[ad_1]

A few weeks ago, I wrote something for this platform titled "Selling Links That No One Named".

It was a recap of the events of the week of September 17, when yields rose, which appeared to be a combination of upward expectations for inflation and futures trading. .

One of the oddities of this week was the dollar (NYSEARCA: UUP), which did not rise alongside US yields. Instead, the greenback has fallen with the commodities recovery, a combination that has helped maintain the sentiment of confidence among the oppressed former United States. assets, especially emerging markets, where equities largely outperformed their US counterparts and where currencies recorded their best week since February.

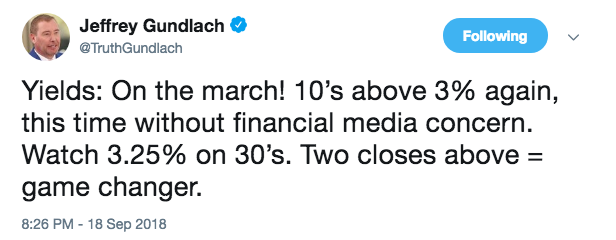

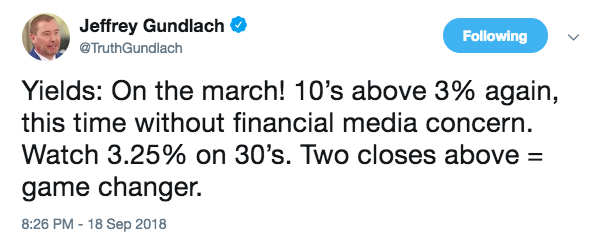

On September 18th, Jeff Gundlach expressed his disbelief at the perceived lack of press coverage:

Fast forward to Wednesday and the Treasures sold out. This time, the financial media have definitely taken note.

Wednesday's defousing of the stock market made it a household name in the financial world, with 30-year and 10-year returns reaching their highest levels since 2014 and 2011, respectively.

The sale started seriously with a big ADP beat and accelerated as a result of an extremely hot printing of ISM services.

The volume of the futures was huge (about 180% of the 10-day average) and the closing was very ugly, with the 10-year yields still rising and close to the day's highs:

The curve fell, while the 2s10 cut 30 bps, the widest in at least two months:

What should you do with all this?

First, according to the volume, it seems that people were stopped, which probably exacerbated the sale. Either that, or people were adding new shorts. If it's the last one, just note that the specification in the market in the decade has already reached a record level (here is the latest available data, in effect until Tuesday, September 25 ):

But more importantly for average investors, it looks a lot like late January / early February. We are considering a massive sell of bonds which, up to now, has been accompanied by a rise in stock prices (SPY) and we are moving towards a crucial report on jobs on Friday.

For the sake of brevity, I will not tell the whole story here, but remember that on January 29, I published a post on this platform titled "Hey Guys? Stop, as now ". The bottom line of this assertion was that bond yields were increasing too much, too quickly, and I suggested that it was only a matter of time before correlation of yields between bonds would become positive, leading to a sale of both stocks and bonds.

Five days later, wage growth exceeded expectations and the trough of the trend collapsed, while the sale of bonds that had accelerated for weeks was over. struck by the first tangible evidence that inflationary pressures were beginning to emerge in the US economy.

January was defined by rising yields and the merger of US stocks. The Fed's new president, Jerome Powell, had to take a more data-dependent monetary policy stance than his predecessor, which had a negative impact on the inflation markets.

This is very similar to the current configuration. 10-year yields have risen more than 30 basis points since September 1. At the same time, US stocks hit a new high after a new record since August, when the S & P finally recovered losses in February and March.

At the same time, Jerome Powell has repeatedly emphasized the economic situation of the United States. In a speech in Boston on Tuesday, he said the following literally about the Phillips curve:

I do not see the probability that the Phillips curve is dead or will soon require a revenge.

You can read the full text of his speech in this related article, but suffice to say that it minimizes the possibility that at some point in this late expansion, wage growth will take off and prevent the Fed to be late .

Today, the market seemed to be trying not only to catch up with 2019, but also to begin to consider the possibility of a significant acceleration of inflation. Think about Charlie McElligott of Nomura Wednesday morning:

I still believe that the market's skepticism about "higher inflation" is a misleading risk that could further aggravate rate-based selling, especially with the recovery 1) of the "wage growth" scenario yesterday (minimum wage Amazon hike), 2) the four-year highs in the gross, 3) the lowest in the U-Rate cycle / another big "beat" of work with the ADP today's 4) the highest in the cycle in consumer confidence, 5) the highest 17-year-old in JOLTS Quit the rate … all this in the "real-time" escalation of the broad catalyst "QE to QT impulse" "bearish fixed income".

This is a characteristic evaluation of Charlie.

Again, note that all of the above raises issues for Friday's employment report, released in September. Nomura said Wednesday in a note that the bottom line was that the payroll could have a disproportionate impact given the Fed's meager dependency on data.

The most critical thing to understand about Wednesday is that the market's interpretation of yield increases can occur at any time, which has all the characteristics of a fear of inflation.

When it comes to raising rates, this is the "why?" And the "how long?" That matter and, although the answer to the first question bodes well for risk, we may soon answer the second question with this: "Too fast". This is precisely what happened in February. Yields have been on the rise for some time, but stocks have skyrocketed as bond sales are generally seen as a reflection of the strength of the US economy. Finally, there was a turning point and concerns about inflation took over.

A few weeks ago, Goldman was back, reiterating the same warning he had issued when selling the February sales, that if yields increase by more than two standard deviations over a three-month period, correlation of three-month bond yields tends to return positive or, more simply, stocks begin to sell with bonds.

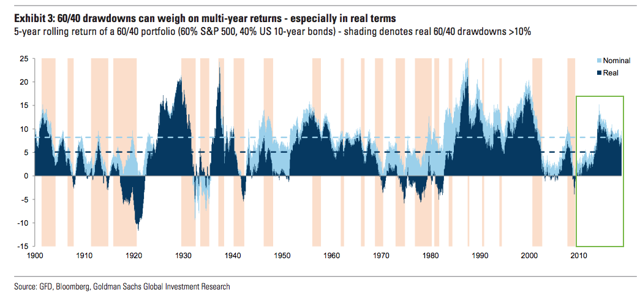

This is the much-feared "desperation for diversification" that upsets balanced portfolios and risk parity. Without dwelling too much on the subject, we are ready for a draw. In fact, the current bull market for balanced equity / bond portfolios is the longest in history.

Here is a little more of a new Goldman note that documents the history of balanced portfolios and how the stock-bond correlation has evolved over the years:

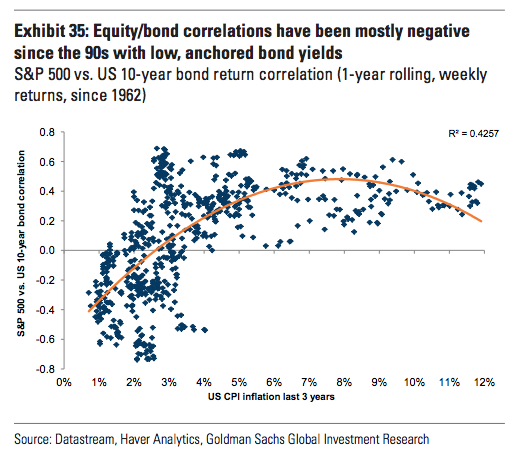

Although this is not our base scenario, with high and rising inflation, as in the 70s and 80s, equities / bond correlations become positive – US CPI levels above 2% on a three-year rolling period often resulted in correlated positive equity / bond correlations (Exhibit 35). In addition, the relationship does not seem linear – when positive surprises in inflation become more worrisome than negative, bonds are unlikely to be good diversification factors for equities and higher returns. can weigh on the shares.

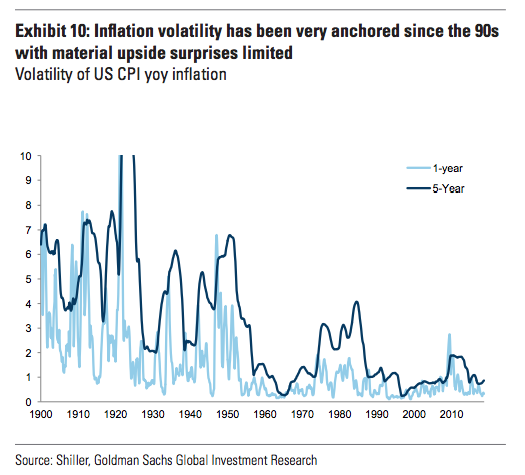

In the same note, Goldman writes that investors may underestimate the risk of upside surprises from inflation. Here is a further excerpt with a visual that shows you how well the inflation data is kept:

The risk of inflation in the United States could be higher than investors think. There is always a risk of rapid selection of inflation and upward pressure on end-of-cycle rates, particularly with the US fiscal stimulus and the introduction of tariffs. . Our economists have highlighted capacity constraints and the risk of overheating the labor market – the current policy environment is similar to the one that preceded the inflationary shock of the late 1960s.

You should also be very aware that real returns are to some extent a function of inflation expectations, given the Fed's data-dependent position. The higher the inflationary pressure, the more likely the market is to believe that Powell's Fed will be ready to react. A hawkish response pushes real rates higher.

Allow me to bring this point home in the most poignant way possible. Did you notice that stocks were running out of gas on Wednesday? It is at the (almost) exact moment that 10 years later real yields reach 1%:

Nothing else.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link