[ad_1]

The most controversial automaker in America, Tesla (TSLA), held a call for results yesterday. I rushed to understand the numbers. Today, I would like to expand this coverage by commenting on three points raised by Tesla about his call for results.

I will not discuss all the positives and negatives. There were many positive points, such as the help provided by customers to the company, the strong margin on its sales and the arrival of Model 3 in Europe early 2019. But some comments from the company deserved to be repulsed. Now, I will quote the leaders of Tesla and will continue with my point of view on this particular comment (including mine):

The Model 3 has become the best-selling car in the United States in terms of revenue and the fifth-best-selling car in terms of volume. We have seen higher revenues and significantly better profitability in our Energy business. I mean, but I think that with solar, it may have been the best quarter of all time for solar.

I noticed that the media and many investors admit that Model 3 is the best-selling car in the United States and this is a major achievement.

This is obviously not a bad data point, but you should not take it too seriously.

Traditional automakers have many different models and very broad competition in all categories. Nobody disputes the very enthusiastic number of the first users of electric vehicles. Model 3 being one of the main choices of electric vehicles, it attracts electric vehicle enthusiasts to this model. Tesla even set up an order booking list for Model 3 and was finally able to deliver the people on this list. Few doubted that he would sell the first lots of Model 3 if he would be able to manufacture them (which they were after facing many difficulties). It makes sense that the model is at the top of the list. Let's see if this stays there as competition intensifies and the reserve list is served.

We achieved GAAP net income of more than $ 300 million, increased cash and cash equivalents by $ 731 million, and gross margin of more than 20% for Model 3. In addition, we expect to return net income and positive cash flow in the fourth quarter. And I believe that our aspirations will be the same for everyone. I think we can actually have a positive and profitable cash flow for every quarter, leaving out areas where we may need to make a large refund, for example in the first quarter of next year. But I think even in the first quarter, I think we can have a pretty steady cash flow by the end of the quarter.

I think it's a very special thing to say. Why would you want to have the aspiration to be a positive cash-flow from now on?

Technically, you could earn $ 1 in green when it comes to cash flow and reach your goal. Certainly, I miss a stock (not a ton) but even if I understand that Tesla is a growing stock.

Growing businesses need to invest. Tesla would like to release a Y model, a semitrailer, a roadster, a Chinese factory, a European factory and maybe more. To achieve this, you must invest real money, which is factored into investment spending. Free cash flow is calculated after investments and should suffer.

This is not a problem as long as you make investments with a solid return on investment. Refraining from making solid positive investments in terms of return on investment as a growing company to achieve a positive number of free cash-flow quarter after quarter can easily be counterproductive. That's why I think it's a special aspiration.

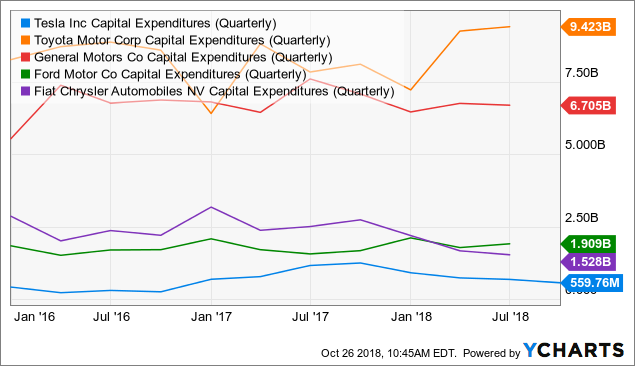

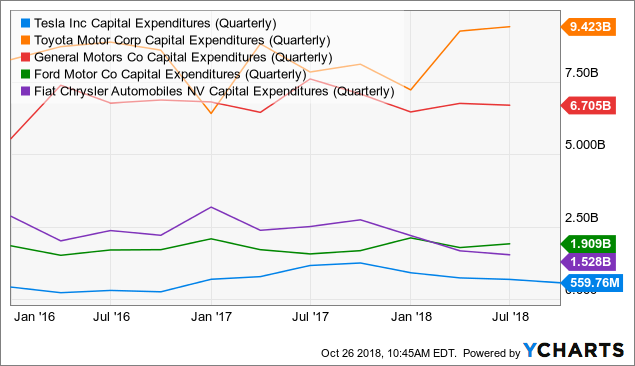

Here's a look at what capex looks like for various automakers like Toyota (TM), GM (GM), Ford (F) Fiat (FCAU) and Tesla itself:

TSLA Capital Expenses (Quarterly) by YCharts

Today, most of its competitors are well established companies with factories on several continents and in different countries. These are running. It could be argued that Tesla will have to spend more to achieve parity. It is before he still needs more capital to dominate them completely. It is not a bad thing to invest money. But you can not make huge investments and generate positive free cash flow.

Yeah. That's our goal. We do not intend to raise equity or debt. At least, that's our intention right now, it could change in the future. But the current operating plan is to pay off our debts, not to refinance them, but to repay them and reduce the debt burden and overall debt of the company. But in fact, I almost forgot a very important thing. As – and this is very helpful, it is always helpful to have this kind of crisis situations with logistics, for example.

I am very surprised that Musk reiterates that Tesla does not intend to raise equity or debt. I imagine that Tesla does not want to increase its debts, but the fact that Musk is firm in not increasing its own funds is one of the main reasons for my short position.

Tesla could be a dominant automaker at some point in the future. I agree it is possible. But I think the chances of that happening are much lower if the company does not raise equity over the next six months. If I were CEO here, I would have done it already.

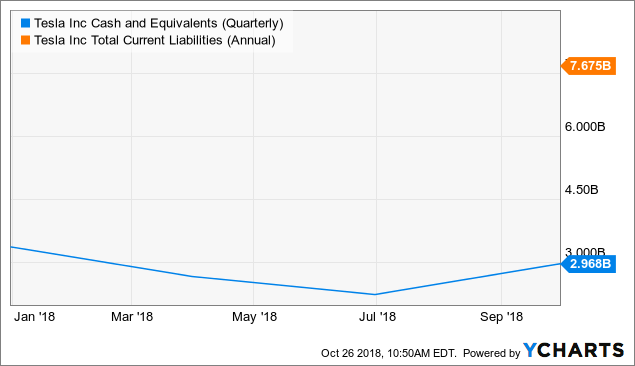

If you look at the size of the market, the size of the research and development budgets of Tesla and its competitors, the investments it wants to achieve (as for multiple factories), its liquidity position is not its most characteristic impressive.

TSLA Cash and Equivalents (Quarterly) by YCharts

There is not a lot of money on the balance sheet. There is an operating profit, but it is not a lot yet.

TSLA Operational data (quarterly) by YCharts

There are huge investments to take in charge.

To make matters worse, the current operational plan is to pay off debt instead of refinancing it. If you think back to the previous statement of the company wanting to release free cash flow every quarter, you will understand that I am confused. Debt repayment hurts cash flow. It is true that Musk conceals this statement, but it always seems a bit ridiculous.

Conclusion

Again, I'm blown away by the quarter considering the difficulties that Tesla has overcome to get it, like the hell of manufacturing, the hell of delivery, and so on. In general, I think the call for results could have been improved by less discussion about hand injuries and on-site health clinics and by appealing to more analysts with a point of view more critical. I will keep my short position for now, but if the company continues to make sales and generate profits while the competition intensifies, I would be happy to concede it.

See the investment report in a special situation if you want uncorrelated statements. We look at special situations such as spin-offs, share buybacks, rights offerings, mergers and acquisitions events, and so on. But we also have a keen interest in the commodities sector. Especially in the last stages of the economic cycle.

Disclosure: I am / we are short TSLA.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: I am also a long GM and indirectly a long FCAU.

[ad_2]

Source link