[ad_1]

When the Chinese stock market falls sharply, there is a good chance that US stocks – and some big names such as Goldman Sachs and Caterpillar – will collapse with.

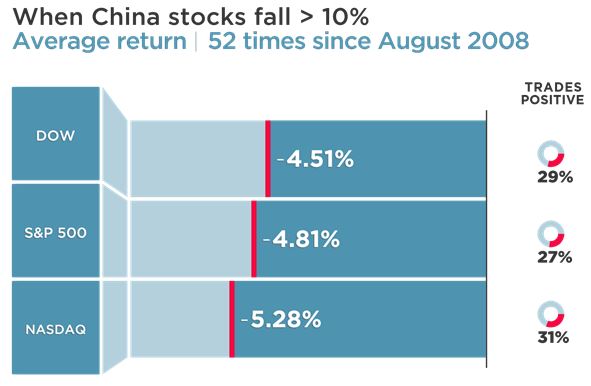

However, a CNBC study using the Kensho analysis tool revealed that US equities are more often weaker when declines in Chinese equities are significant. In the last 10 years, when Shanghai shares fell by 10% or more over a 30-day period, the US stock market grew by only about 30% and US indices all posted significant declines.

For example, the S & P 500 fell 4.8% on average when China lost 10% or more, and the Nasdaq was even worse with a loss of 5.3%.

Source: Kensho

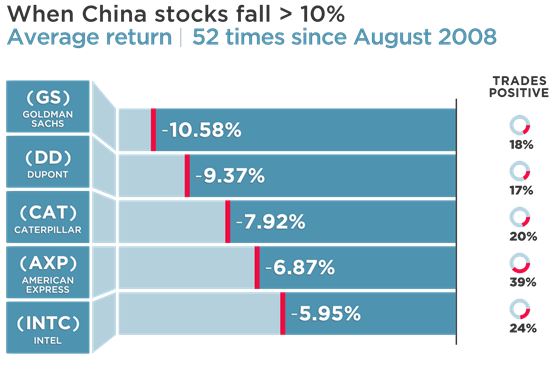

For individual stocks, Goldman Sachs shares lost an average of 10.6% over a 30-day period and increased only 18% of the time. Caterpillar's revenues are closely related to those of China. They fell by an average of 7.9% during these periods and grew only 20% of the time. Dupont lost 9.3% on average and only increased 17% of the time.

Caterpillar contributed to the decline of the Dow on Thursday, with a decline of more than 3%.

Source: Kensho

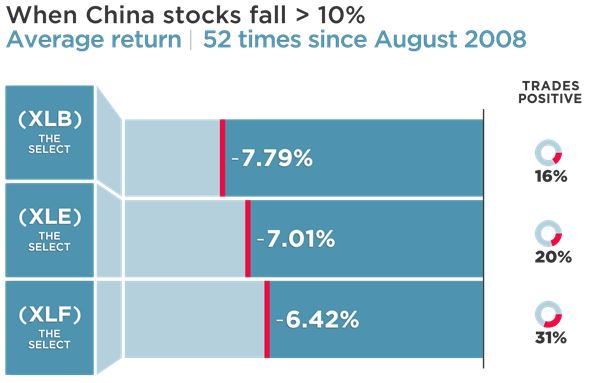

Among the sectors, the shares of companies producing raw materials and materials fell by 84% when Chinese stocks fell sharply. The SPDR material selection sector lost 7.8% on average. The XLF, the Select Financial Sector SPDR fund, lost an average of 6.4% and was up 31% of the time. Energy stocks, represented by the Select Energy Select SPDR fund, lost an average of 7% and fell 20% of the time.

Source: Kensho

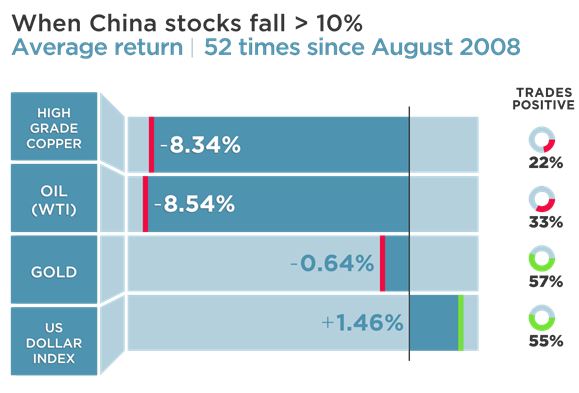

As Shanghai shares fell, commodities, such as copper, fell 8.3% and oil fell 8.5% on average over 30 days. Crude oil fell 70% of the time when Chinese stocks plummeted and copper 78%. Safe havens, on the other hand, grew on average and gold rose 0.6%, while the dollar index rose 1.5%. Both were higher more than half the time.

Source: Kensho

Source link