[ad_1]

Bandar Algaloud | Courtesy of Saudi Royal Court | Reuters

President Donald Trump makes a gesture when King Salman bin Abdulaziz Al Saud (R) in Saudi Arabia stands beside him at a ceremony in Riyadh, Saudi Arabia on May 20, 2017.

President Donald Trump has repeatedly ordered OPEC to curb rising oil prices, but his spades on Twitter could be squandered in the global oil cartel.

On Tuesday, Trump told the UN General Assembly that OPEC "scam the rest of the world" by driving up prices.

Trump blames OPEC for the rally because the cartel has been limiting production since January 2017 in order to balance the market after a slump in oil prices. In June, OPEC and its allies agreed to increase production by about 1 million barrels a day after reducing their planned quantities.

However, prices have remained high since then and the national average price of gasoline remains stuck at nearly $ 2.85 a gallon as the market prepares for the impact of sanctions on the price of gasoline. Iran.

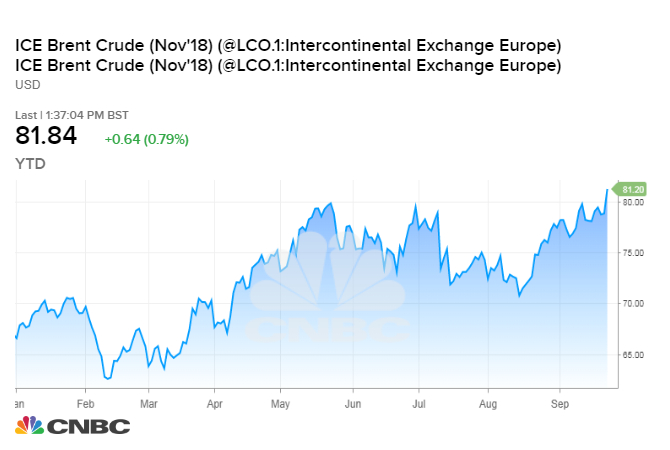

On Monday, Brent crude, the international benchmark for oil prices, hit its highest level in almost four years above $ 81 a barrel. The rally continued on Tuesday, with Brent exceeding $ 82 for the first time since November 2014.

The main factor is the inaction of the oil producers' alliance at its meeting on Sunday, said John Kilduff, founding partner of Again Capital. OPEC issued a statement saying that producers would continue to monitor the market and respond to customer demand, but did not provide any new details on how they would compensate for the lost Iranian barrels.

"They are angry again at their plans," Kilduff said. "They give these answers to questions that are sort of a Rubik dialogue cube."

A Wall Street Journal report indicates that the main Saudi exporter, which is short of Arab light supply, its most popular crude category, is also raging in the market, analysts said. The report suggests that the shortage of certain types of oil is already developing with the decline of Iranian exports.

Saudi Energy Minister Khalid al-Falih told CNBC on Sunday that markets are "fairly balanced today" and "there is plenty of supply to satisfy customers who need them".

[ad_2]

Source link