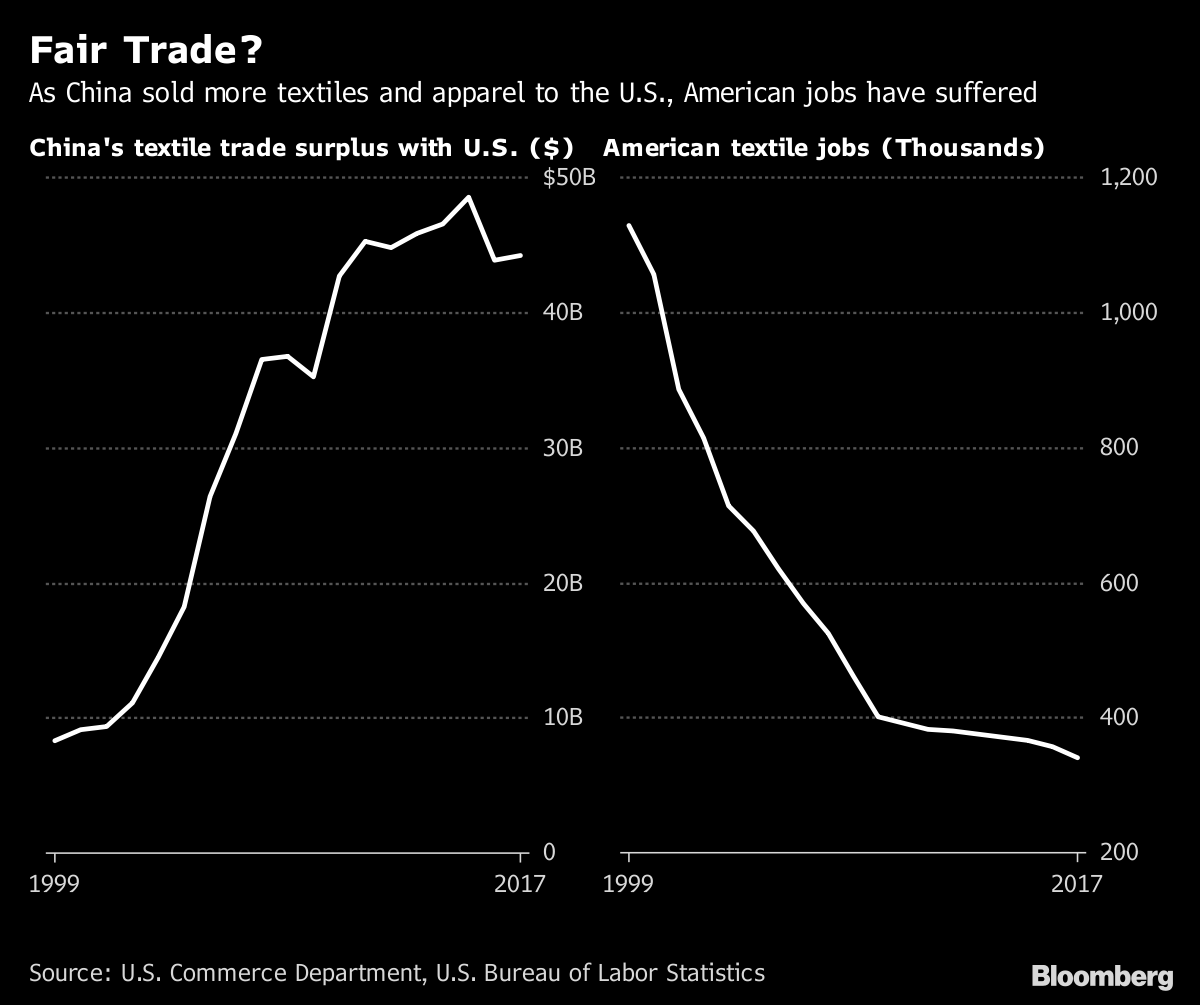

Fair Trade?

As China was selling more textiles and clothing to the US, US jobs suffered

: US Department of Commerce, Bureau of Labor Statistics of the United States

The industry immediately saw the Trump election as the best chance in a generation to reorient US trade policy. And until now, it has not been disappointed. The President withdrew America from the Trans-Pacific Partnership (TPP) trade agreement negotiations during his first week of work. He has now imposed tariffs on $ 36 billion worth of goods made in China, including textiles, and he wants to push that to $ 250 billion.

But the industry wants more. Textiles – such as fabrics and yarns – are the materials used to make everything from clothing to seatbelts. And duties on finished or finished products, clothing and other goods from China would help domestic manufacturers compete with Chinese firms over prices and generate more orders for US-made textiles, according to industry leaders. l & # 39; industry. Trump, however, has largely avoided targeting consumer products for fear of antagonizing voters who might face higher prices at the mall.

Credit Trump

"We need to do something to level the playing field with China," said Michael Woody, CEO of Trans-Tex LLC, a Cranston, Rhode Island-based manufacturer . cords and laces. "I give credit to the president for trying to do something, for an American manufacturer like my company we want tariffs on finished products."

Putting duties on finished products is anathema to US retailers and consumer brands that rely on Chinese products, including $ 28 billion last year, keep prices low for buyers.They say the levies will only raise prices and that they will end up costing jobs.

The Trump administration largely avoided touching consumers in the first round with 25% tariffs – mainly on machines – which came into effect on July 6 Four days later, the president responded with a proposal to impose 10% taxes on $ 200 billion worth of imports, including finished products like handbags, baseball gloves l and handbags. Dog leashes, a small part of Trans-Tex's business that Woody called "good news".

And while clothing was spared, Trump threatened to put tariffs on all Chinese imports that totaled half a trillion dollars. This triggered an alarm around America's businesses. Rick Helfenbein, president of the American Apparel & Footwear Association with members such as Gap Inc. and Macy's Inc., has begun qualifying the proposed rights of "Trump Tax".

Consumers to pay

"This will do nothing to help American workers, American consumers or US companies," Helfenbein said in a statement after the announcement of the $ 200 billion list dollars. "This will result in inflationary costs throughout the supply chain, ultimately paid for by US consumers."

Textile and apparel manufacturing industries have little sympathy for businesses that Are opposed to a trade war with China.This means that the United States opened its trade with China from 2000 and that the entry of China into the World Trade Organization – thanks to the support of then President Bill Clinton – ushered in an era of national decline. "For the community of retailers and importers, guess what – what is it on President Trump has campaigned, "said Lloyd Wood, director of public affairs of the National Council of Textile Organizations . "They knew it was going to happen, if you chose to keep all your eggs in the Chinese basket, it's a risk you knowingly take."

"Positive enough"

Since Trump was a candidate he criticized the US trade deficit with China, which reached a record high. $ 375 billion last year. If it is serious about reducing it, the obvious targets would be textiles and products made from them. In 1999, the United States imported $ 8.5 billion worth of textiles and clothing from China and exported only $ 176 million. Go from the front to last year, when the United States imported $ 45 billion of these products from China, and exported less than $ 1 billion. This is a trade gap of only about $ 44 billion just for textiles and clothing.

That is why the Trump election has generated so much optimism in the industry. In January 2017, shortly after the swearing in of Trump, Thomas Caudle, managing director of Unifi Inc. – one of the largest US producers of yarns and fabrics with a figure of over $ 20,000. annual business of about $ 670 million – said that it could be very positive. The President's decision to withdraw from the TPP would also allow the company, located at the heart of what's left of the US textile industry in Greensboro, NC, to save money. 39; money. Unifi refused to comment on this story

Shift West

Since then, Trump's sabotage has become a very public conflict with the largest trading partner of the United States

. According to Christopher McGinnis, an analyst at Sidoti & Co., US textile manufacturers sell yarns and fabrics to companies such as Nike Inc. and Abercrombie & Fitch Co., according to free trade agreements that have strengthened the prospects for Companies like Unifi. which ends up manufacturing the goods in these regions and exports them to the United States duty-free. According to McGinnis, more protections against Chinese imports could also boost production in America, "if you're looking for a green shoot, this could be an industry that could benefit," McGinnis said. "They have been so beaten by China."

Related: Can Trump win a trade war in China? We can soon discover

Woody, the CEO of Trans-Tex, has been at the forefront of the competition against China for more than three decades, and in 2016 released "American Dragon", a book based on these experiences. In the 1980s and 1990s, he was sales manager at a pen manufacturer, Quill Co., which was challenged by cheaper Chinese imports and later acquired by Newell Rubbermaid.

In 2008, Woody joined Trans-Tex. company that goes head-to-head with China. He buys polyester material from a North Carolina factory and uses it to make items such as branded cords for trade shows. It survives by returning small orders quickly – about a third of its orders are shipped in 24 hours – and by presenting better quality and less hassle because US customers do not have to deal with overseas shipments .

For 100,000 or more units, which are not needed so quickly, Trans-Tex faces Chinese competitors who often quote prices at one third of what they can, Woody says. Even a 10% tariff – like the one the Trump administration proposed last week – would help the company consider equating more with the Chinese, he said.

"It would make a big difference," said Woody. "China is the problem."

Source link