[ad_1]

Investment thesis

The Vanguard FTSE All-World Ex-US ETF (VEU) is the ideal investment choice for investors seeking international diversification. It is a low-cost, well-diversified ETF with broad exposure to international markets, with investments in 2,767 shares in 46 countries. VEU would be a solid addition to any equity investor's portfolio and would help reduce the investment risk and volatility of the portfolio.

VEU Features

VEU is an ETF, administered by Vanguard, which focuses on large and mid-cap stocks in developed and emerging markets, with the exception of the United States. Its overhead ratio is 0.11%, which is slightly higher than some of its larger peers in the US alone, but lower than most similar ETFs.

The ETF tracks the FTSE All-World ex US Index, which equals the FTSE Global Equity Index Series, excluding US companies. The index includes several criteria for inclusion and eligibility for companies, including minimum requirements for liquidity and market capitalization, as well as countries, mainly related to their market environment and their marketability. regulatory. Readers can review the rules outlined in the links above, but it usually involves a very broad index designed to hedge and track the performance of the global stock markets.

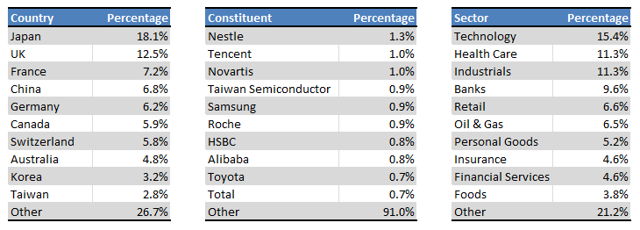

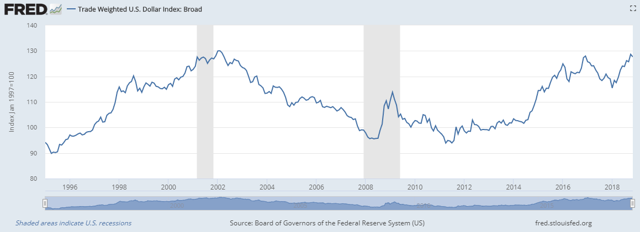

The resulting ETF is well diversified across countries, sectors and assets:

(Source: FTSE Factsheet)

VEU clearly succeeds in offering investors diversified and diversified exposure to international markets. Let's take a look at the benefits of this.

Benefits of international diversification

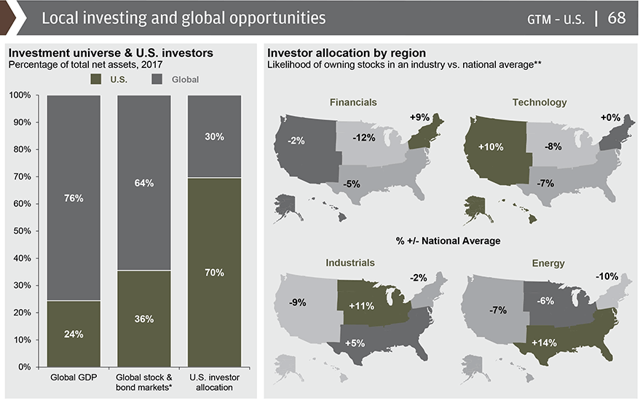

Investors generally display what is known as the home country bias, investing most of their wealth in stocks, bonds, etc., of their country of residence. This is true for most, if not all, countries including the United States:

(Source: J.P.Morgan)

There is obviously some logic to the above. According to Vanguard, investors prefer to invest in their home markets because they are generally more informed and optimistic about them and do not like the foreign exchange risk inherent in foreign markets.

Although the above makes sense, most analyzes show the opposite. Investors are overly exposed to their original markets and would significantly reduce the risk and volatility of their portfolios as they diversify their holdings.

According to Vanguard:

(…) by adding foreign equities to portfolios comprising US equities and fixed income securities, the average volatility could be reduced.

(Source: Vanguard)

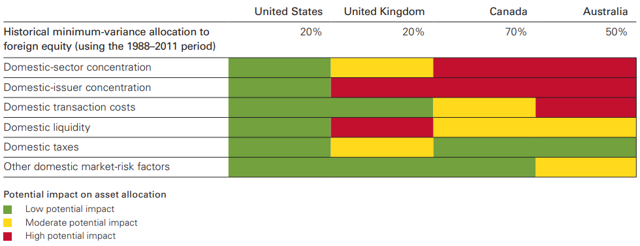

Vanguard was also kind enough to calculate appropriate foreign equity allocations for investors in several countries:

(Source: Vanguard)

According to Vanguard, foreign stocks should compromise 20% of the portfolios of US investors if they want to minimize volatility and the possibility of losses. Generally, all investors should want to do it. Of course, most investors are well aware that investing in foreign markets helps to reduce the risk and volatility of the portfolio, but most are not sufficiently informed in foreign markets to make the right investment decisions. foreign shares. For these investors, an ETF like VEU can easily provide all the benefits of international diversification, without much time or effort.

Peer comparison

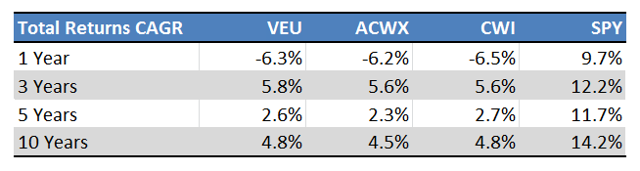

VEU's performance over the years has been at best below average. Although the ETF behaves about as well as its counterparts like ACWX and CWI, it has significantly underperformed the S & P 500 index over the past decade, and this is not the case. is not even close:

(Source: Ycharts)

There are two reasons for this.

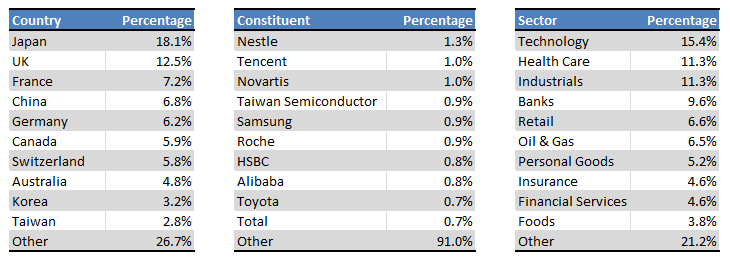

First, the value of the US dollar has appreciated about 30% over the past decade, which has reduced the value of most foreign currency investments:

(Source: Federal Reserve Bank of St. Louis)

According to my estimates, the above has reduced the annual returns of VEU by approximately 2.7%, although the exact figure depends on the allocation of the ETF's assets over time.

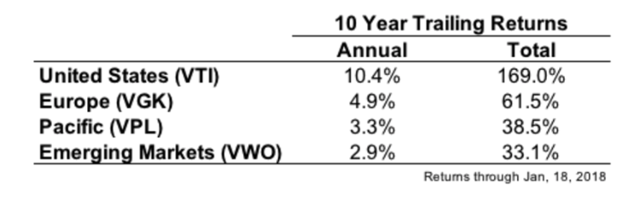

Second, US equity markets have significantly outperformed most other regional markets over the last decade:

(Source: Bloomberg)

Most regional markets underperformed for idiosyncratic reasons. The end of the economic crisis in Europe has been particularly weak and has had repercussions on the continent's equity markets. Many emerging markets, particularly those in Latin America, suffered from the collapse in commodity prices in 2013. Trump's pricing has had a negative impact on Chinese equity markets. The sanctions imposed by Russia have had disastrous effects on the economy and the stock markets of the country. The list continues. Moreover, Trump's tax cuts have been extremely beneficial for the US stock markets.

Of course, past performance does not guarantee future results. Let's see what will be the performance of VEU in the years to come.

Future performance

I think VEU will get better performance than it has recently been for four reasons.

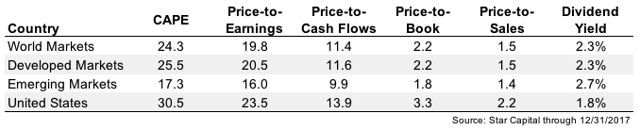

First, international equities are much more attractive than US equities in all relevant valuation indicators:

VEU has fallen somewhat over the past few months, as most US equities rallied during the year, and valuation is even more interesting today:

VEU data by YCharts

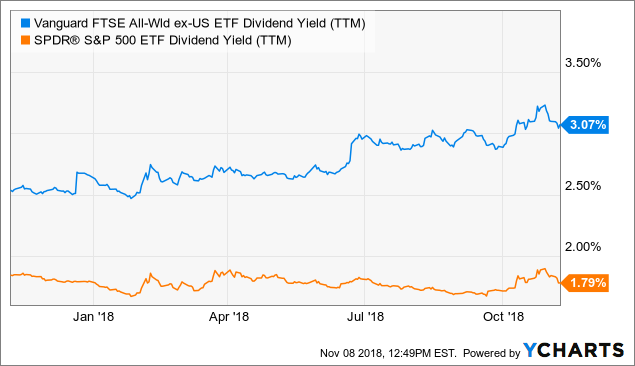

Second, and as a corollary to the first point, VEU offers a slightly higher dividend yield than comparable US ETFs:

VEU Dividend Yield Data (TTM) by YCharts

An additional 1.3% dividend may not be a great deal, but it is definitely good for investors.

Third, many of the reasons why VEU underperformed US equity markets are no longer valid. I do not think anybody is expecting a new round of tax cuts in the United States or any other tightening of commodity prices that would derail the Latin American economies, for example.

Fourth, given that the dollar is currently trading at its strongest levels in decades, it is unlikely that new exchange rate movements will hurt US investors in foreign markets. On the other hand, predicting price movements in foreign currency is a task for fool. This last point is therefore very speculative.

Conclusion

VEU offers investors exposure to international markets. The benefits of international diversification are obvious: reduced investment risk and portfolio volatility. Investors looking for an international diversification should consider including VEU in their portfolios as they offer a simple, easy and inexpensive way to invest in international stocks.

Thank you for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive future updates.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link