[ad_1]

It seems that Sunday has become a popular day for announcing major contracts involving companies. IBM announced the $ 34 billion Red Hat deal two weeks ago. SAP announced its intention to acquire Qualtrics for $ 8 billion last night and Vista Equity Partners has also taken on its responsibilities, announcing the signing of an agreement to purchase Apptio for $ 1.94 billion, a 53% premium for shareholders.

Vista paid $ 38 a share for Apptio, a Seattle-based company that helps businesses manage and understand their cloud spend in a hybrid computing environment with on-premise and cloud assets. The company was founded in 2007, just as the cloud began to take off, and has developed alongside the cloud. He acknowledged that companies would have a hard time understanding their cloud computing assets alongside those on-premise. It turned out to be a company in the right place at the right time with the right idea.

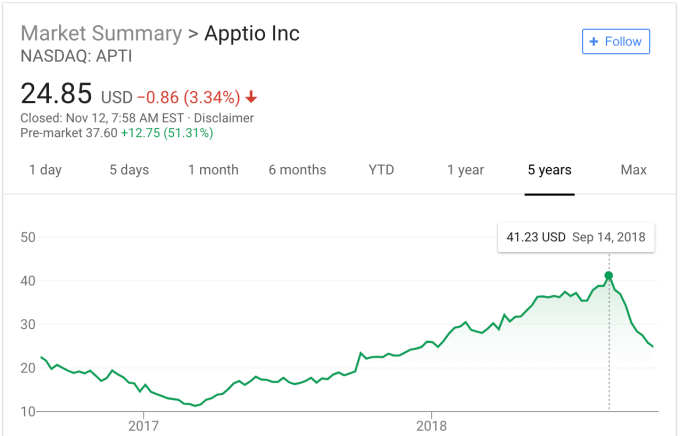

Investors such as Andreessen Horowitz, Greylock and Madrona have certainly appreciated the concept. In 2016, the company had received $ 261 million before being floated on the stock market. . The $ 38 per share paid by Vista is nearing the high water mark for the title.

Stock Chart: Google

Sunny Gupta, co-founder and CEO of Apptio, liked the idea of giving a good return to its shareholders while offering a good landing point for his company to be private. Vista has the reputation of continuing to invest in the companies it acquires and this prospect is clearly exciting. "Vista's investment and deep expertise in world-class SaaS businesses and the flexibility we will have as a private company will help us accelerate our growth …," Gupta said in a statement.

The transaction has been approved by Apptio's Board of Directors, which will recommend to shareholders to accept it. With such a high premium, it is hard to imagine that they refuse it. If it crosses all regulatory hurdles, the acquisition is expected to be finalized in the first quarter of 2019.

It should be noted that the company has a "go shop" provision of 30 days, which would allow it to seek a better price. Given the current strength of the enterprise market and the popularity of hybrid cloud tools, it is possible to find another buyer, but it may be difficult to find a buyer willing to pay such a high price.

Vista clearly likes to buy technology companies that have cashed Ping Identity for $ 600 million and Marketo for $ 1.8 billion in 2016. She seized Jamf, a company-owned device management company. Apple, and Datto, a disaster recovery company from the previous year. Just two months ago, Marketo earned $ 4.75 billion from Marketo.

Source link