[ad_1]

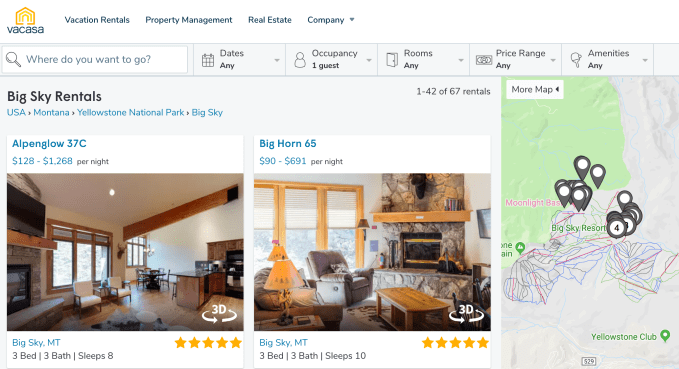

Airbnbing can be a ton of work. Between key collection, storage and maintenance emergencies, renting your home is not such a passive source of income. But Vacasa offers homeowners complete management of their vacation homes, including listings of the best rental platforms, such as Airbnb and HomeAway, as well as local cleaning agents between two guests. It now manages 10,000 vacation rental properties in more than 16 countries.

With the mature peer-to-peer housing market and Airbnb Private equity firms looking to become public see an opportunity to know who controls the ultimate relationship with homeowners like Vacasa Is. Today, the start-up announces that it raised $ 64 million during a round of B series led by Riverwood and joined by Level Equity, Assurant and Newspring. This money will fuel Vacasa's expansion in real estate, which seeks to sell real estate to people wishing to own and rent a holiday home.

Vacasa was started impressively from 2009 to 2015. "I have always been passionate about vacation rentals. When I travel with friends or family, I love having common spaces in which to meet, "said CEO Eric Breon. He founded the company after owning a vacation cabin on the Washington Coast. He would go up in the spring, spend a weekend repairing the place, stay idle all summer, and then, he should spend another weekend to close it. He considered a local property manager, but they massively underestimated how much he could earn by renting it. Breon has therefore designed Vacasa to make it easy for homeowners to earn money as easily as possible.

After years of organic growth in its business, Vacasa raised $ 35 million from Level Equity's A Series in 2015 and an additional $ 5 million from Assurant. Then, in the fall of 2017, he raised $ 103.5 million in Series B. He now completes this cycle with $ 64 million and a new valuation guaranteed by the growth of the startup last year. This brings the total sum of $ 207.5 million to Vacasa.

After years of organic growth in its business, Vacasa raised $ 35 million from Level Equity's A Series in 2015 and an additional $ 5 million from Assurant. Then, in the fall of 2017, he raised $ 103.5 million in Series B. He now completes this cycle with $ 64 million and a new valuation guaranteed by the growth of the startup last year. This brings the total sum of $ 207.5 million to Vacasa.

This represents only a fraction of the $ 4.4 billion of Airbnb collected. But Vacasa's address to a more upscale market that does not want to handle the properties themselves. With many popular ad sites, Vacasa is easily distributed. However, when other giants in the sector become listed companies, they will be forced to seek greater margins that could allow them to compete with Vacasa after years of partnership.

Breon remains confident, though. When I ask him what is the greatest existential threat to the company, he states that "We have reached a point where failure is not realistic. We have excellent retention from our owners and high recurring revenues. The question is how quickly we can continue to evolve in the huge $ 32 billion market we are focusing on. no shortage of people looking for a getaway.

Source link