[ad_1]

While the uncertainty surrounding oil prices remains, my expectation for July is that West Texas Intermediate will typically be between $ 65 and $ 75 a barrel. WTI prices could reach five dollars a barrel outside this range for a few days, but I think it should stay in that range for most of the month.

Reduced stocks and limited spare capacity in OPEC countries help push up higher prices. Part of the capacity problem is that countries such as Libya and Venezuela have serious production problems while Iran is affected by sanctions.

On June 24, Nick Butler wrote in the Financial Times article: in the coming years "(subscription required), the following:

The first is the situation in Venezuela, which went from in the short term, the situation remains the biggest uncertainty in the oil market.The country's crude oil production fell to 1.36 million barrels per day in May, 600,000 bpd less than a year ago The International Energy Agency has raised the possibility that production could fall to 800,000 b / d next year Given the dramatic collapse in Venezuelan living standards, it is hard to imagine that the government can stay in power, but until now, predictions of political change have not been made. not filled in.

June 26, in an online article titled "US Toughens Stance on Export Futures" Iranian oil companies (subscription required), Wall Street Journal reports:

WASHINGTON On 4 November, the United States threatened to punish countries that do not reduce Iranian oil imports as part of Trump administration to further isolate Tehran politically and economically, said a senior official of the US State Department.

Iranian crude buyers were waiting for the United States to give them time to reduce their oil imports over a much longer period, by issuing sanctions waivers for those countries that have done so much. considerable efforts to reduce their purchases. This expectation was in part based on previous comments from senior Trump officials, as well as previous efforts by the Obama administration to get rid of Iranian oil for several years.

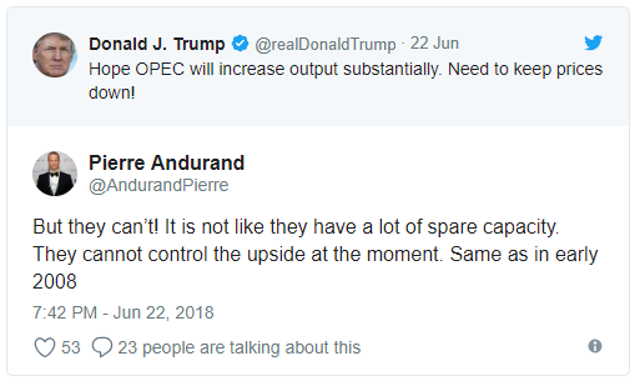

President Trump's request for Saudi Arabia would increase production and production. Just this morning, in fact, Trump tweeted:

How much Saudi Arabia actually increases production, no one guesses it.

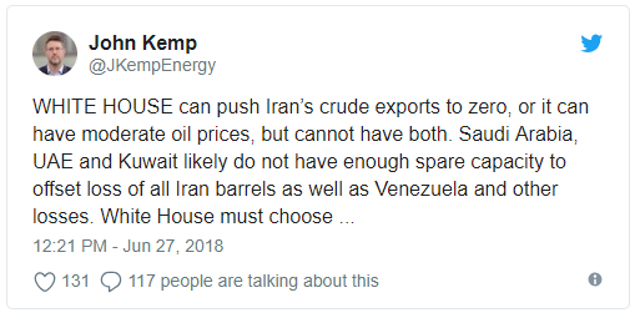

And, on June 27, John Kemp, energy analyst at Reuters, tweeted:

There are competing forces. There are political forces that want to drive down prices, and there are physical forces in the form of constraints that limit the ability of OPEC to react. On June 22, famed oil trader Pierre Andurand wrote the following in response to a previous tweet from Trump for OPEC to cut prices:

In summary, there is political pressure to try to keep oil prices moderate. Yet, as mentioned by Kemp and Andurand, there are physical forces in the form of constraints with regard to much lower stocks due to withdrawals and the reduction of excess capacity. Because it's impossible to know how these competing forces will play over the next few weeks, it's also impossible to have a more definitive view of oil prices. With WTI prizes of nearly $ 74 a barrel on Friday and Trump tweets to drive down prices, I am inclined to think that $ 74 is near the top end. Until where can he go? I expect that OPEC will want prices as high as possible to maximize its own income and encourage new sources of production, but not so high that oil prices rise in times of temporary scarcity. With these thoughts in mind, I expect that $ 65 could be the low end.

[ad_2]

Source link